This version of the form is not currently in use and is provided for reference only. Download this version of

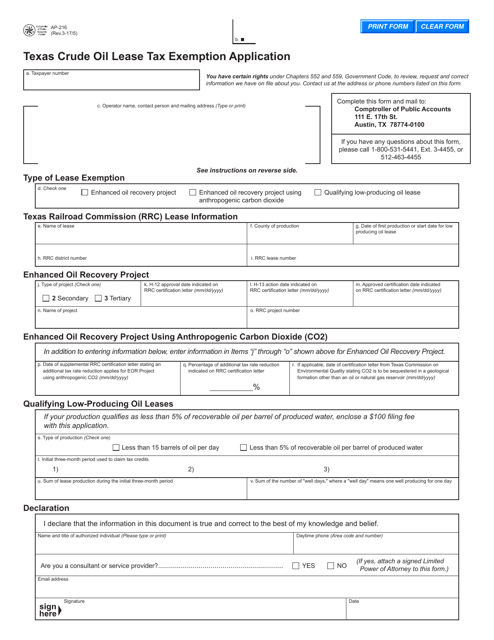

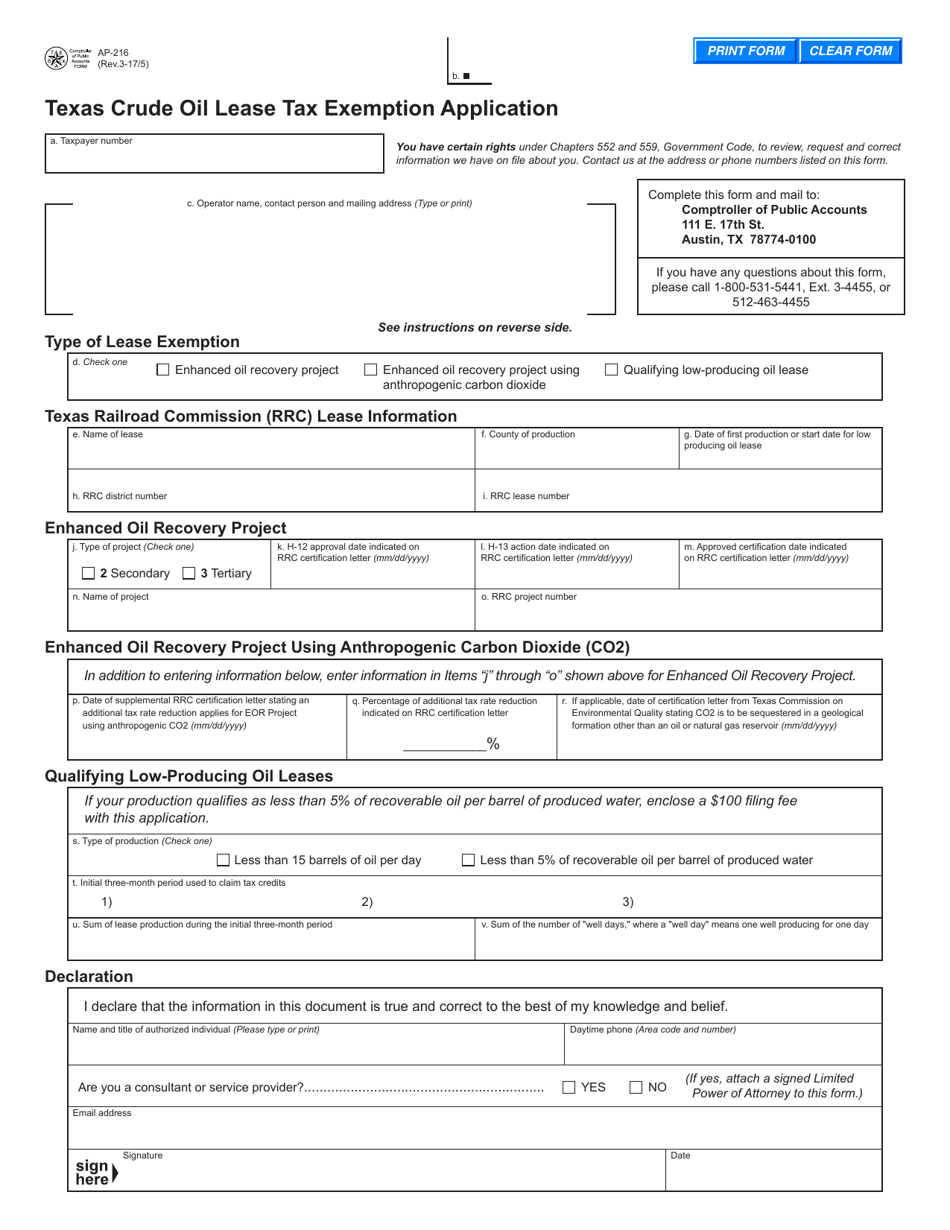

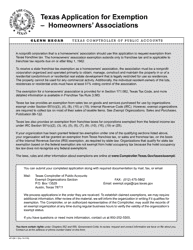

Form AP-216

for the current year.

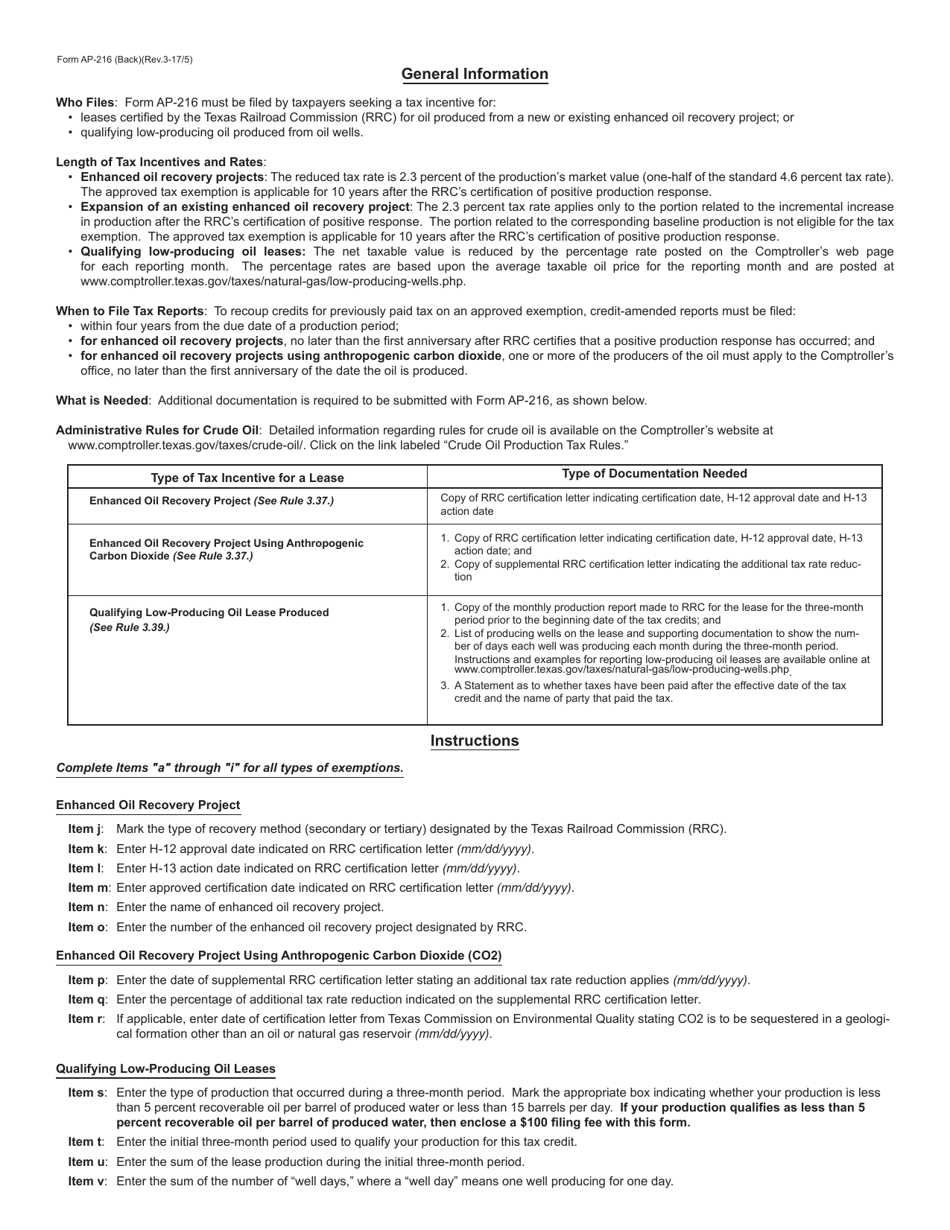

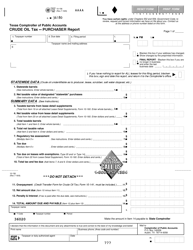

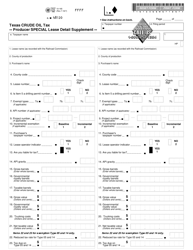

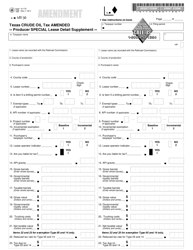

Form AP-216 Texas Crude Oil Lease Tax Exemption Application - Texas

What Is Form AP-216?

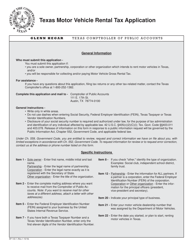

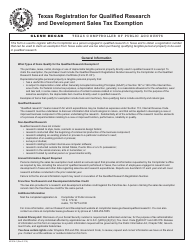

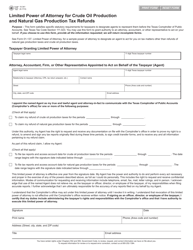

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AP-216?

A: Form AP-216 is the Texas Crude OilLease Tax Exemption Application.

Q: What is the purpose of Form AP-216?

A: The purpose of Form AP-216 is to apply for a tax exemption for crude oil leases in Texas.

Q: Who needs to fill out Form AP-216?

A: Anyone who wants to claim a tax exemption for their crude oil lease in Texas needs to fill out Form AP-216.

Q: Is there a deadline for submitting Form AP-216?

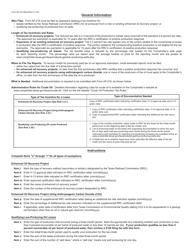

A: Yes, Form AP-216 must be submitted within 30 days of the first sale of crude oil from the lease.

Q: Are there any fees associated with Form AP-216?

A: No, there are no fees associated with submitting Form AP-216.

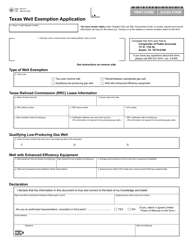

Q: What information do I need to provide on Form AP-216?

A: You will need to provide information such as your lease number, lease name, operator name, and the date of the first sale of crude oil.

Q: Can I claim a tax exemption for multiple crude oil leases on one Form AP-216?

A: No, you will need to submit a separate Form AP-216 for each lease.

Q: How long does it take to process Form AP-216?

A: It typically takes 4 to 6 weeks to process Form AP-216.

Q: What should I do if there are changes to my lease information after submitting Form AP-216?

A: You should notify the Texas Comptroller of Public Accounts in writing within 15 days of any changes to your lease information.

Form Details:

- Released on March 5, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-216 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.