This version of the form is not currently in use and is provided for reference only. Download this version of

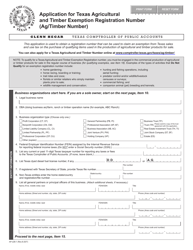

Form AP-217

for the current year.

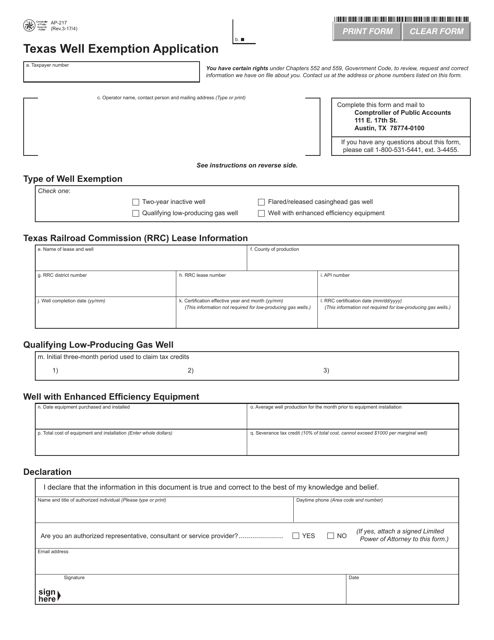

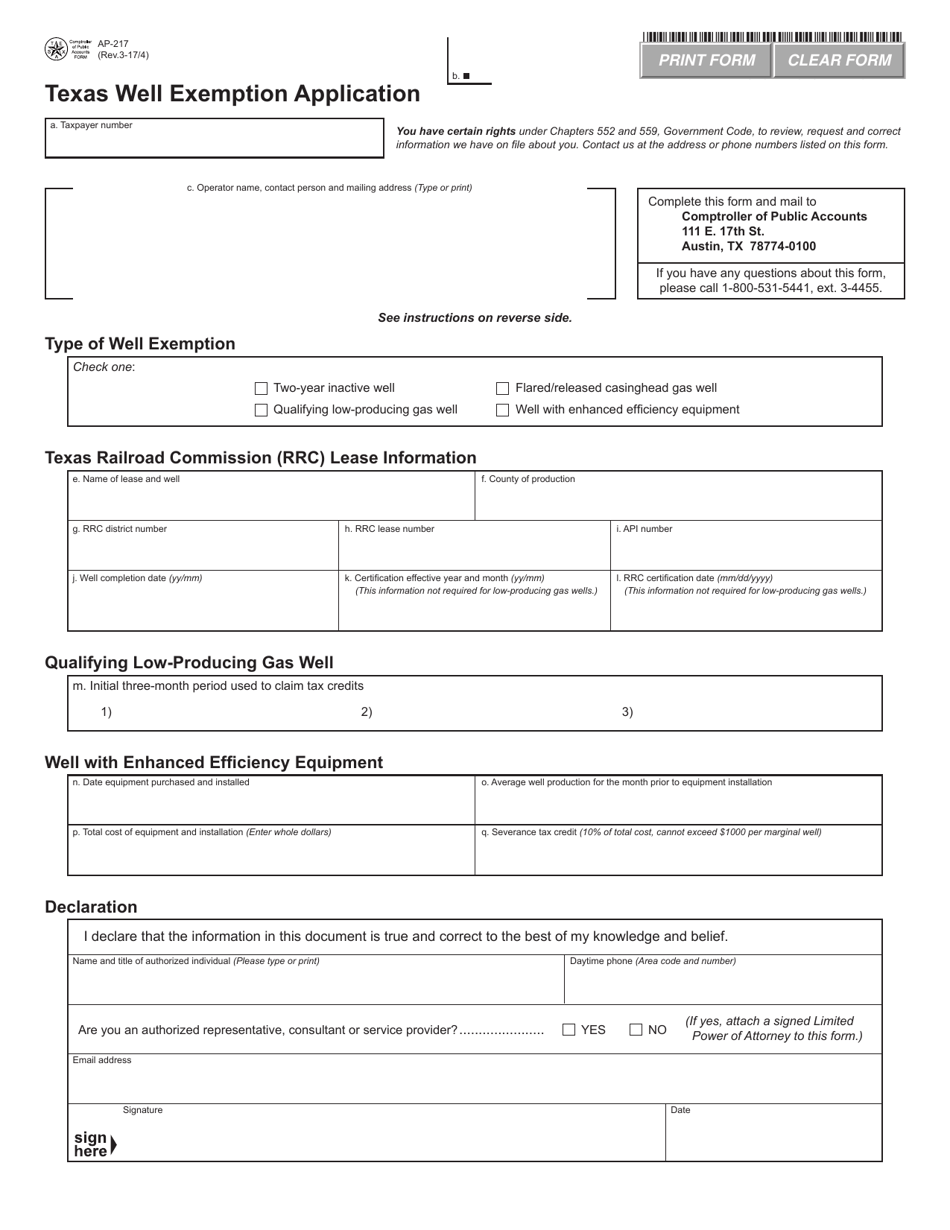

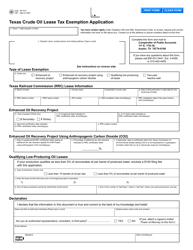

Form AP-217 Texas Well Exemption Application - Texas

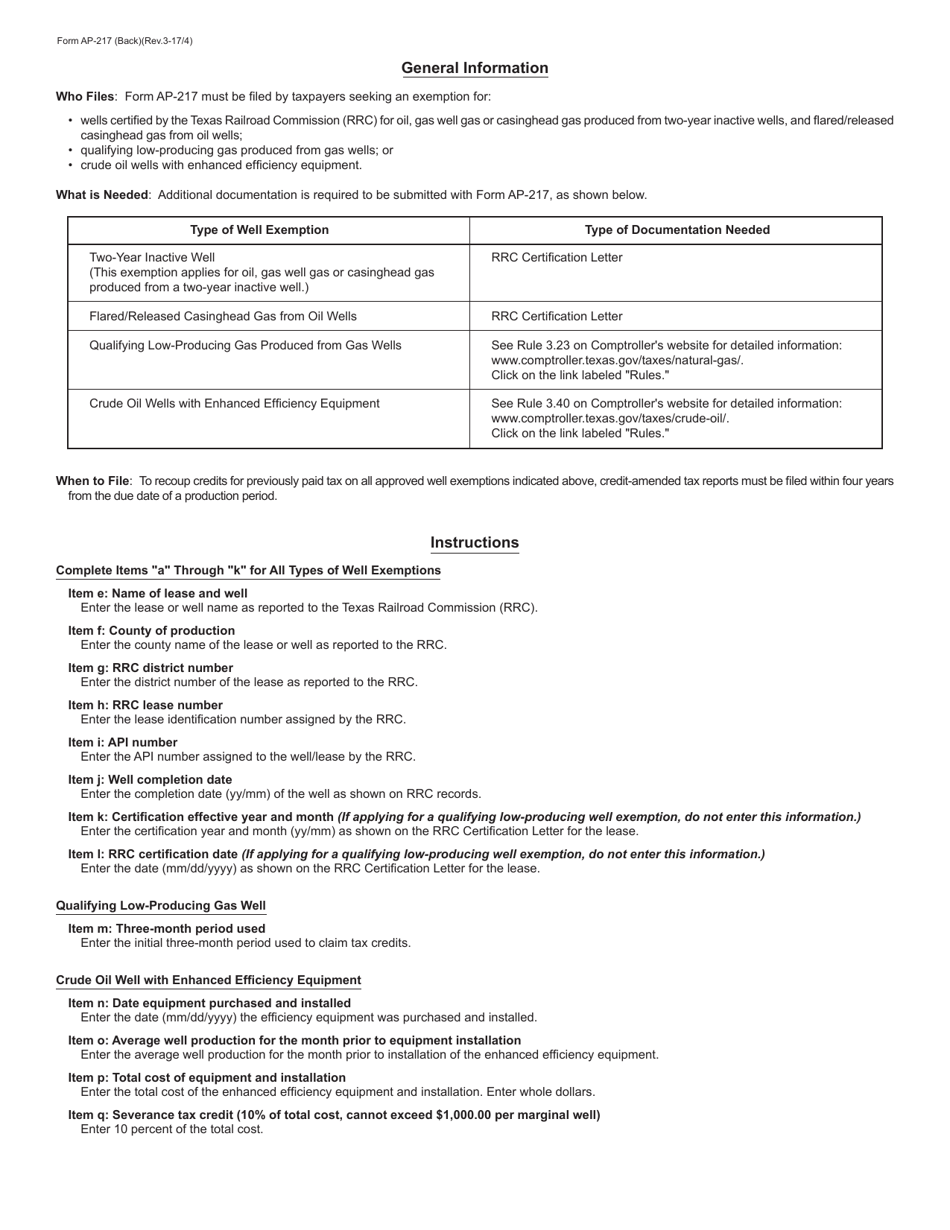

What Is Form AP-217?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

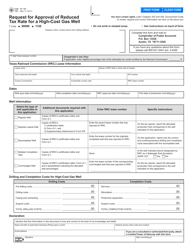

Q: What is Form AP-217?

A: Form AP-217 is the Texas Well Exemption Application.

Q: What is the purpose of Form AP-217?

A: The purpose of Form AP-217 is to apply for an exemption from the Texas Well ReportSubmission requirement.

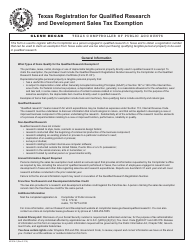

Q: Who should use Form AP-217?

A: Form AP-217 should be used by individuals or entities seeking an exemption from reporting well information in Texas.

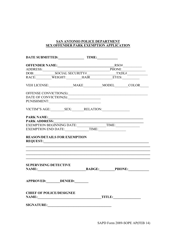

Q: Are there any fees associated with submitting Form AP-217?

A: There are no fees associated with submitting Form AP-217.

Q: What information is required on Form AP-217?

A: Form AP-217 requires information about the well, such as the well location, owner information, and exemption basis.

Q: What is the deadline for submitting Form AP-217?

A: Form AP-217 should be submitted before the well exemption expiration date or within 90 days after drilling or completing the well, whichever comes later.

Q: Can I apply for multiple well exemptions using a single Form AP-217?

A: Yes, you can apply for multiple well exemptions using a single Form AP-217.

Q: What happens after I submit Form AP-217?

A: After submitting Form AP-217, the Texas Comptroller of Public Accounts will review the application and determine if the exemption is granted.

Form Details:

- Released on March 4, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-217 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.