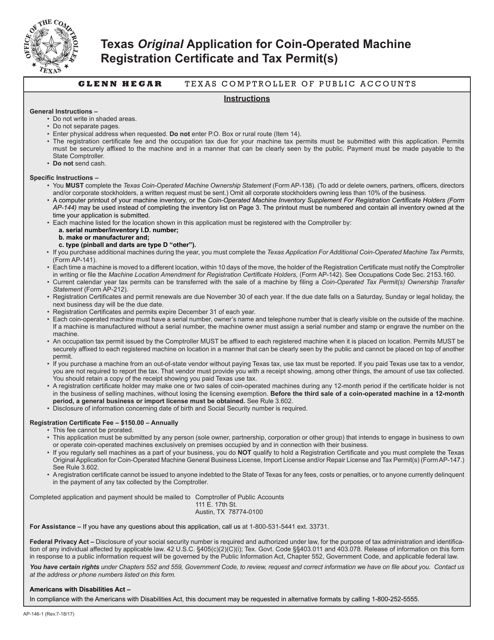

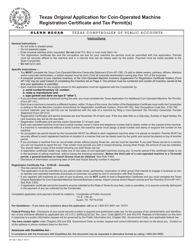

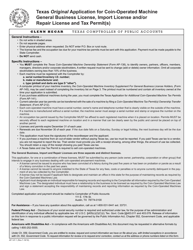

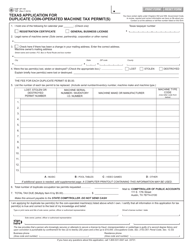

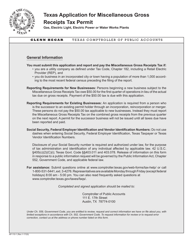

Form AP-146 Texas Original Application for Coin-Operated Machine Registration Certificate and Tax Permit(S) - Texas

What Is Form AP-146?

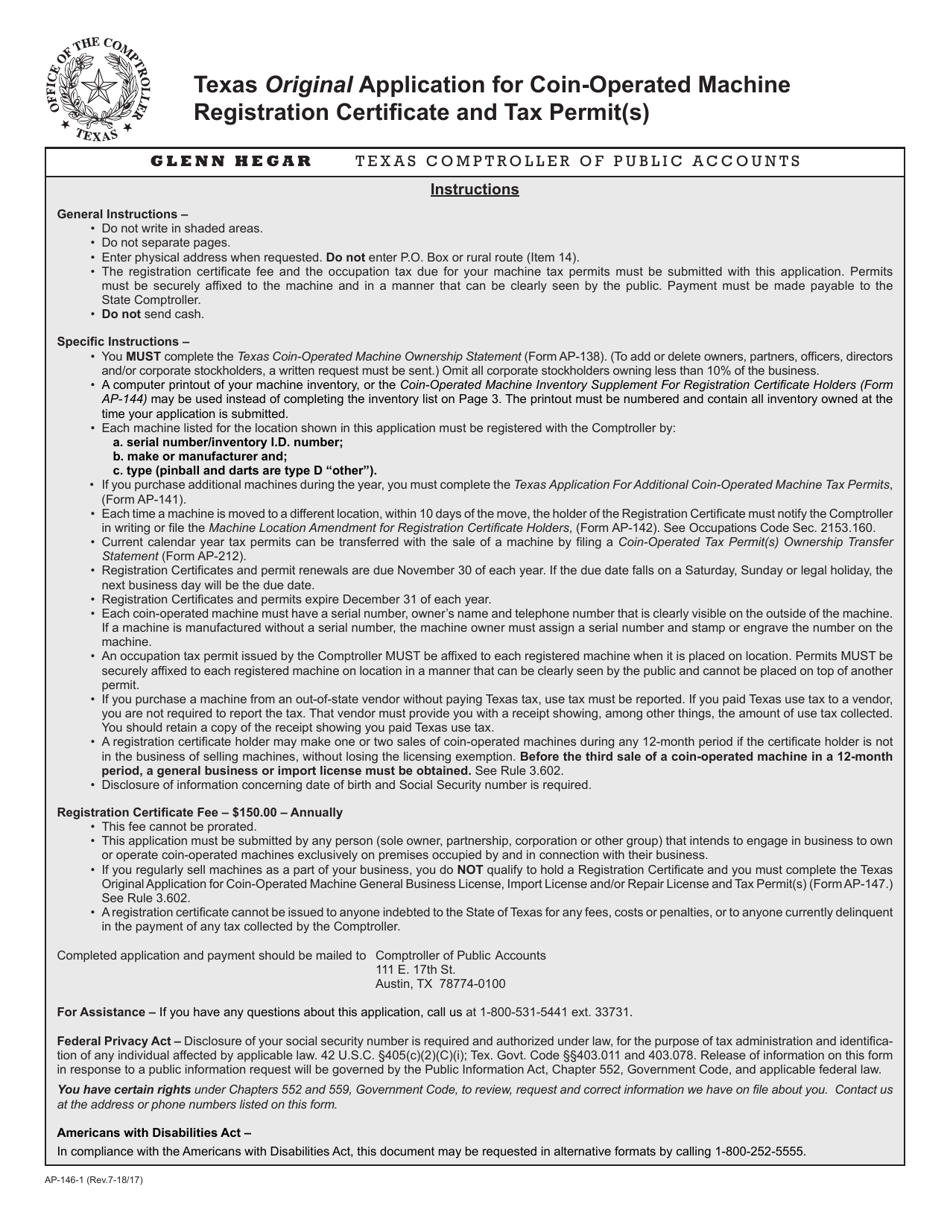

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AP-146?

A: Form AP-146 is the Texas Original Application for Coin-Operated Machine Registration Certificate and Tax Permit(s).

Q: What is the purpose of Form AP-146?

A: The purpose of Form AP-146 is to apply for a coin-operated machine registration certificate and tax permit(s) in Texas.

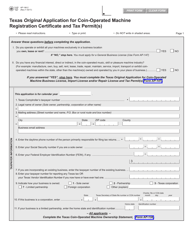

Q: Who needs to fill out Form AP-146?

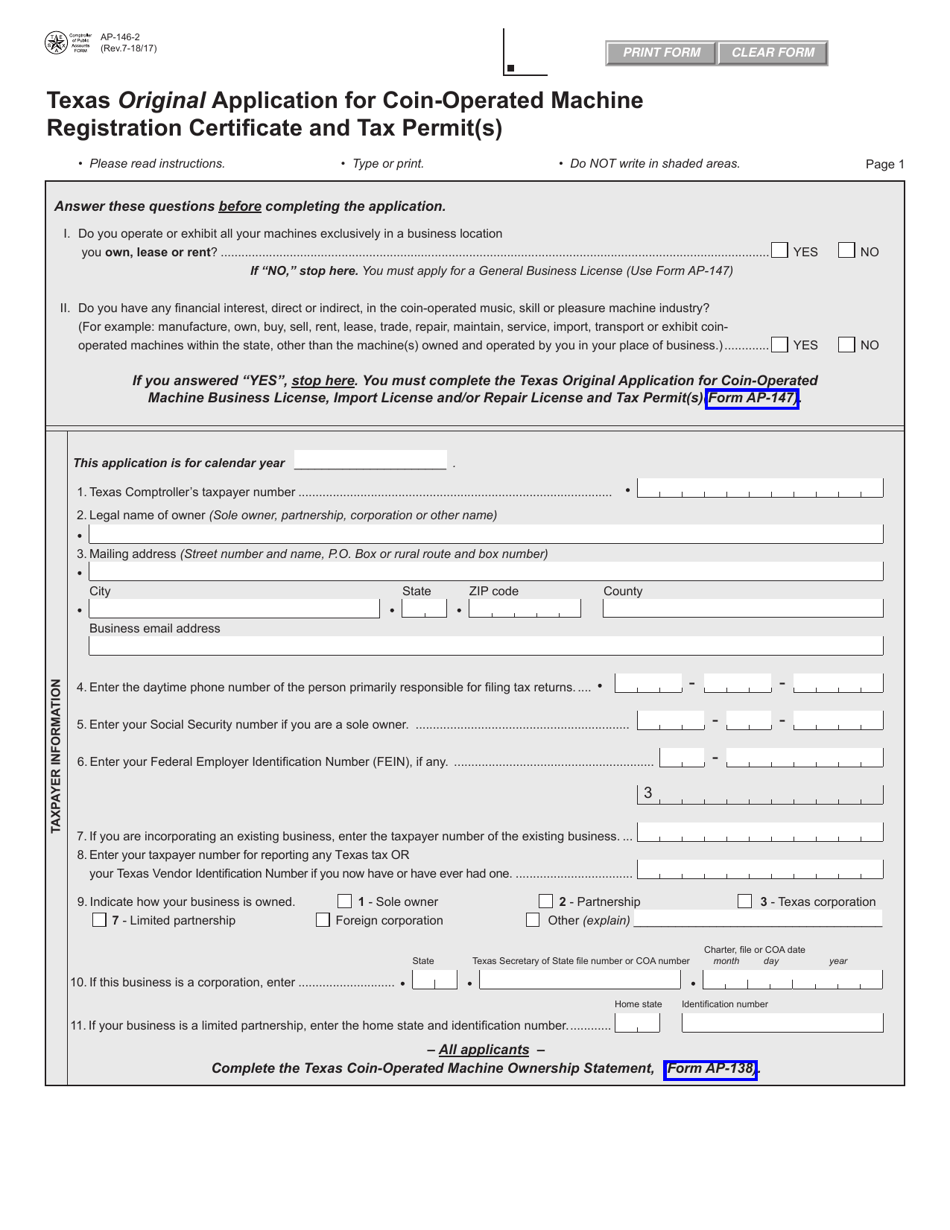

A: Individuals or businesses that operate coin-operated machines in Texas need to fill out Form AP-146.

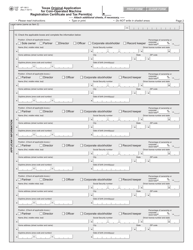

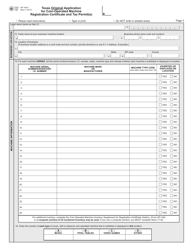

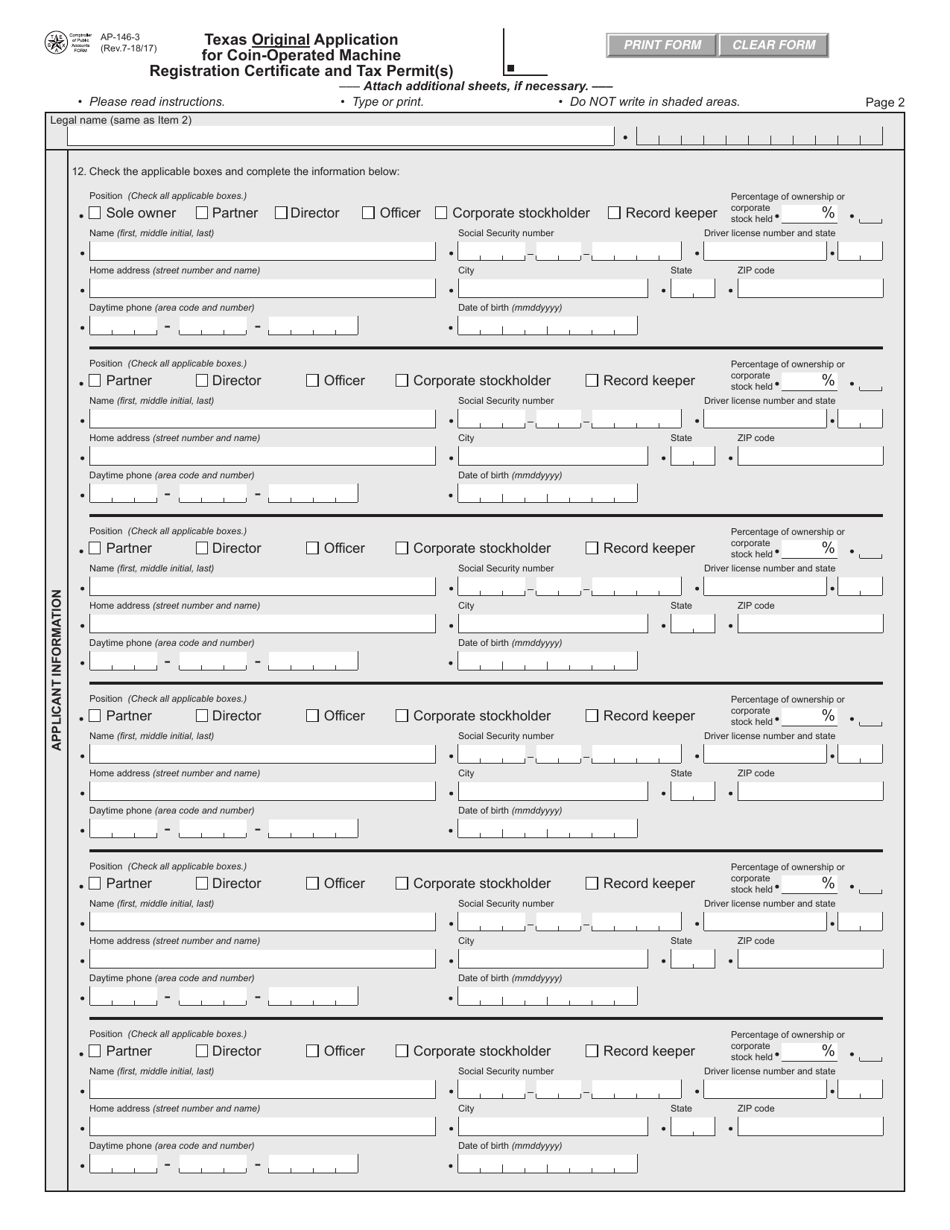

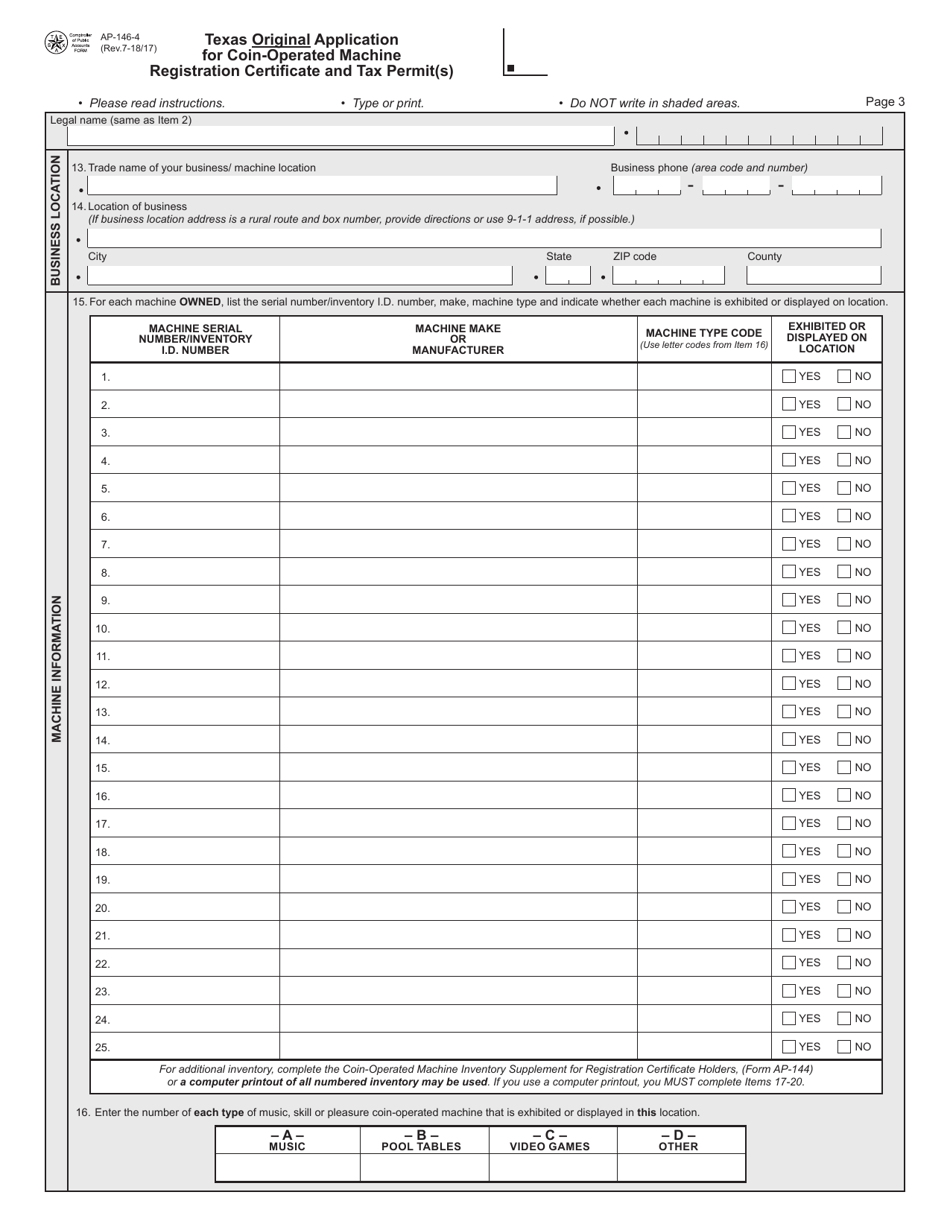

Q: What information is required on Form AP-146?

A: Form AP-146 requires information such as the applicant's name, contact information, machine details, and business information.

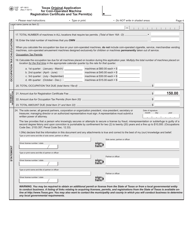

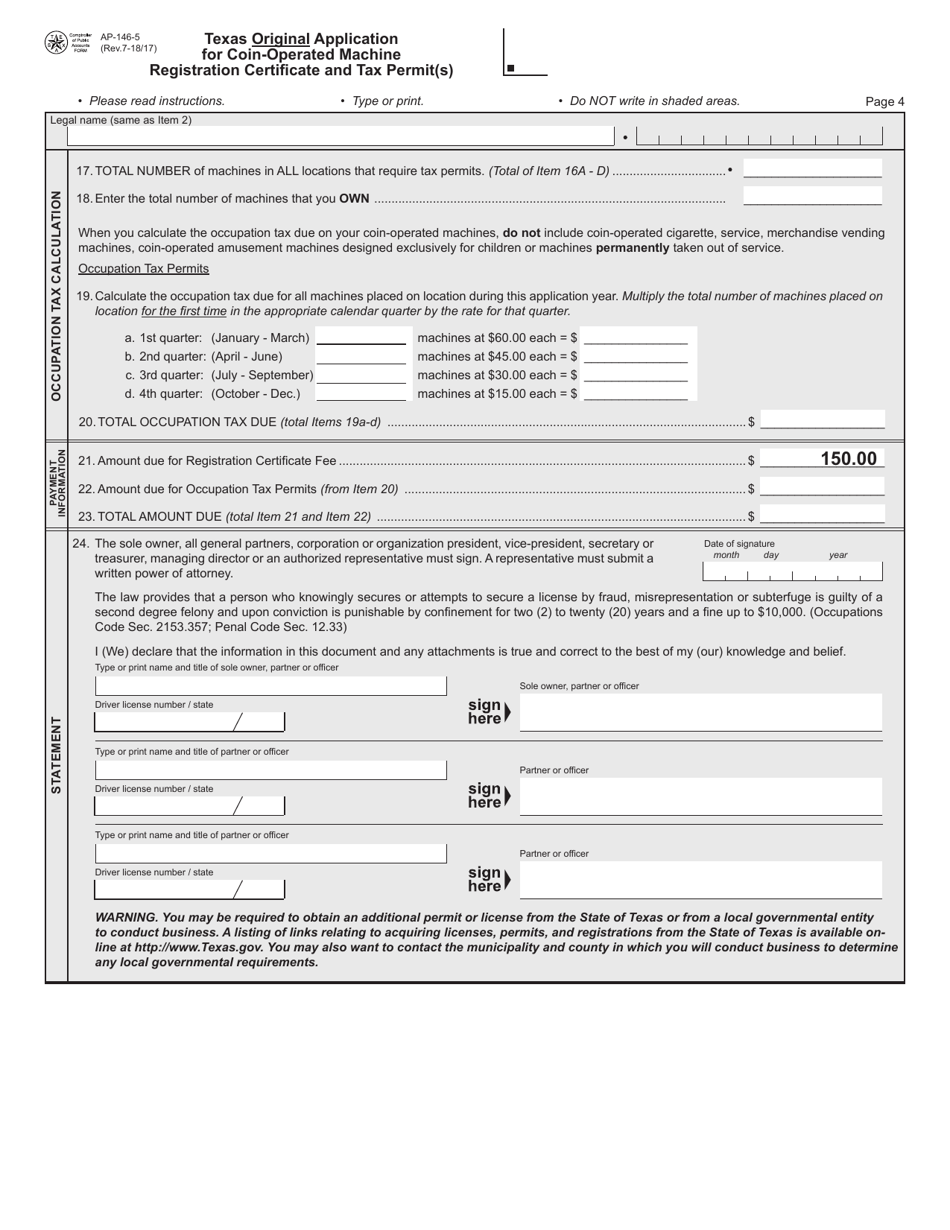

Q: Are there any fees associated with Form AP-146?

A: Yes, there are fees associated with Form AP-146. The exact fees depend on the number of machines being registered.

Q: What is the deadline for submitting Form AP-146?

A: Form AP-146 should be submitted before the operation of the coin-operated machines in Texas.

Q: What happens after submitting Form AP-146?

A: After submitting Form AP-146, the Texas Comptroller of Public Accounts will review the application and issue the necessary registration certificate and tax permit(s).

Q: Are there any penalties for not registering coin-operated machines in Texas?

A: Yes, there are penalties for not registering coin-operated machines in Texas. It is important to comply with the registration requirements to avoid penalties or legal consequences.

Form Details:

- Released on July 17, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-146 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.