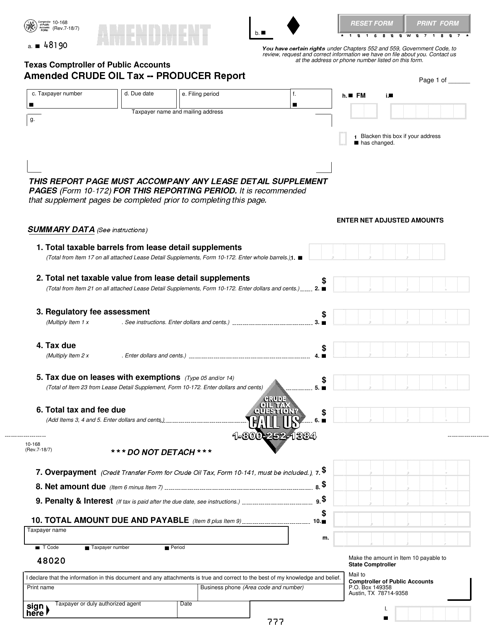

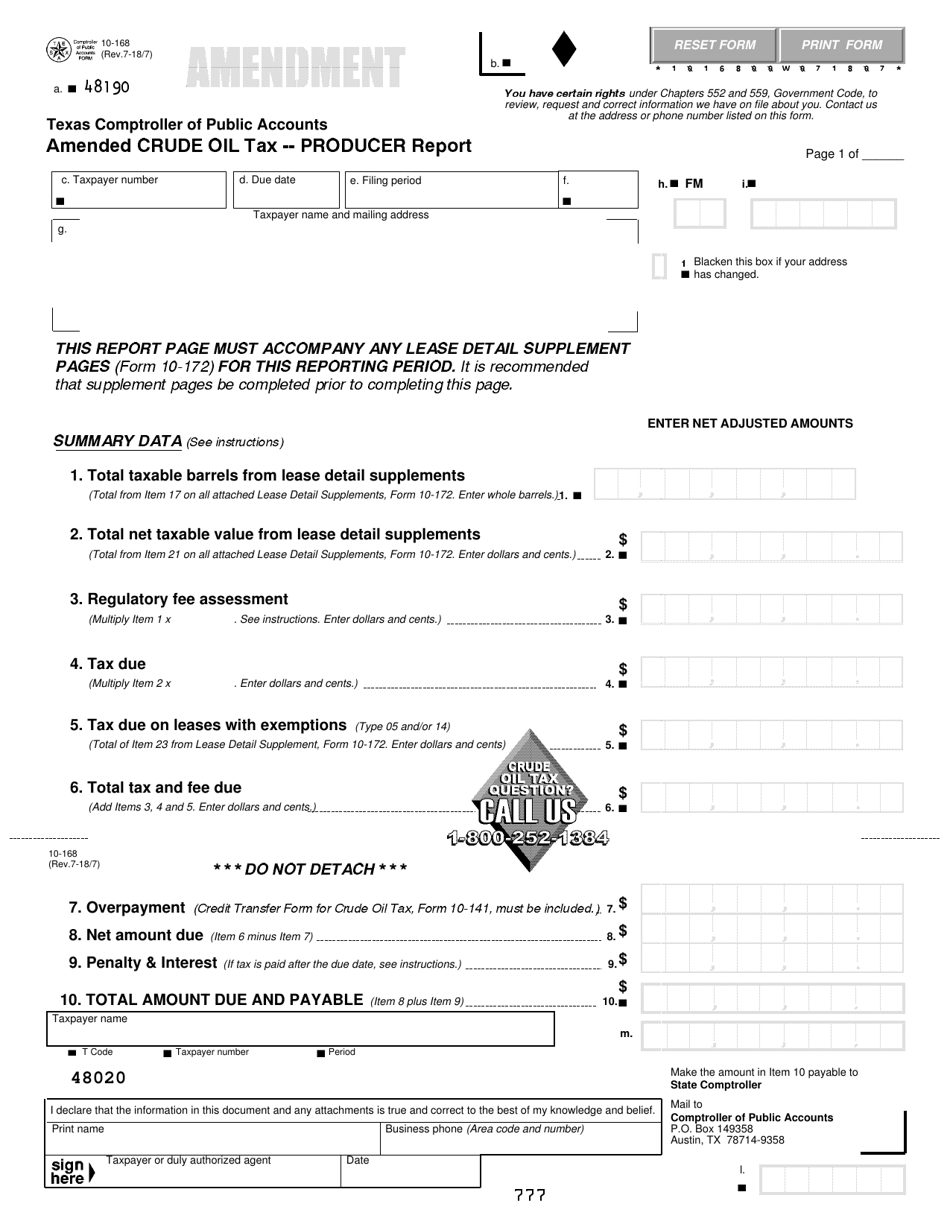

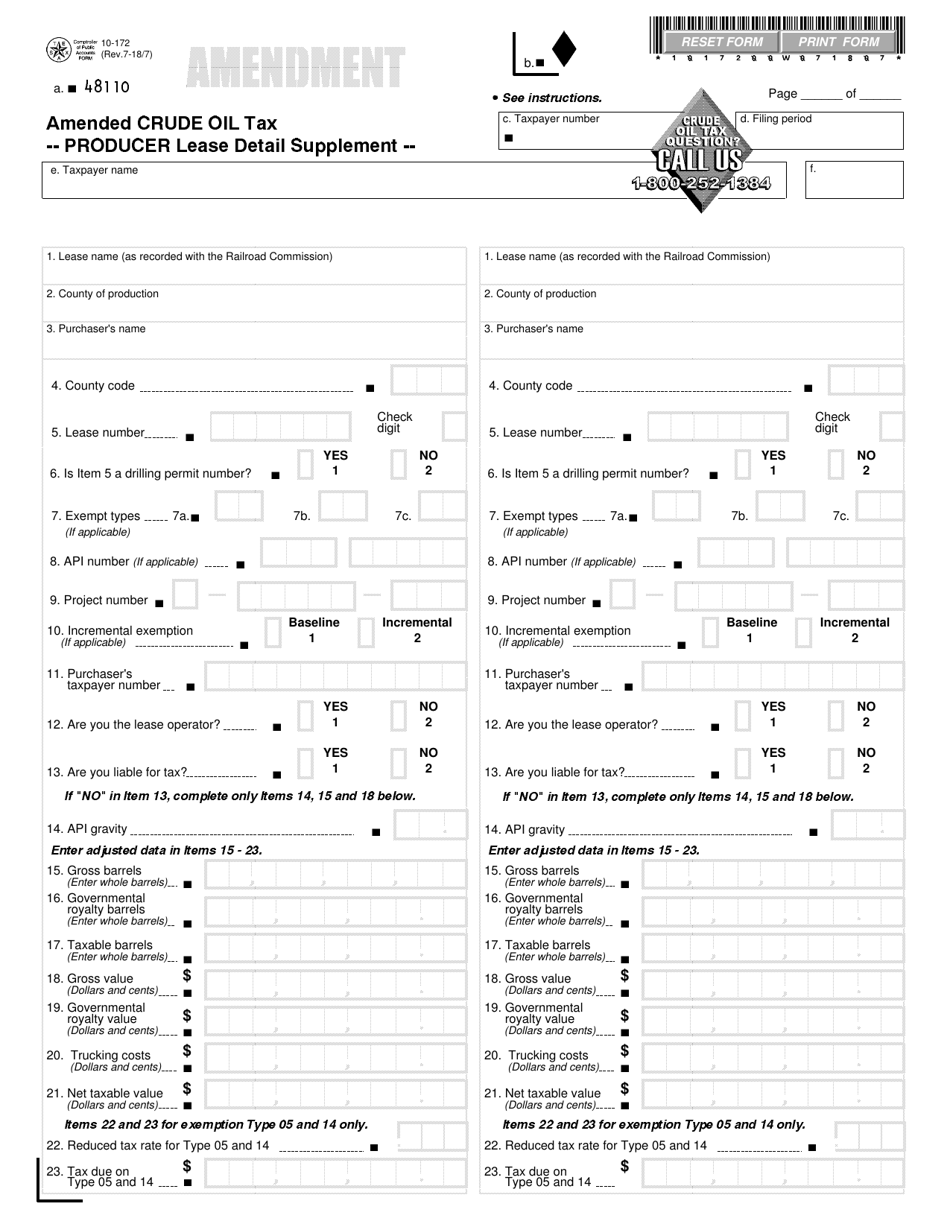

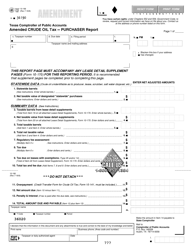

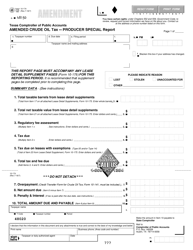

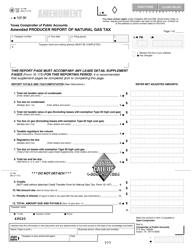

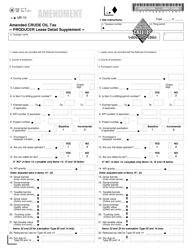

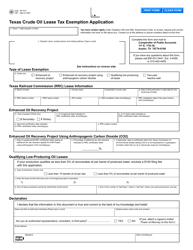

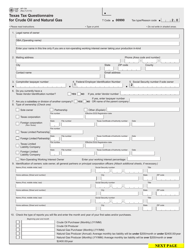

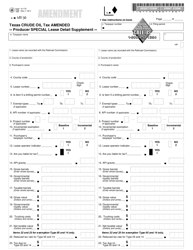

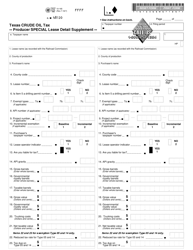

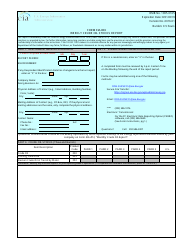

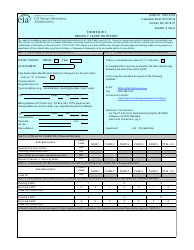

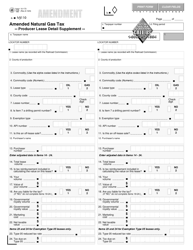

Form 10-168 Amended Crude Oil Tax Producer Report - Texas

What Is Form 10-168?

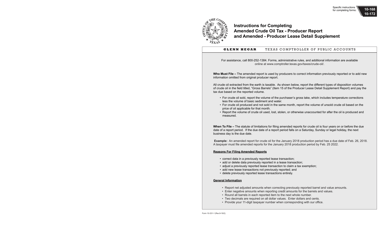

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 10-168?

A: Form 10-168 is the Amended Crude Oil Tax Producer Report for the state of Texas.

Q: Who needs to file Form 10-168?

A: Crude oil producers in Texas who need to report amended tax information.

Q: What is the purpose of Form 10-168?

A: The purpose of Form 10-168 is to report amended crude oil tax information to the Texas authorities.

Q: Is there a deadline to file Form 10-168?

A: Yes, the deadline to file Form 10-168 is determined by the Texas Comptroller of Public Accounts and can vary.

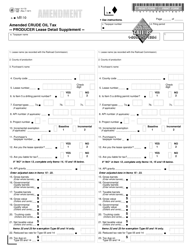

Q: What information is required on Form 10-168?

A: Form 10-168 requires information such as producer name, tax identification number, amended production volumes, and tax payment details.

Q: Can a producer file multiple amended reports using Form 10-168?

A: Yes, a producer can file multiple amended reports using Form 10-168 as needed.

Q: Are there any penalties for not filing Form 10-168?

A: Penalties may be imposed for failure to file Form 10-168 or for inaccurate or incomplete information.

Q: Is Form 10-168 specific to crude oil tax producers in Texas?

A: Yes, Form 10-168 is specific to crude oil tax producers in Texas and is used to report amended tax information.

Form Details:

- Released on July 7, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10-168 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.