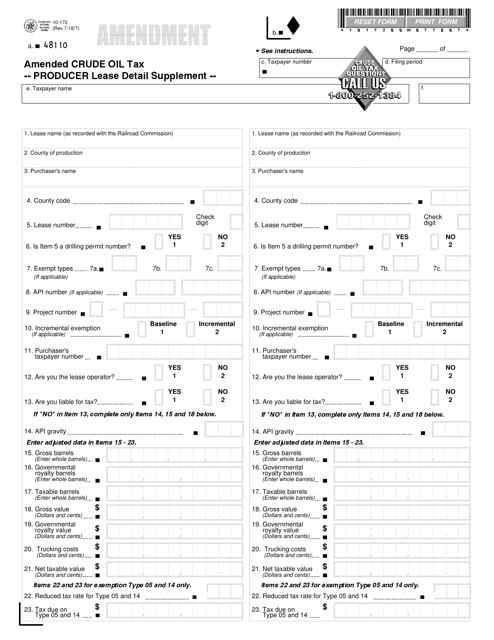

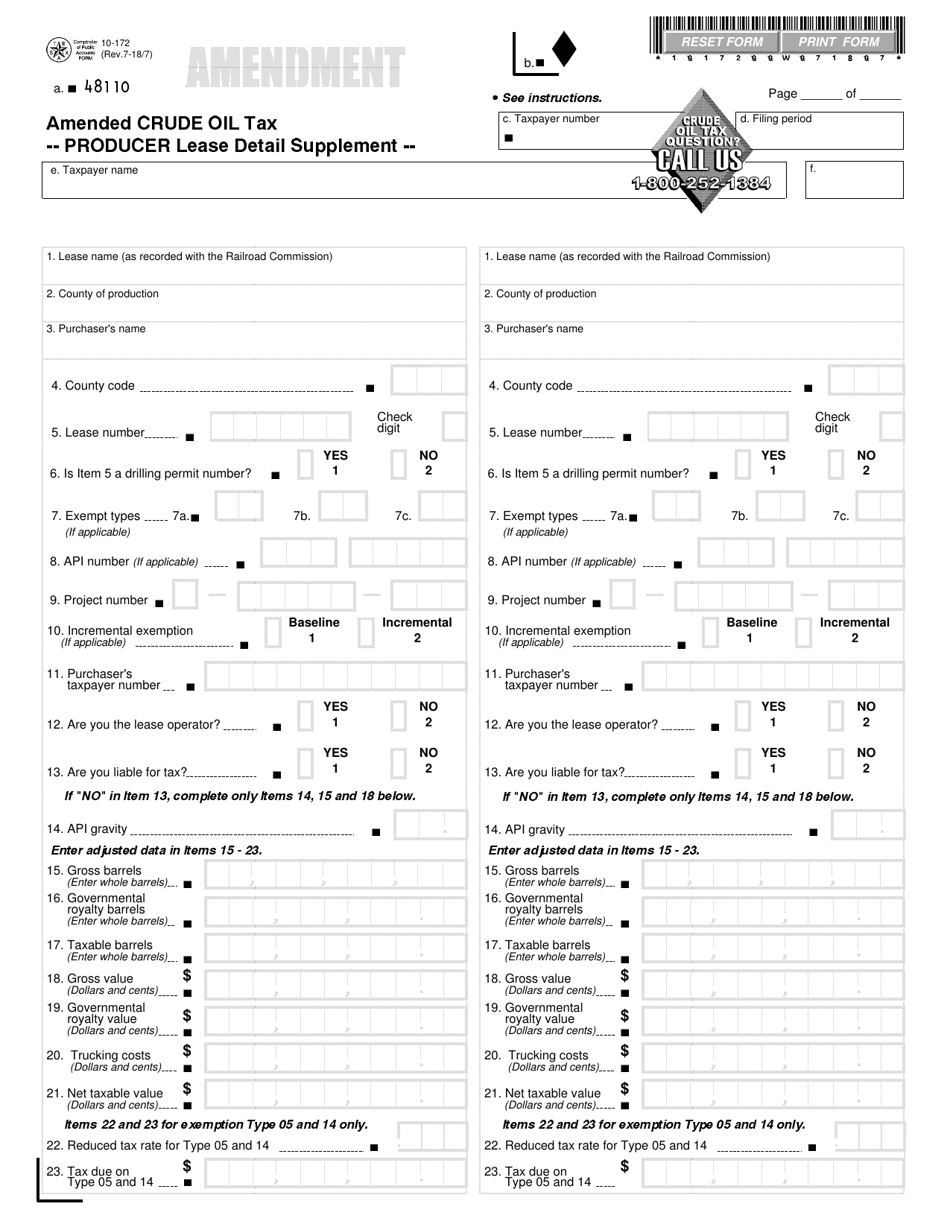

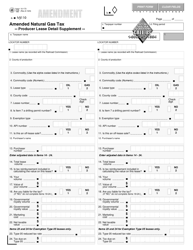

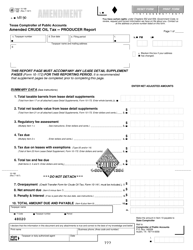

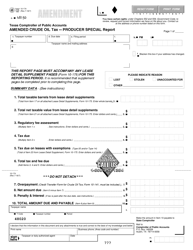

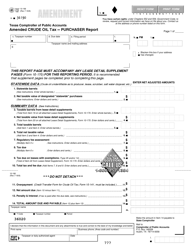

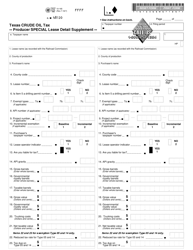

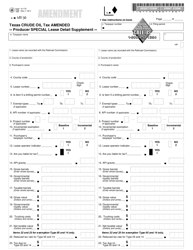

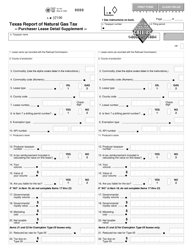

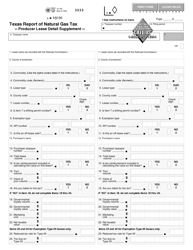

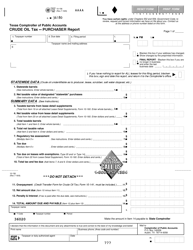

Form 10-172 Amended Crude Oil Tax Producer Lease Detail Supplement - Texas

What Is Form 10-172?

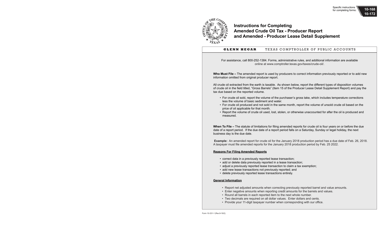

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 10-172?

A: Form 10-172 is a tax form used for reporting crude oil production in Texas.

Q: Who needs to file Form 10-172?

A: Crude oil producers in Texas need to file Form 10-172.

Q: What is the purpose of Form 10-172?

A: The purpose of Form 10-172 is to report and pay taxes on crude oil production in Texas.

Q: What is an Amended Crude Oil Tax Producer Lease Detail Supplement?

A: An Amended Crude Oil Tax Producer Lease Detail Supplement is a form used to make changes or corrections to previously filed Form 10-172.

Q: Are there any penalties for not filing Form 10-172?

A: Yes, there are penalties for failure to file or late filing of Form 10-172. It is important to file the form on time to avoid these penalties.

Form Details:

- Released on July 7, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10-172 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.