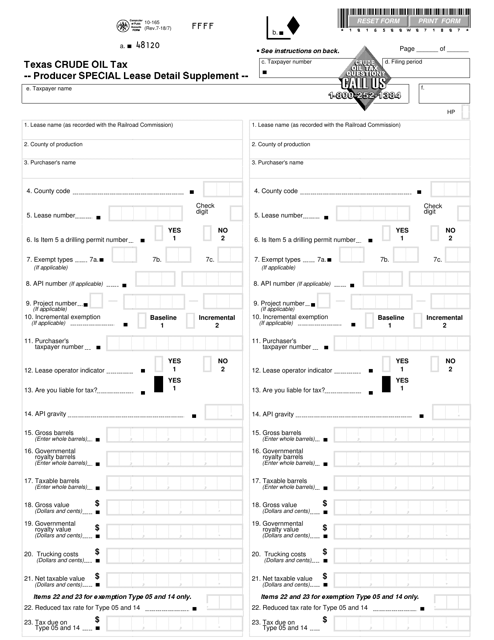

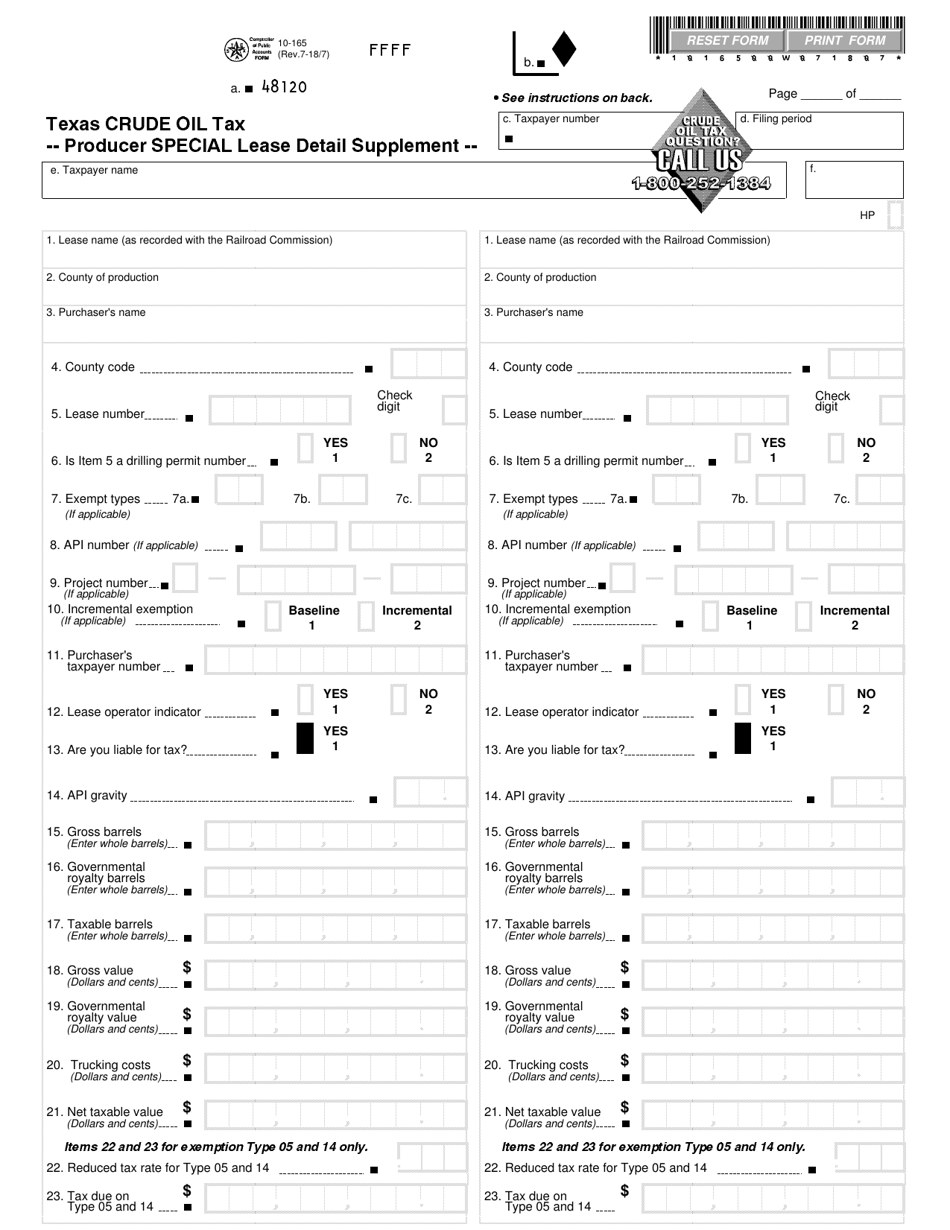

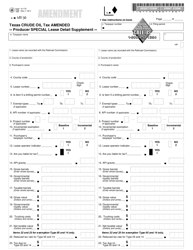

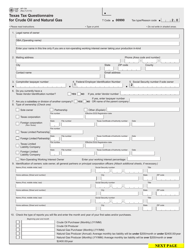

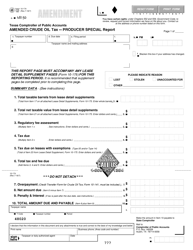

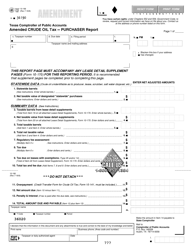

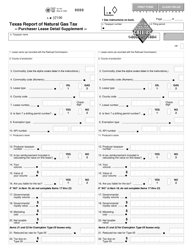

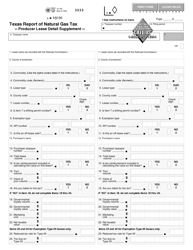

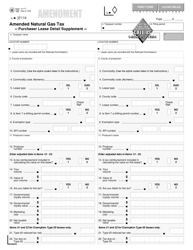

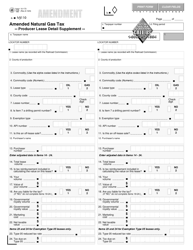

Form 10-165 Texas Crude Oil Tax Producer Special Lease Detail Supplement - Texas

What Is Form 10-165?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 10-165?

A: Form 10-165 is a tax form related to Texas crude oil tax.

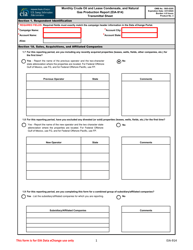

Q: What is the purpose of Form 10-165?

A: The purpose of Form 10-165 is to provide supplemental information about special lease detail for crude oil tax producers in Texas.

Q: Who needs to fill out Form 10-165?

A: Crude oil tax producers in Texas who have special lease details are required to fill out Form 10-165.

Q: What information is required on Form 10-165?

A: Form 10-165 requires information about the special lease, such as the lease number, lease name, lease operator, and royalty owner.

Q: Are there any filing deadlines for Form 10-165?

A: Yes, Form 10-165 must be filed on or before the 20th day of the second month following the end of the reporting period.

Q: Are there any penalties for not filing Form 10-165?

A: Yes, failure to file Form 10-165 or filing a late or incomplete form may result in penalties and interest.

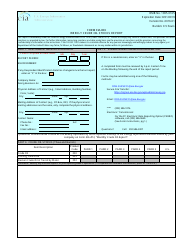

Form Details:

- Released on July 7, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10-165 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.