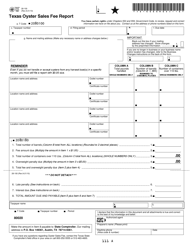

This version of the form is not currently in use and is provided for reference only. Download this version of

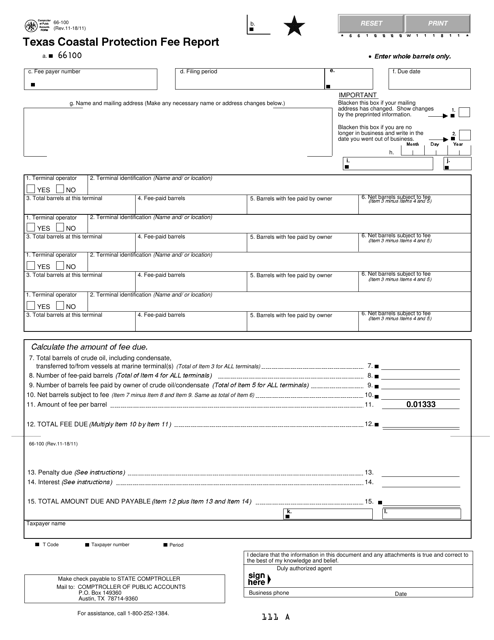

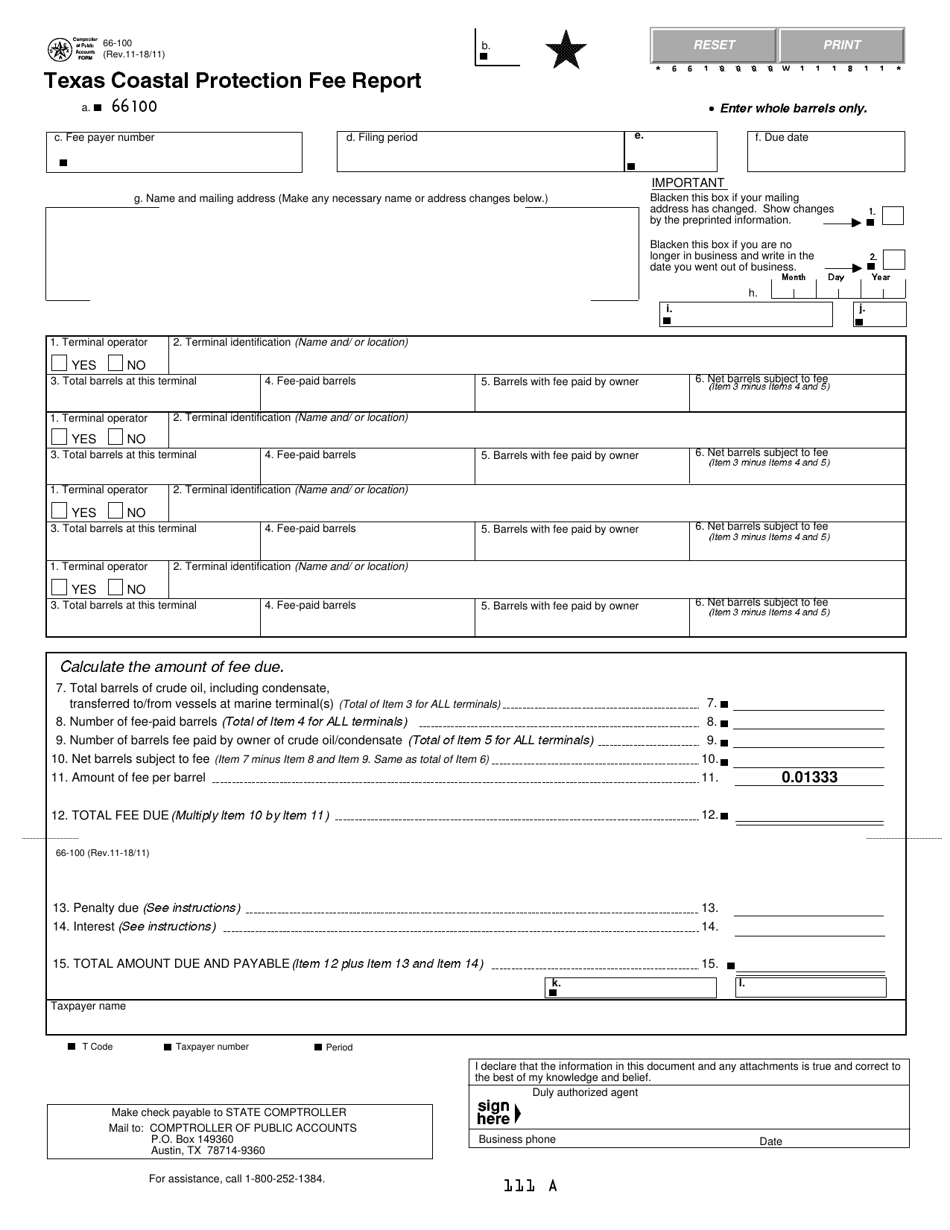

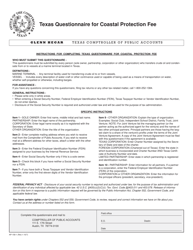

Form 66-100

for the current year.

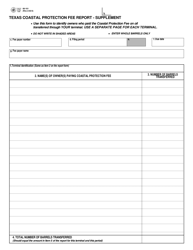

Form 66-100 Texas Coastal Protection Fee Report - Texas

What Is Form 66-100?

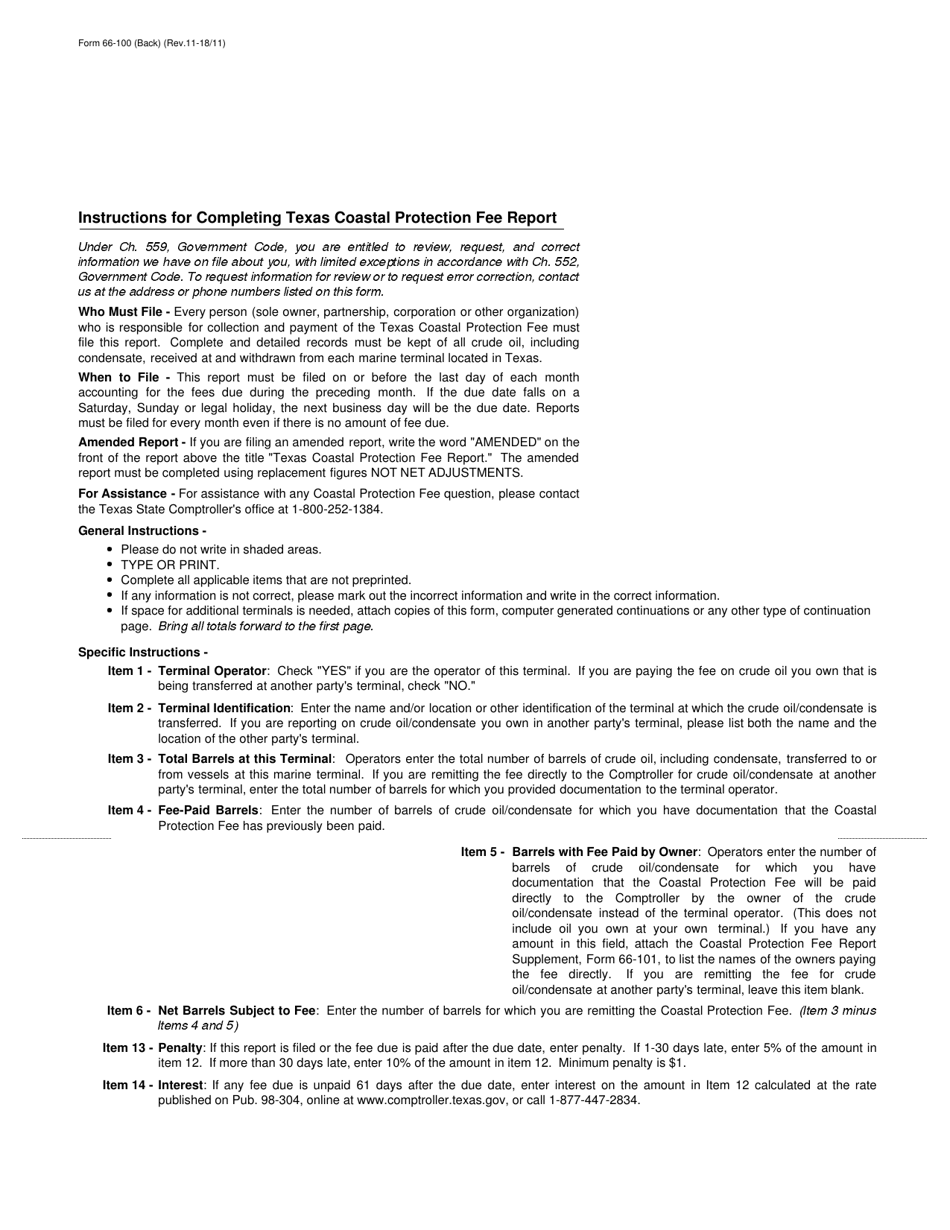

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 66-100?

A: Form 66-100 is the Texas Coastal ProtectionFee Report.

Q: Who needs to file Form 66-100?

A: Entities engaged in seaweed removal activities in Texas coastal waters need to file Form 66-100.

Q: What is the purpose of Form 66-100?

A: The purpose of Form 66-100 is to report and remit the Texas Coastal Protection Fee for seaweed removal activities.

Q: When is Form 66-100 due?

A: Form 66-100 is due on or before the 30th day of each month.

Q: How can I file Form 66-100?

A: Form 66-100 can be filed electronically or by mail.

Q: Are there any penalties for late filing of Form 66-100?

A: Yes, failure to file Form 66-100 by the due date may result in penalties and interest.

Q: What is the Texas Coastal Protection Fee used for?

A: The Texas Coastal Protection Fee is used to support and conserve the coastal natural resources and habitats.

Form Details:

- Released on November 11, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 66-100 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.