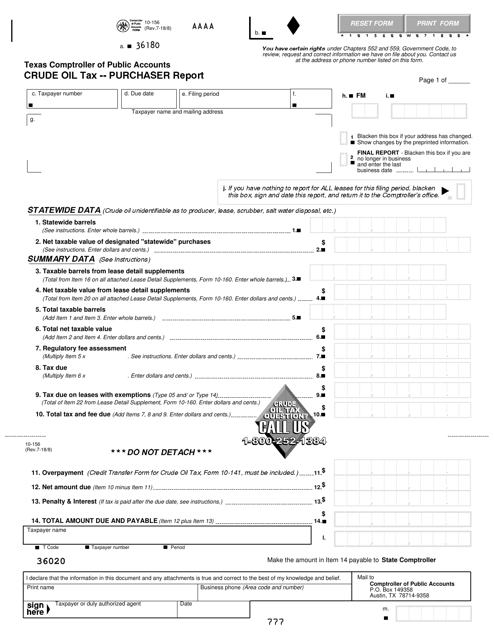

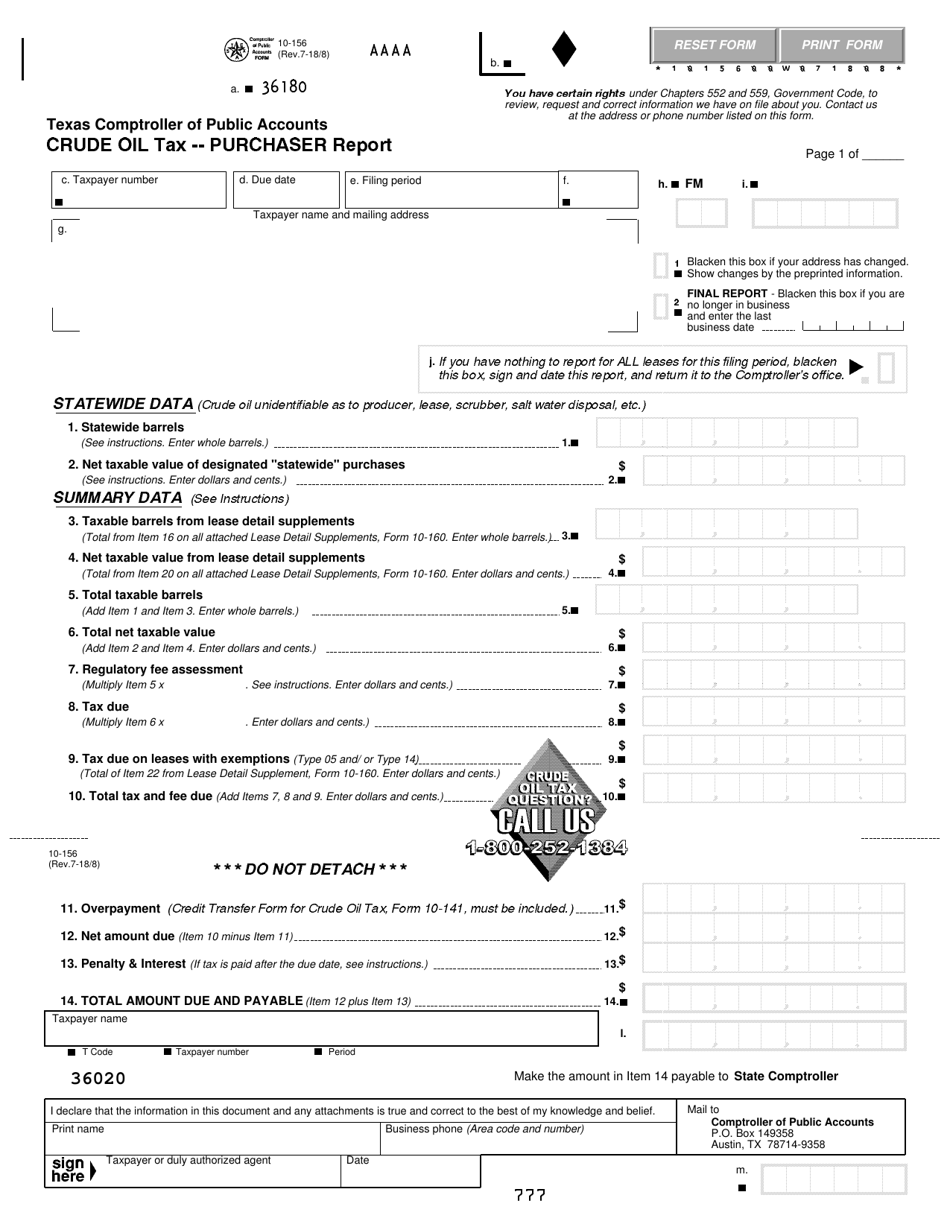

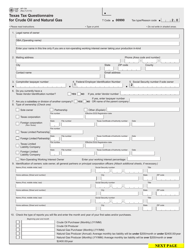

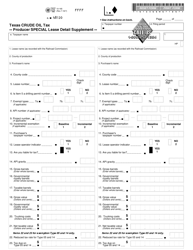

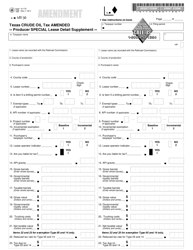

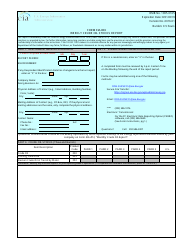

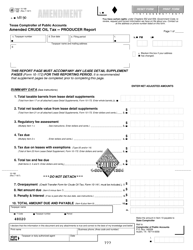

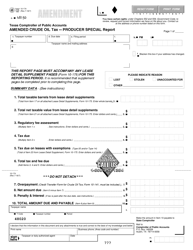

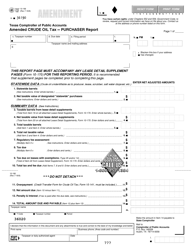

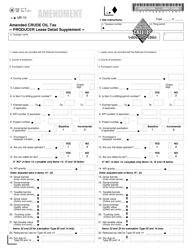

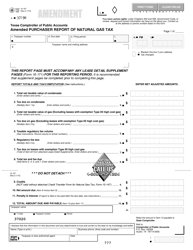

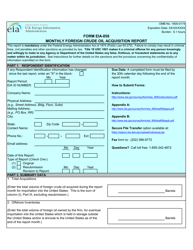

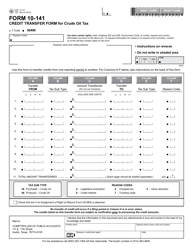

Form 10-156 Crude Oil Tax - Purchaser Report - Texas

What Is Form 10-156?

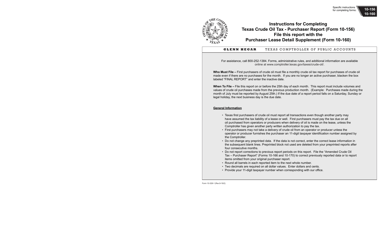

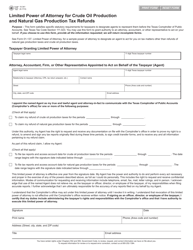

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 10-156?

A: Form 10-156 is a report used by crude oil purchasers in Texas to report their purchases and pay the applicable tax.

Q: Who is required to file Form 10-156?

A: Crude oil purchasers in Texas are required to file Form 10-156.

Q: What is the purpose of Form 10-156?

A: The purpose of Form 10-156 is to report crude oil purchases and pay the associated tax in Texas.

Q: What information is required on Form 10-156?

A: Form 10-156 requires information about the crude oil purchased, including the buyer and seller details, quantity, and price per barrel.

Q: When is Form 10-156 due?

A: Form 10-156 is generally due on the 25th day of the month following the month in which the purchases were made.

Q: What happens if I don't file Form 10-156?

A: Failure to file Form 10-156 or pay the associated tax may result in penalties and interest being assessed by the Texas Comptroller of Public Accounts.

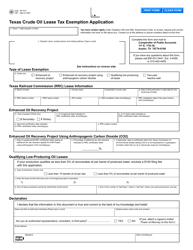

Q: Are there any exemptions or deductions available for crude oil purchases in Texas?

A: Yes, there are certain exemptions and deductions available for crude oil purchases in Texas. It is recommended to consult the Texas Comptroller of Public Accounts or a tax professional for specific details.

Q: Can I file Form 10-156 for previous months?

A: Yes, you can file Form 10-156 for previous months if you have missed the deadline. However, late filing may result in penalties and interest.

Form Details:

- Released on July 8, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10-156 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.