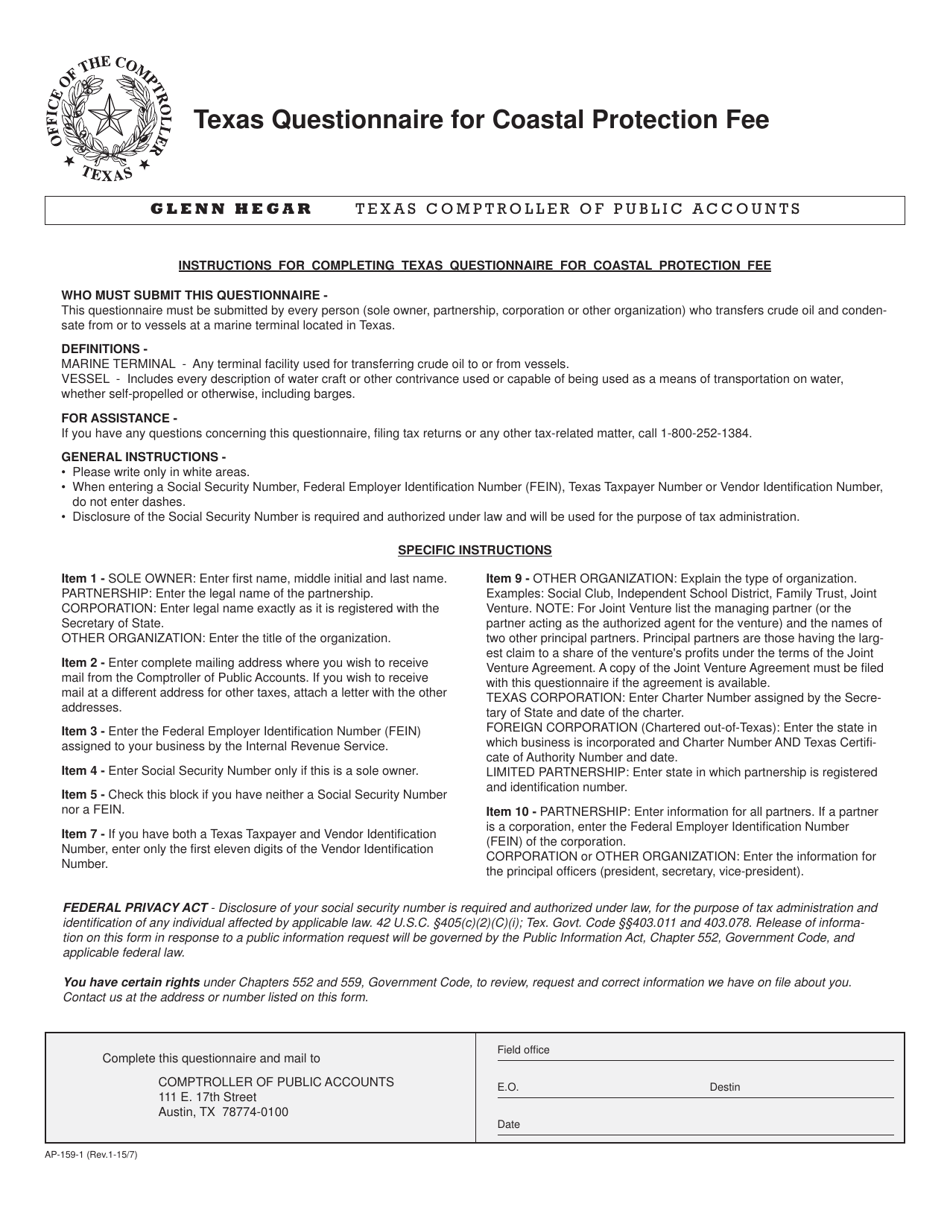

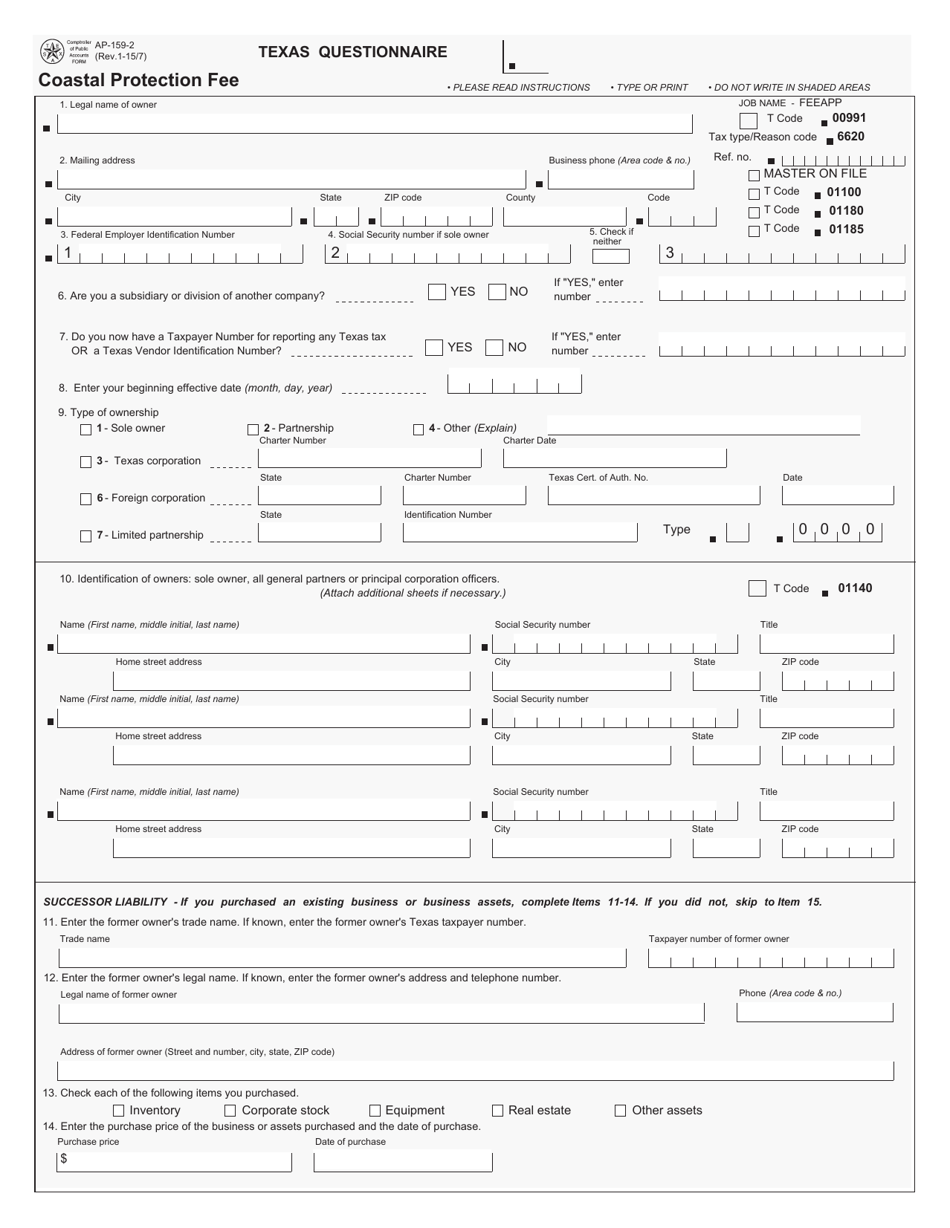

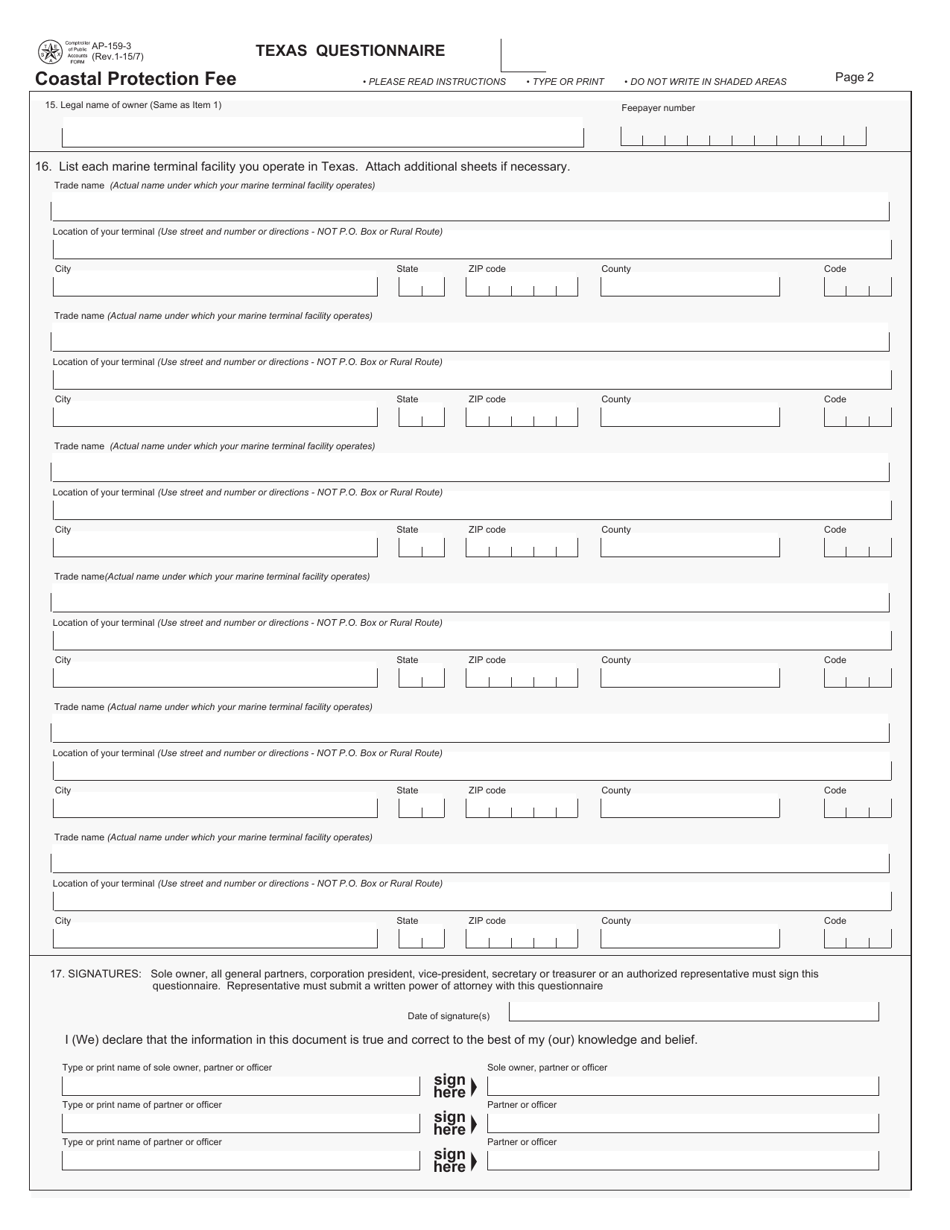

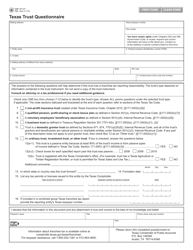

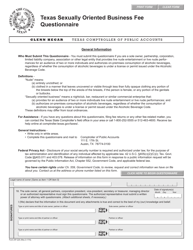

Form AP-159 Texas Questionnaire for Coastal Protection Fee - Texas

What Is Form AP-159?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

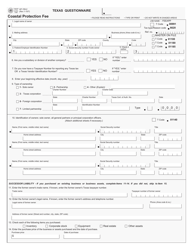

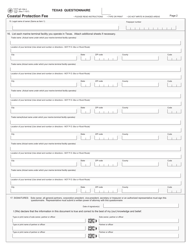

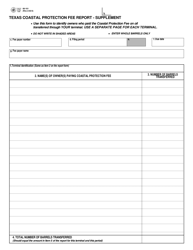

Q: What is Form AP-159?

A: Form AP-159 is the Texas Questionnaire for Coastal Protection Fee.

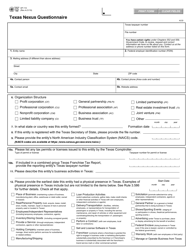

Q: What is the purpose of Form AP-159?

A: The purpose of Form AP-159 is to determine if a claim of exemption from the Coastal Protection Fee is valid.

Q: Who is required to complete Form AP-159?

A: Any person claiming an exemption from the Coastal Protection Fee is required to complete Form AP-159.

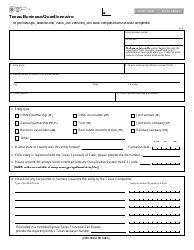

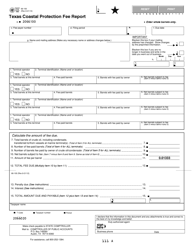

Q: When should Form AP-159 be filed?

A: Form AP-159 should be filed with the Comptroller of Public Accounts at the same time the claim of exemption is filed.

Q: Is there a deadline for filing Form AP-159?

A: Yes, Form AP-159 must be filed within 60 days after the claim of exemption is filed.

Q: Are there any penalties for not filing Form AP-159?

A: Yes, failure to file Form AP-159 may result in the denial of the claimed exemption.

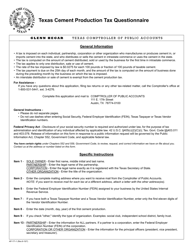

Q: Can I submit Form AP-159 electronically?

A: Currently, Form AP-159 cannot be submitted electronically. It must be submitted by mail or in person.

Form Details:

- Released on January 7, 2015;

- The latest edition provided by the Texas Comptroller of Public Accounts;

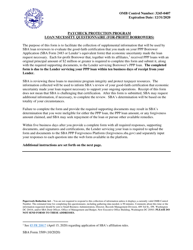

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-159 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.