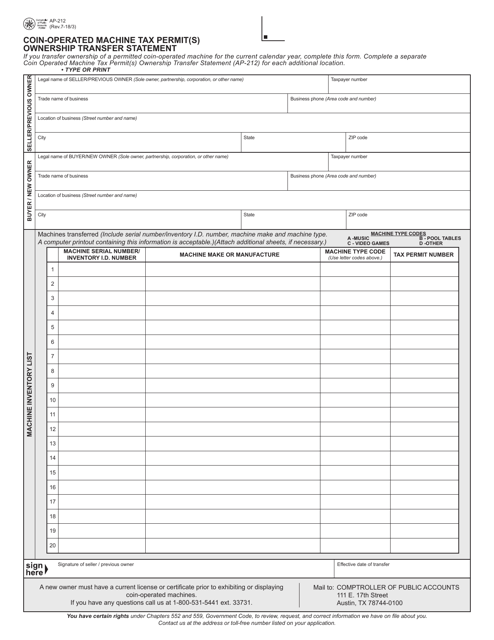

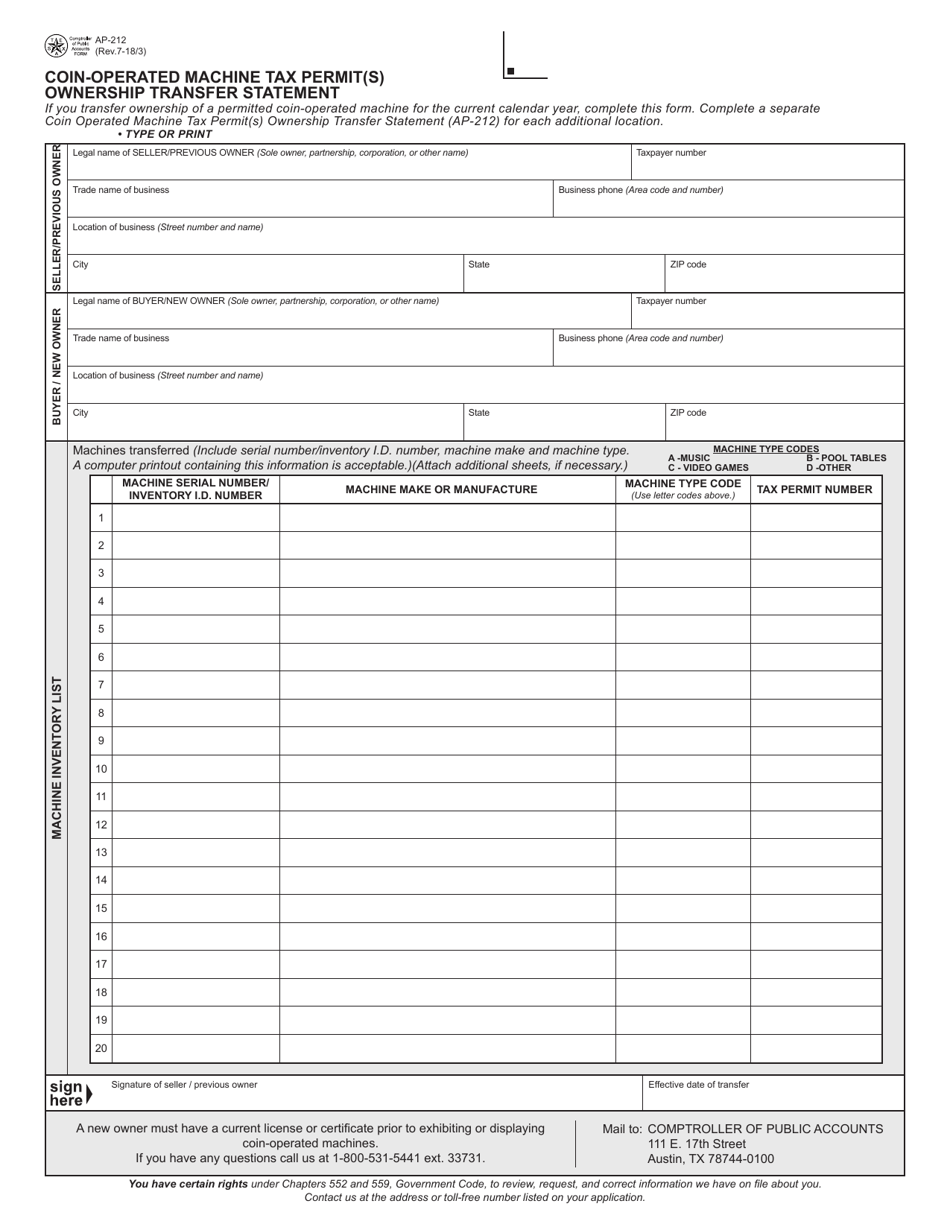

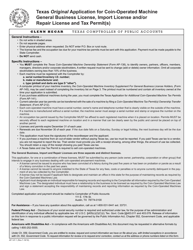

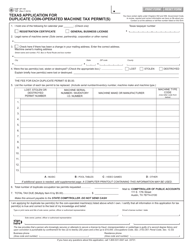

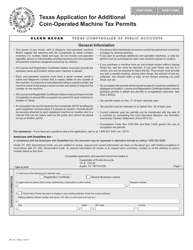

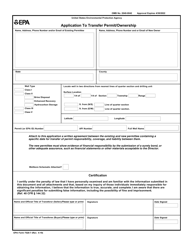

Form AP-212 Coin-Operated Machine Tax Permit(S) Ownership Transfer Statement - Texas

What Is Form AP-212?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AP-212?

A: Form AP-212 is the Coin-Operated Machine Tax Permit(S) Ownership Transfer Statement in Texas.

Q: What is the purpose of Form AP-212?

A: The purpose of Form AP-212 is to transfer ownership of coin-operated machines for tax purposes in Texas.

Q: Who needs to file Form AP-212?

A: Anyone who is transferring ownership of coin-operated machines in Texas needs to file Form AP-212.

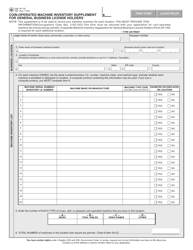

Q: What information is required on Form AP-212?

A: Form AP-212 requires information such as the name and address of the transferor and transferee, details of the machines being transferred, and the effective date of the transfer.

Form Details:

- Released on July 3, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-212 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.