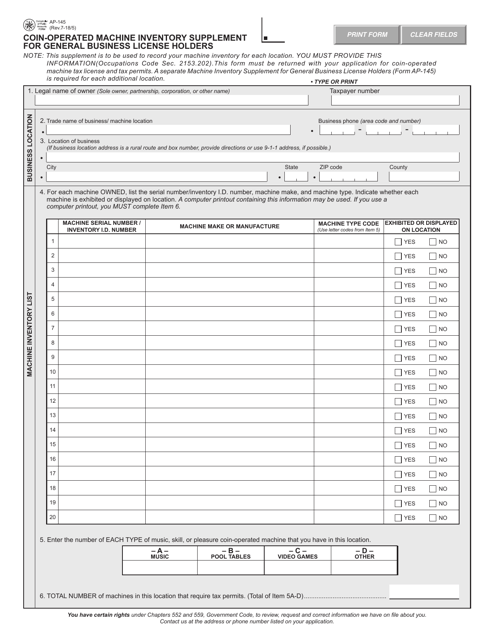

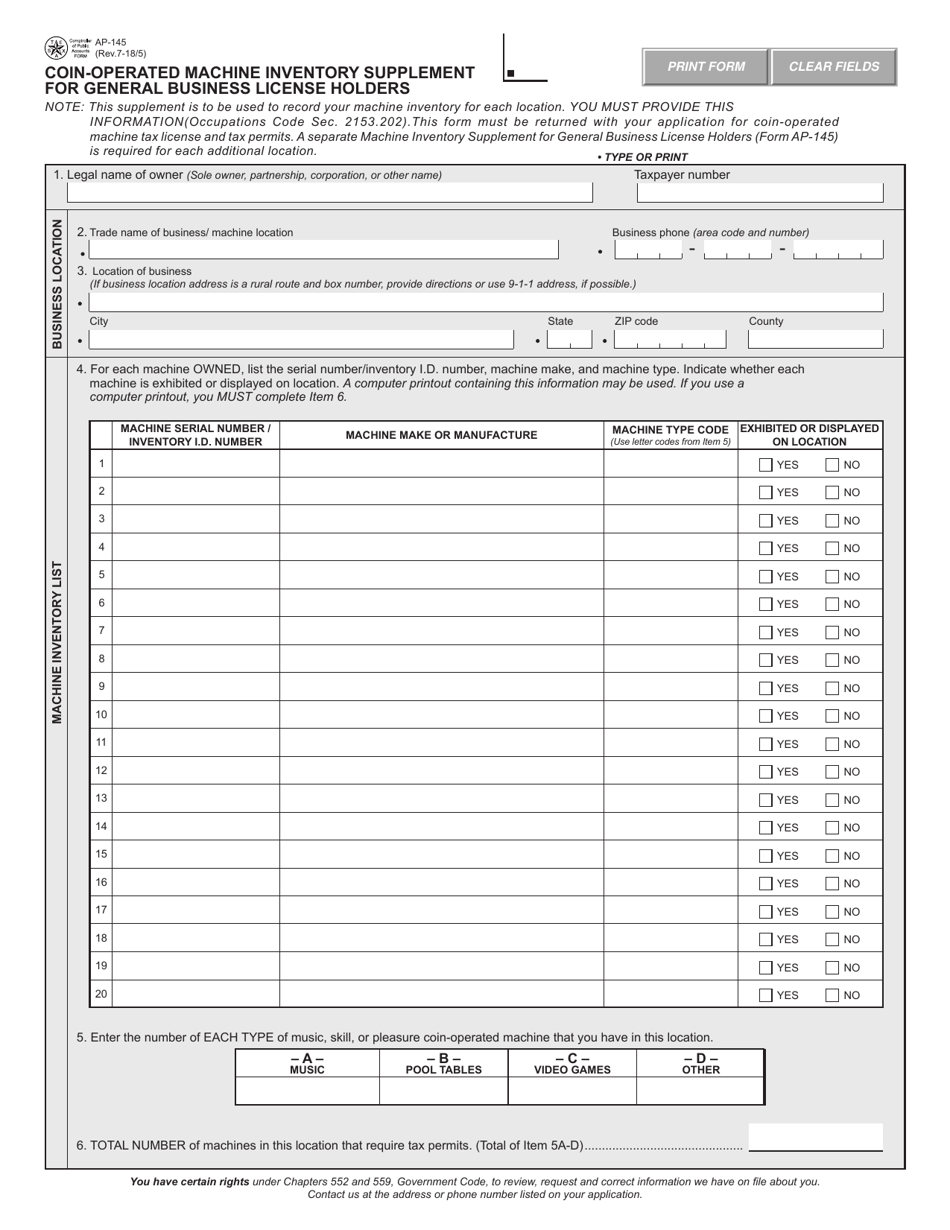

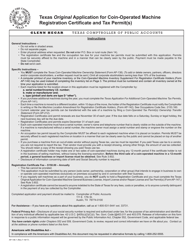

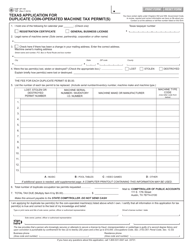

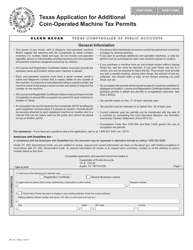

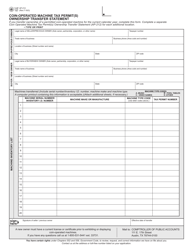

Form AP-145 Coin-Operated Machine Inventory Supplement for General Business License Holders - Texas

What Is Form AP-145?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AP-145?

A: Form AP-145 is the Coin-Operated Machine Inventory Supplement for General Business License Holders in Texas.

Q: Who is required to file Form AP-145?

A: General businesslicense holders in Texas who have coin-operated machines are required to file Form AP-145.

Q: What is the purpose of Form AP-145?

A: The purpose of Form AP-145 is to report and provide an inventory of coin-operated machines owned or operated by general business license holders in Texas.

Q: When is Form AP-145 due?

A: Form AP-145 is due on or before the 10th day of each month.

Q: Is there a fee for filing Form AP-145?

A: No, there is no fee for filing Form AP-145.

Q: What information do I need to provide on Form AP-145?

A: You need to provide information such as the location of each machine, machine type, and the number of machines owned or operated.

Q: What happens if I fail to file Form AP-145?

A: Failure to file Form AP-145 or providing false information may result in penalties or legal consequences.

Q: Who should I contact for more information about Form AP-145?

A: For more information about Form AP-145, you can contact the Texas Comptroller of Public Accounts.

Form Details:

- Released on July 5, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-145 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.