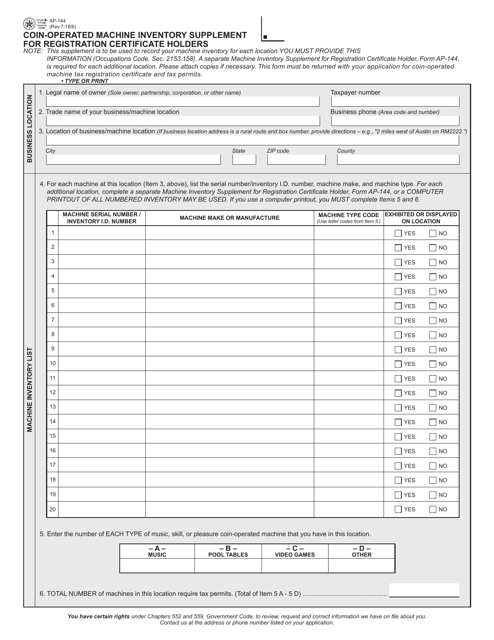

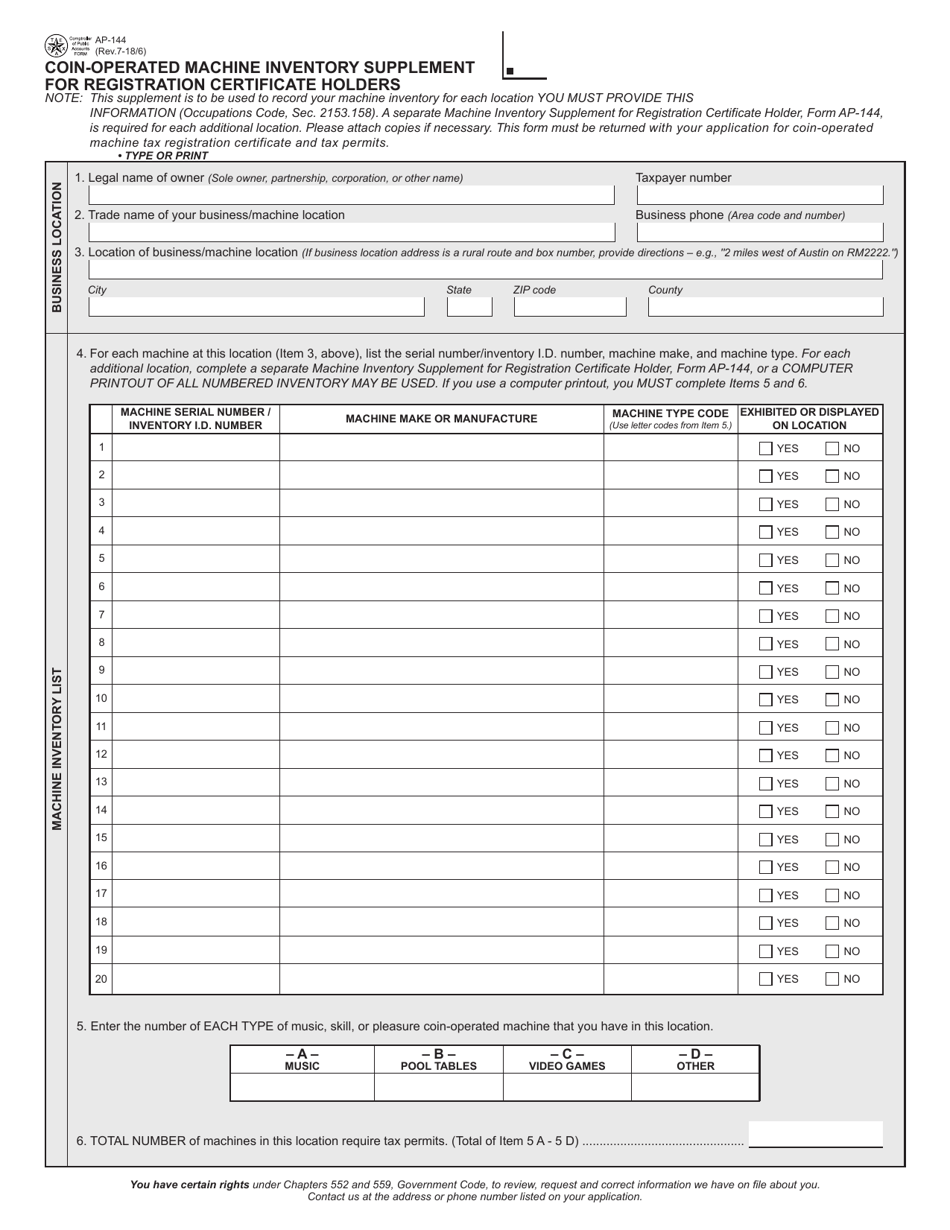

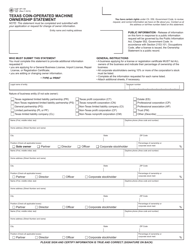

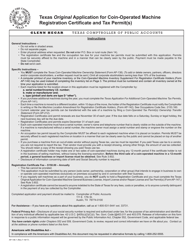

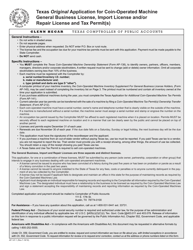

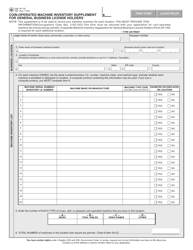

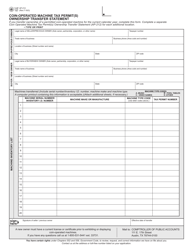

Form AP-144 Coin-Operated Machine Inventory Supplement for Registration Certificate Holders - Texas

What Is Form AP-144?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AP-144?

A: Form AP-144 is the Coin-Operated Machine Inventory Supplement for Registration Certificate Holders in Texas.

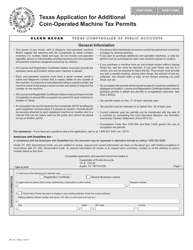

Q: Who needs to use Form AP-144?

A: Registration Certificate Holders with coin-operated machines in Texas need to use Form AP-144.

Q: What is the purpose of Form AP-144?

A: Form AP-144 is used to supplement the information provided on the Coin-Operated Machine Registration Certificate in Texas.

Q: Do I need to file Form AP-144 annually?

A: Yes, Form AP-144 needs to be filed annually to update the inventory of your coin-operated machines in Texas.

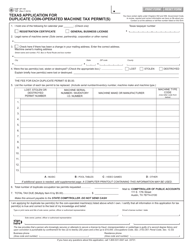

Q: What information is required on Form AP-144?

A: Form AP-144 requires you to provide details about each coin-operated machine you own, including location, type, model, and serial number.

Q: Are there any fees associated with filing Form AP-144?

A: No, there are no fees associated with filing Form AP-144.

Q: What should I do with Form AP-144 once it is completed?

A: You should keep a copy of Form AP-144 for your records and submit the original to the Texas Comptroller's office.

Q: What happens if I fail to file Form AP-144?

A: Failure to file Form AP-144 or providing false information may result in penalties and fines.

Form Details:

- Released on July 6, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-144 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.