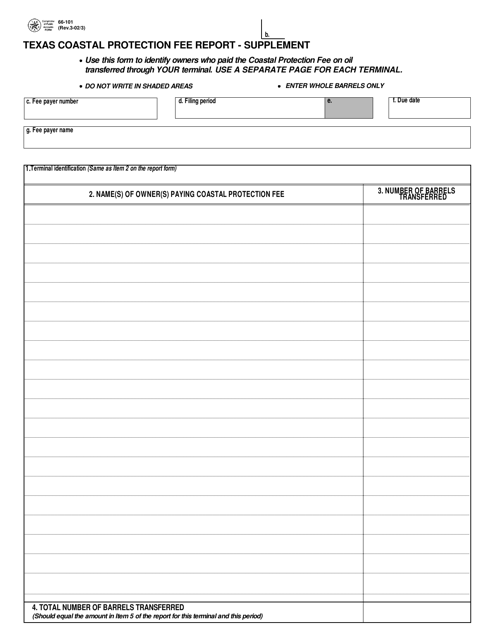

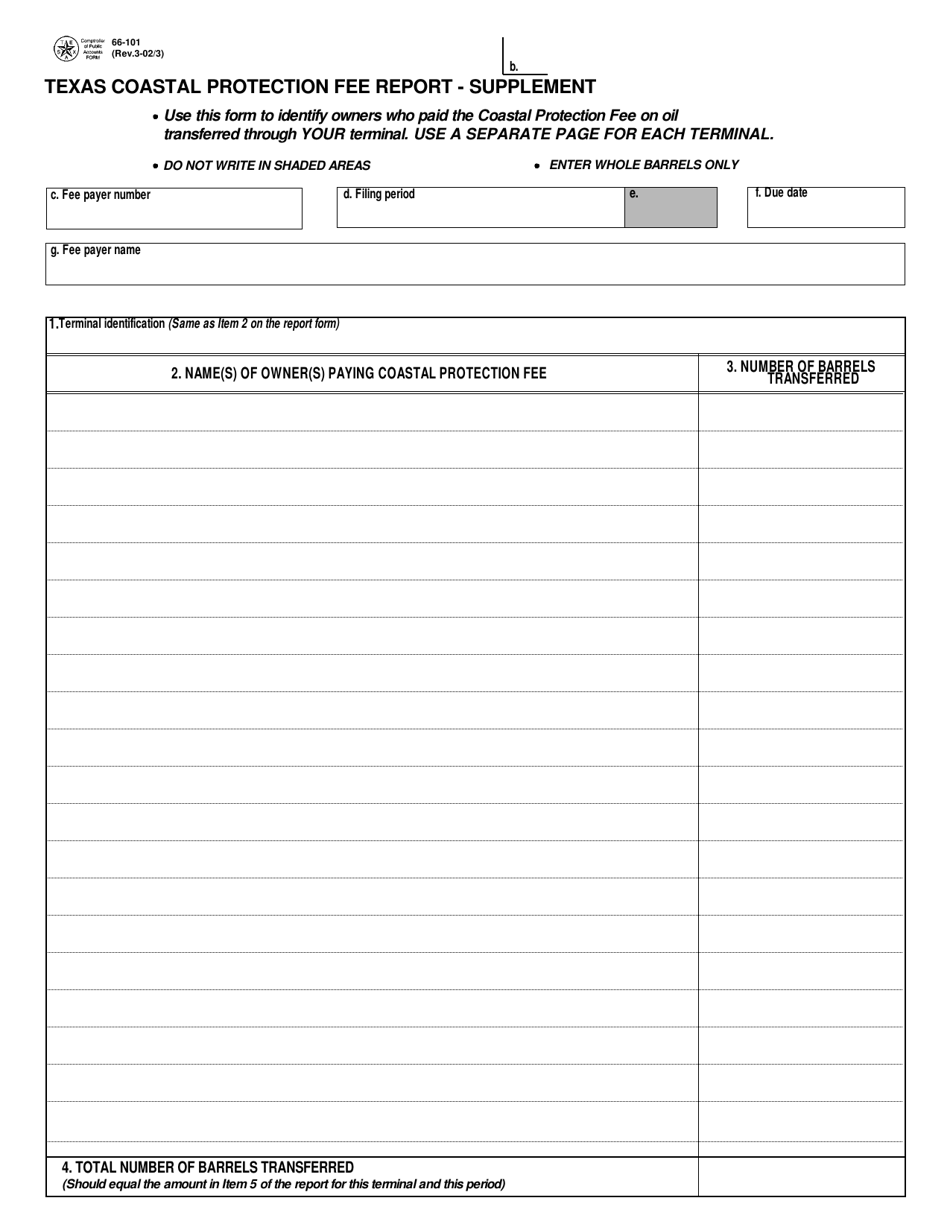

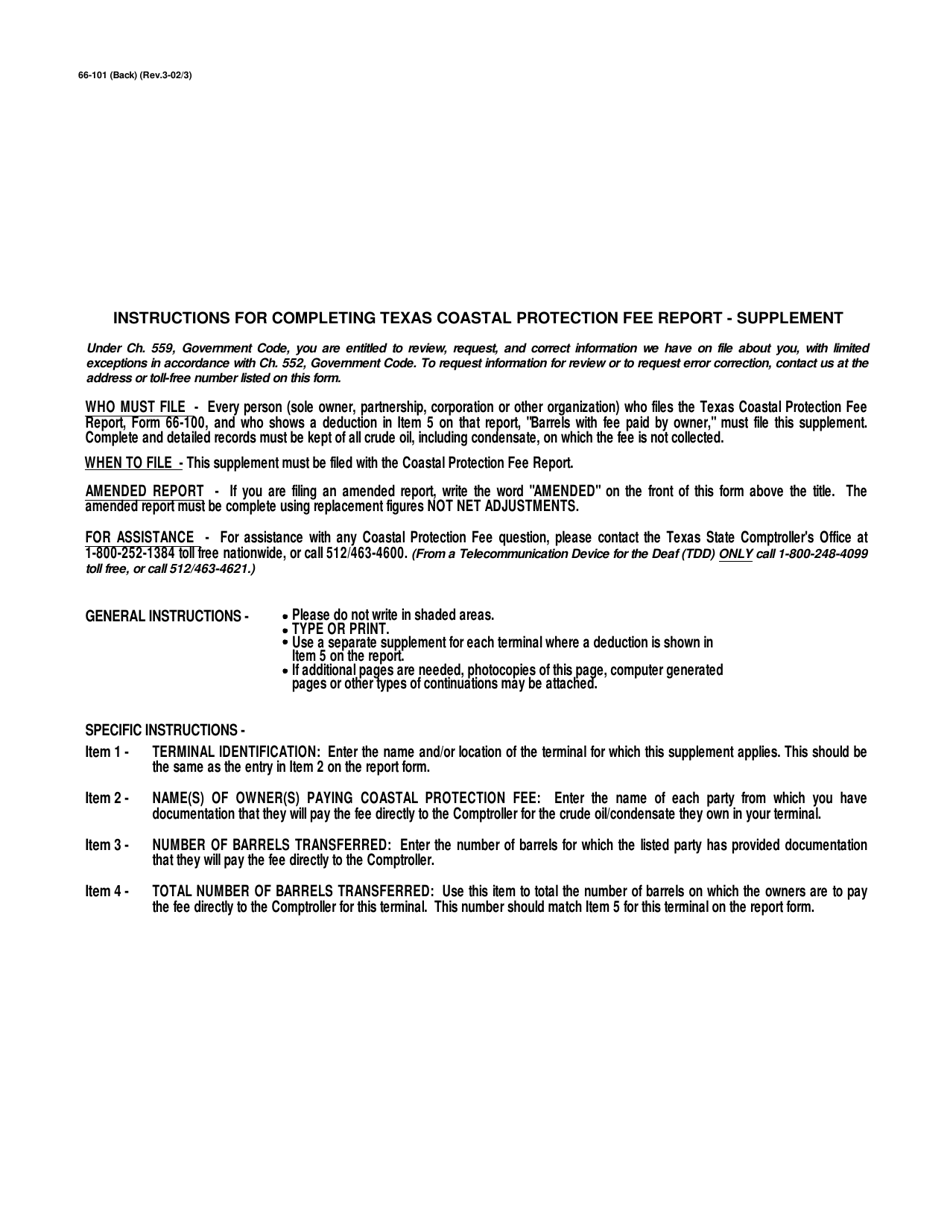

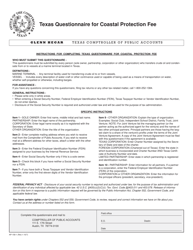

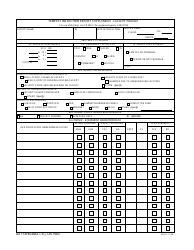

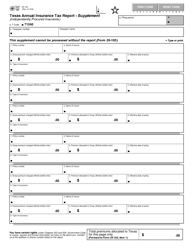

Form 66-101 Texas Coastal Protection Fee Report - Supplement - Texas

What Is Form 66-101?

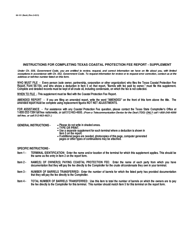

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 66-101?

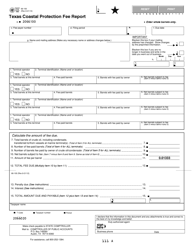

A: Form 66-101 is the Texas Coastal ProtectionFee Report - Supplement, used in Texas.

Q: What is the purpose of Form 66-101?

A: The purpose of Form 66-101 is to report the Texas Coastal Protection Fee.

Q: Who needs to file Form 66-101?

A: Individuals or entities subject to the Texas Coastal Protection Fee need to file Form 66-101.

Q: What is the Texas Coastal Protection Fee?

A: The Texas Coastal Protection Fee is a fee imposed on certain activities that may impact the Texas coast.

Q: Is Form 66-101 specific to Texas?

A: Yes, Form 66-101 is specific to Texas and is used to report the Texas Coastal Protection Fee.

Q: Is Form 66-101 required to be filed annually?

A: Yes, Form 66-101 is required to be filed annually by those subject to the Texas Coastal Protection Fee.

Q: Are there any penalties for not filing Form 66-101?

A: Yes, there can be penalties for not filing Form 66-101, including monetary fines and other enforcement actions.

Q: Is Form 66-101 only for individuals?

A: No, Form 66-101 is for both individuals and entities.

Q: Can I get assistance in filling out Form 66-101?

A: Yes, you can seek assistance from the Texas Comptroller's office or a qualified tax professional to help you fill out Form 66-101.

Form Details:

- Released on March 3, 2002;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 66-101 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.