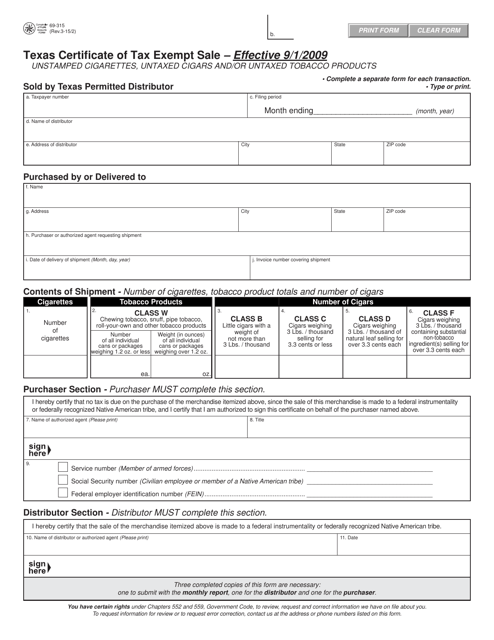

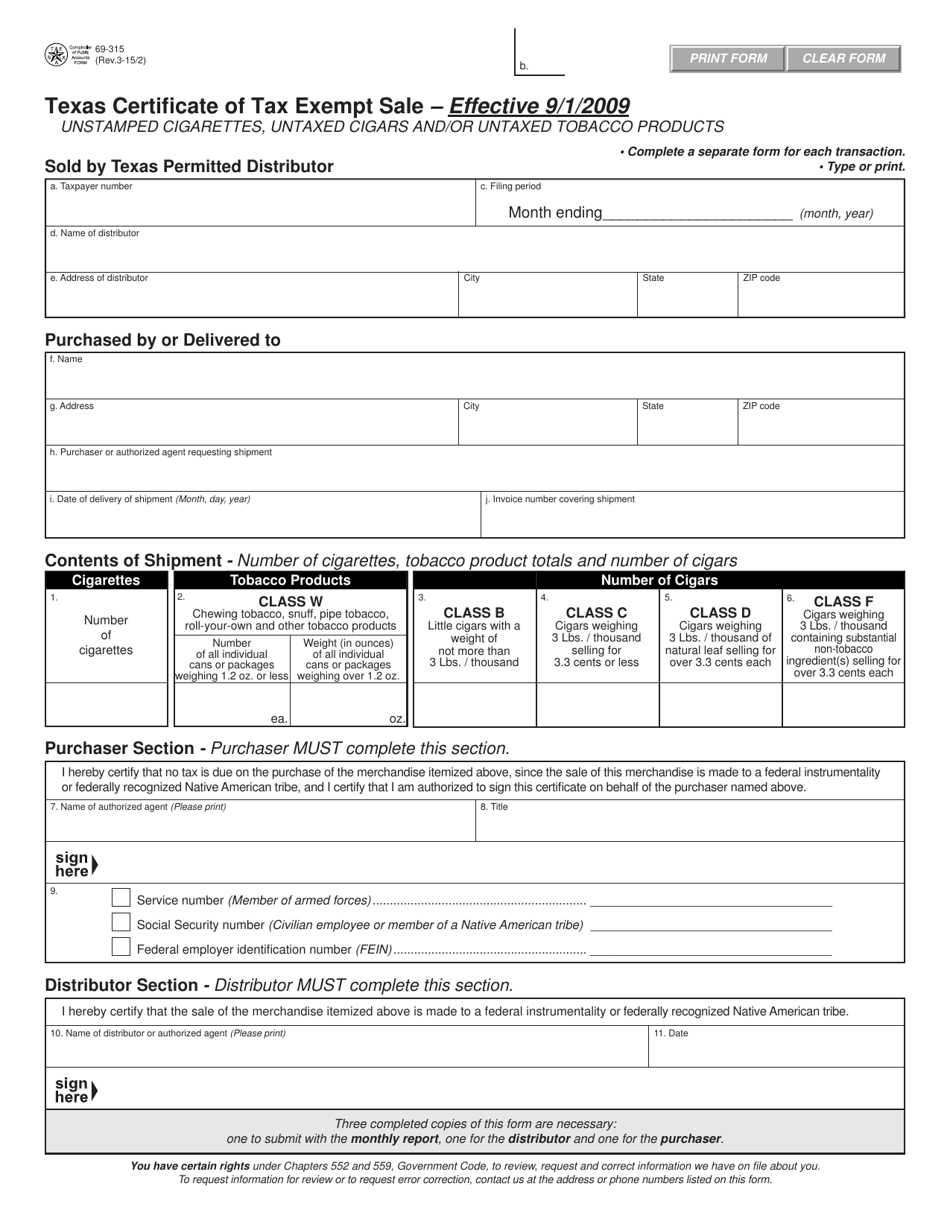

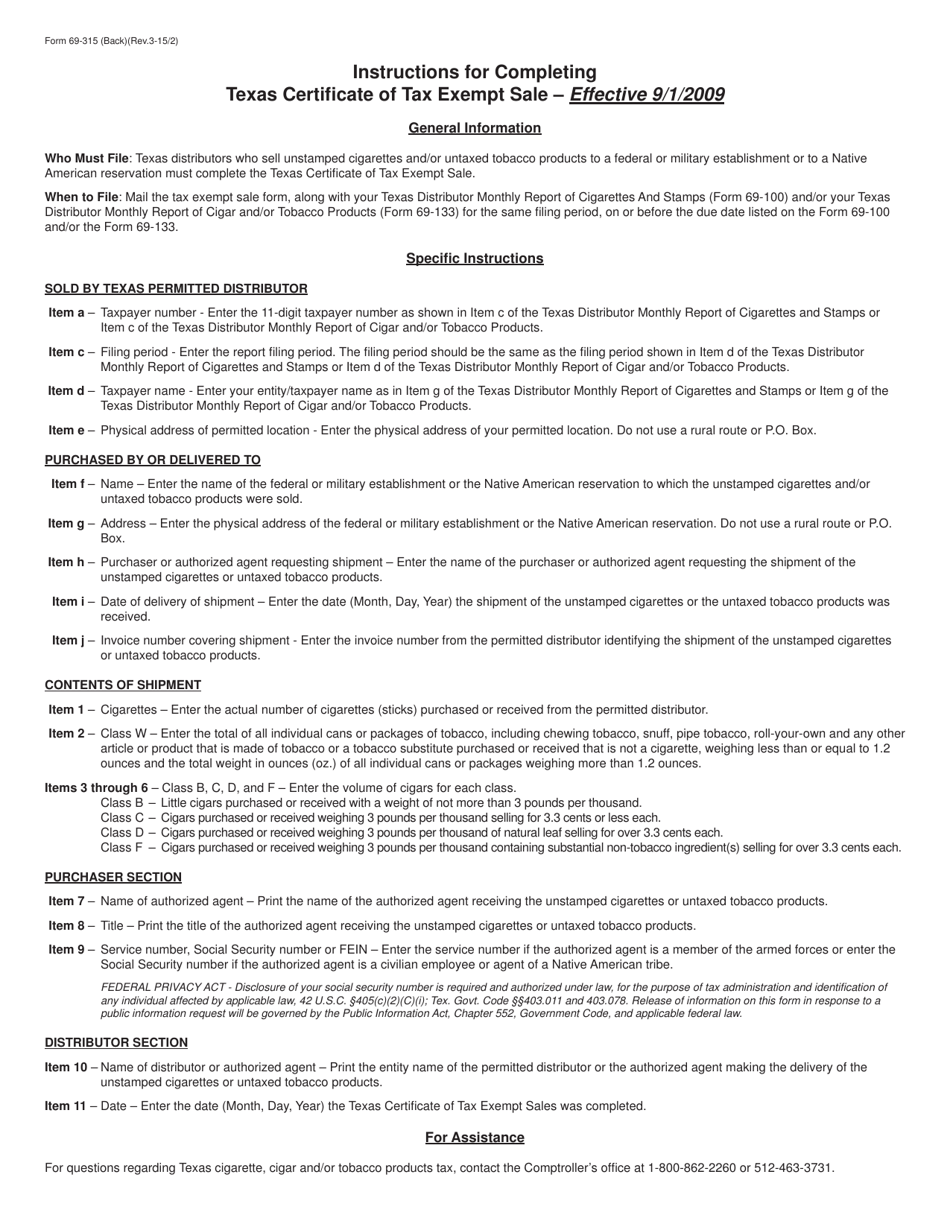

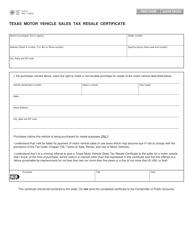

Form 69-315 Texas Certificate of Tax Exempt Sale - Texas

What Is Form 69-315?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 69-315?

A: Form 69-315 is the Texas Certificate of Tax Exempt Sale.

Q: Who needs to fill out Form 69-315?

A: The seller of a taxable item in Texas needs to fill out Form 69-315.

Q: What is the purpose of Form 69-315?

A: The purpose of Form 69-315 is to provide proof of a tax-exempt sale in Texas.

Q: When should Form 69-315 be completed?

A: Form 69-315 should be completed at the time of sale.

Form Details:

- Released on March 2, 2015;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 69-315 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.