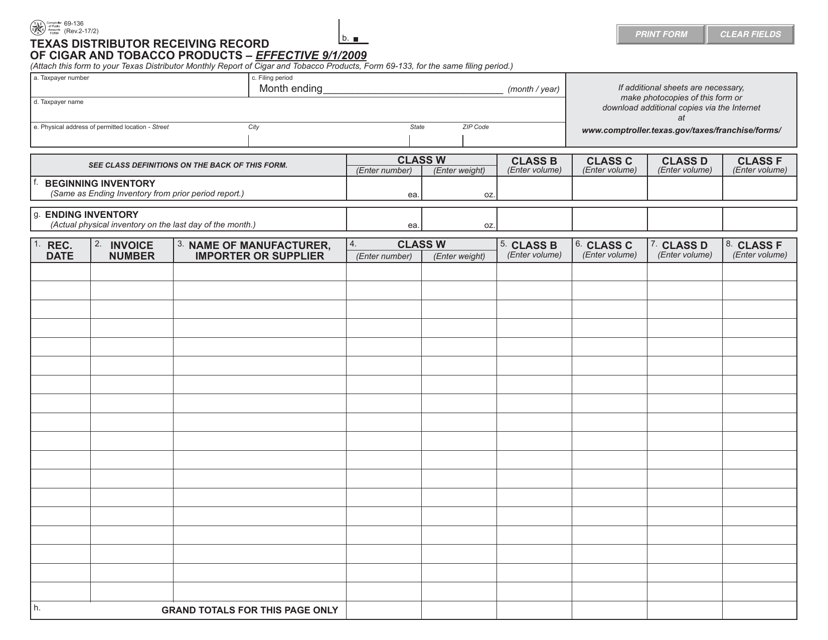

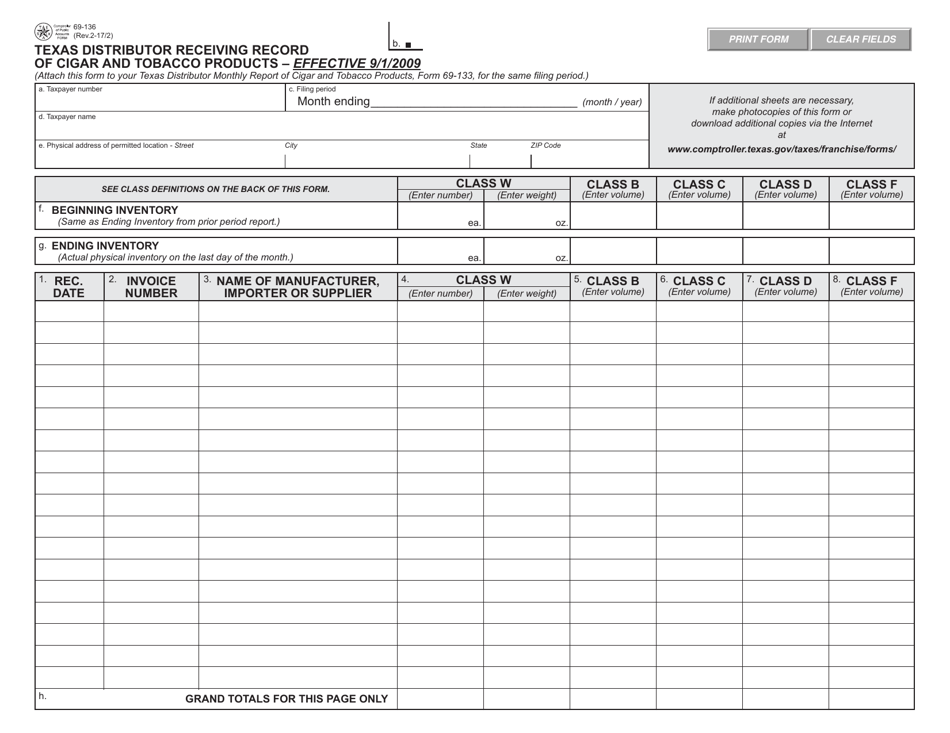

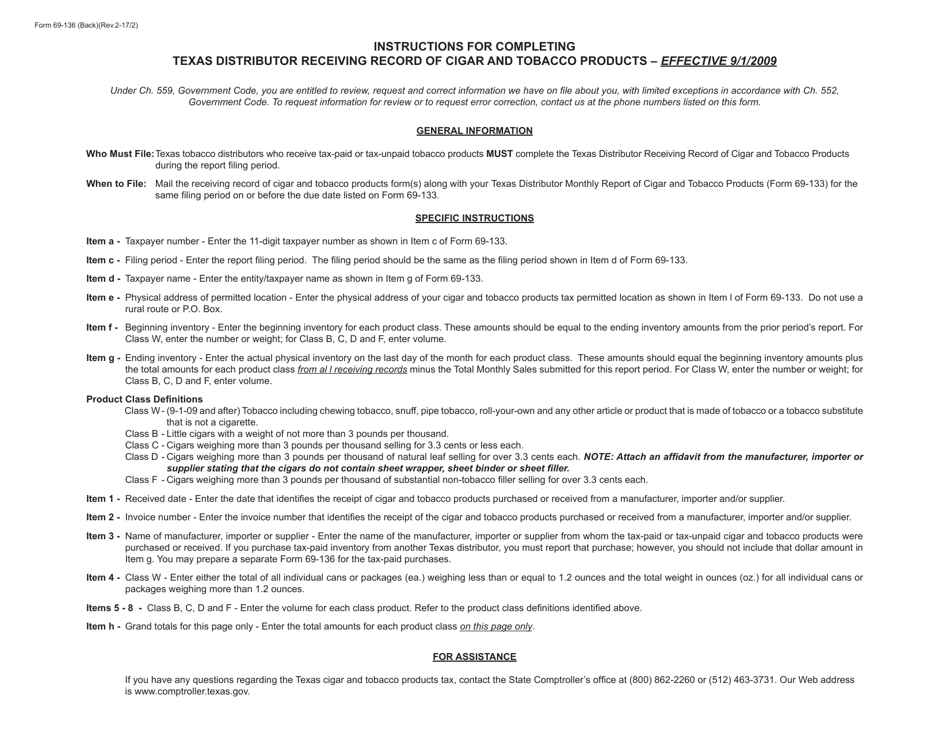

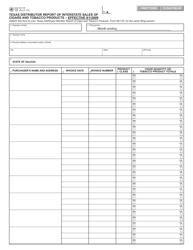

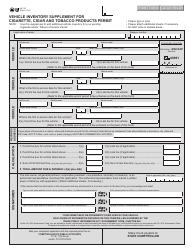

Form 69-136 Texas Distributor Receiving Record of Cigar and Tobacco Products - Texas

What Is Form 69-136?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

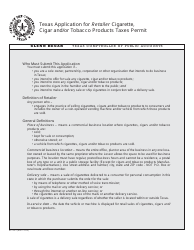

Q: What is the Form 69-136 Texas Distributor Receiving Record of Cigar and Tobacco Products used for?

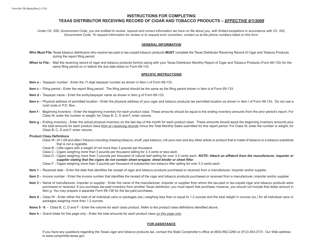

A: The Form 69-136 is used by Texas distributors to record the receipt of cigar and tobacco products.

Q: Who needs to fill out the Form 69-136 Texas Distributor Receiving Record of Cigar and Tobacco Products?

A: Texas distributors who receive cigar and tobacco products need to fill out this form.

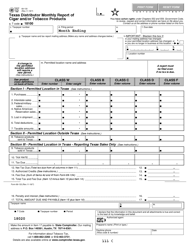

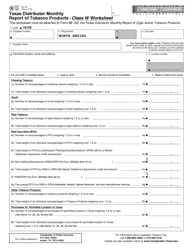

Q: What information is required on the Form 69-136 Texas Distributor Receiving Record of Cigar and Tobacco Products?

A: The form requires information such as the date, the name of the supplier, the quantity received, and the product description.

Q: Is there a deadline for submitting the Form 69-136 Texas Distributor Receiving Record of Cigar and Tobacco Products?

A: Yes, the form must be submitted within 20 days after the receipt of the cigar and tobacco products.

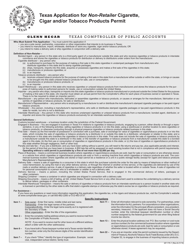

Form Details:

- Released on February 2, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 69-136 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.