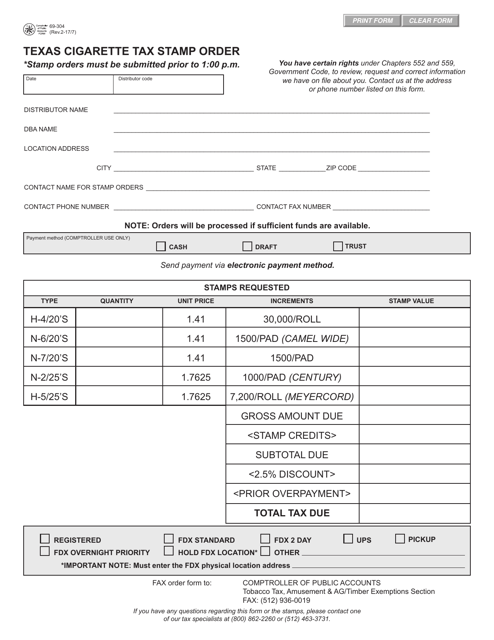

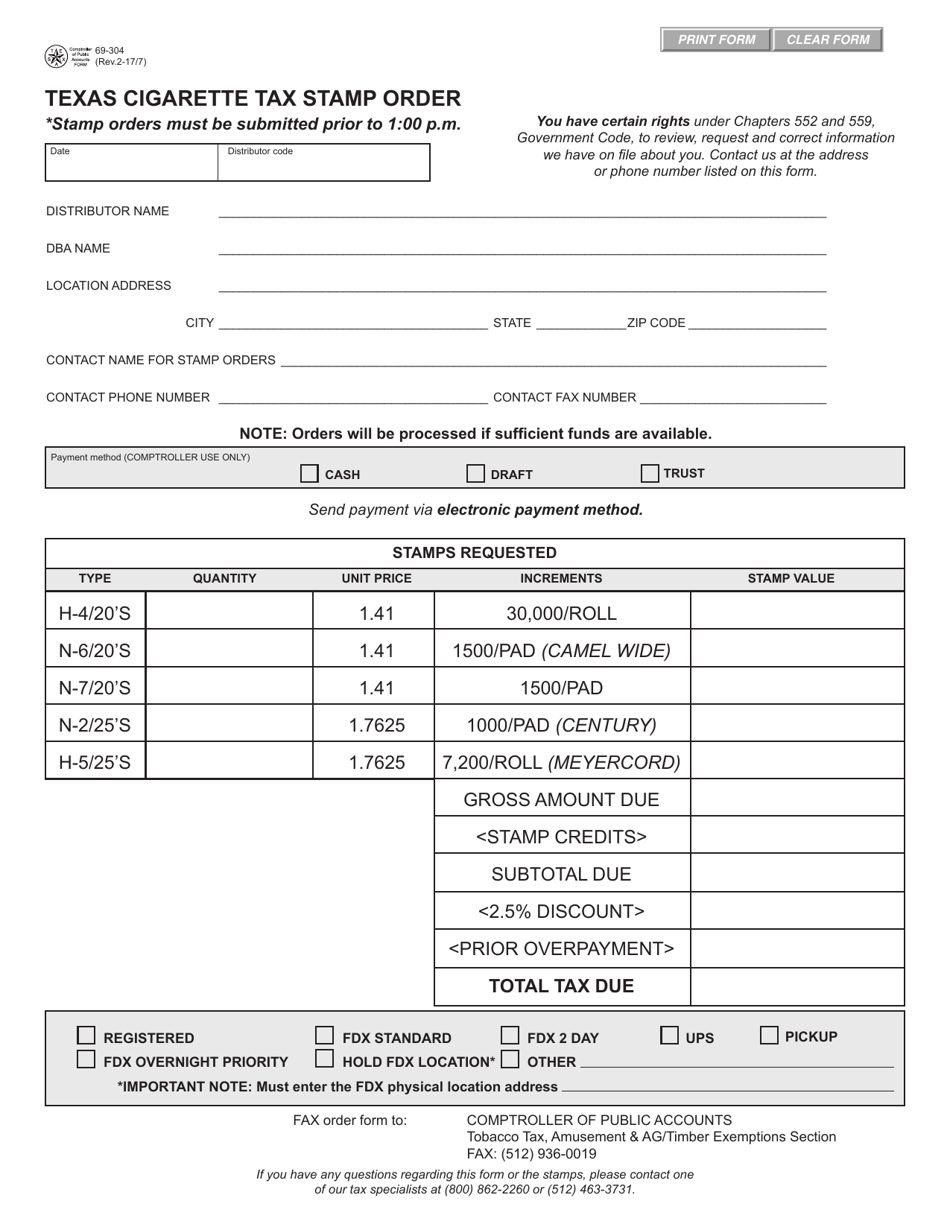

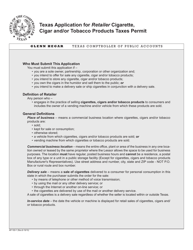

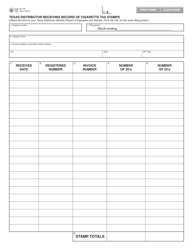

Form 69-304 Texas Cigarette Tax Stamp Order - Texas

What Is Form 69-304?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 69-304?

A: Form 69-304 is the Texas Cigarette Tax Stamp Order form.

Q: What is the purpose of Form 69-304?

A: The purpose of Form 69-304 is to order Texas cigarette tax stamps.

Q: Who needs to fill out Form 69-304?

A: Wholesale and distributor cigarette stamp purchasers in Texas need to fill out Form 69-304.

Q: How do I fill out Form 69-304?

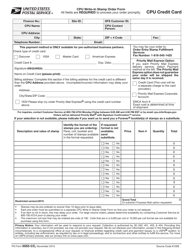

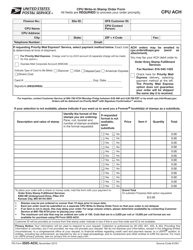

A: You need to provide your business information, quantities of cigarette tax stamps required, and payment details.

Q: What is the deadline for submitting Form 69-304?

A: The deadline for submitting Form 69-304 varies and is determined by the Comptroller's office.

Q: Are there any fees associated with Form 69-304?

A: Yes, there is a handling fee of 0.5% of the total amount due.

Q: How long does it take to process Form 69-304?

A: It generally takes 10 business days to process Form 69-304.

Form Details:

- Released on February 7, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 69-304 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.