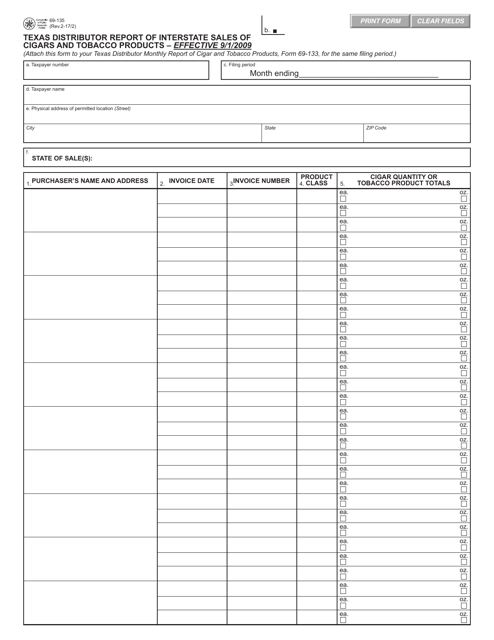

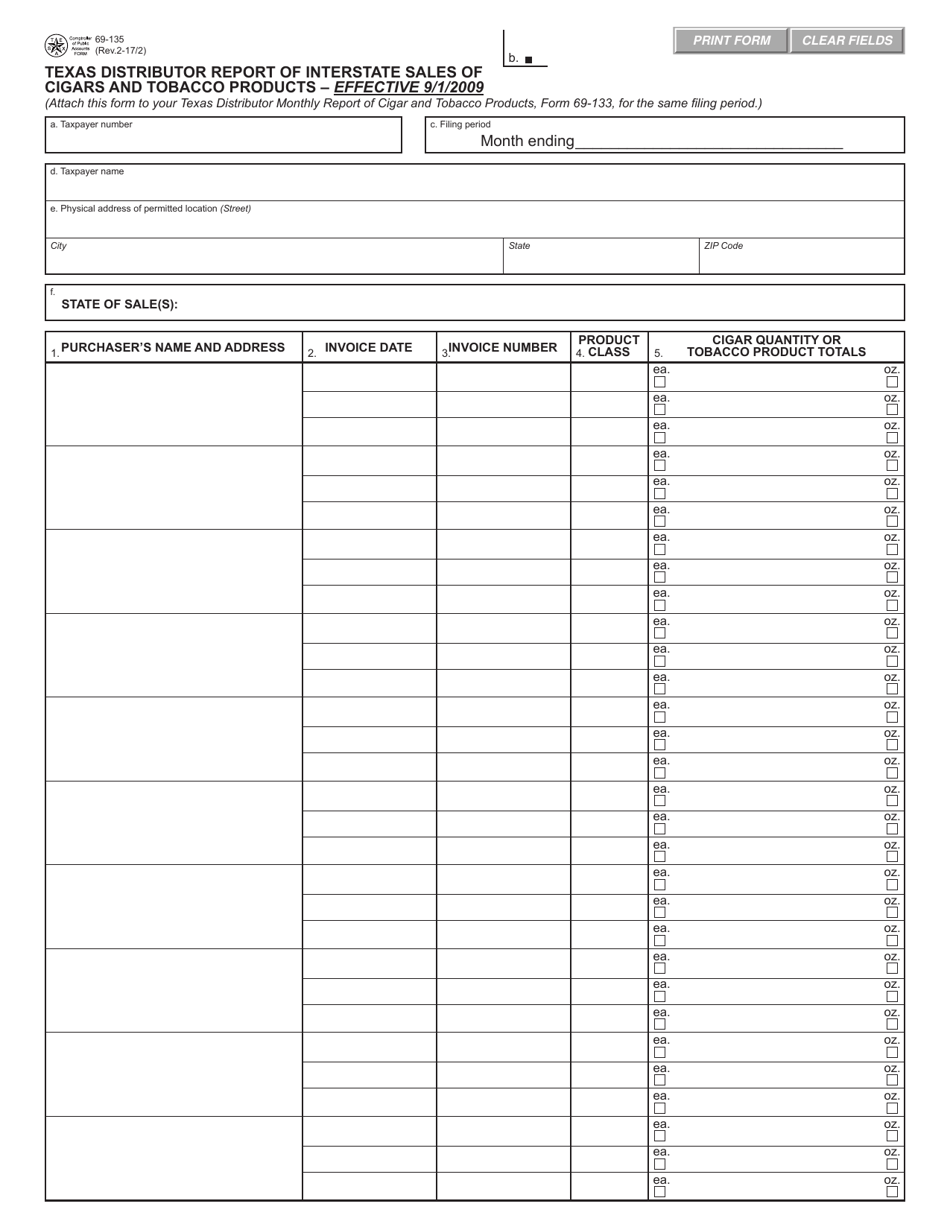

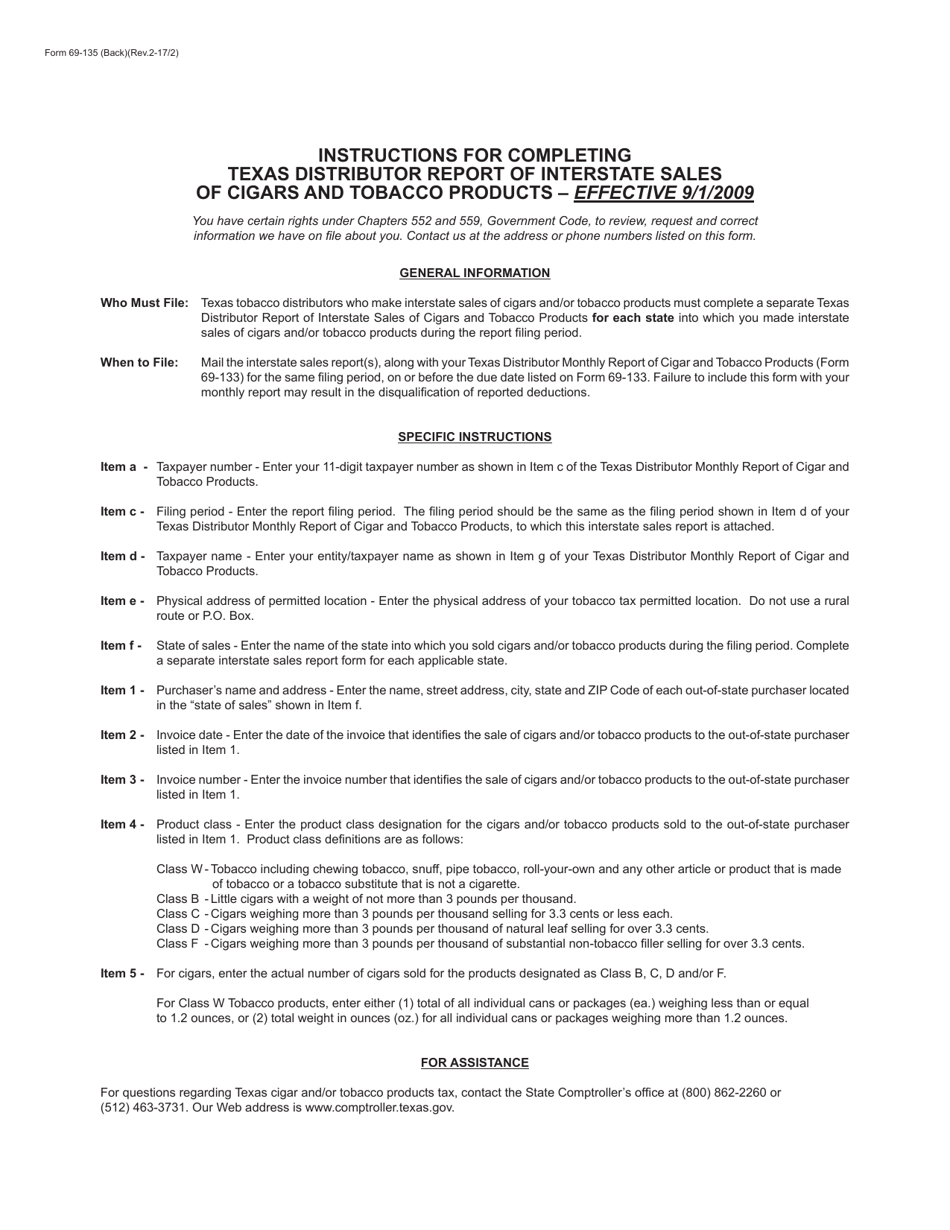

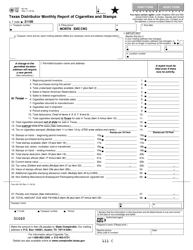

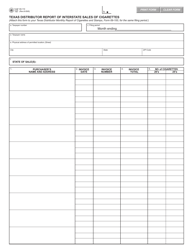

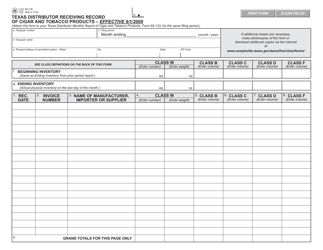

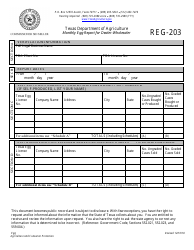

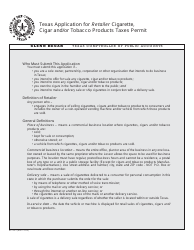

Form 69-135 Texas Distributor Report of Interstate Sales of Cigars and Tobacco Products - Texas

What Is Form 69-135?

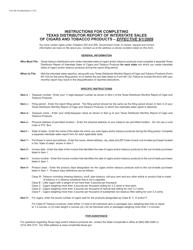

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form 69-135?

A: Form 69-135 is used to report interstate sales of cigars and tobacco products in the state of Texas.

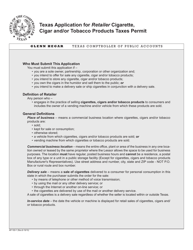

Q: Who is required to fill out Form 69-135?

A: Distributors of cigars and tobacco products in Texas are required to fill out this form.

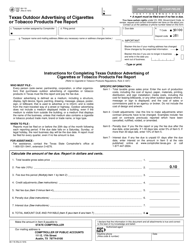

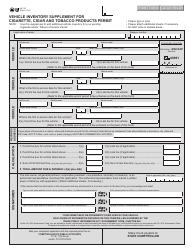

Q: What information needs to be included in Form 69-135?

A: The form requires information about the distributor's name, contact information, and details of interstate sales of cigars and tobacco products.

Q: When is Form 69-135 due?

A: The form is due on or before the 20th day of the month following the end of each calendar quarter.

Q: Are there any penalties for late or incorrect filing of Form 69-135?

A: Yes, there may be penalties for late or incorrect filing, including monetary fines.

Form Details:

- Released on February 2, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 69-135 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.