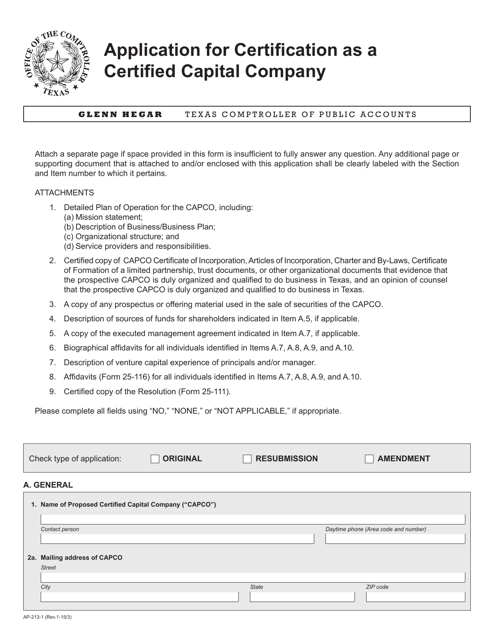

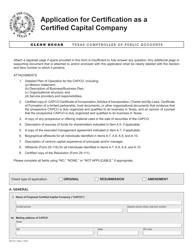

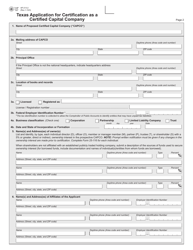

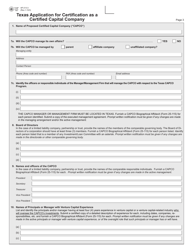

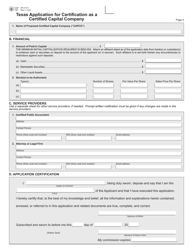

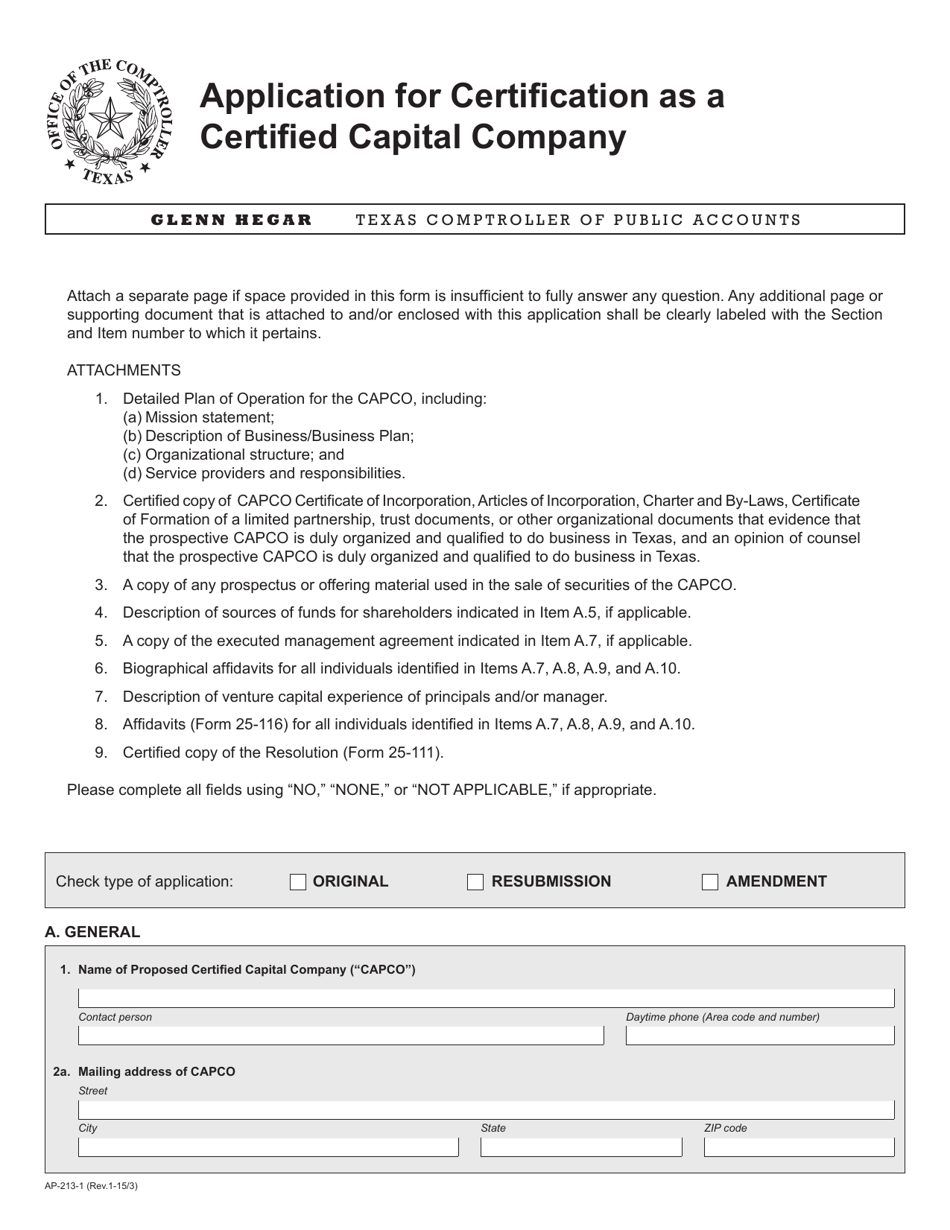

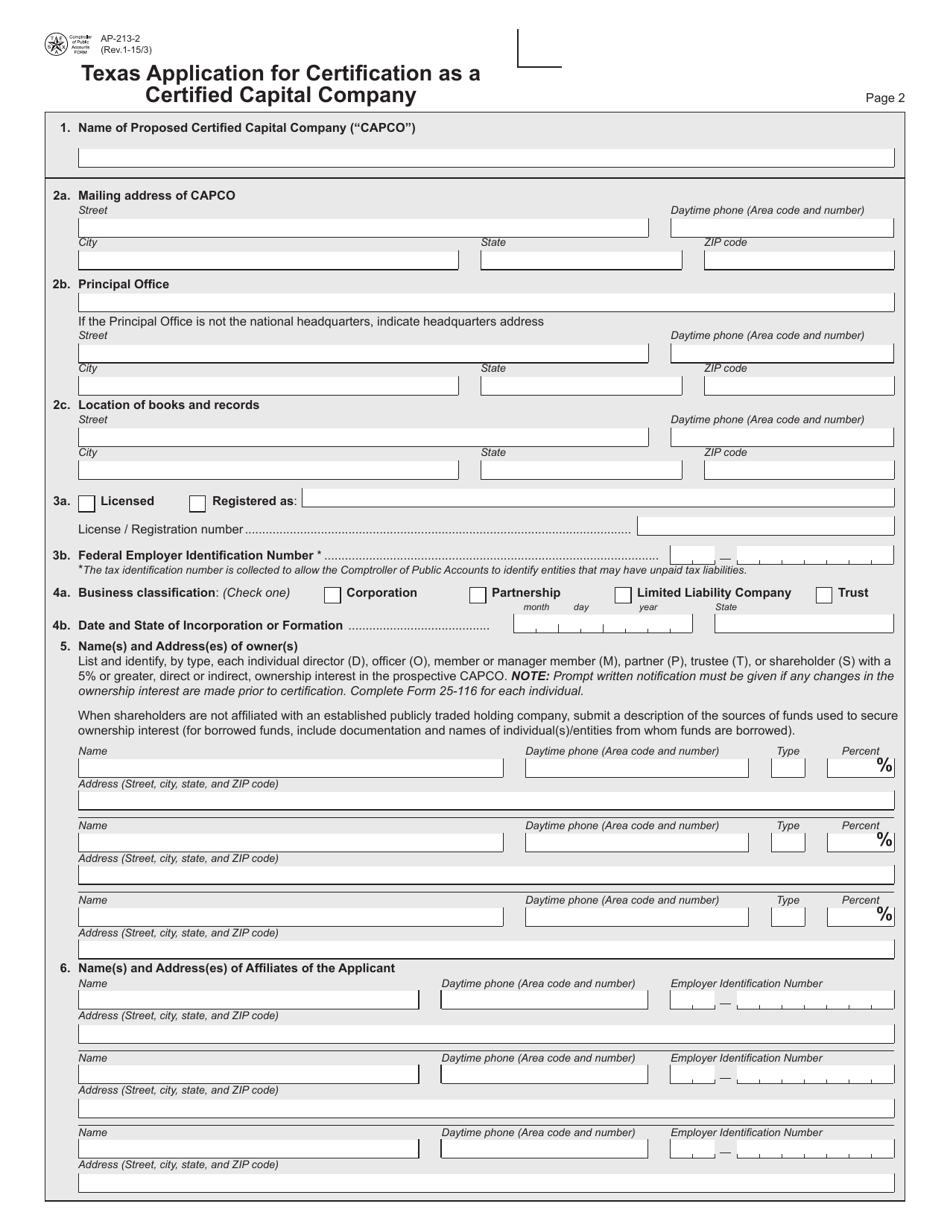

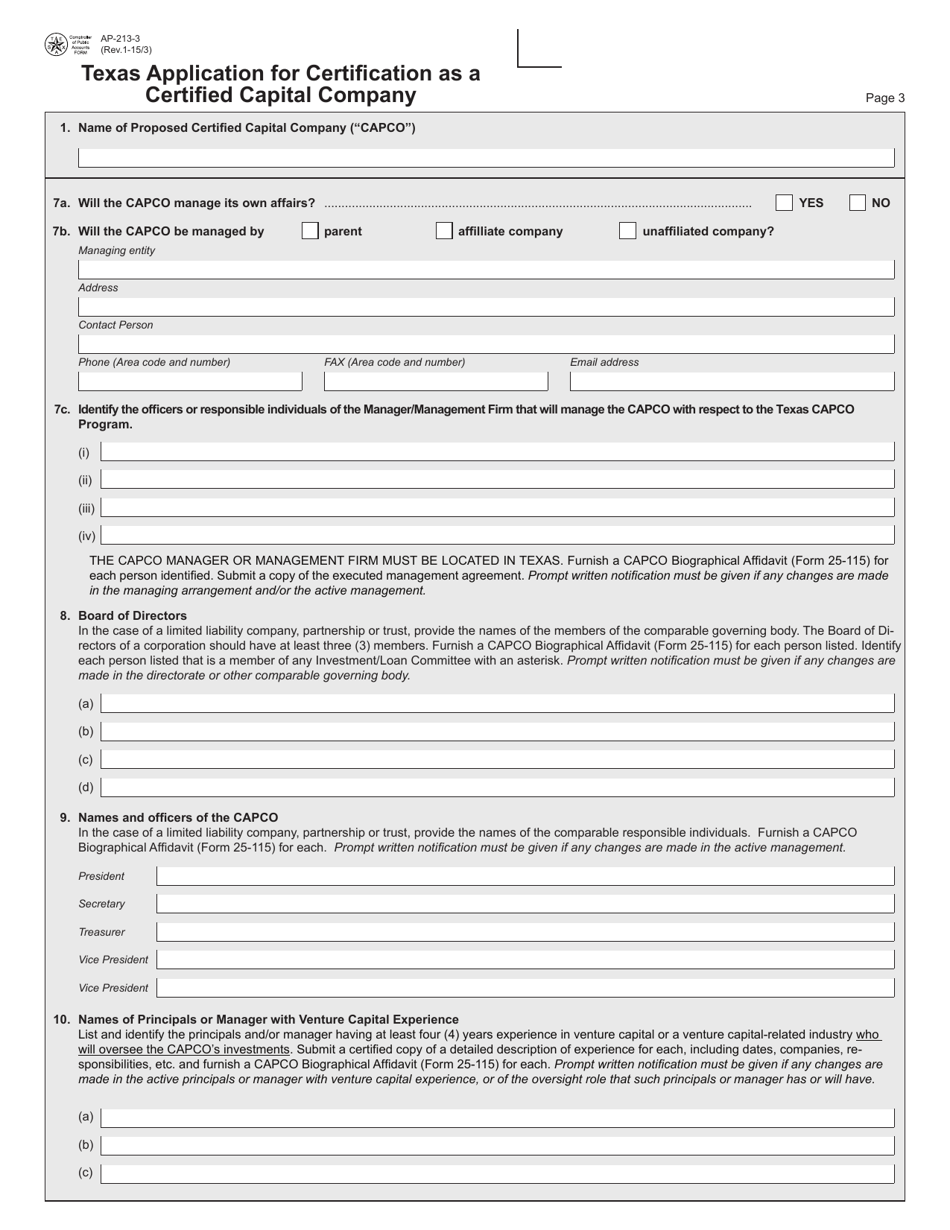

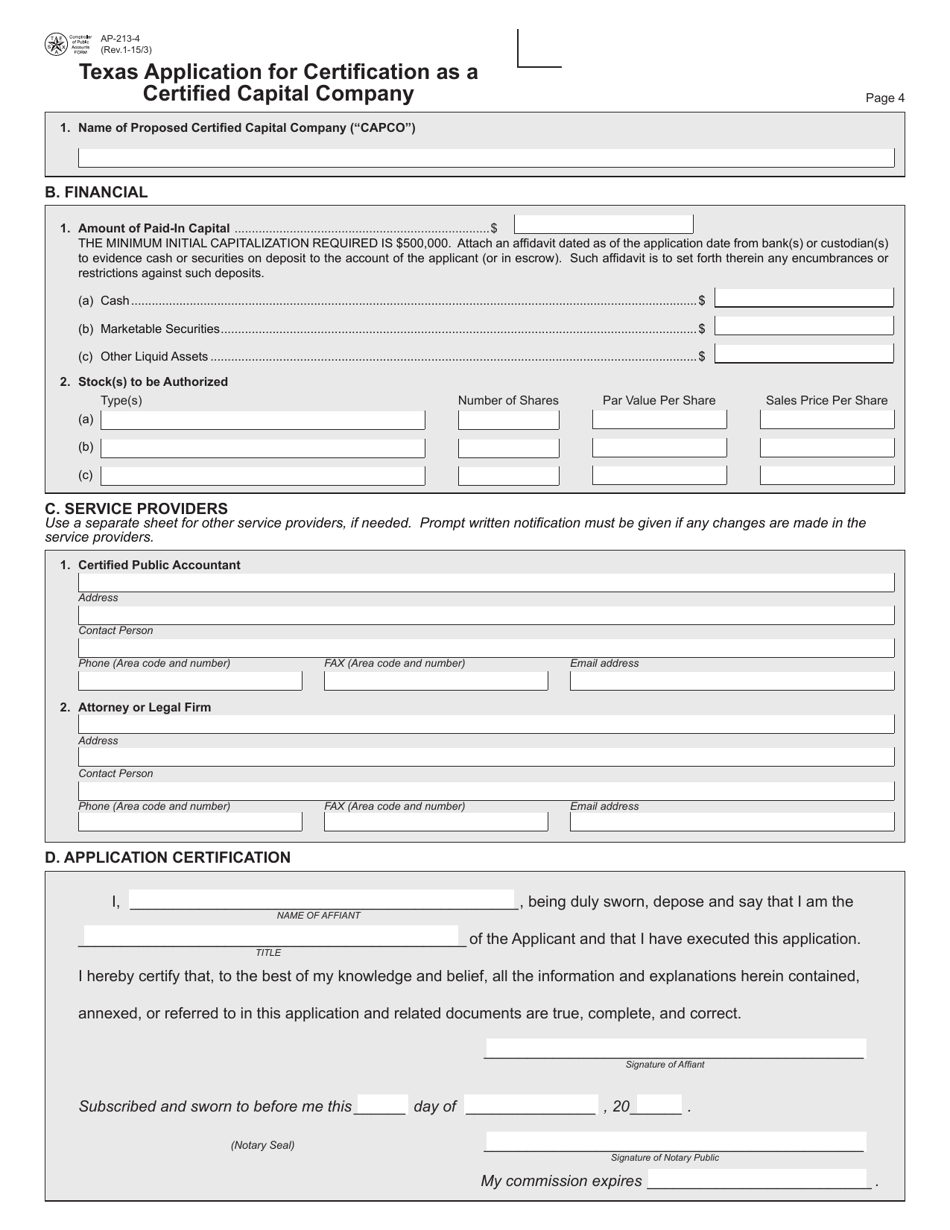

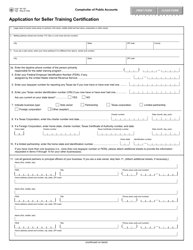

Form AP-213 Texas Application for Certification as a Certified Capital Company - Texas

What Is Form AP-213?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AP-213?

A: Form AP-213 is the Texas Application for Certification as a Certified Capital Company.

Q: What is a Certified Capital Company?

A: A Certified Capital Company is a business that has been certified by the state of Texas to participate in the Certified Capital Company Program.

Q: What is the Certified Capital Company Program?

A: The Certified Capital Company Program is a program administered by the state of Texas that provides incentives for investments in certain types of businesses.

Q: Who can apply for certification as a Certified Capital Company?

A: Any business that meets the eligibility requirements outlined in the program guidelines can apply for certification.

Q: What are the benefits of being a Certified Capital Company?

A: Certified Capital Companies may receive tax credits and other incentives to attract investment capital.

Q: Is there a fee to submit Form AP-213?

A: Yes, there is a fee to submit Form AP-213. The fee amount is specified in the program guidelines.

Q: How long does the certification process take?

A: The certification process can take several months, depending on the volume of applications and the completeness of the submitted materials.

Q: Are there any ongoing reporting requirements for Certified Capital Companies?

A: Yes, Certified Capital Companies are required to submit annual reports to the Texas Comptroller of Public Accounts.

Q: Can a Certified Capital Company invest in any type of business?

A: No, Certified Capital Companies can only invest in businesses that meet the program's eligibility requirements.

Form Details:

- Released on January 3, 2015;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-213 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.