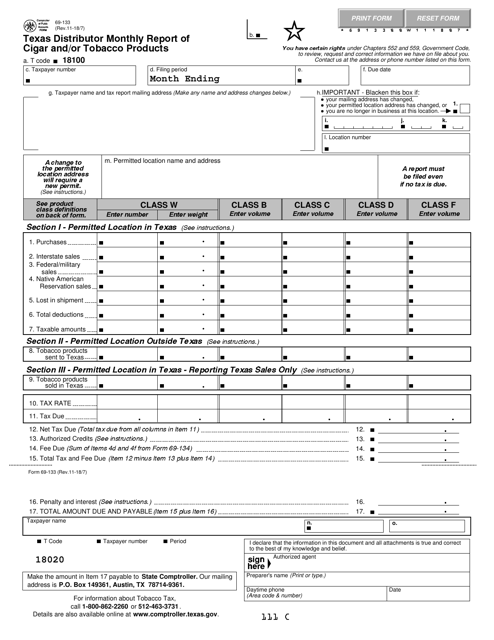

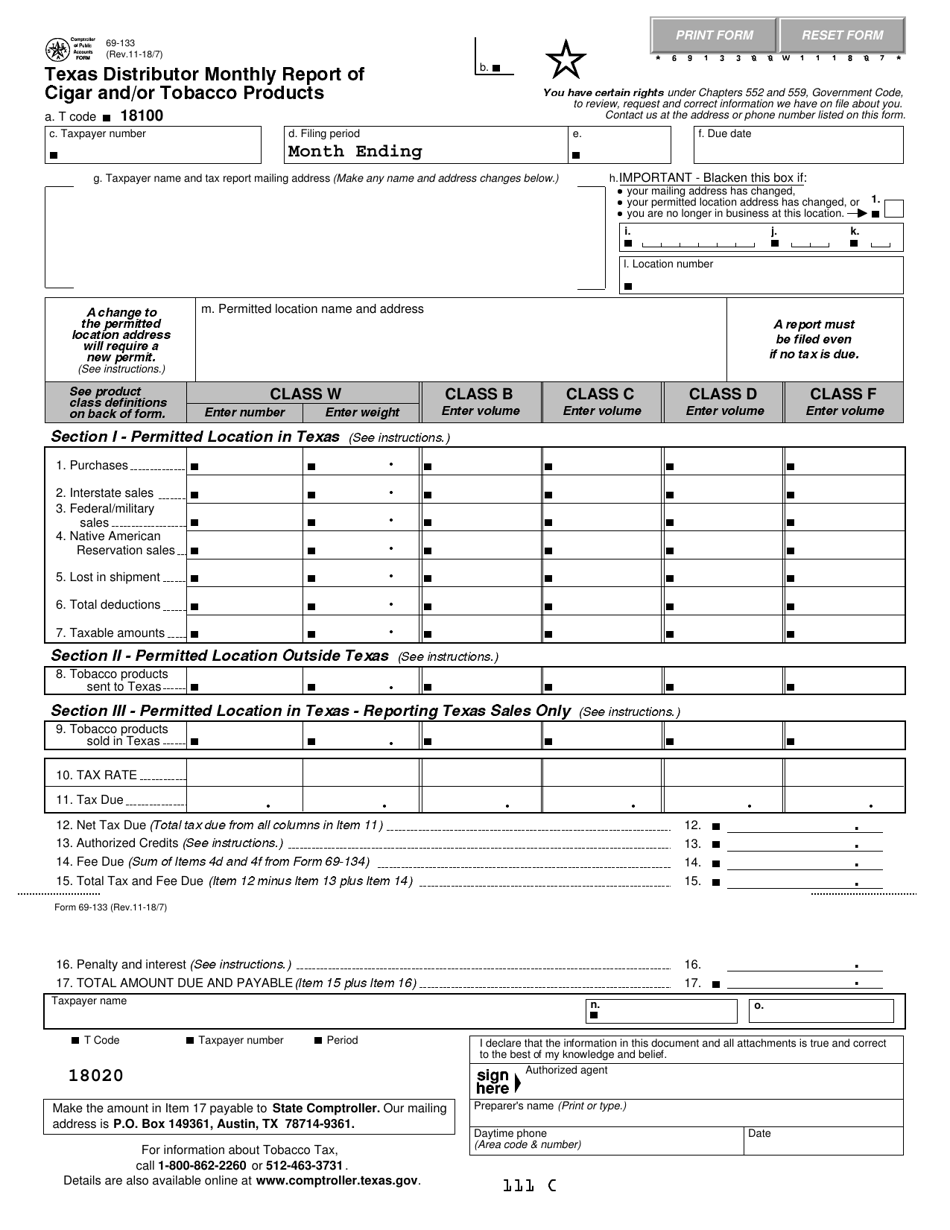

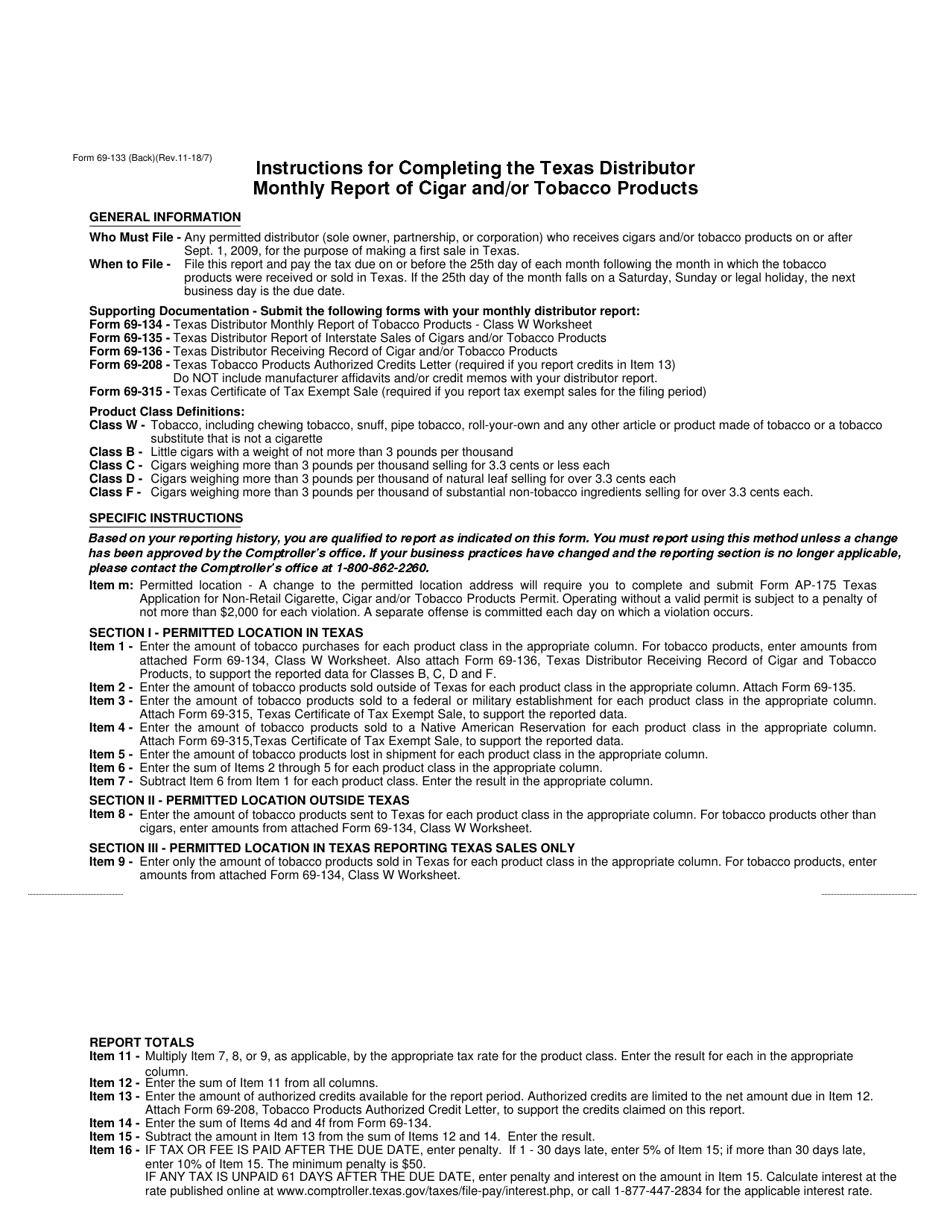

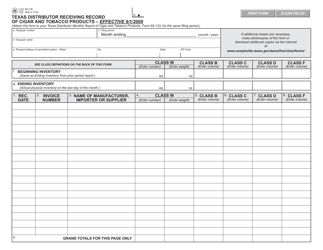

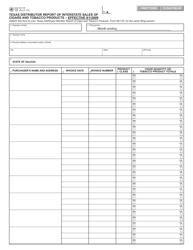

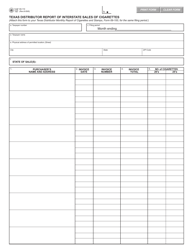

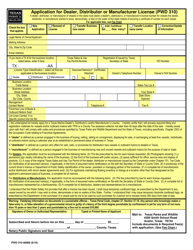

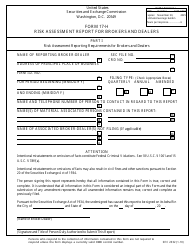

Form 69-133 Texas Distributor Monthly Report of Cigar and / or Tobacco Products - Texas

What Is Form 69-133?

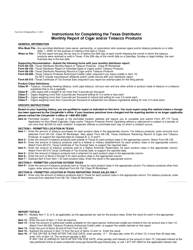

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 69-133?

A: Form 69-133 is the Texas Distributor Monthly Report of Cigar and/or Tobacco Products.

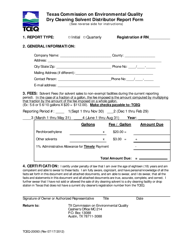

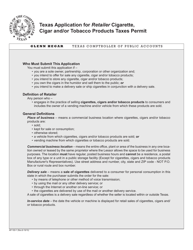

Q: Who needs to submit Form 69-133?

A: Distributors of cigar and/or tobacco products in Texas need to submit Form 69-133.

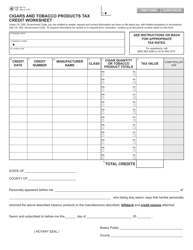

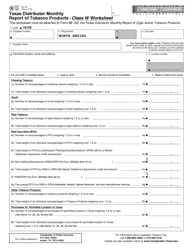

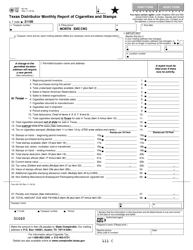

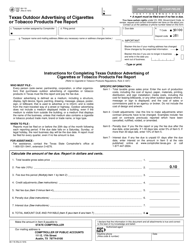

Q: What information is required on Form 69-133?

A: Form 69-133 requires information about the quantity and sales value of cigar and/or tobacco products distributed in Texas.

Q: When is Form 69-133 due?

A: Form 69-133 is due on or before the 20th day of the month following the reporting period.

Q: Are there any penalties for late or non-filing of Form 69-133?

A: Yes, there are penalties for late or non-filing of Form 69-133, including possible fines and interest charges.

Form Details:

- Released on November 7, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 69-133 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.