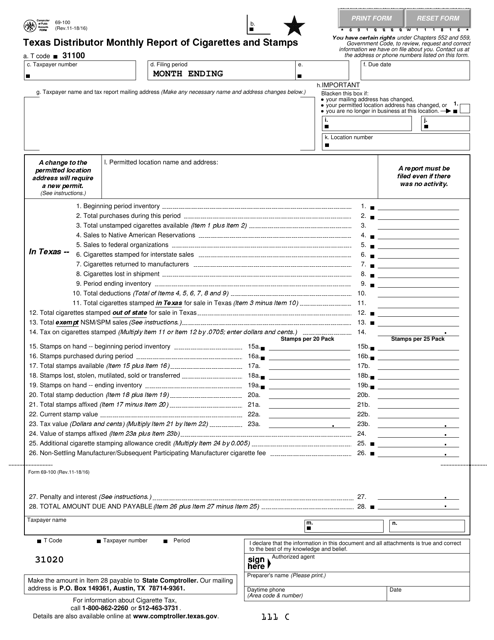

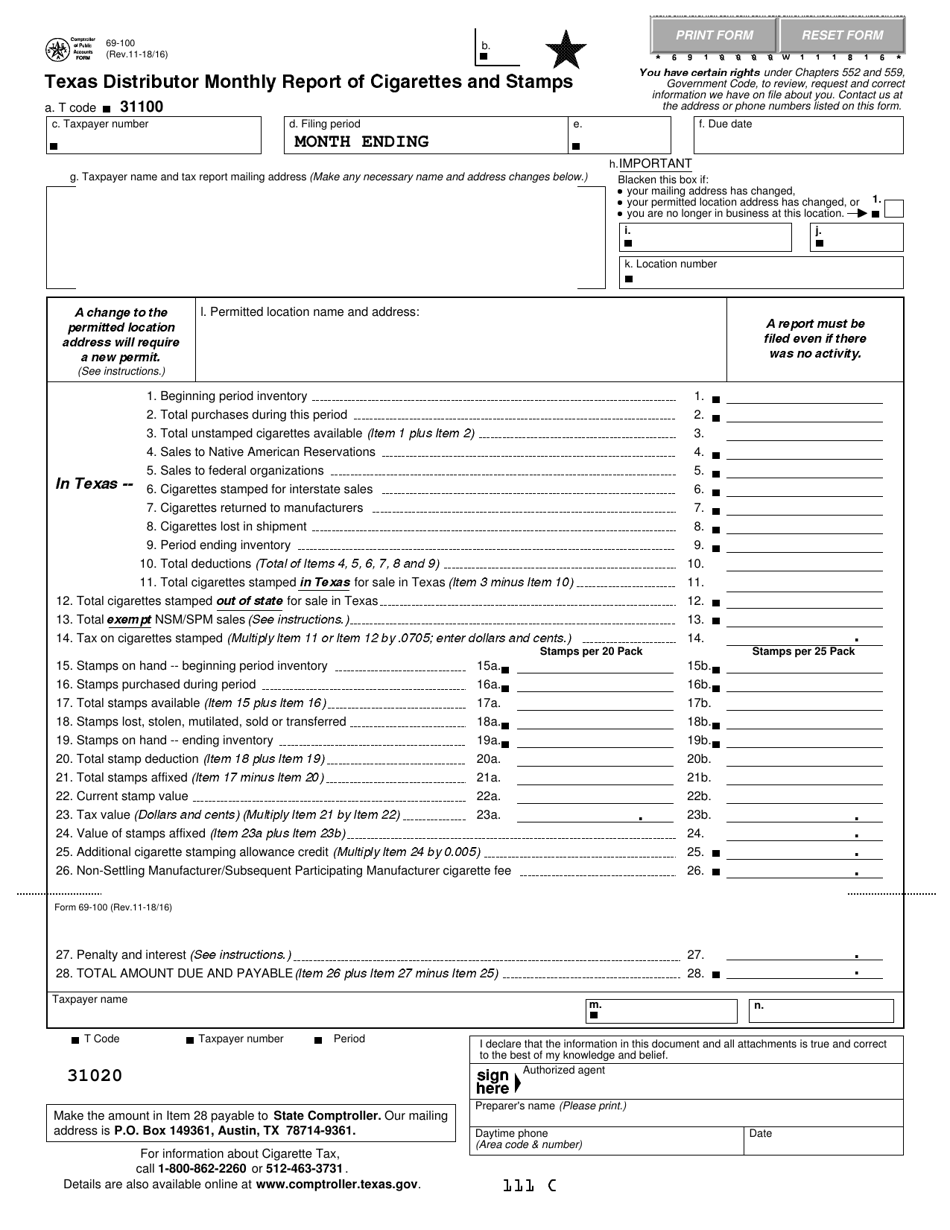

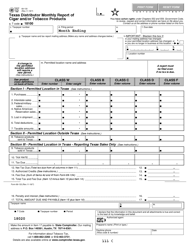

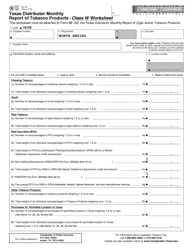

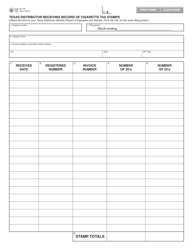

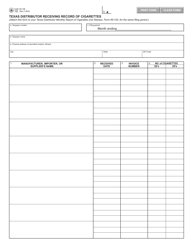

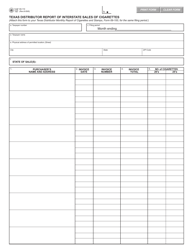

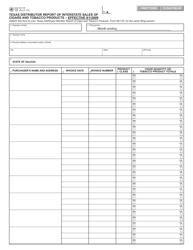

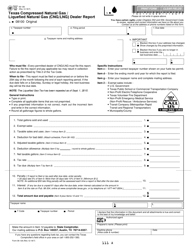

Form 69-100 Texas Distributor Monthly Report of Cigarettes and Stamps - Texas

What Is Form 69-100?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 69-100?

A: Form 69-100 is a Texas Distributor Monthly Report of Cigarettes and Stamps.

Q: Who needs to file Form 69-100?

A: Distributors of cigarettes and stamps in Texas need to file Form 69-100.

Q: What is the purpose of Form 69-100?

A: Form 69-100 is used to report the monthly sales of cigarettes and stamps by distributors in Texas.

Q: What information is required on Form 69-100?

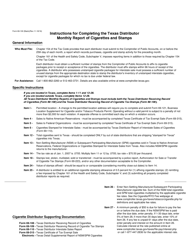

A: Form 69-100 requires distributors to report details such as the quantity of cigarettes sold, stamp purchases, taxes due, and other related information.

Q: How often does Form 69-100 need to be filed?

A: Form 69-100 needs to be filed on a monthly basis.

Q: Are there any penalties for not filing Form 69-100?

A: Yes, failure to file Form 69-100 or filing it late may result in penalties and interest charges.

Q: Are there any exemptions or deductions available on Form 69-100?

A: Yes, there are certain exemptions and deductions available for distributors, but they must meet specific criteria to qualify.

Q: What should I do if I have questions or need assistance with Form 69-100?

A: If you have questions or need assistance with Form 69-100, you can contact the Texas Comptroller's office for guidance.

Form Details:

- Released on November 16, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 69-100 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.