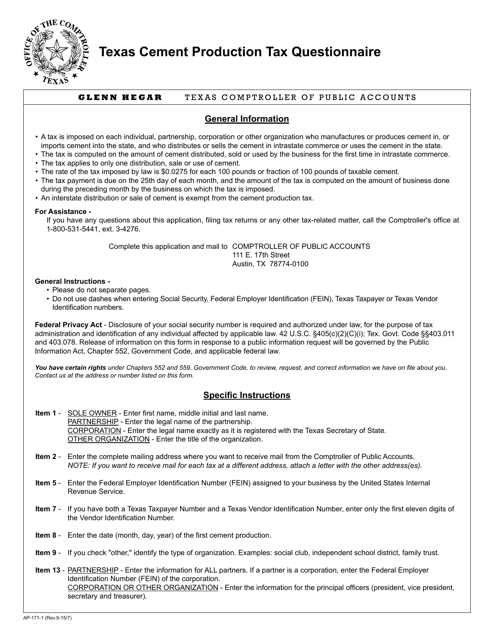

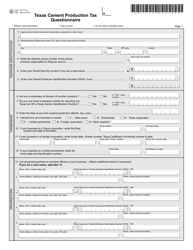

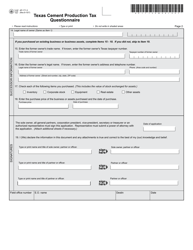

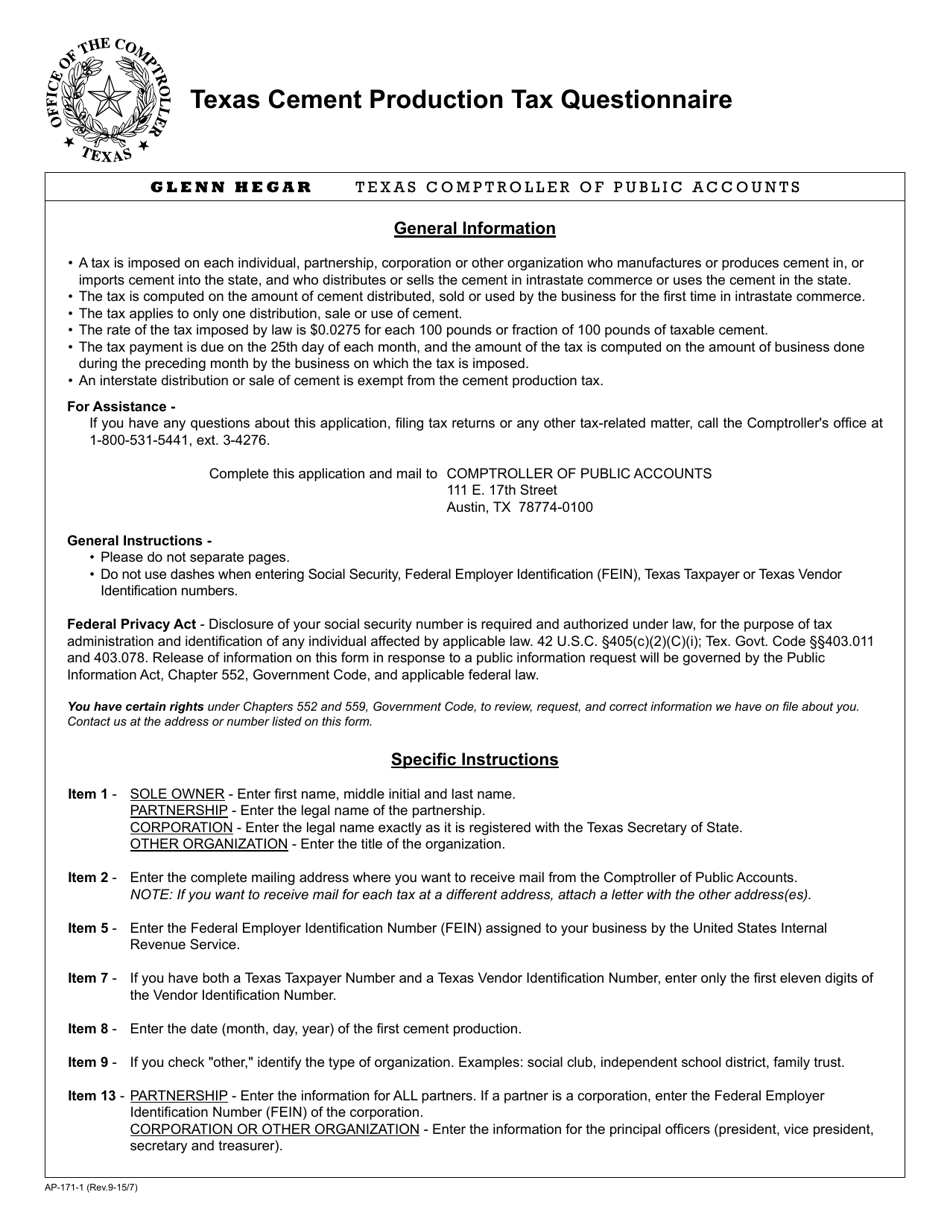

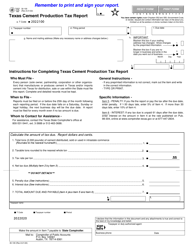

Form AP-171 Texas Cement Production Tax Questionnaire - Texas

What Is Form AP-171?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

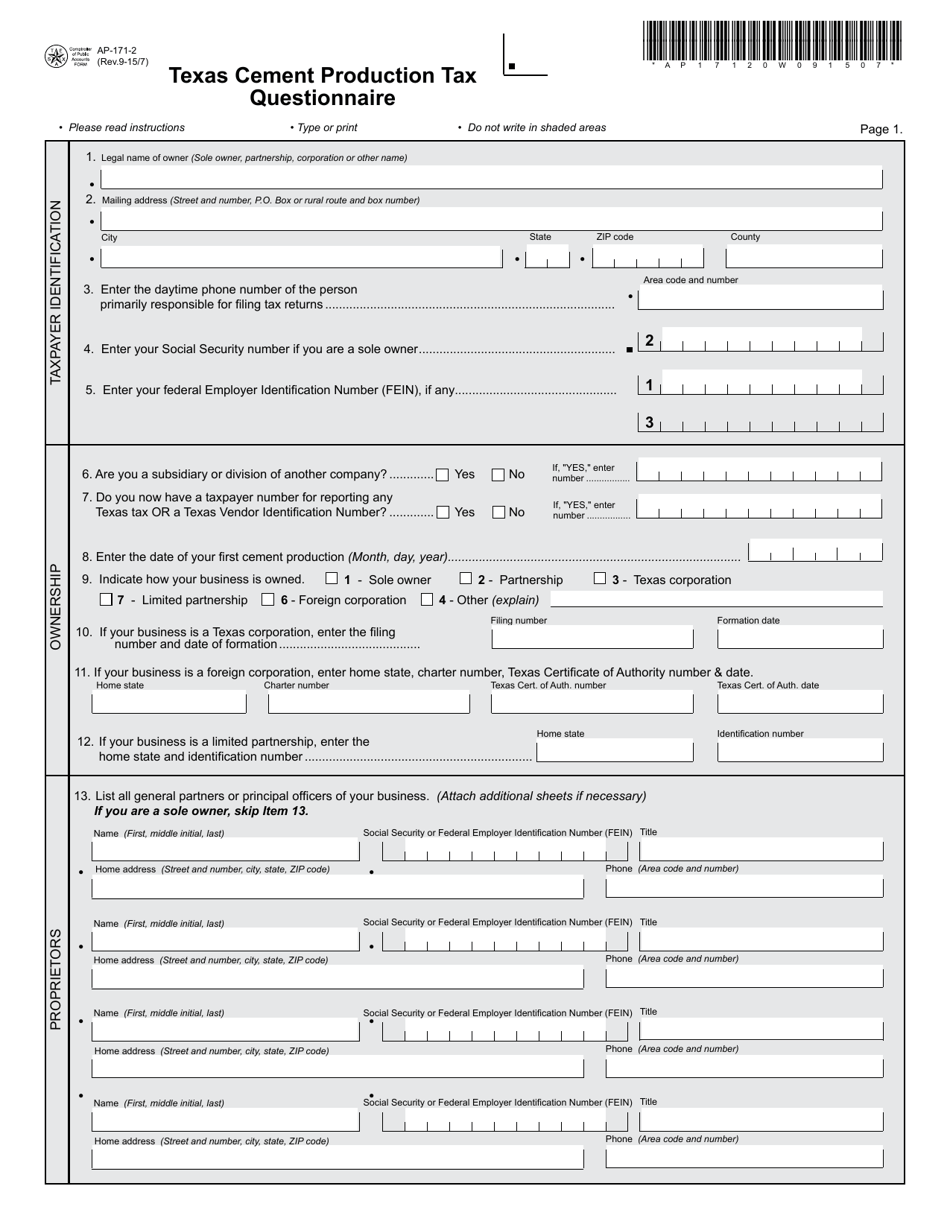

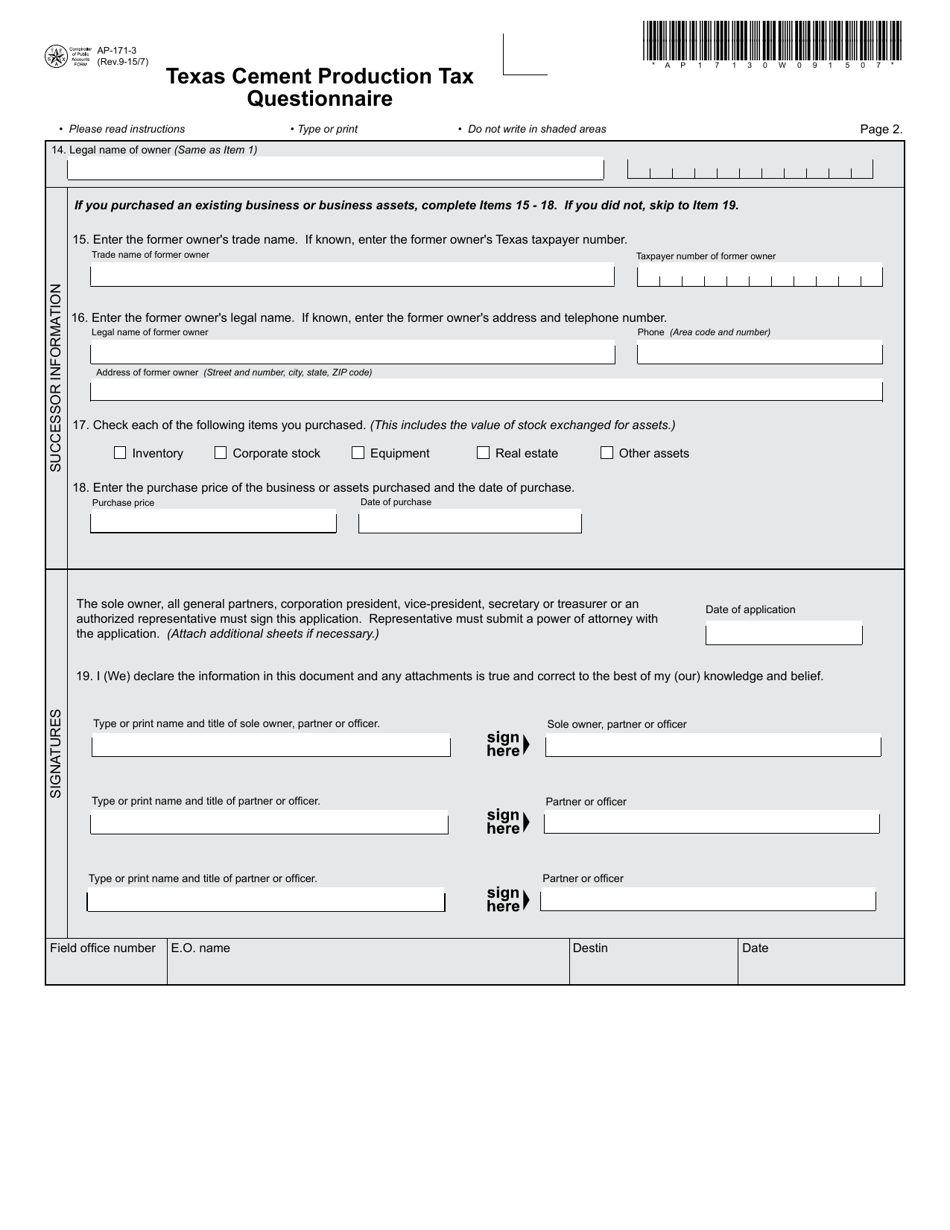

Q: What is Form AP-171?

A: Form AP-171 is the Texas Cement Production Tax Questionnaire.

Q: What is the purpose of Form AP-171?

A: The purpose of Form AP-171 is to gather information related to cement production for tax purposes in Texas.

Q: Who needs to complete Form AP-171?

A: Cement producers in Texas need to complete Form AP-171.

Q: When is Form AP-171 due?

A: Form AP-171 is due on the 25th day of the month following the end of the reporting period.

Q: Are there any penalties for late submission of Form AP-171?

A: Yes, there are penalties for late submission of Form AP-171. The penalty is 5% of the tax due for each month or partial month that the report is late, up to a maximum of 25%.

Form Details:

- Released on September 7, 2015;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-171 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.