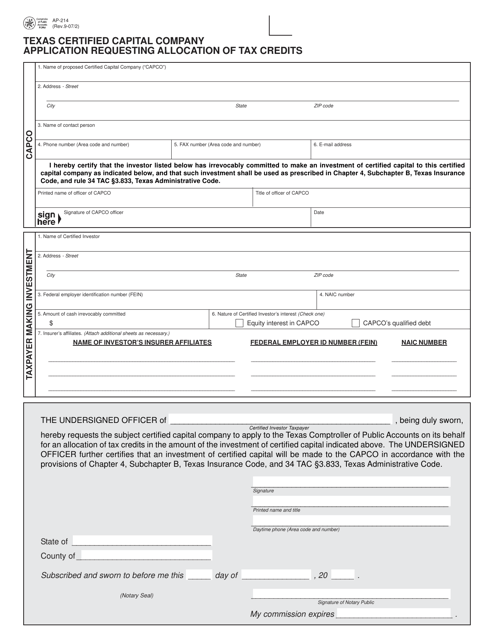

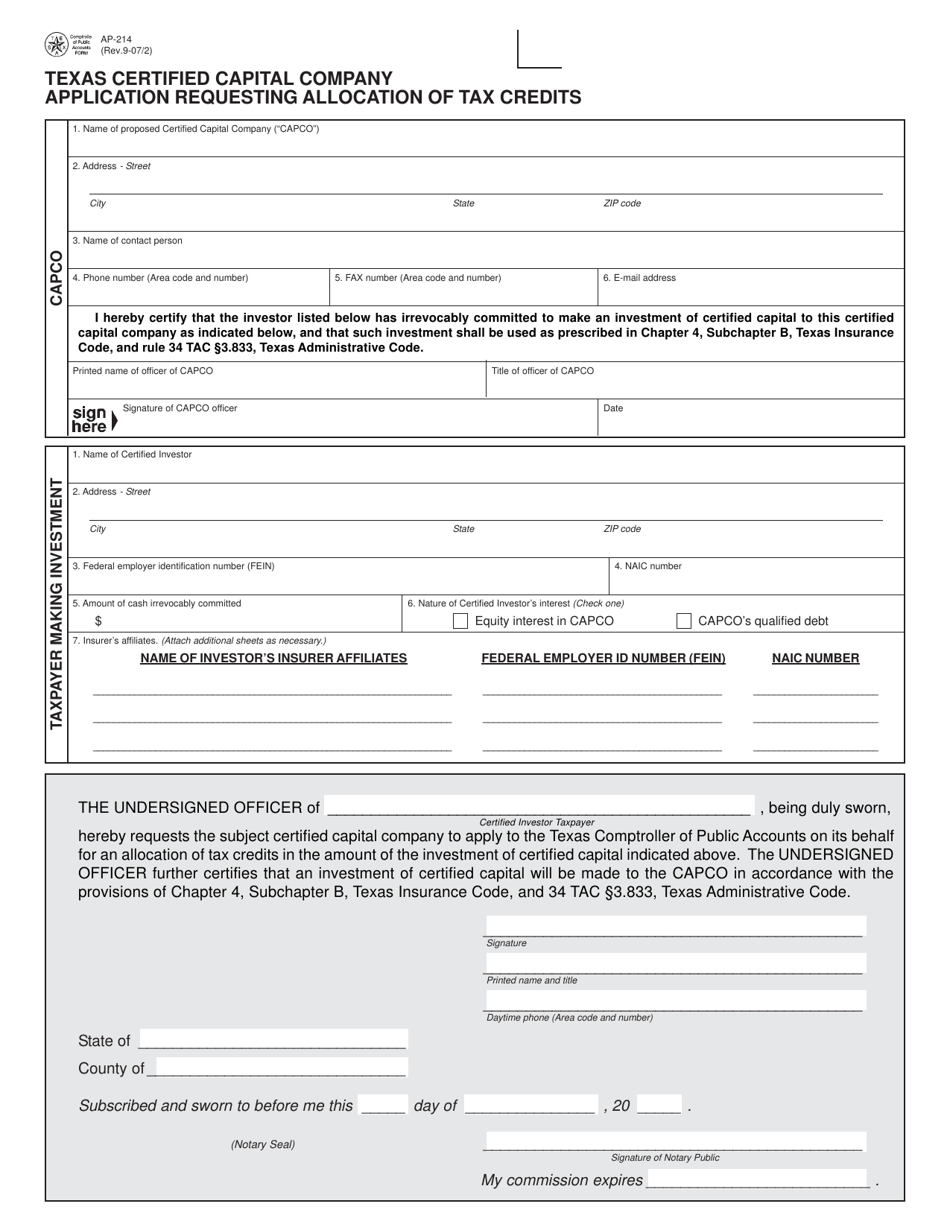

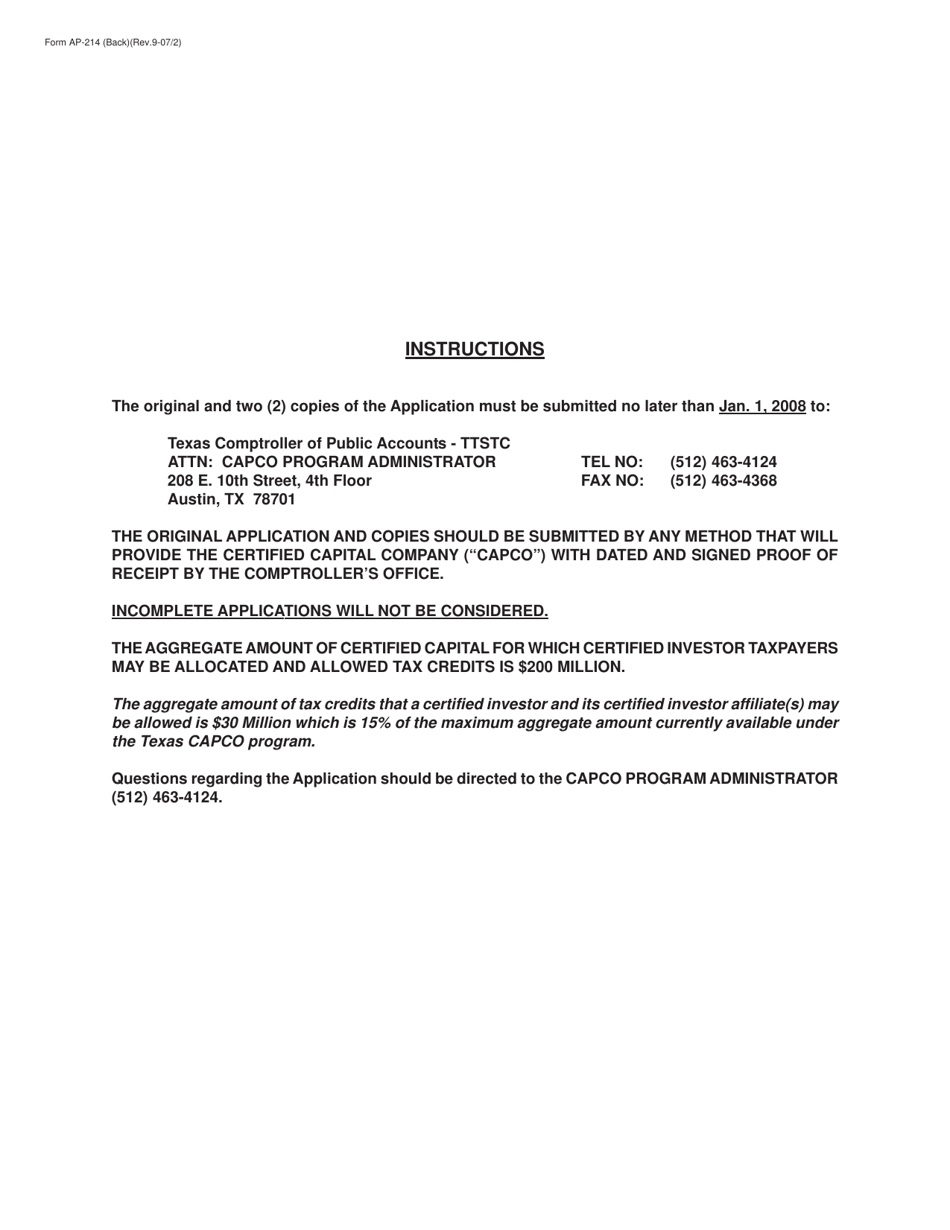

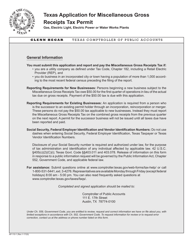

Form AP-214 Texas Certified Capital Company Application Requesting Allocation of Tax Credits - Texas

What Is Form AP-214?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AP-214?

A: Form AP-214 is the Texas Certified Capital Company Application for requesting allocation of tax credits in Texas.

Q: What is a Certified Capital Company (CAPCO)?

A: A Certified Capital Company (CAPCO) is a company that invests in small businesses in Texas and receives tax credits as an incentive.

Q: What are tax credits?

A: Tax credits are incentives provided by the government that allow companies to reduce their tax liability.

Q: Why would a company apply for Form AP-214?

A: A company would apply for Form AP-214 to request the allocation of tax credits as a Certified Capital Company in Texas.

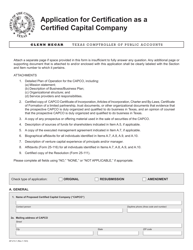

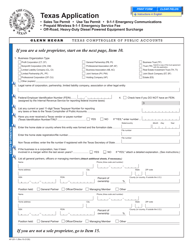

Q: What information is required in Form AP-214?

A: Form AP-214 requires information about the Certified Capital Company, details of the proposed investment, financial statements, and other supporting documentation.

Q: Who should submit Form AP-214?

A: The Certified Capital Company (CAPCO) or its authorized representative should submit Form AP-214 to the Texas Comptroller of Public Accounts.

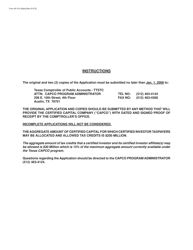

Q: What is the deadline for submitting Form AP-214?

A: The deadline for submitting Form AP-214 varies each year and is specified by the Texas Comptroller of Public Accounts.

Q: How long does it take to process Form AP-214?

A: The processing time for Form AP-214 may vary, but generally, it takes a few months for the application to be reviewed and approved.

Q: What happens after Form AP-214 is approved?

A: After Form AP-214 is approved, the Certified Capital Company may receive an allocation of tax credits, which can be used to offset their tax liability in Texas.

Form Details:

- Released on September 2, 2007;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-214 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.