This version of the form is not currently in use and is provided for reference only. Download this version of

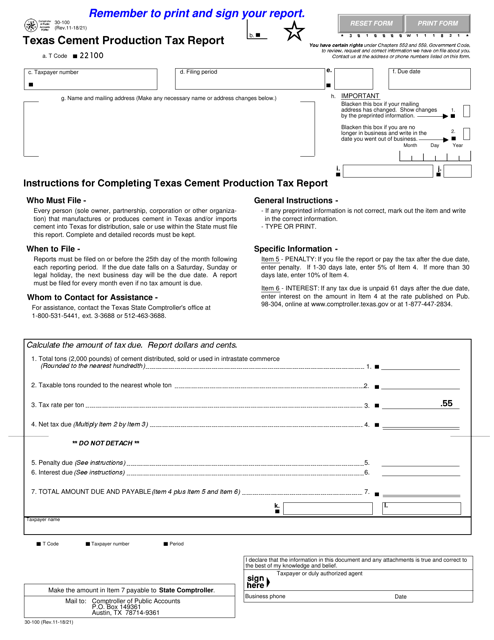

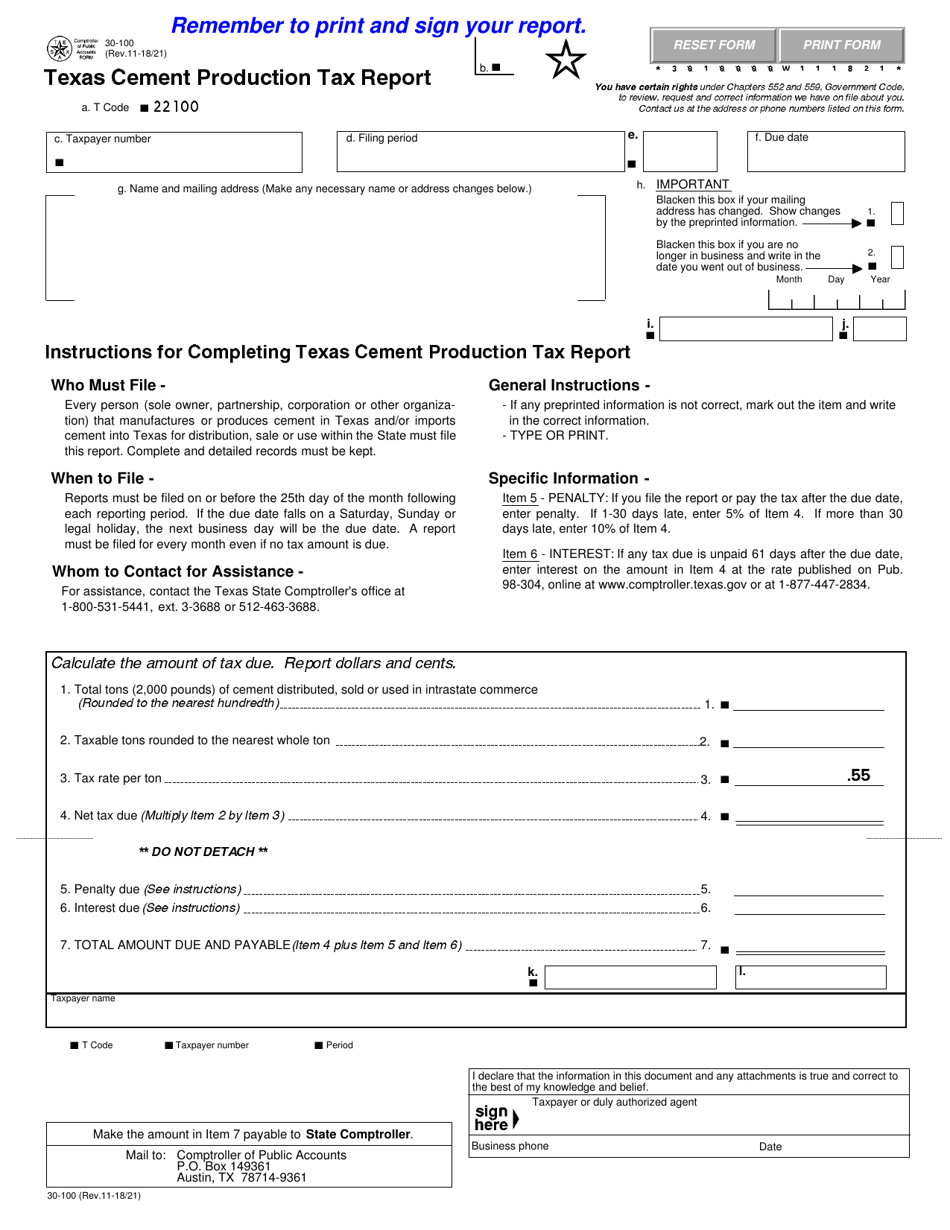

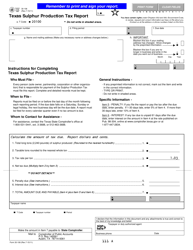

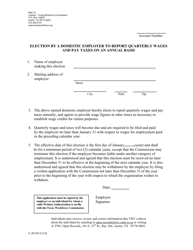

Form 30-100

for the current year.

Form 30-100 Texas Cement Production Tax Report - Texas

What Is Form 30-100?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 30-100 Texas Cement Production Tax Report?

A: The Form 30-100 is a tax report specific to Texas cement production.

Q: Who needs to file Form 30-100?

A: Cement manufacturers in Texas are required to file Form 30-100.

Q: What is the purpose of Form 30-100?

A: Form 30-100 is used to report and pay the cement production tax in Texas.

Q: How often is Form 30-100 filed?

A: Form 30-100 is filed monthly by cement manufacturers in Texas.

Q: What information is required on Form 30-100?

A: Form 30-100 requires information about the monthly production and sales of cement.

Q: Is there a deadline for filing Form 30-100?

A: Yes, Form 30-100 must be filed and the tax paid by the 20th day of the month following the reporting month.

Form Details:

- Released on November 21, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 30-100 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.