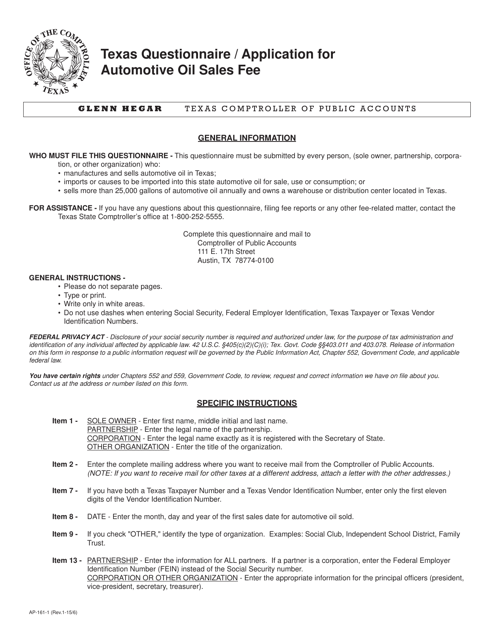

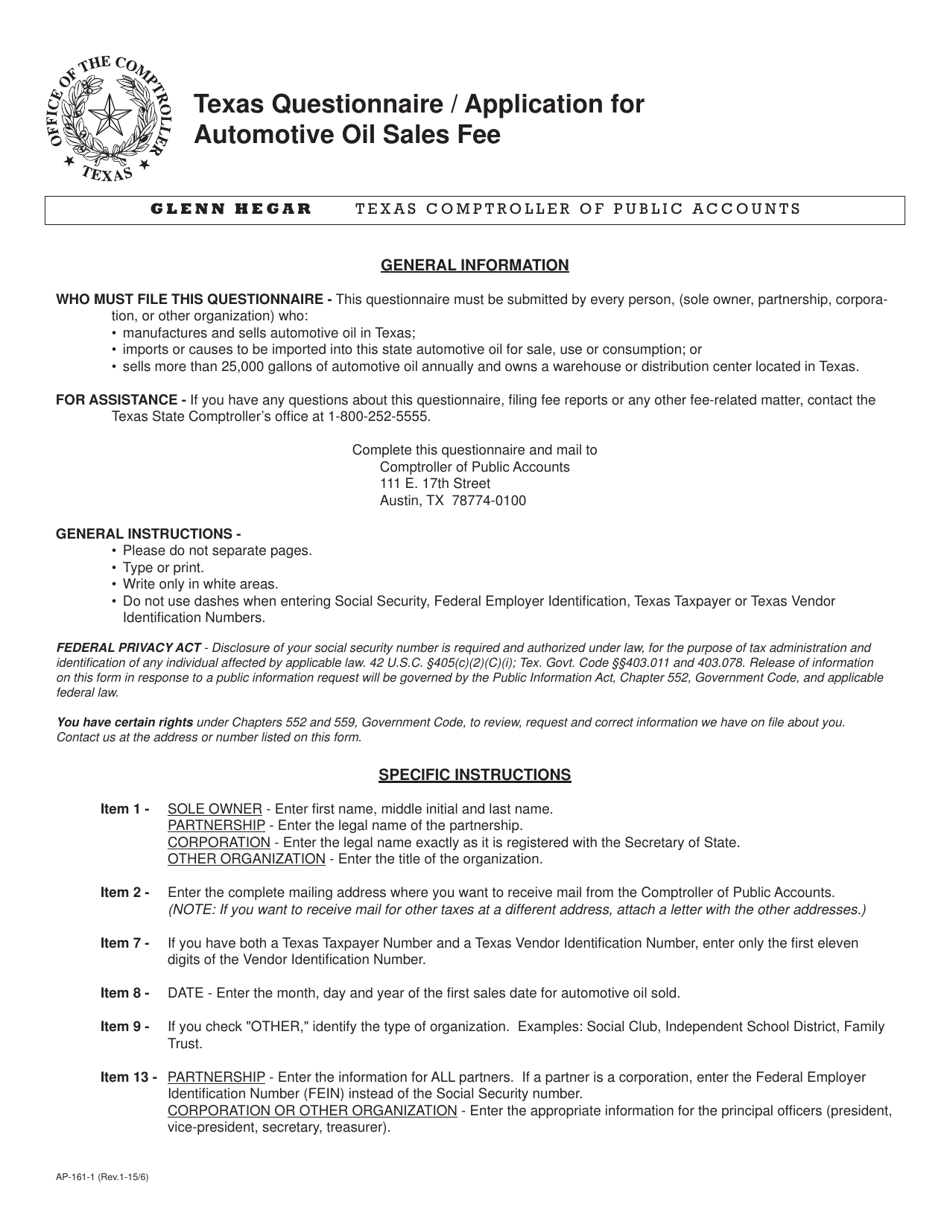

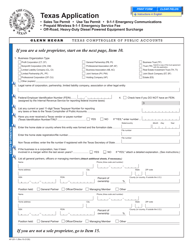

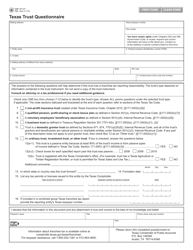

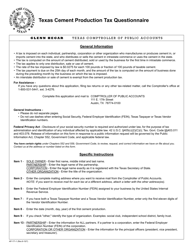

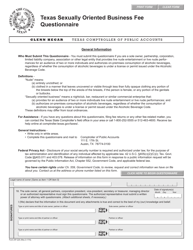

Form AP-161 Texas Questionnaire / Application for Automotive Oil Sales Fee - Texas

What Is Form AP-161?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AP-161 Texas Questionnaire/Application for Automotive Oil Sales Fee?

A: Form AP-161 is a questionnaire/application for automotive oil sales fee in Texas.

Q: Who needs to fill out Form AP-161?

A: Anyone engaged in the business of selling automotive oil in Texas needs to fill out Form AP-161.

Q: What is the purpose of Form AP-161?

A: The purpose of Form AP-161 is to collect information and assess fees for the sale of automotive oil in Texas.

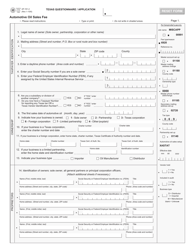

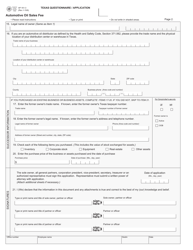

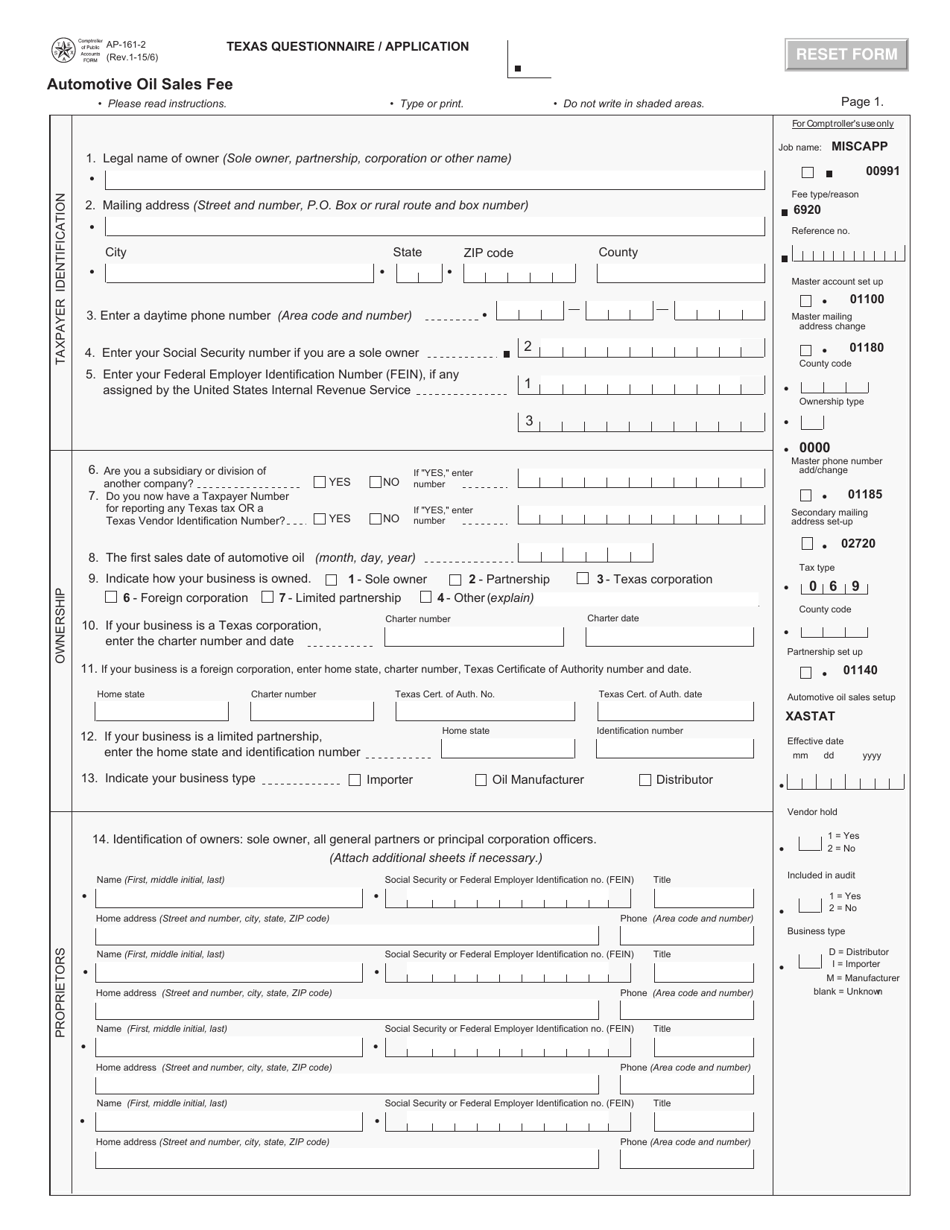

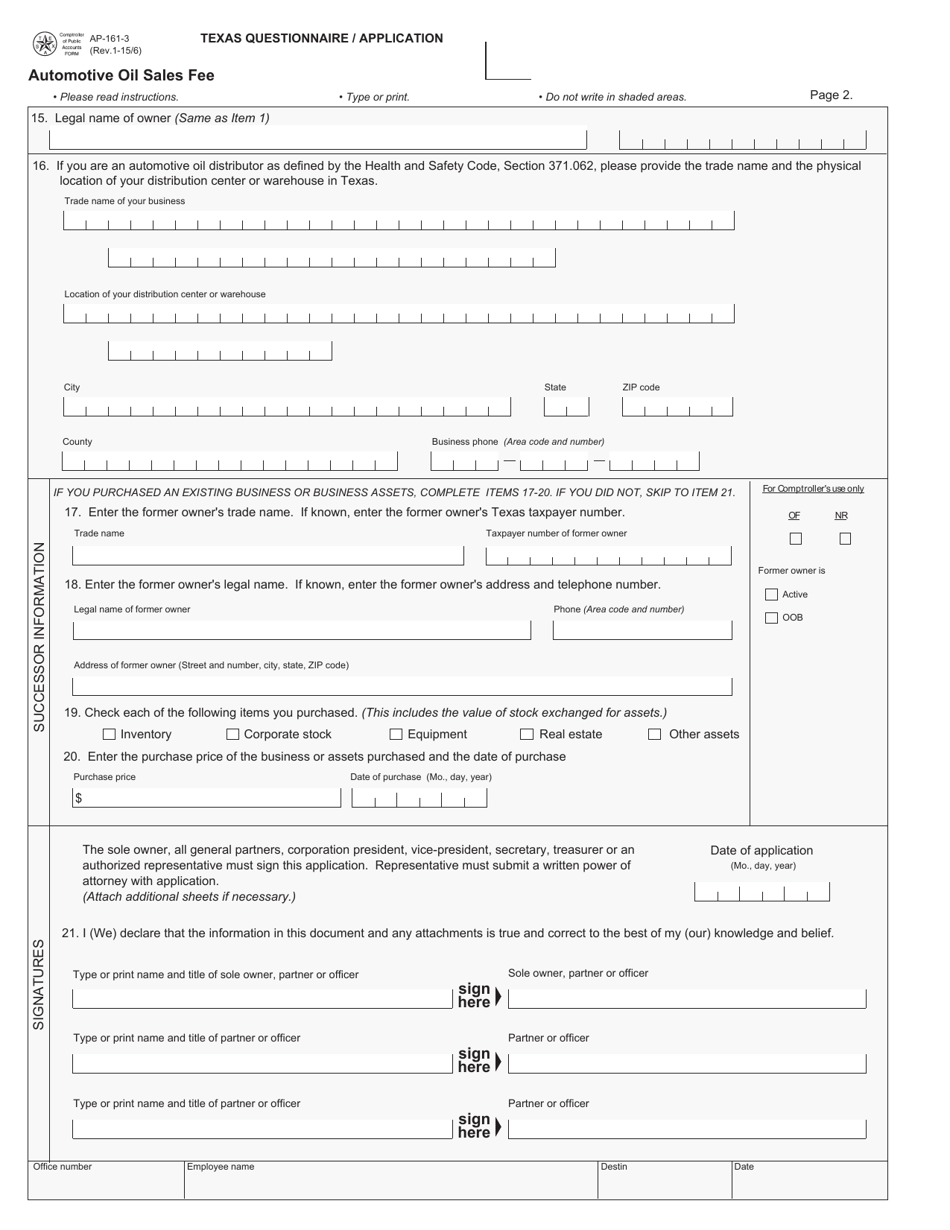

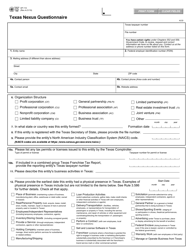

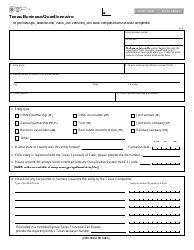

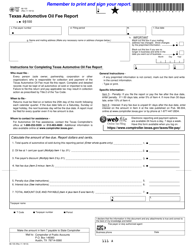

Q: What information is required on Form AP-161?

A: Form AP-161 requires information about the business selling automotive oil, including contact information, sales data, and other relevant details.

Q: Are there any fees associated with Form AP-161?

A: Yes, there are fees associated with the sale of automotive oil in Texas, and the amount will depend on the information provided on Form AP-161.

Q: When is Form AP-161 due?

A: Form AP-161 is due on or before the 20th day of the month following the end of the calendar quarter.

Q: What happens if I don't submit Form AP-161?

A: Failure to submit Form AP-161 or pay the required fees may result in penalties and interest.

Q: Is Form AP-161 specific to automotive oil sales in Texas only?

A: Yes, Form AP-161 is specific to automotive oil sales in Texas and is not applicable to other states.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-161 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.