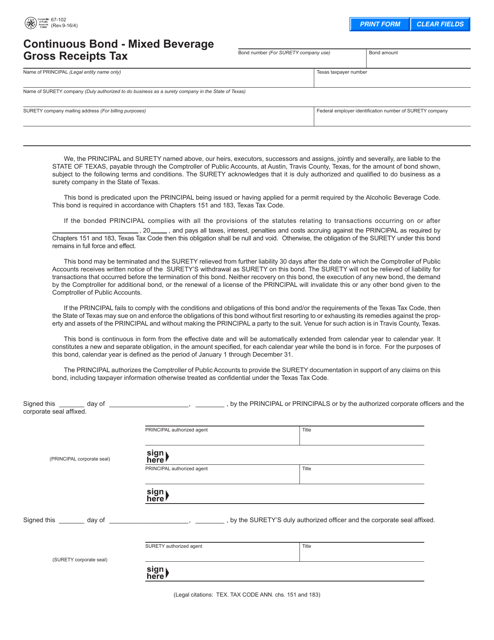

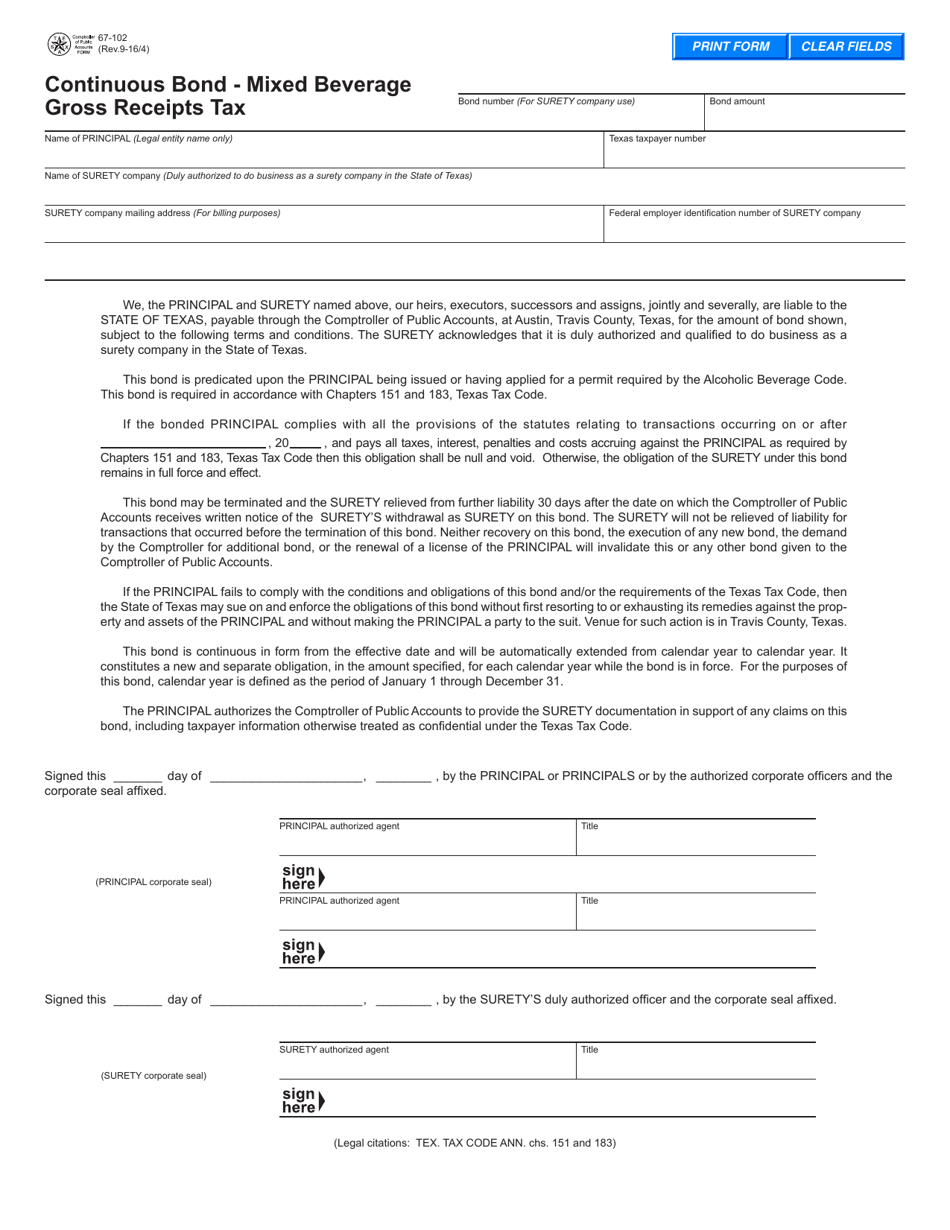

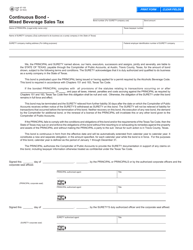

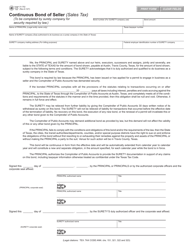

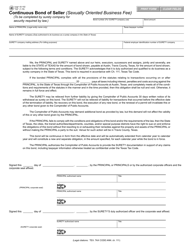

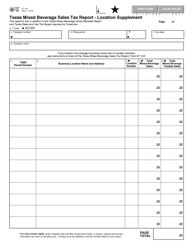

Form 67-102 Continuous Bond - Mixed Beverage Gross Receipts Tax - Texas

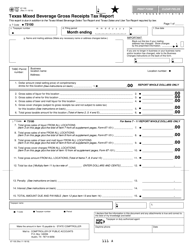

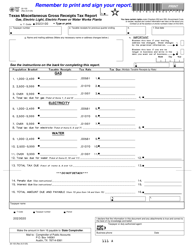

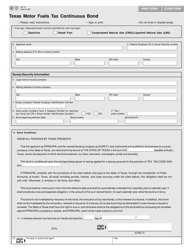

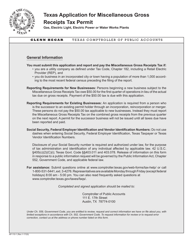

What Is Form 67-102?

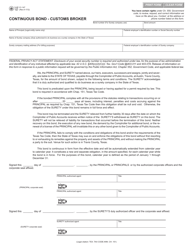

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

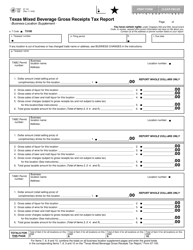

Q: What is Form 67-102?

A: Form 67-102 is a form used for reporting and paying the Mixed Beverage Gross Receipts Tax in Texas.

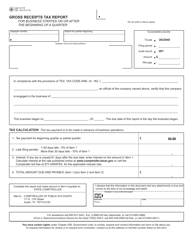

Q: What is the Mixed Beverage Gross Receipts Tax?

A: The Mixed Beverage Gross Receipts Tax is a tax imposed on businesses that sell mixed beverages in Texas.

Q: Who needs to file Form 67-102?

A: Businesses that sell mixed beverages in Texas need to file Form 67-102.

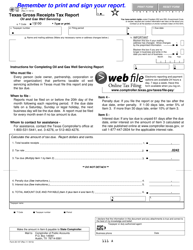

Q: How often should Form 67-102 be filed?

A: Form 67-102 should be filed on a monthly basis.

Q: What information is required on Form 67-102?

A: Form 67-102 requires information such as gross receipts from the sale of mixed beverages, tax rate, and payment details.

Q: Are there any penalties for not filing or late filing of Form 67-102?

A: Yes, there are penalties for not filing or late filing of Form 67-102. It is important to file the form on time to avoid penalties.

Q: Is Form 67-102 only applicable to businesses in Texas?

A: Yes, Form 67-102 is specific to businesses in Texas that sell mixed beverages.

Form Details:

- Released on September 4, 2016;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 67-102 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.