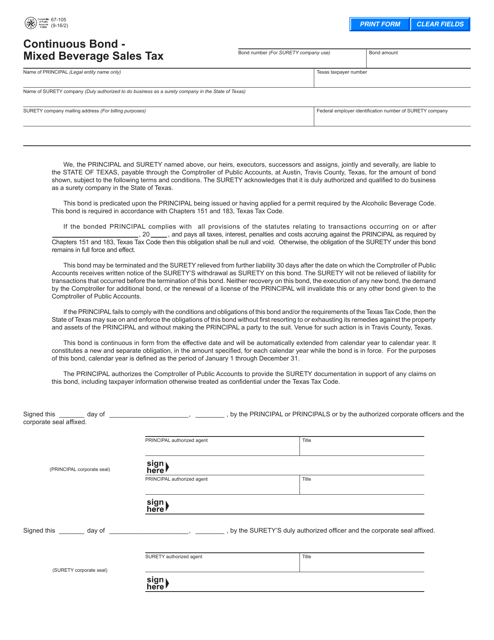

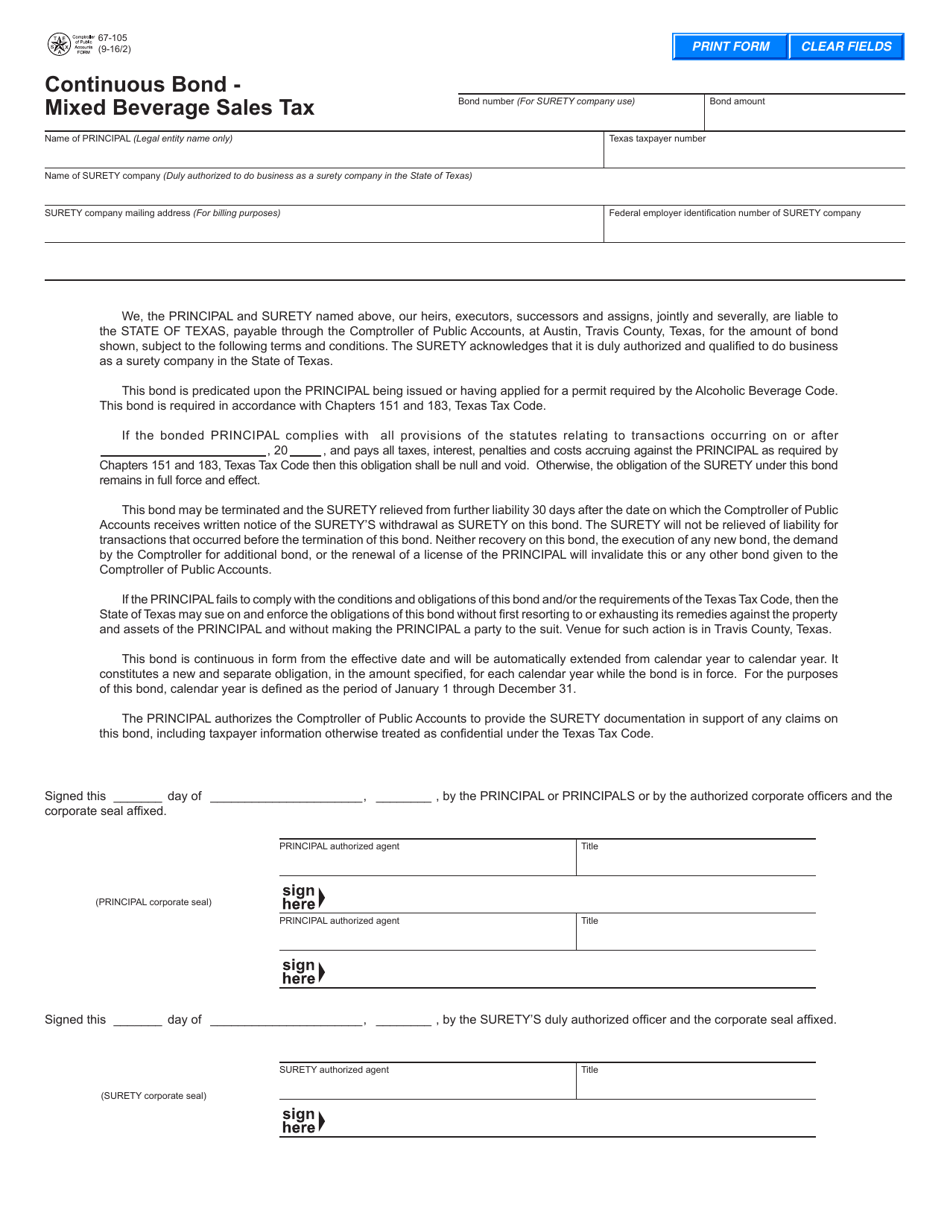

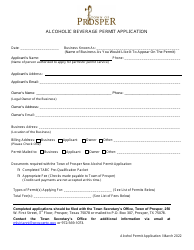

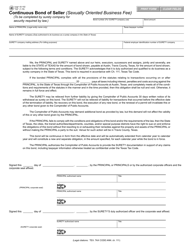

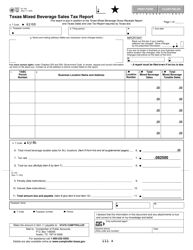

Form 67-105 Continuous Bond - Mixed Beverage Sales Tax - Texas

What Is Form 67-105?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 67-105 Continuous Bond?

A: Form 67-105 Continuous Bond is a document used for Texas Mixed Beverage Sales Tax.

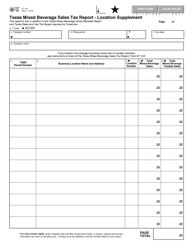

Q: What is the purpose of Form 67-105?

A: Form 67-105 is used to report and pay the Mixed Beverage Sales Tax in Texas.

Q: Who needs to file Form 67-105?

A: Businesses that sell mixed beverages in Texas need to file Form 67-105.

Q: How often should Form 67-105 be filed?

A: Form 67-105 should be filed monthly.

Form Details:

- Released on September 2, 2016;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 67-105 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.