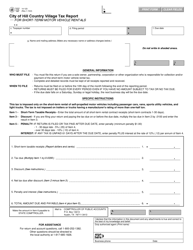

This version of the form is not currently in use and is provided for reference only. Download this version of

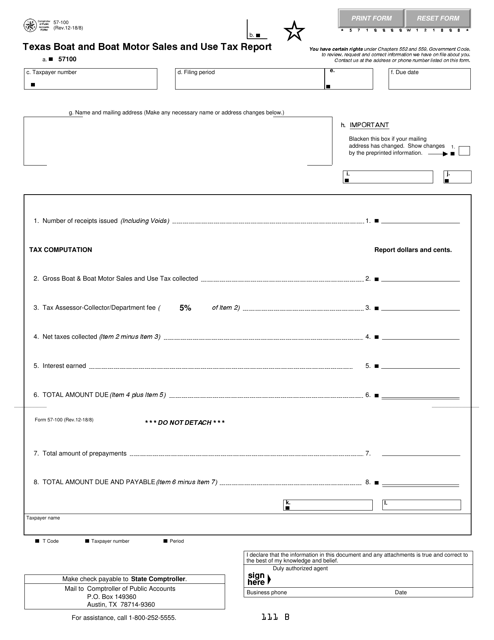

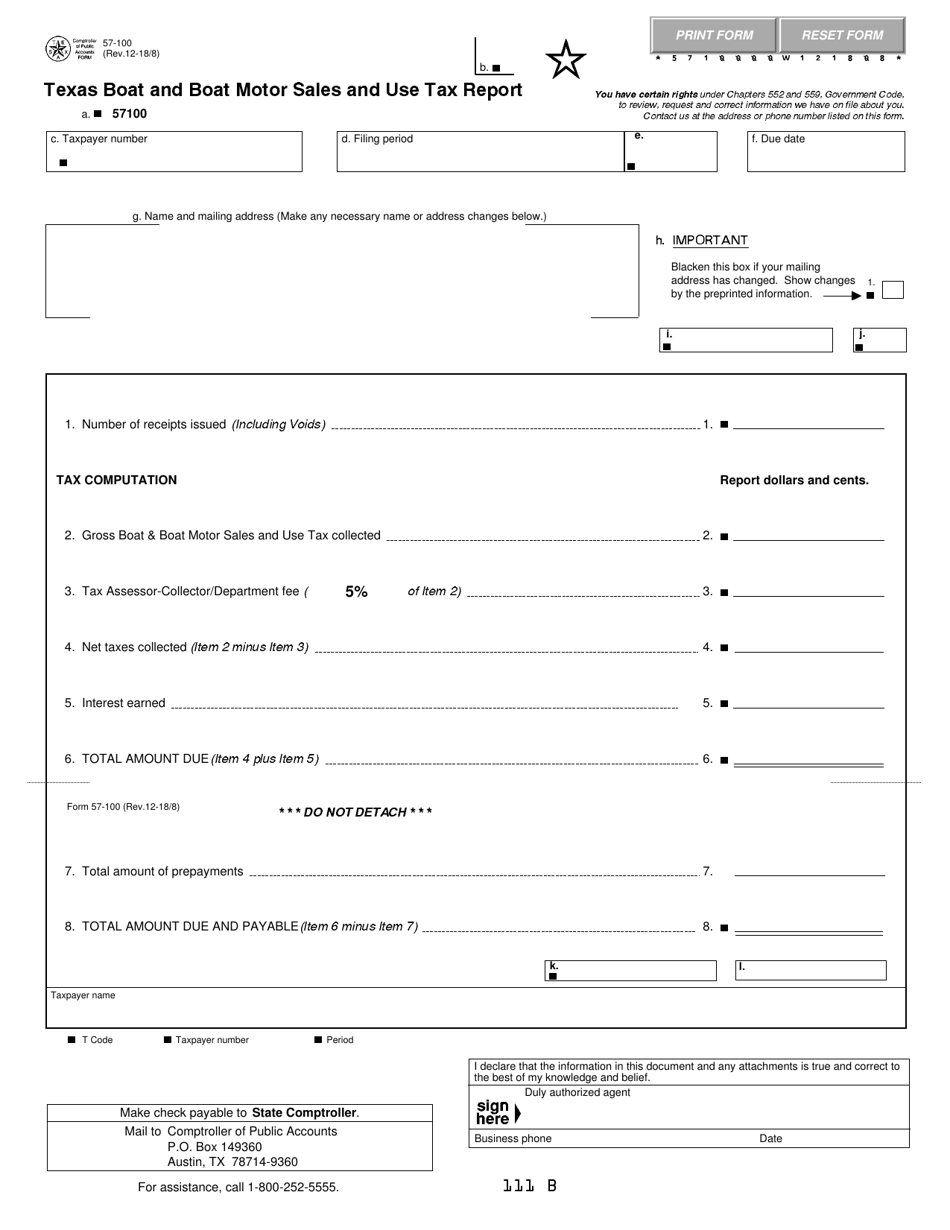

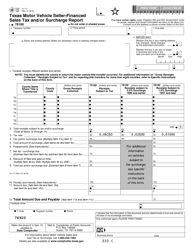

Form 57-100

for the current year.

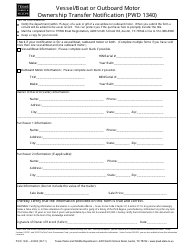

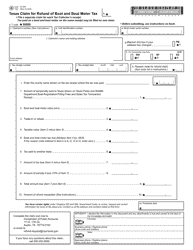

Form 57-100 Texas Boat and Boat Motor Sales and Use Tax Report - Texas

What Is Form 57-100?

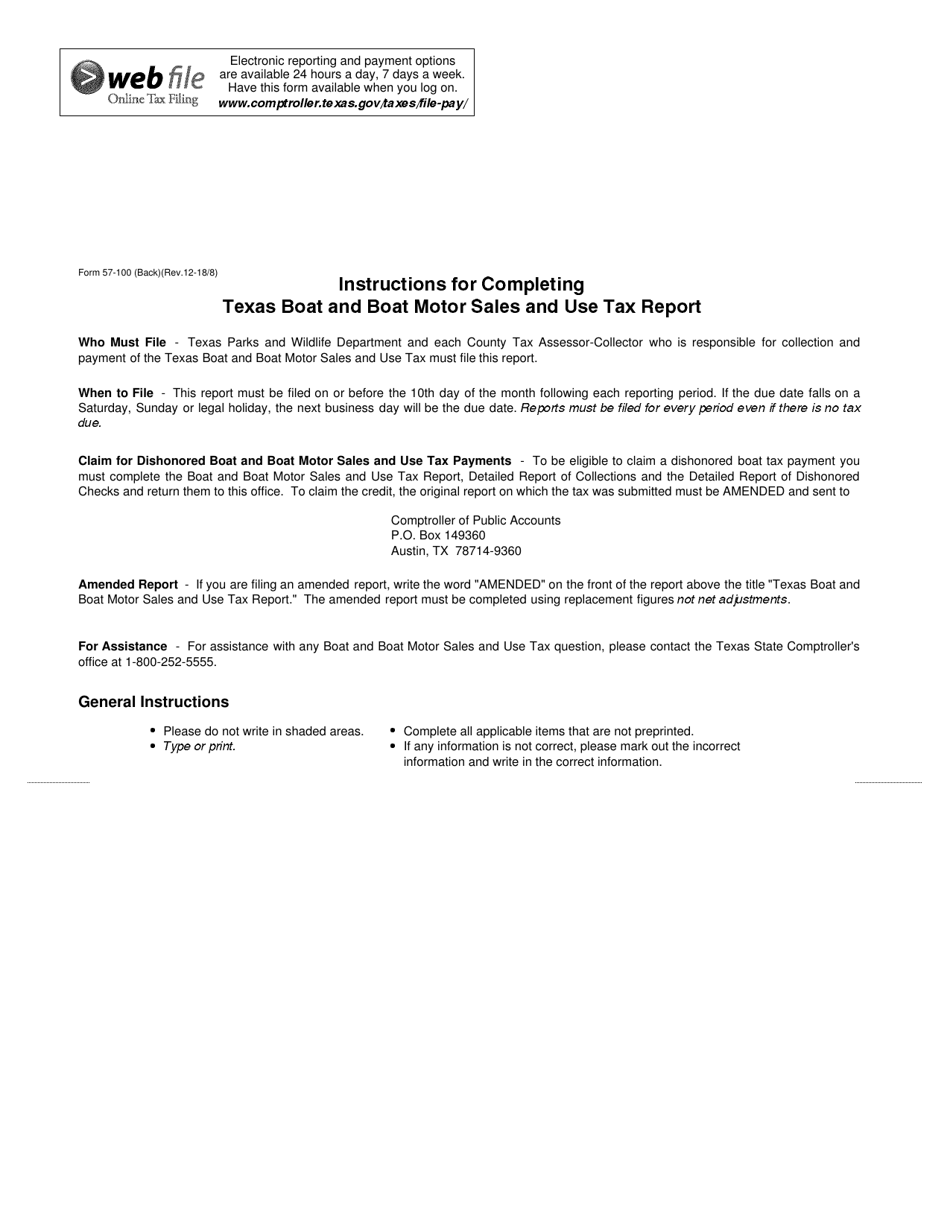

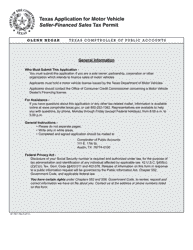

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 57-100?

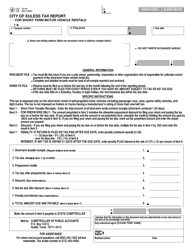

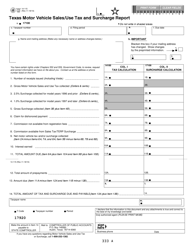

A: Form 57-100 is the Texas Boat and Boat Motor Sales and Use Tax Report.

Q: What is the purpose of Form 57-100?

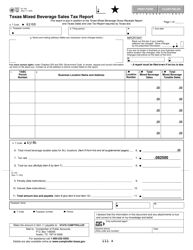

A: The purpose of Form 57-100 is to report sales and use tax on boat and boat motor transactions in Texas.

Q: Who needs to file Form 57-100?

A: Anyone who sells or uses boats or boat motors in Texas needs to file Form 57-100.

Q: When is Form 57-100 due?

A: Form 57-100 is due on or before the 20th day of each month.

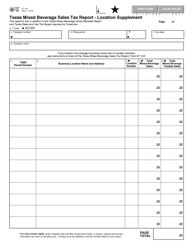

Q: What information do I need to fill out Form 57-100?

A: You will need information about the buyer, the seller, the boat or boat motor being sold, and the transaction details.

Q: Are there any exemptions or deductions available on Form 57-100?

A: Yes, there are certain exemptions and deductions available. It is important to review the instructions for Form 57-100 or consult a tax professional for more information.

Q: What happens if I don't file Form 57-100?

A: Failure to file Form 57-100 or pay the required taxes can result in penalties and interest charges.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 57-100 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.