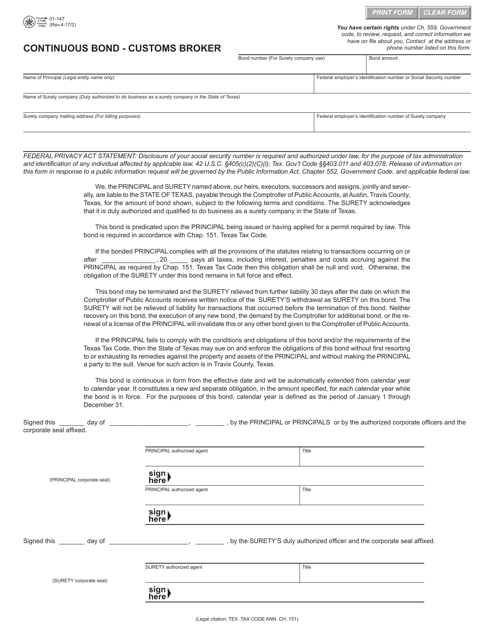

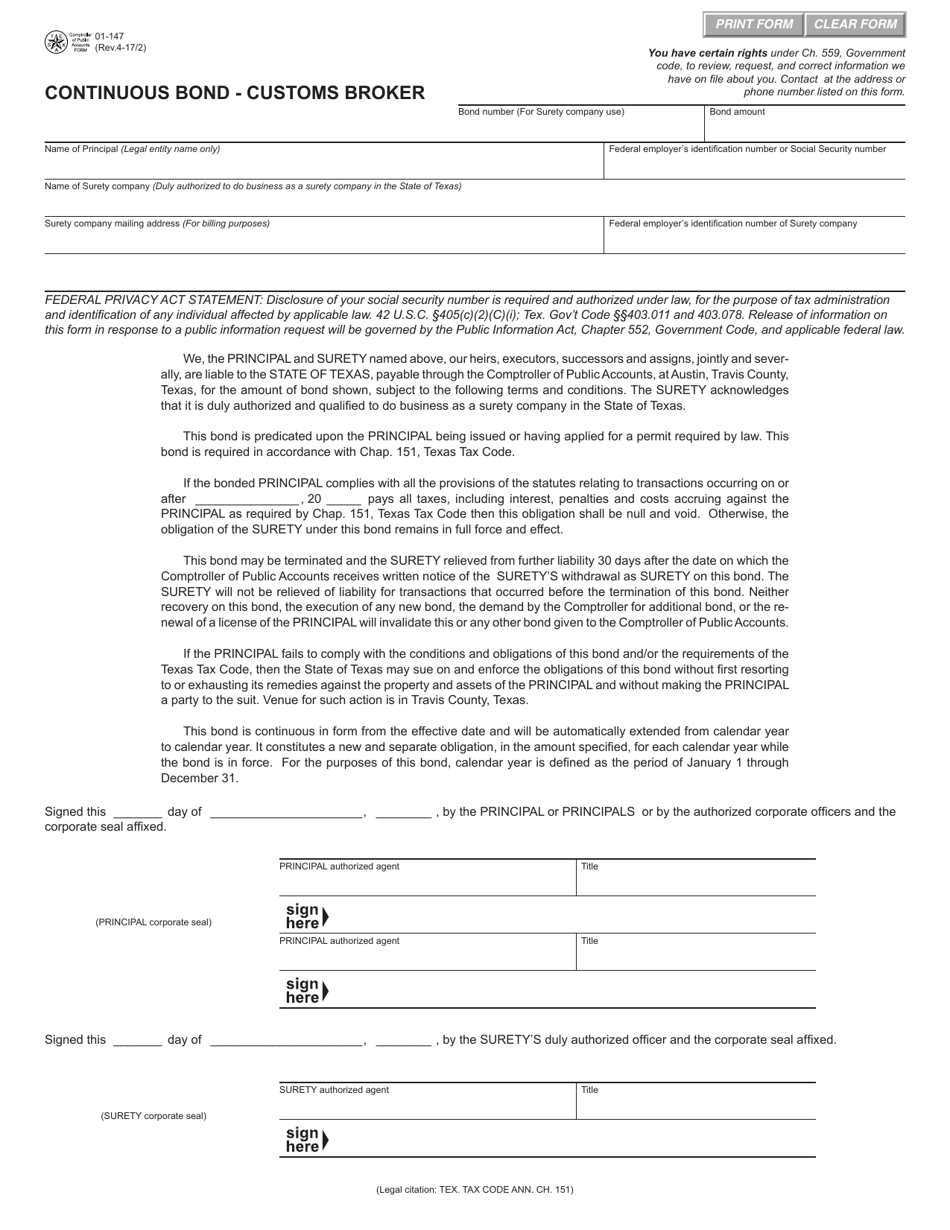

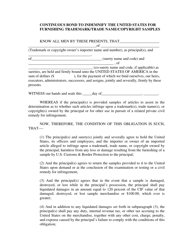

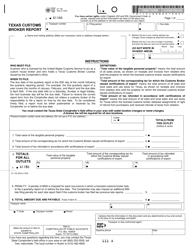

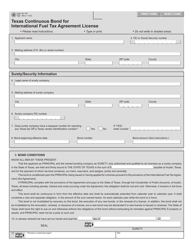

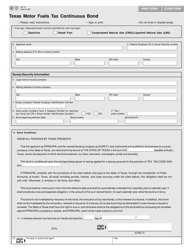

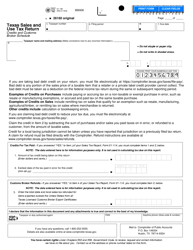

Form 01-147 Continuous Bond - Customs Broker - Texas

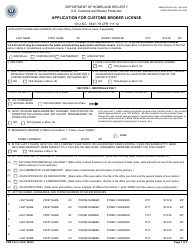

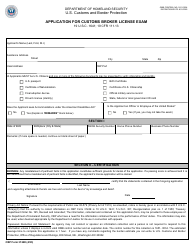

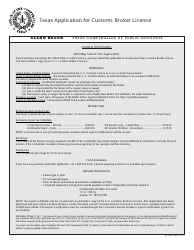

What Is Form 01-147?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 01-147 Continuous Bond?

A: Form 01-147 Continuous Bond is a customs document used by customs brokers in Texas.

Q: Who uses Form 01-147 Continuous Bond?

A: Customs brokers in Texas use Form 01-147 Continuous Bond.

Q: What is the purpose of Form 01-147 Continuous Bond?

A: The purpose of Form 01-147 Continuous Bond is to provide a guarantee to US Customs and Border Protection (CBP) for the payment of duties, taxes, and fees.

Q: Is Form 01-147 Continuous Bond only applicable in Texas?

A: No, Form 01-147 Continuous Bond can be used by customs brokers across the United States.

Q: What happens if a customs broker does not have a Continuous Bond?

A: If a customs broker does not have a Continuous Bond, they may not be able to conduct business with CBP.

Q: Can individuals use Form 01-147 Continuous Bond?

A: No, Form 01-147 Continuous Bond is specifically for customs brokers.

Q: What other documents are required for customs brokers in Texas?

A: Customs brokers in Texas are also required to have a valid Customs Broker License issued by CBP.

Form Details:

- Released on April 2, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 01-147 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.