This version of the form is not currently in use and is provided for reference only. Download this version of

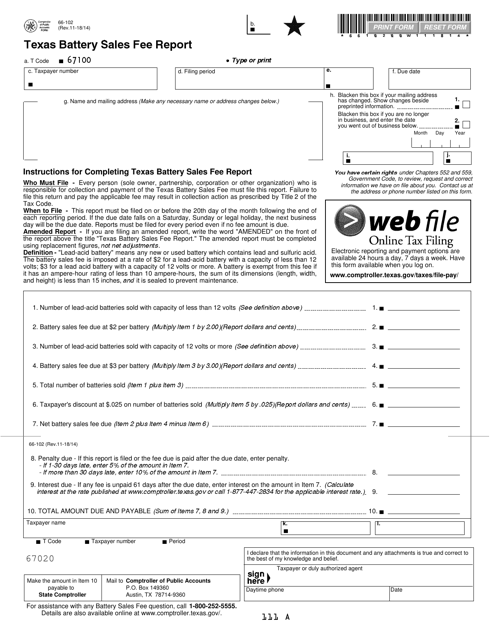

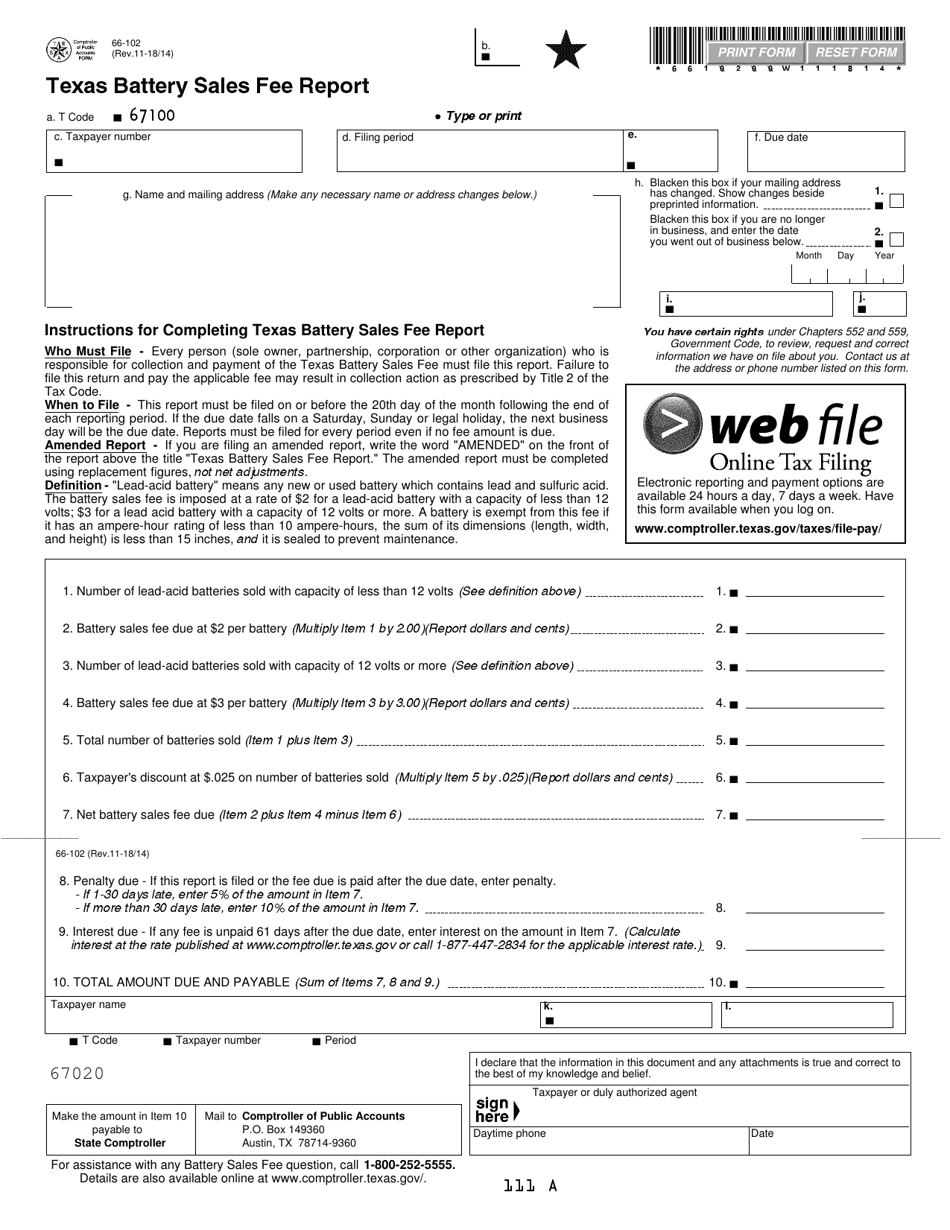

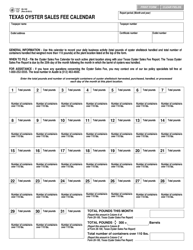

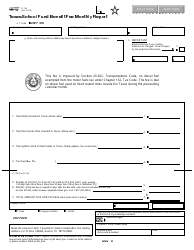

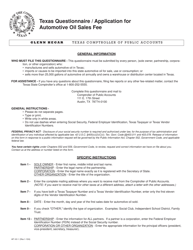

Form 66-102

for the current year.

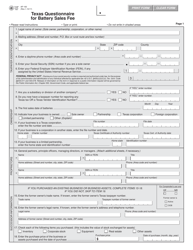

Form 66-102 Texas Battery Sales Fee Report - Texas

What Is Form 66-102?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

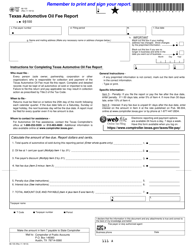

Q: What is form 66-102 Texas Battery Sales Fee Report?

A: Form 66-102 Texas Battery Sales Fee Report is a tax form used in Texas to report the sales of batteries.

Q: Who needs to file the form 66-102 Texas Battery Sales Fee Report?

A: Any business or individual engaged in the sale or distribution of batteries in Texas needs to file the form 66-102 Texas Battery Sales Fee Report.

Q: How often do I need to file form 66-102 Texas Battery Sales Fee Report?

A: Form 66-102 Texas Battery Sales Fee Report needs to be filed on a monthly basis.

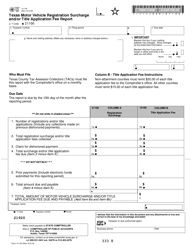

Q: What information do I need to provide on form 66-102 Texas Battery Sales Fee Report?

A: You need to provide information about your business, the type and quantity of batteries sold, and the amount of sales tax collected.

Form Details:

- Released on November 14, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 66-102 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.