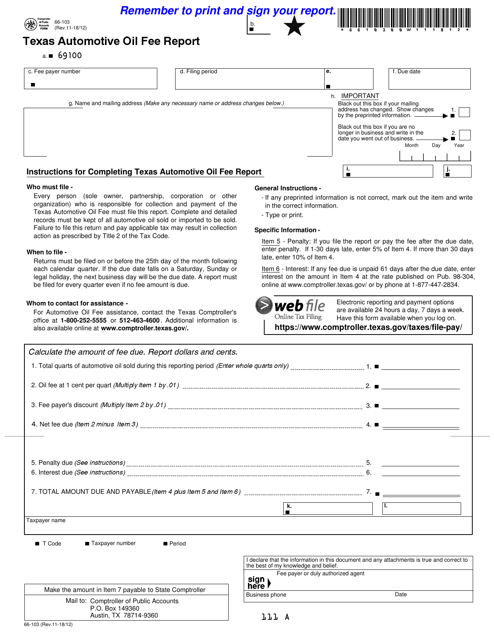

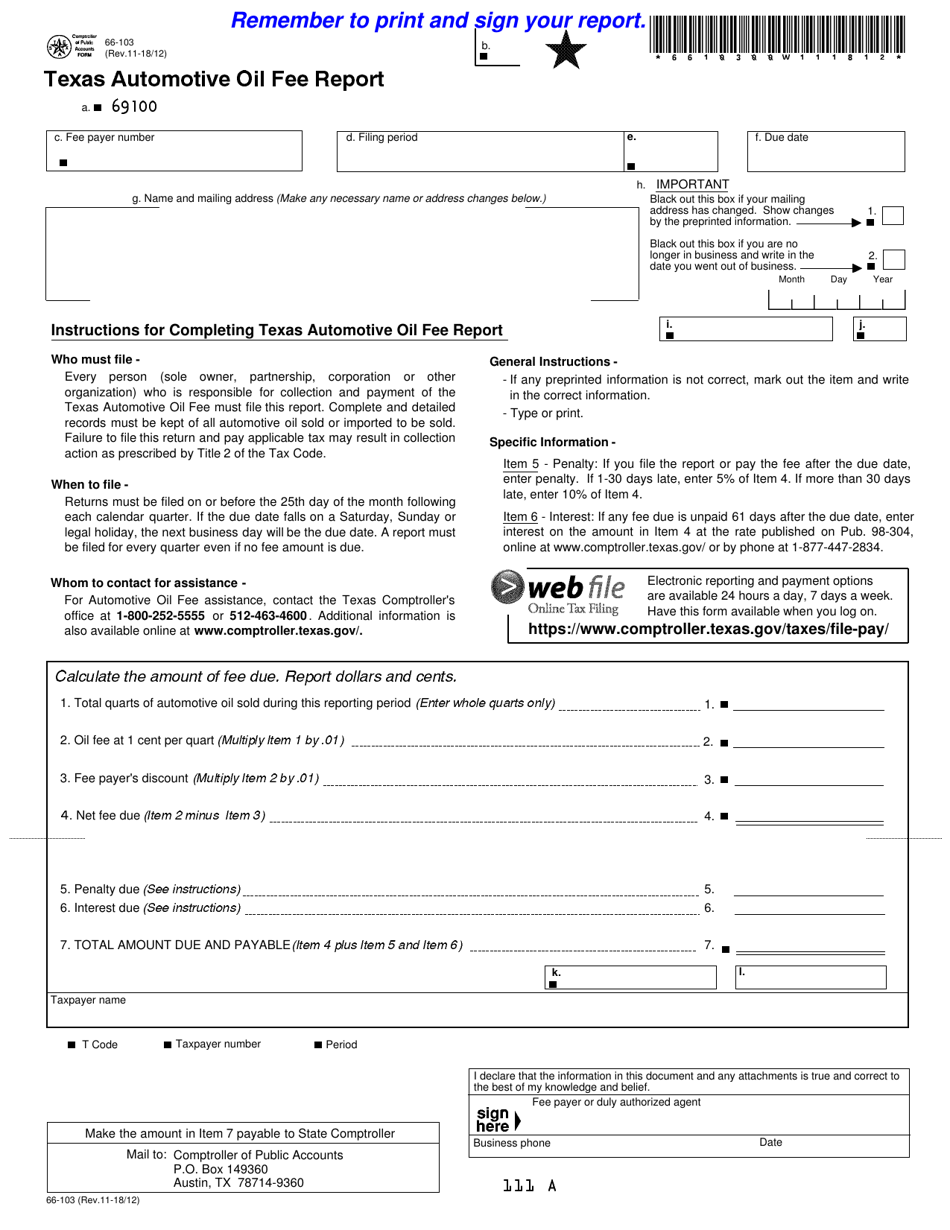

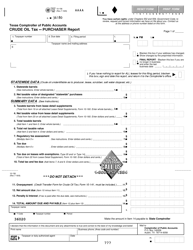

Form 66-103 Texas Automotive Oil Fee Report - Texas

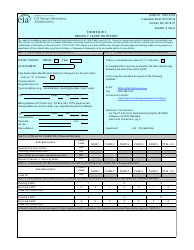

What Is Form 66-103?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 66-103?

A: Form 66-103 is the Texas Automotive Oil Fee Report.

Q: What is the purpose of Form 66-103?

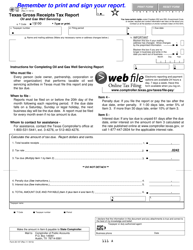

A: The purpose of Form 66-103 is to report and pay the automotive oil fee in Texas.

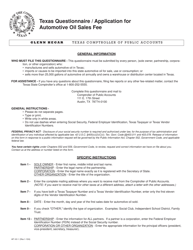

Q: Who needs to file Form 66-103?

A: Anyone engaged in the business of selling automotive oil in Texas needs to file Form 66-103.

Q: How often is Form 66-103 filed?

A: Form 66-103 is filed on a monthly basis.

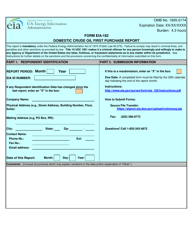

Q: What information is required on Form 66-103?

A: Form 66-103 requires information such as the total gallons of automotive oil sold, the amount of fee due, and other related details.

Form Details:

- Released on November 12, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 66-103 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.