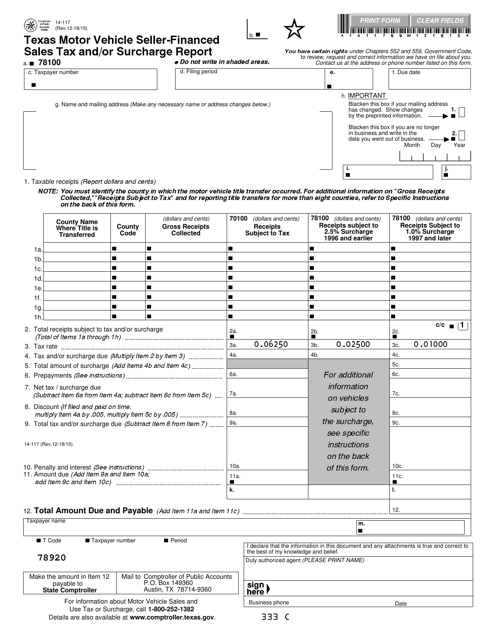

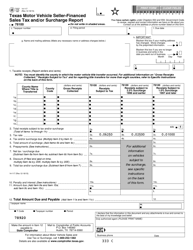

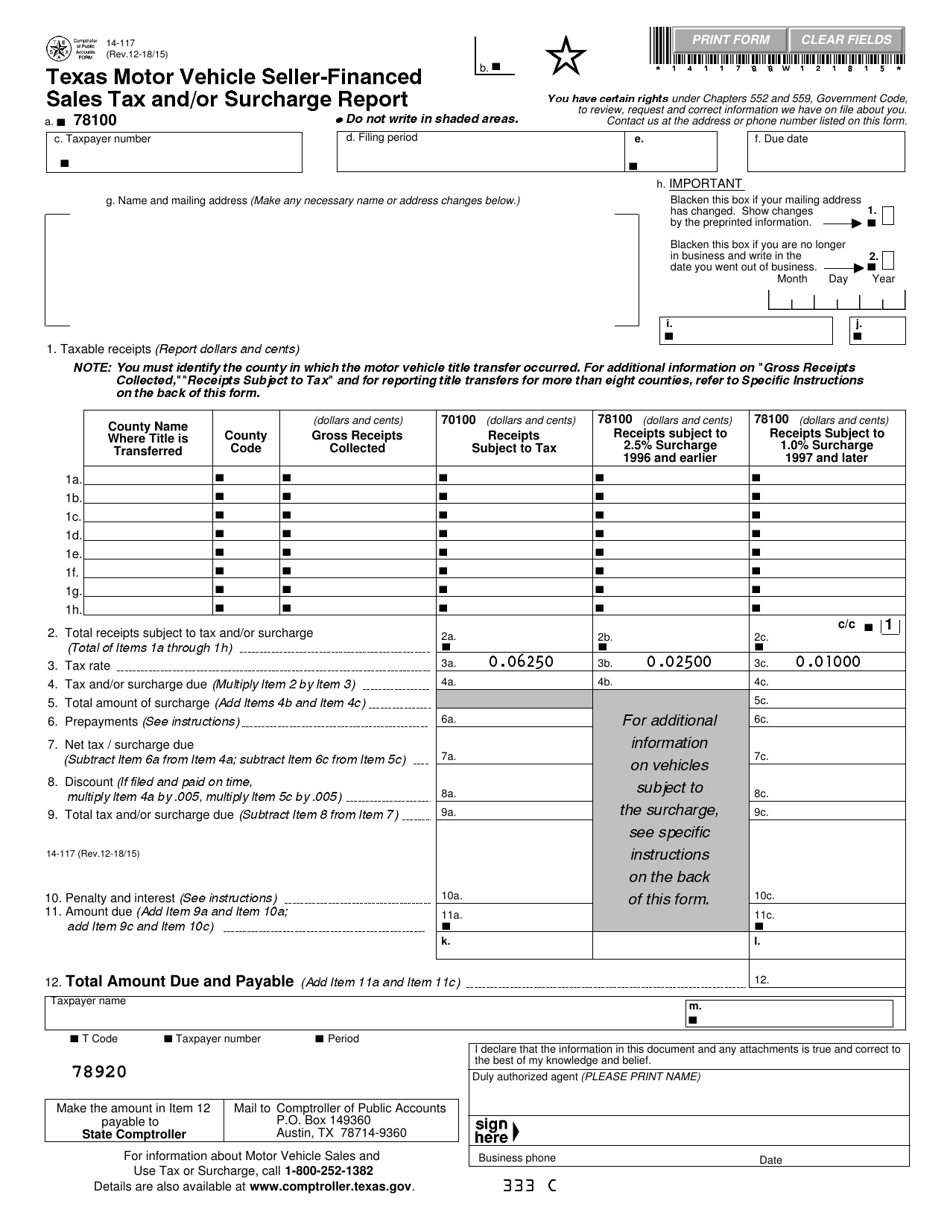

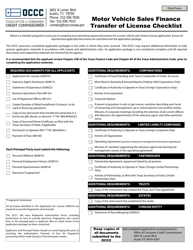

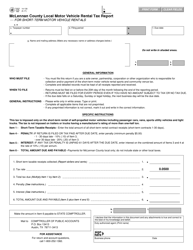

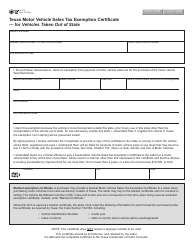

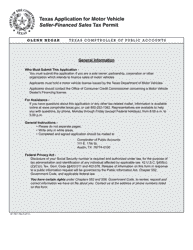

Form 14-117 Texas Motor Vehicle Seller-Financed Sales Tax and / or Surcharge Report - Texas

What Is Form 14-117?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 14-117?

A: Form 14-117 is the Texas Motor Vehicle Seller-Financed Sales Tax and/or Surcharge Report.

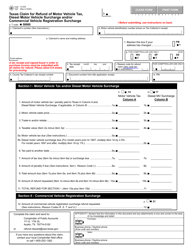

Q: What is the purpose of Form 14-117?

A: The purpose of Form 14-117 is to report and remit the sales tax and/or surcharge collected by a motor vehicle seller on a seller-financed sale.

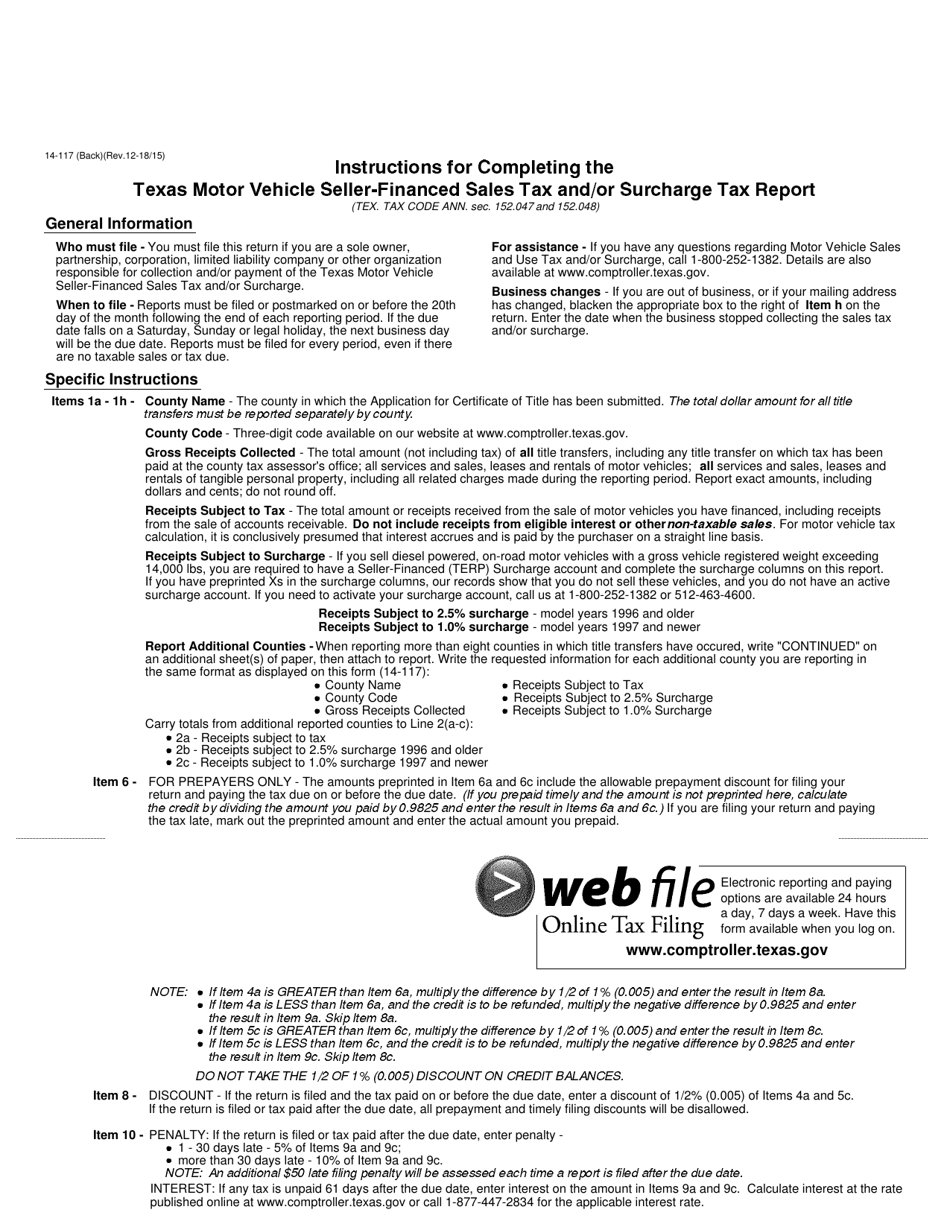

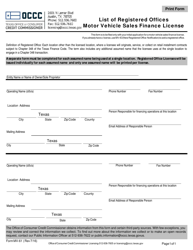

Q: Who needs to file Form 14-117?

A: Motor vehicle sellers who engage in seller-financed sales and collect sales tax and/or surcharge must file Form 14-117.

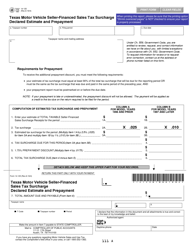

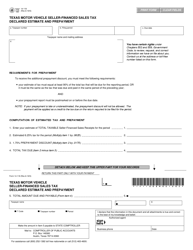

Q: What information is required on Form 14-117?

A: Form 14-117 requires information such as the total amount of sales tax and/or surcharge collected, the number of vehicles sold, and the seller-financed sales tax rate.

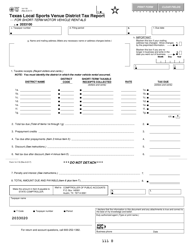

Q: When is Form 14-117 due?

A: Form 14-117 is due on a monthly basis and must be filed by the 20th day of the following month.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 14-117 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.