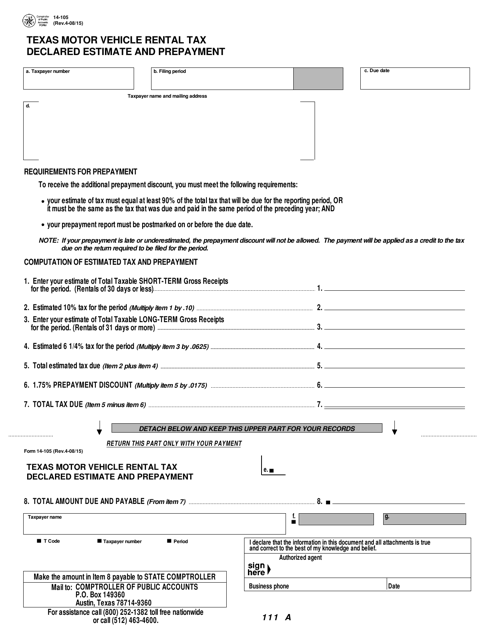

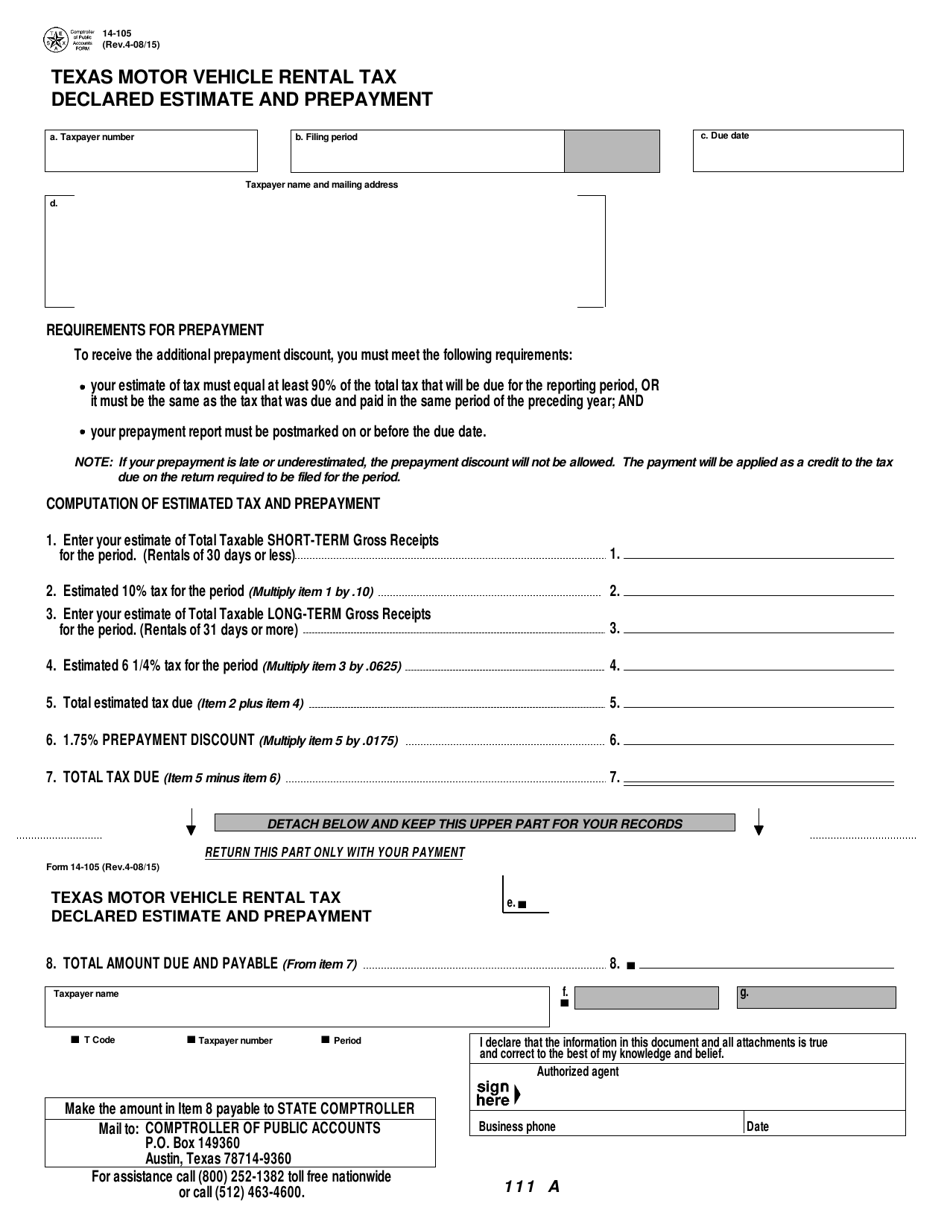

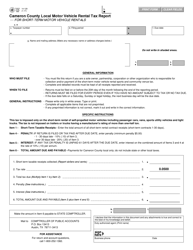

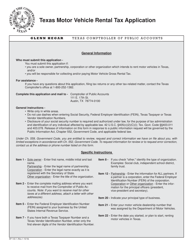

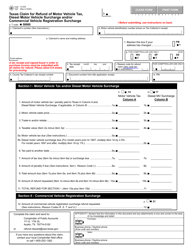

Form 14-105 Texas Motor Vehicle Rental Tax Declared Estimate and Prepayment - Texas

What Is Form 14-105?

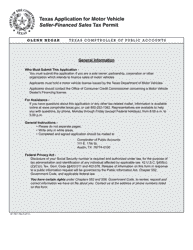

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 14-105?

A: Form 14-105 is the Texas Motor Vehicle Rental Tax Declared Estimate and Prepayment form.

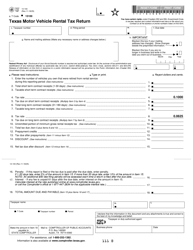

Q: What is the purpose of Form 14-105?

A: Form 14-105 is used to declare and make estimated prepayments of the Texas Motor Vehicle Rental Tax.

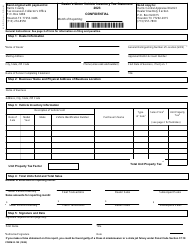

Q: Who needs to file Form 14-105?

A: Vehicle rental businesses in Texas need to file Form 14-105.

Q: What is the Motor Vehicle Rental Tax in Texas?

A: The Motor Vehicle Rental Tax in Texas is a tax imposed on the rental of motor vehicles.

Q: How often is Form 14-105 filed?

A: Form 14-105 is filed quarterly, with the due dates falling on the last day of April, July, October, and January.

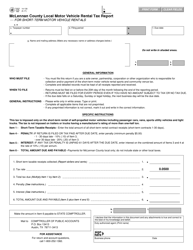

Q: What are the penalties for not filing Form 14-105?

A: Penalties for not filing Form 14-105 include interest and additional surcharges based on the amount of tax due.

Q: Is Form 14-105 only for motor vehicle rentals in Texas?

A: Yes, Form 14-105 is specifically for motor vehicle rentals in Texas.

Q: How do I calculate the prepayment amount on Form 14-105?

A: The prepayment amount is calculated based on a percentage of the total tax liability from the previous calendar year.

Form Details:

- Released on April 15, 2008;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 14-105 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.