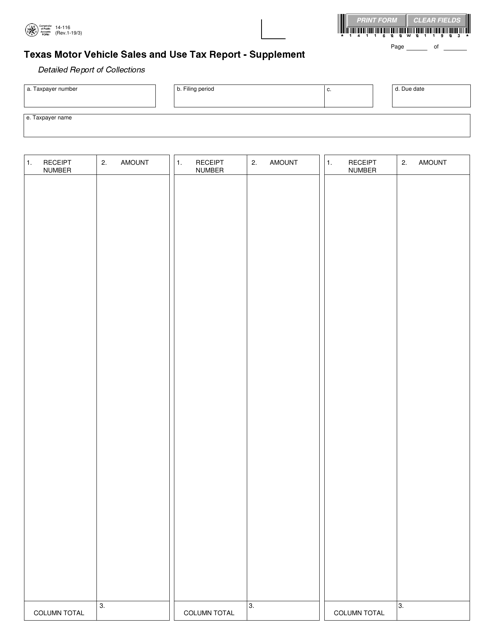

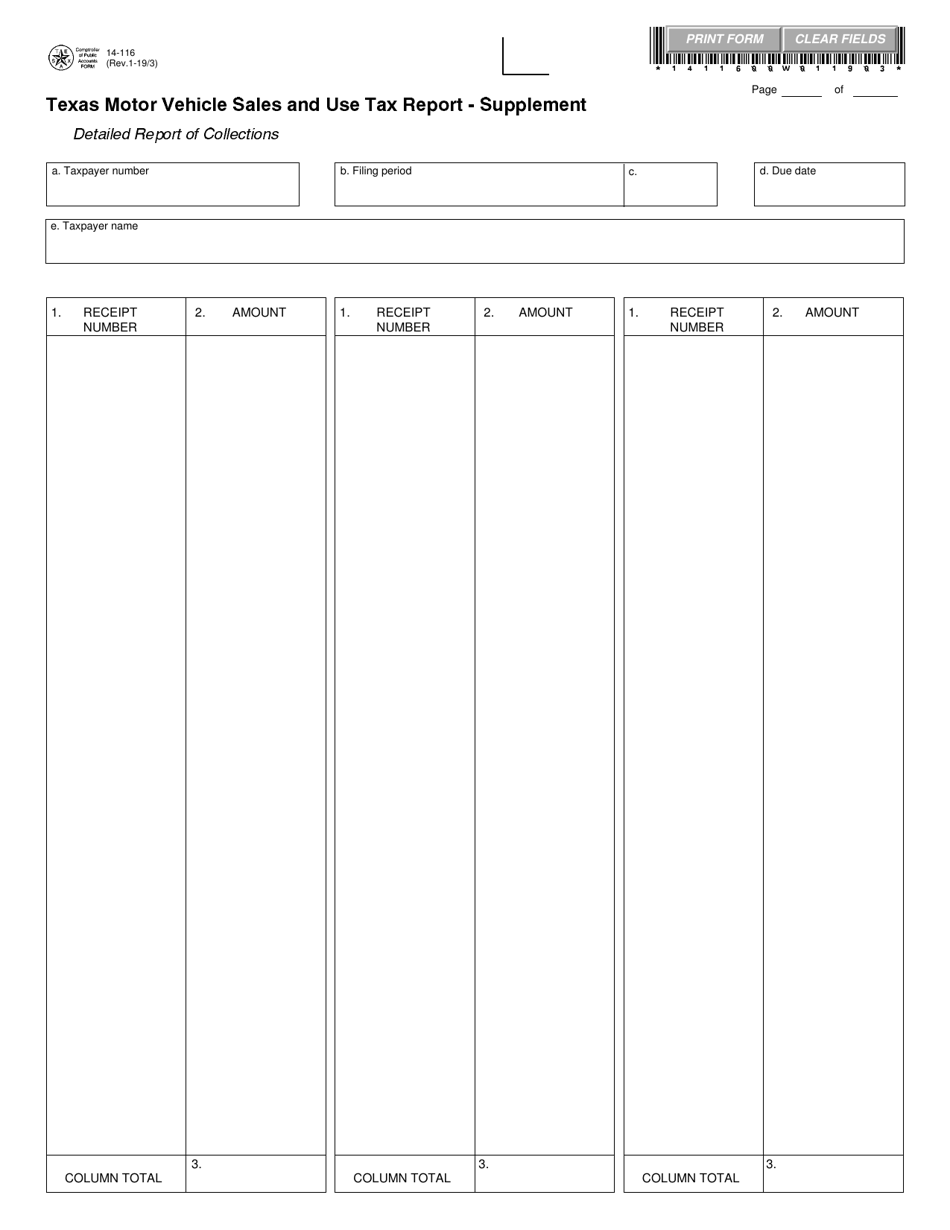

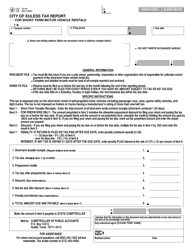

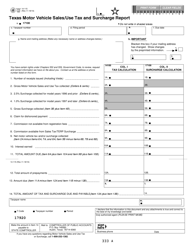

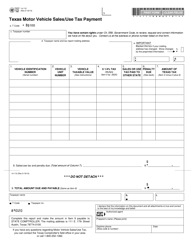

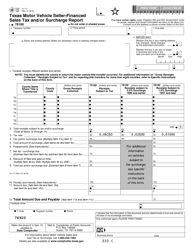

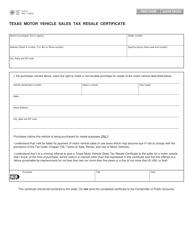

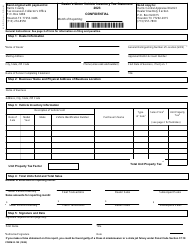

Form 14-116 Texas Motor Vehicle Sales and Use Tax Report - Supplement - Texas

What Is Form 14-116?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 14-116?

A: Form 14-116 is the Texas Motor Vehicle Sales and Use Tax Report - Supplement.

Q: What is the purpose of Form 14-116?

A: The purpose of Form 14-116 is to report motor vehiclesales and use tax in Texas.

Q: Who needs to file Form 14-116?

A: Anyone involved in motor vehicle sales and use tax in Texas needs to file Form 14-116.

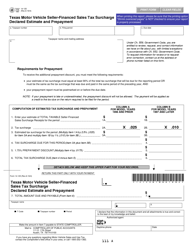

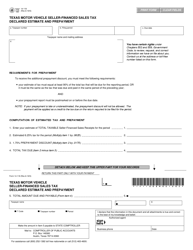

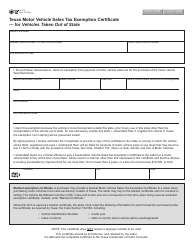

Q: Are there any specific requirements for filing Form 14-116?

A: Yes, there are specific requirements and instructions provided with the form.

Q: Is there a deadline for filing Form 14-116?

A: Yes, there is a deadline for filing Form 14-116. The deadline is mentioned in the form instructions.

Q: What happens if I don't file Form 14-116?

A: Failure to file Form 14-116 may result in penalties and interest.

Q: Are there any alternative methods for filing Form 14-116?

A: Yes, you can also file Form 14-116 by mail or in person.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 14-116 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.