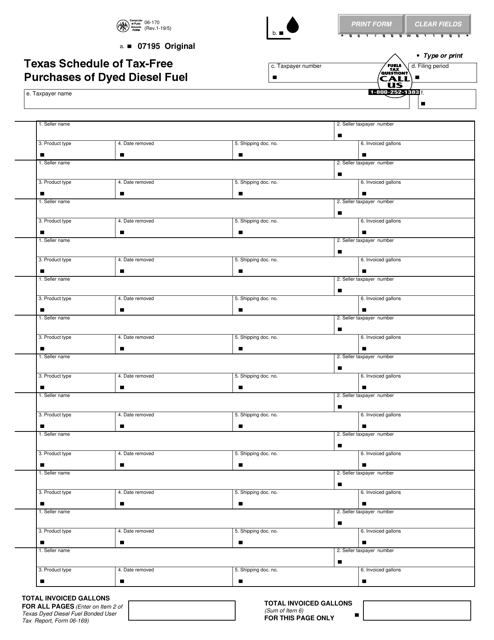

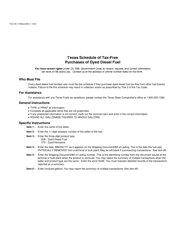

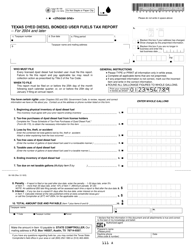

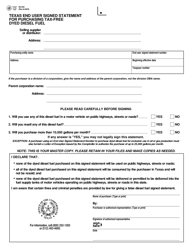

Form 06-170 Texas Schedule of Tax-Free Purchases of Dyed Diesel Fuel - Texas

What Is Form 06-170?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 06-170?

A: Form 06-170 is the Texas Schedule of Tax-Free Purchases of Dyed Diesel Fuel.

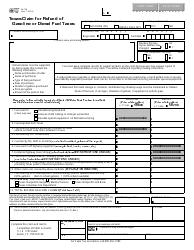

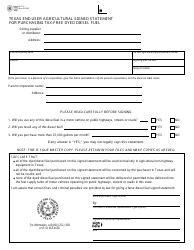

Q: What is dyed diesel fuel?

A: Dyed diesel fuel is diesel fuel that has been colored with a special dye to indicate that it is not intended for use on public roads.

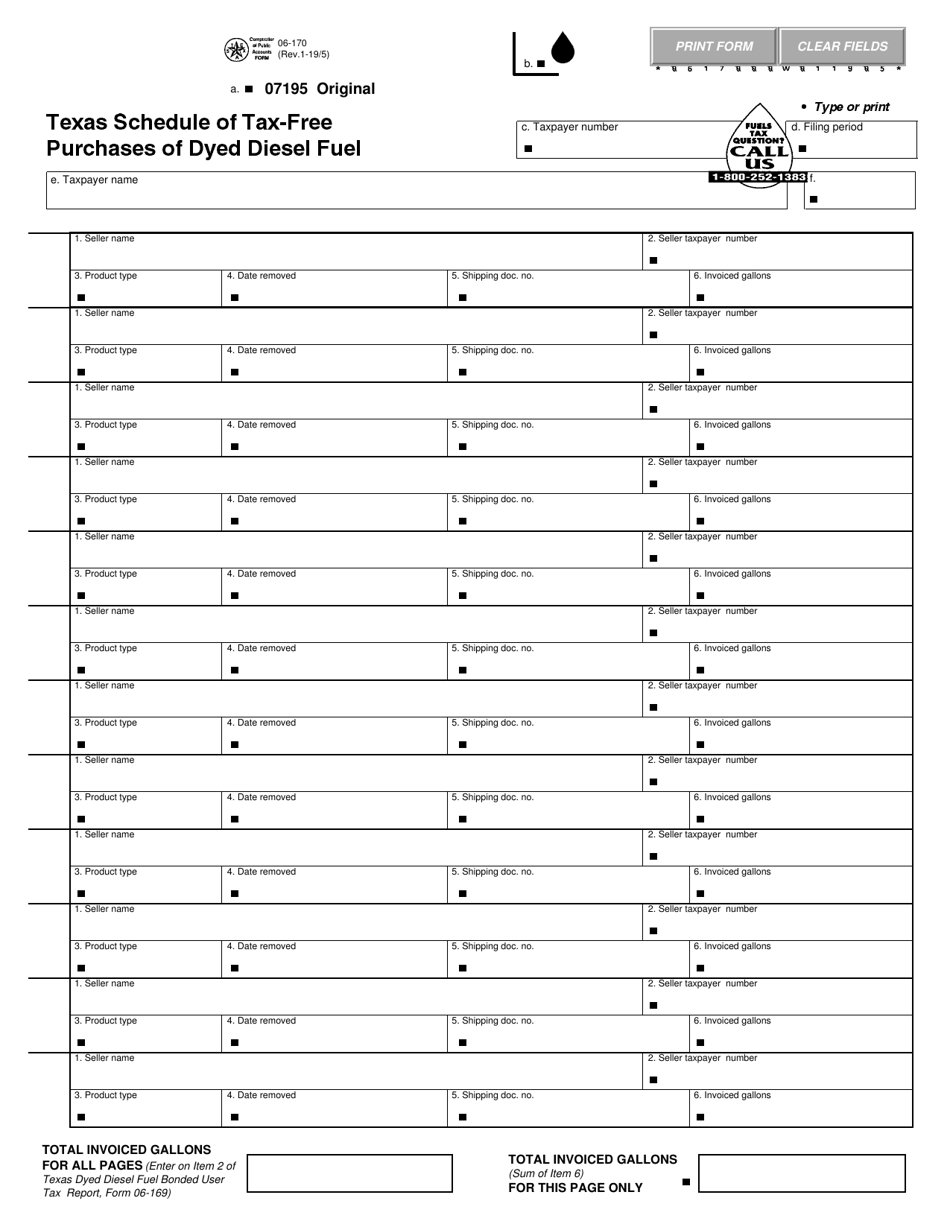

Q: Who uses Form 06-170?

A: Form 06-170 is used by individuals or businesses in Texas who purchase tax-free dyed diesel fuel for non-taxable purposes.

Q: What are non-taxable purposes?

A: Non-taxable purposes refer to uses of dyed diesel fuel that are exempt from state motor fuel tax, such as off-road use or agricultural purposes.

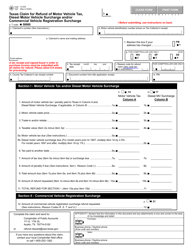

Q: Do I need to file Form 06-170?

A: You need to file Form 06-170 if you make tax-free purchases of dyed diesel fuel in Texas for non-taxable purposes.

Q: Are there any penalties for not filing Form 06-170?

A: Yes, failure to timely file Form 06-170 or providing false information can result in penalties and interest.

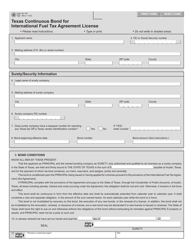

Form Details:

- Released on January 5, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 06-170 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.