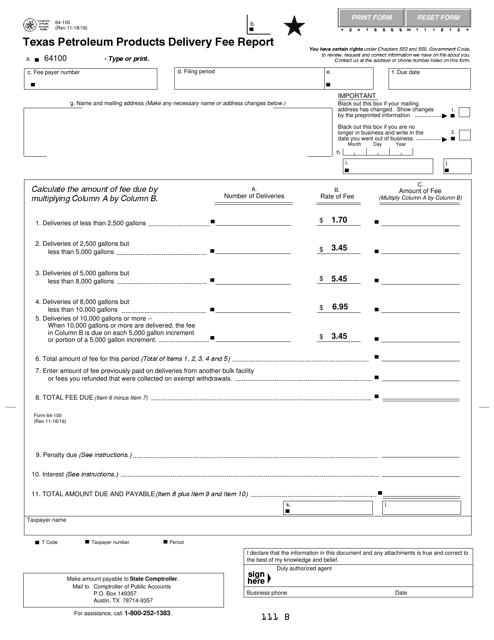

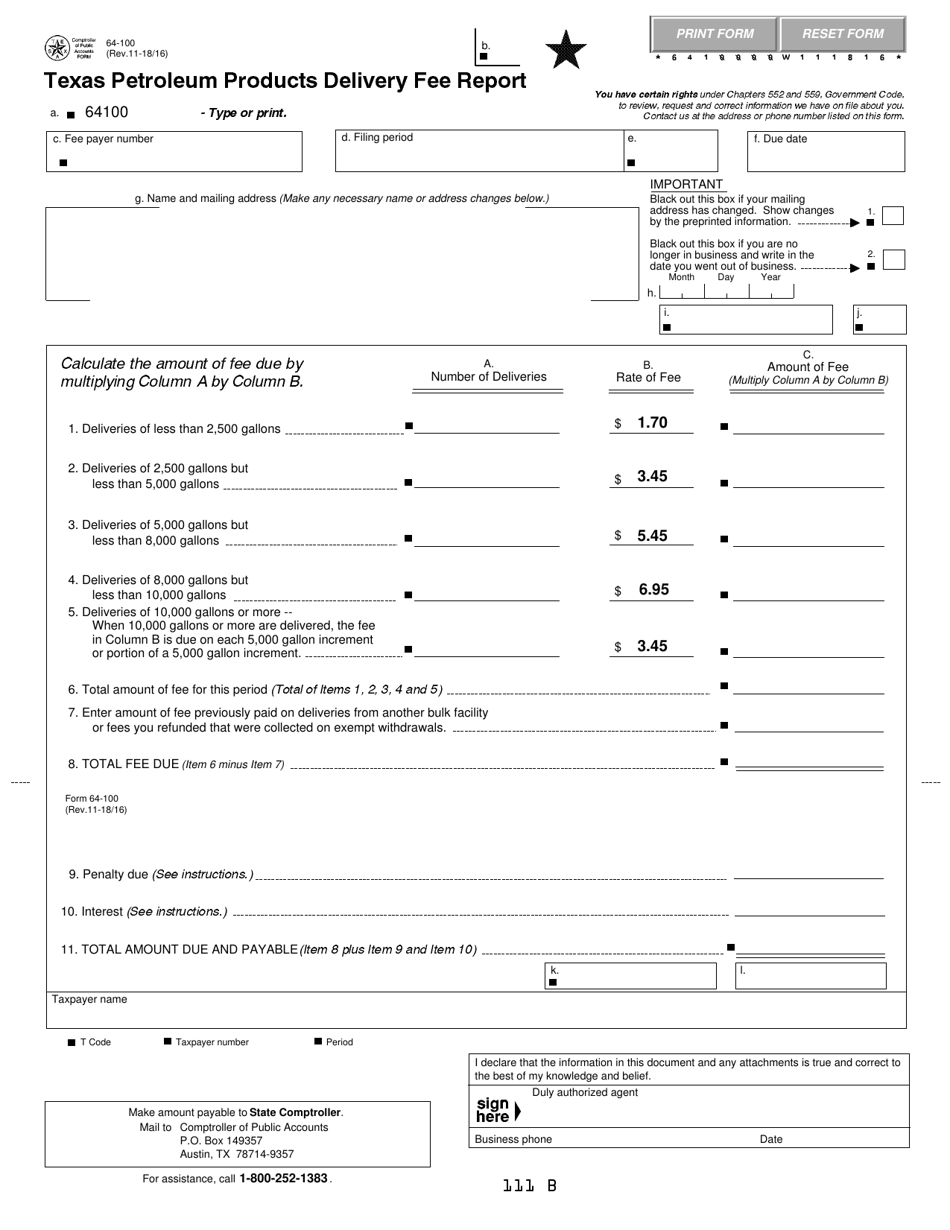

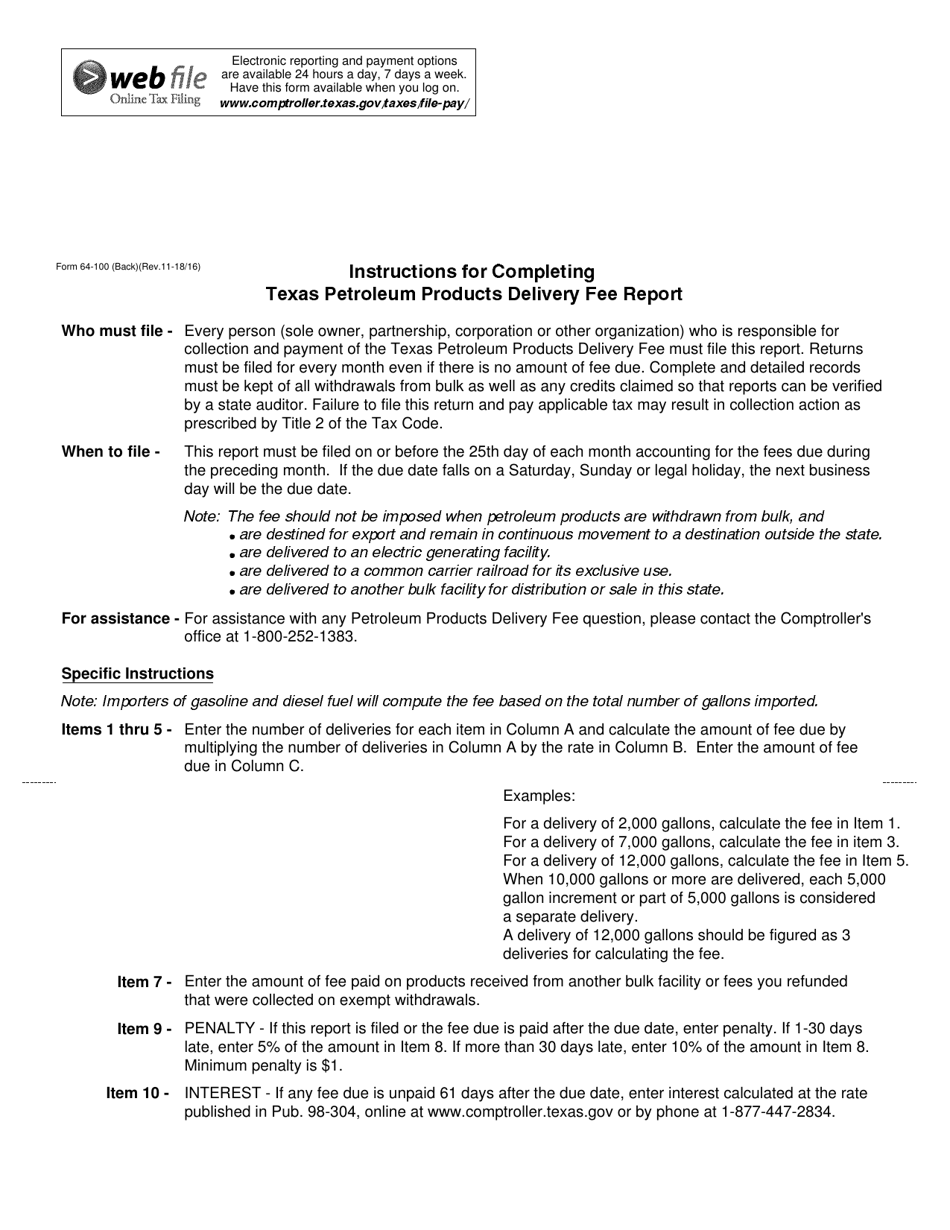

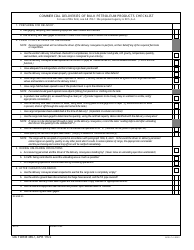

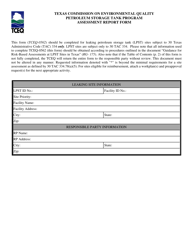

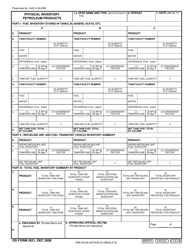

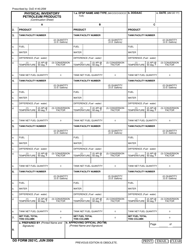

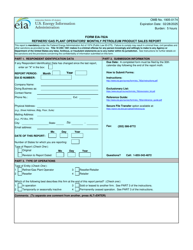

Form 64-100 Texas Petroleum Products Delivery Fee Report - Texas

What Is Form 64-100?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 64-100?

A: Form 64-100 is the Texas Petroleum Products Delivery Fee Report.

Q: What is the purpose of Form 64-100?

A: The purpose of Form 64-100 is to report the delivery of petroleum products in Texas.

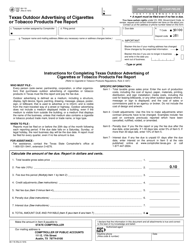

Q: Who is required to file Form 64-100?

A: Anyone who delivers petroleum products in Texas is required to file Form 64-100.

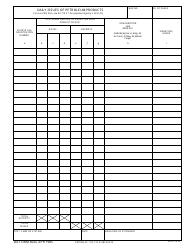

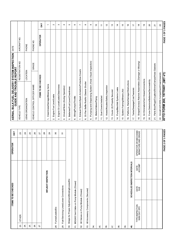

Q: What information is needed to complete Form 64-100?

A: To complete Form 64-100, you will need to provide information such as the name and address of the seller, the date and location of delivery, and the type and quantity of petroleum products delivered.

Q: When is Form 64-100 due?

A: Form 64-100 is due on the 20th day of the month following the reporting period.

Q: Are there any penalties for late or incorrect filing of Form 64-100?

A: Yes, there are penalties for late or incorrect filing of Form 64-100. It is important to file the form accurately and on time to avoid penalties.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 64-100 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.