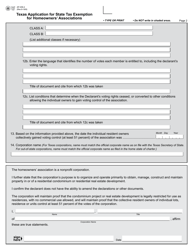

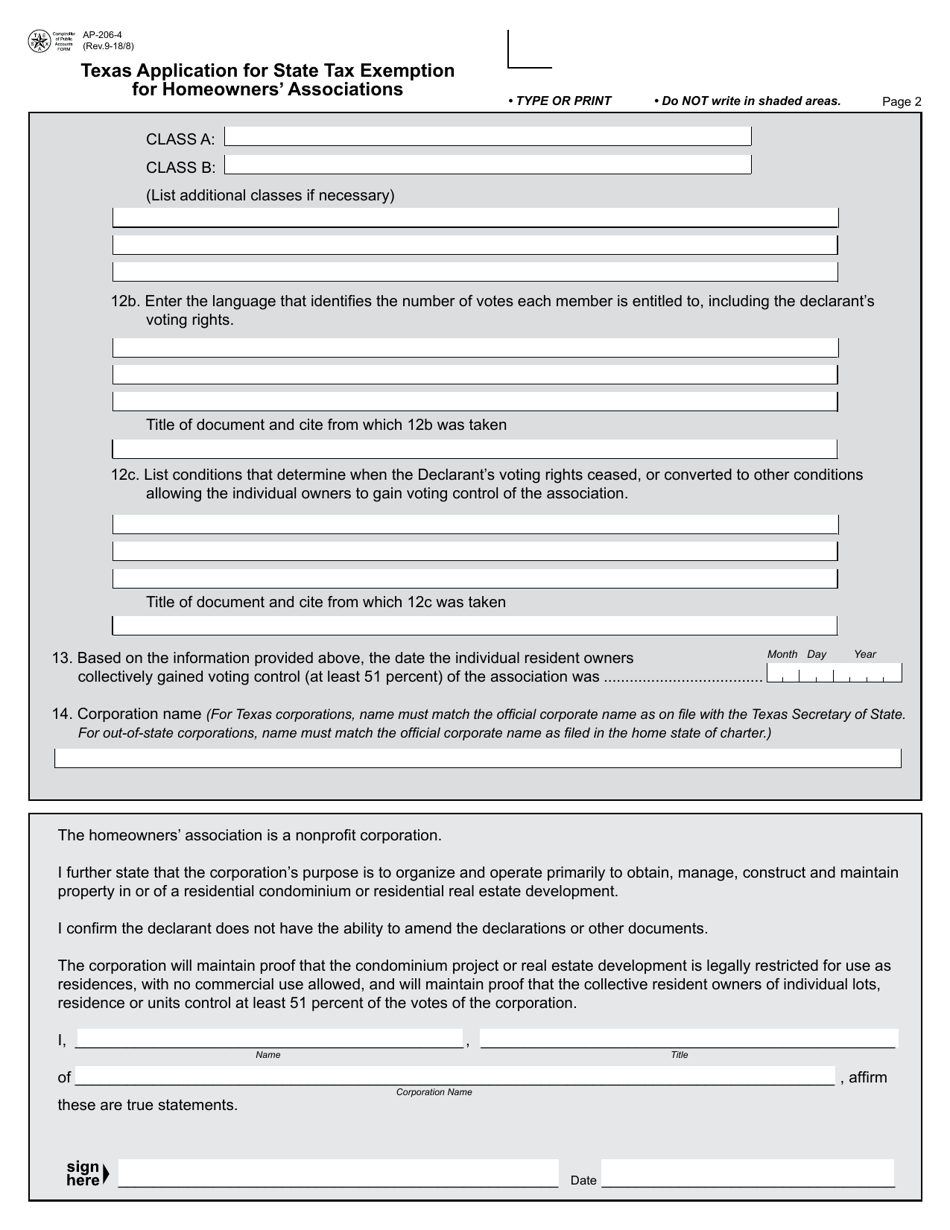

Form AP-206 Texas Application for State Tax Exemption for Homeowners' Associations - Texas

What Is Form AP-206?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AP-206?

A: Form AP-206 is the Texas Application for State Tax Exemption for Homeowners' Associations.

Q: Who is required to fill out Form AP-206?

A: Homeowners' Associations in Texas are required to fill out Form AP-206.

Q: What is the purpose of Form AP-206?

A: The purpose of Form AP-206 is to apply for a state tax exemption for homeowners' associations.

Q: What does a state tax exemption mean for homeowners' associations?

A: A state tax exemption means that homeowners' associations are exempt from paying certain state taxes.

Q: Is there a fee to file Form AP-206?

A: No, there is no fee to file Form AP-206.

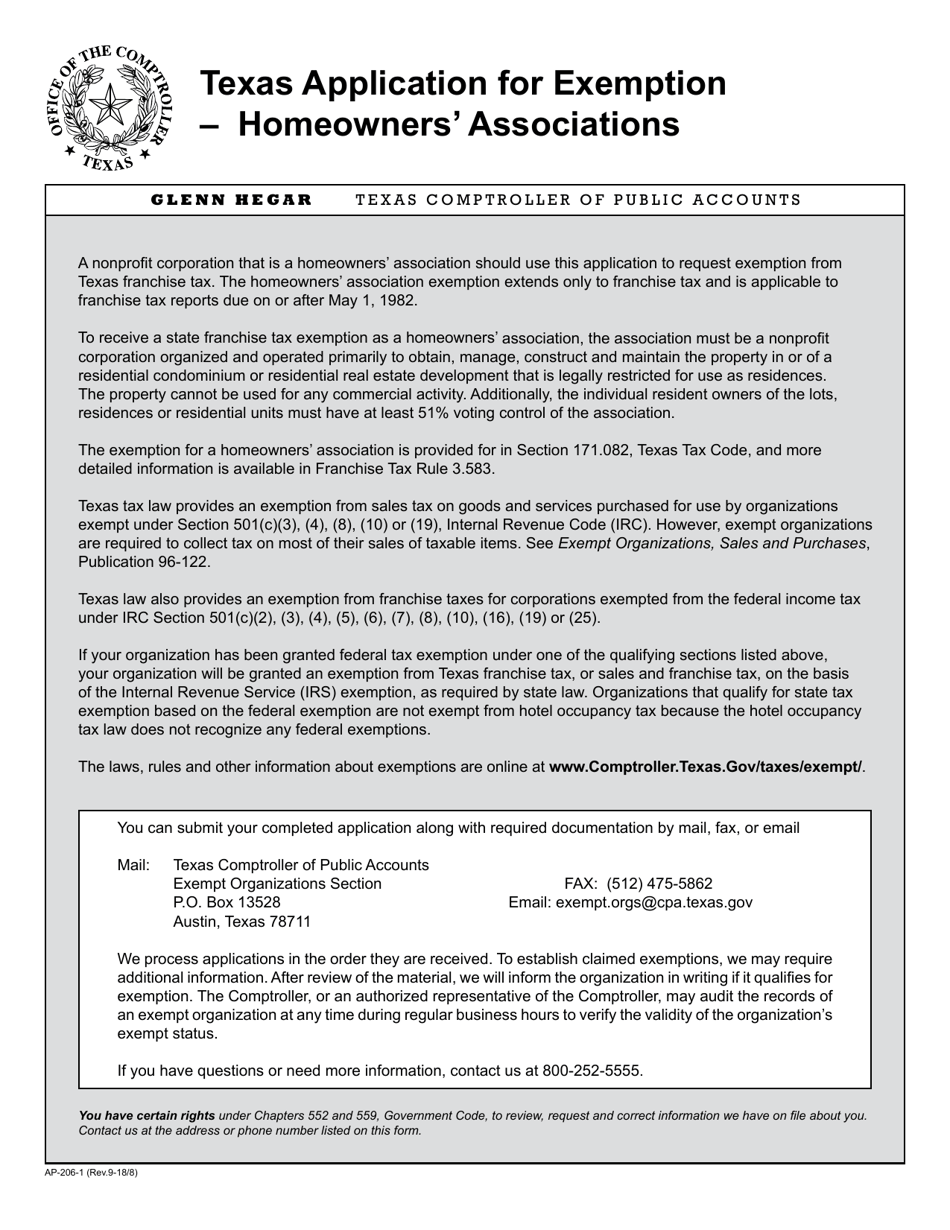

Q: Are there any eligibility requirements for the state tax exemption?

A: Yes, homeowners' associations must meet certain eligibility requirements to qualify for the state tax exemption.

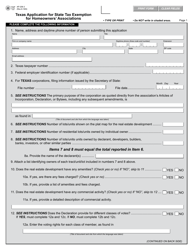

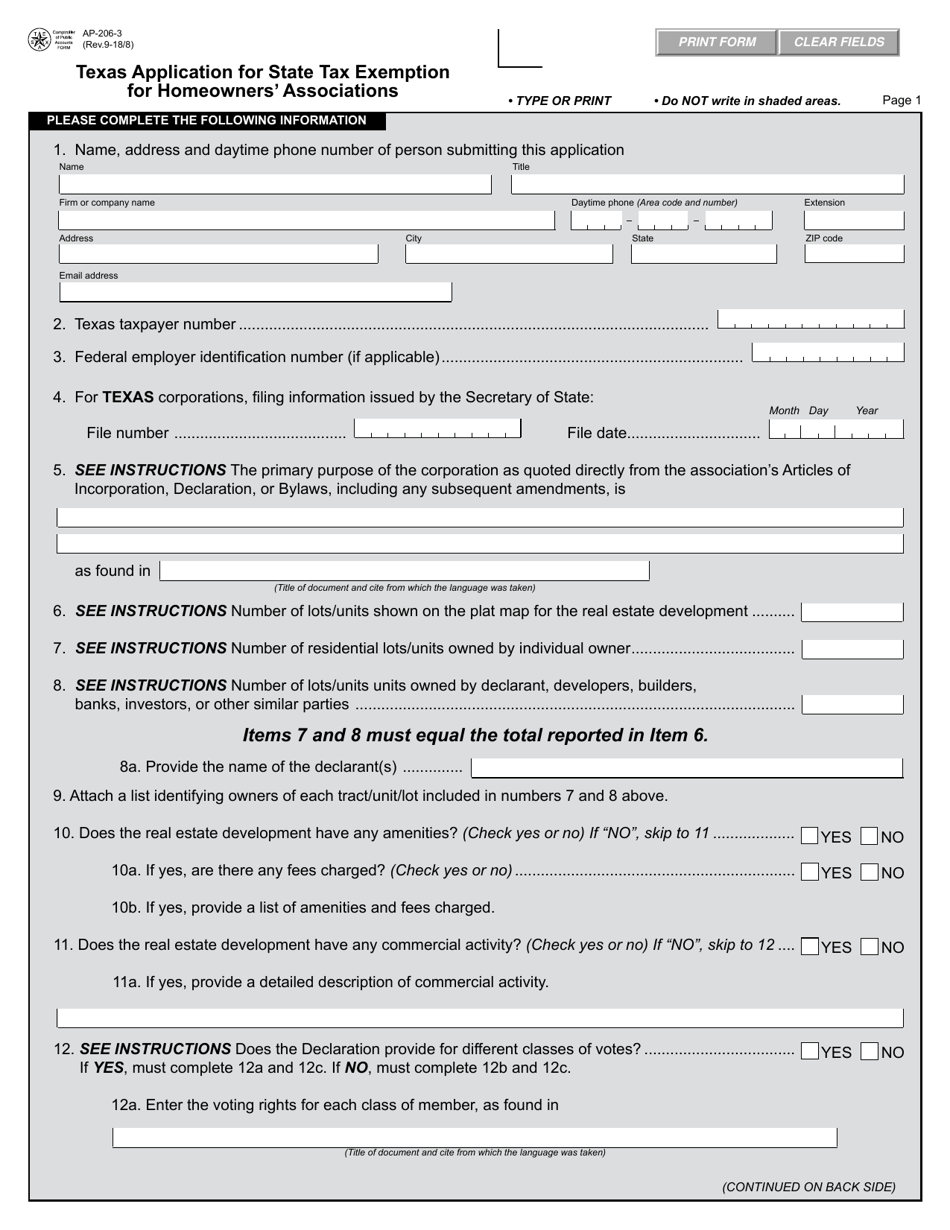

Q: What supporting documents are required with Form AP-206?

A: Homeowners' associations are required to submit supporting documents such as a copy of their bylaws and financial statements.

Q: When is the deadline to file Form AP-206?

A: The deadline to file Form AP-206 is usually the 15th day of the 5th month after the close of the homeowners' association's fiscal year.

Q: How long does it take to process Form AP-206?

A: The processing time for Form AP-206 can vary, but it typically takes several weeks to months for the application to be reviewed and processed.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-206 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.