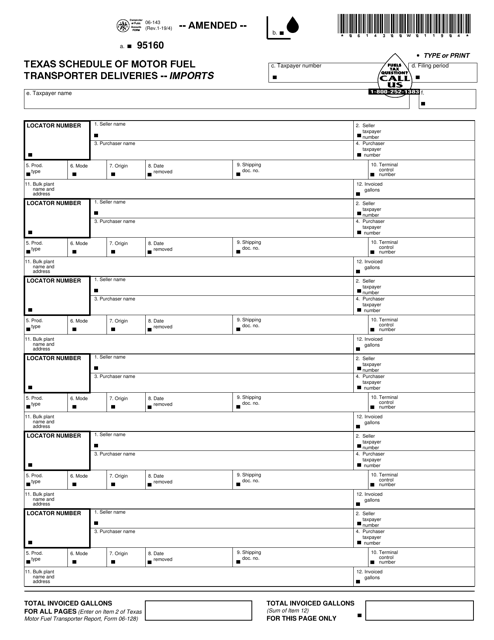

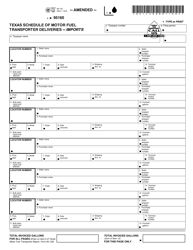

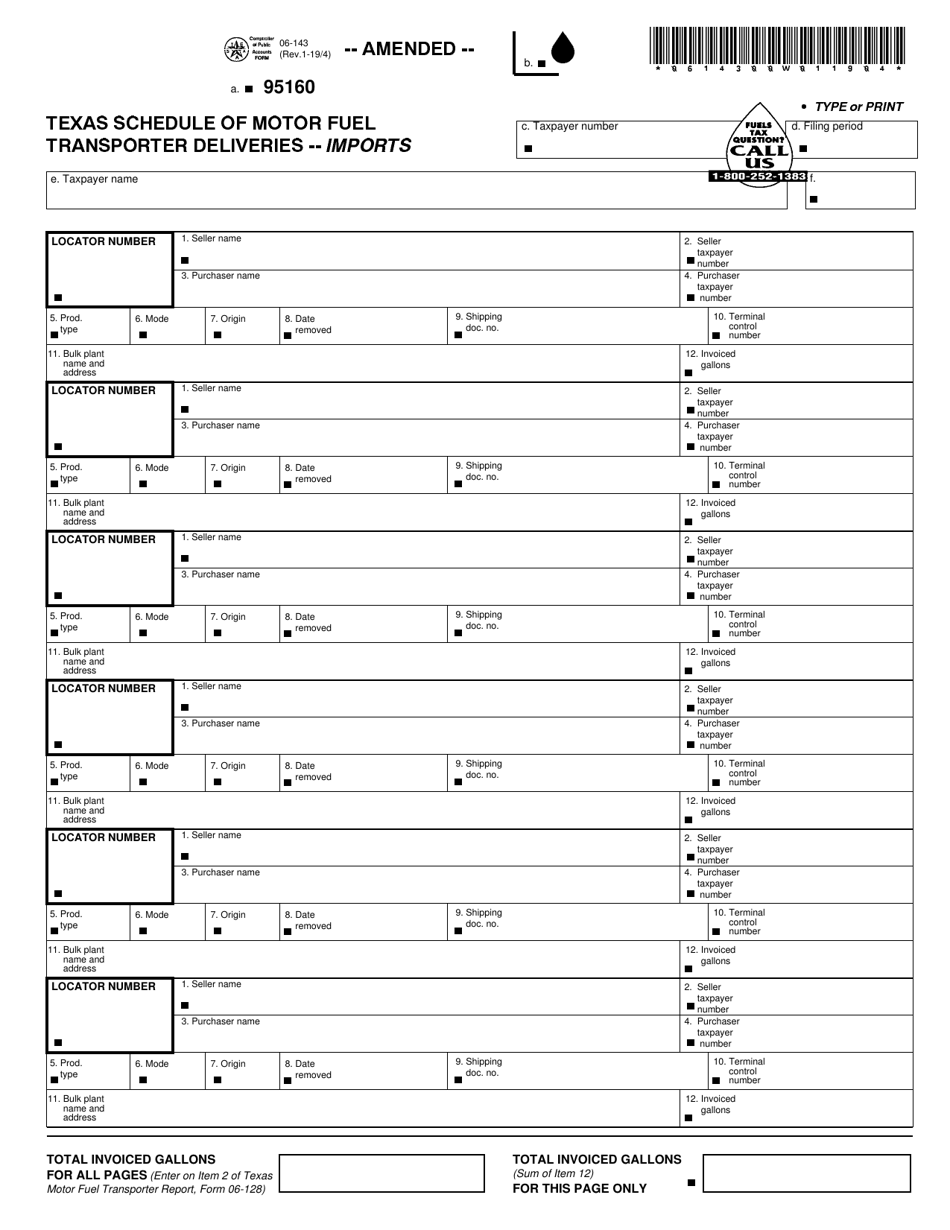

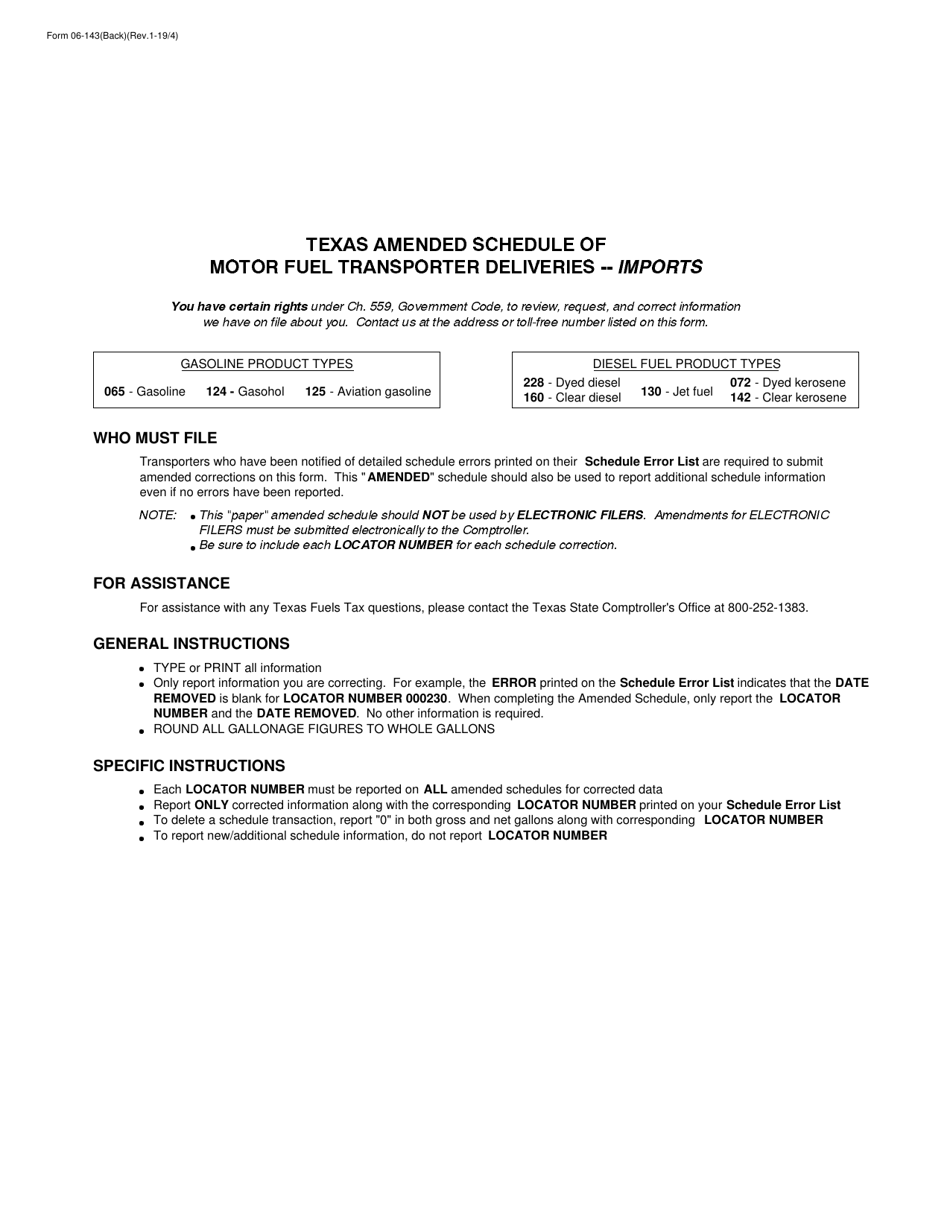

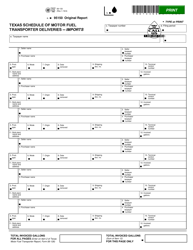

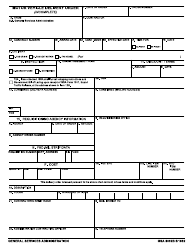

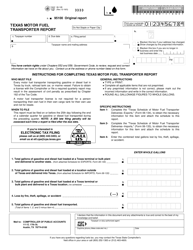

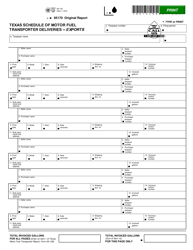

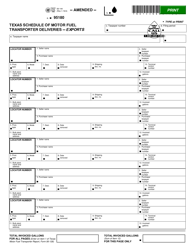

Form 06-143 Texas Schedule of Motor Fuel Transporter Deliveries - Imports - Texas

What Is Form 06-143?

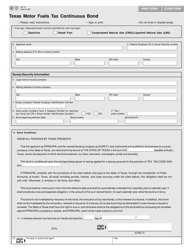

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form 06-143?

A: To report motor fuel transporter deliveries and imports in Texas.

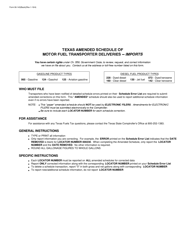

Q: Who is required to file Form 06-143?

A: Motor fuel transporters and importers operating in Texas.

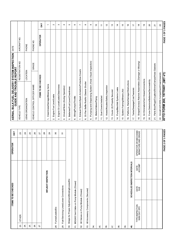

Q: What information is reported on Form 06-143?

A: The quantity of motor fuel deliveries and imports in Texas.

Q: When is Form 06-143 due?

A: Form 06-143 is due on the 25th day of the month following the reporting period.

Q: Are there any penalties for late filing of Form 06-143?

A: Yes, there are penalties for late filing of Form 06-143.

Q: Is Form 06-143 required for both deliveries and imports of motor fuel?

A: Yes, Form 06-143 is required for both motor fuel deliveries and imports in Texas.

Q: Is Form 06-143 only for Texas residents?

A: No, Form 06-143 is for motor fuel transporters and importers operating in Texas, regardless of residency.

Q: Is Form 06-143 required for all types of motor fuel?

A: Yes, Form 06-143 is required for all types of motor fuel, including gasoline, diesel, and aviation fuel.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 06-143 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.