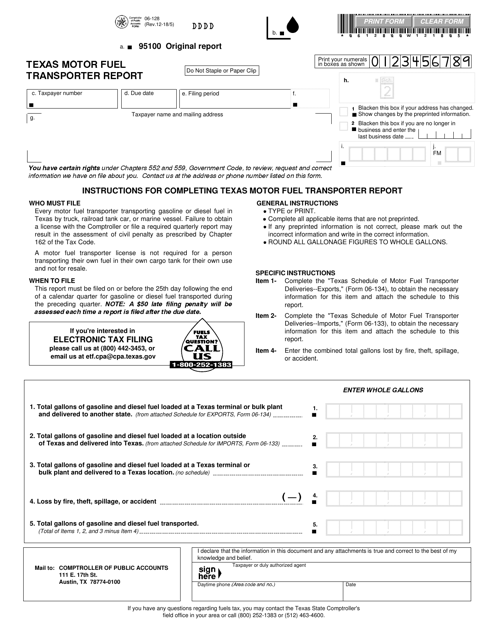

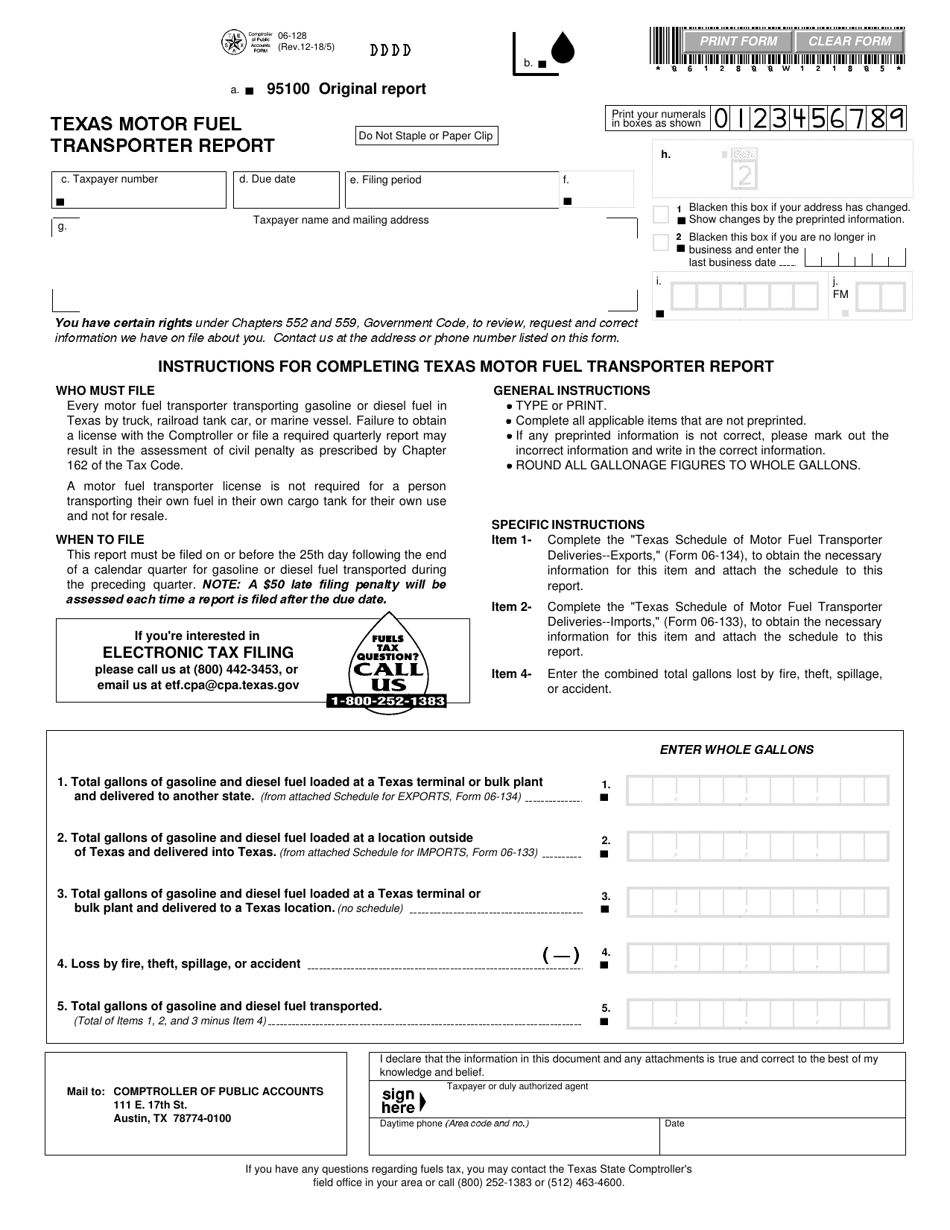

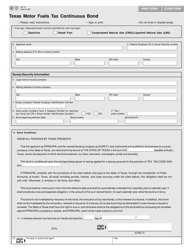

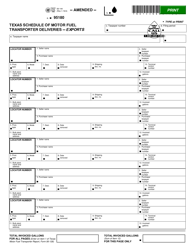

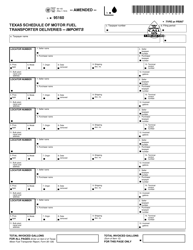

Form 06-128 Texas Motor Fuel Transporter Report - Texas

What Is Form 06-128?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 06-128?

A: Form 06-128 is the Texas Motor Fuel Transporter Report.

Q: What is the purpose of Form 06-128?

A: The purpose of Form 06-128 is to report the movement of motor fuel in Texas.

Q: Who needs to file Form 06-128?

A: Motor fuel transporters in Texas need to file Form 06-128.

Q: When is Form 06-128 due?

A: Form 06-128 is due on the 25th day of each month following the reporting month.

Q: Are there any penalties for late or incorrect filing of Form 06-128?

A: Yes, there are penalties for late or incorrect filing of Form 06-128. Penalties can range from $50 to $5,000 per violation.

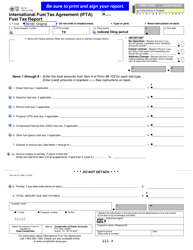

Q: What information is required on Form 06-128?

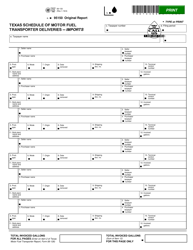

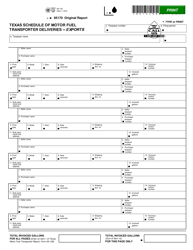

A: Form 06-128 requires information such as gallons of motor fuel received, delivered, and in storage, as well as the names and addresses of suppliers and purchasers.

Q: Can Form 06-128 be filed electronically?

A: Yes, Form 06-128 can be filed electronically through the Texas Comptroller's eSystems.

Q: Is Form 06-128 only applicable in Texas?

A: Yes, Form 06-128 is specific to motor fuel transporters in Texas.

Q: Are there any exemptions for filing Form 06-128?

A: Yes, certain motor fuel transporters may be exempt from filing Form 06-128. Contact the Texas Comptroller's office for more information.

Form Details:

- Released on December 5, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 06-128 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.