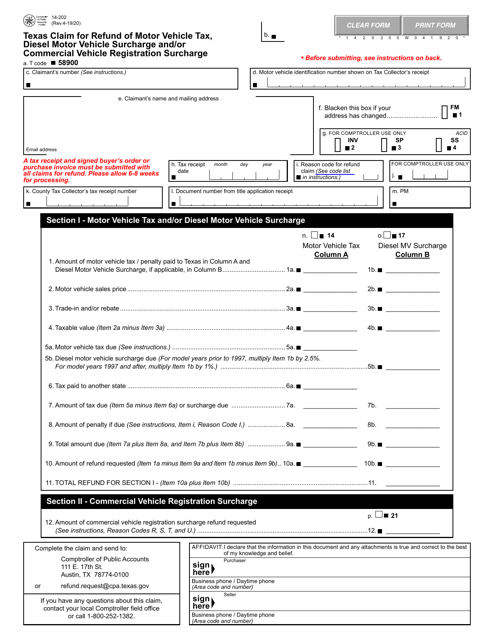

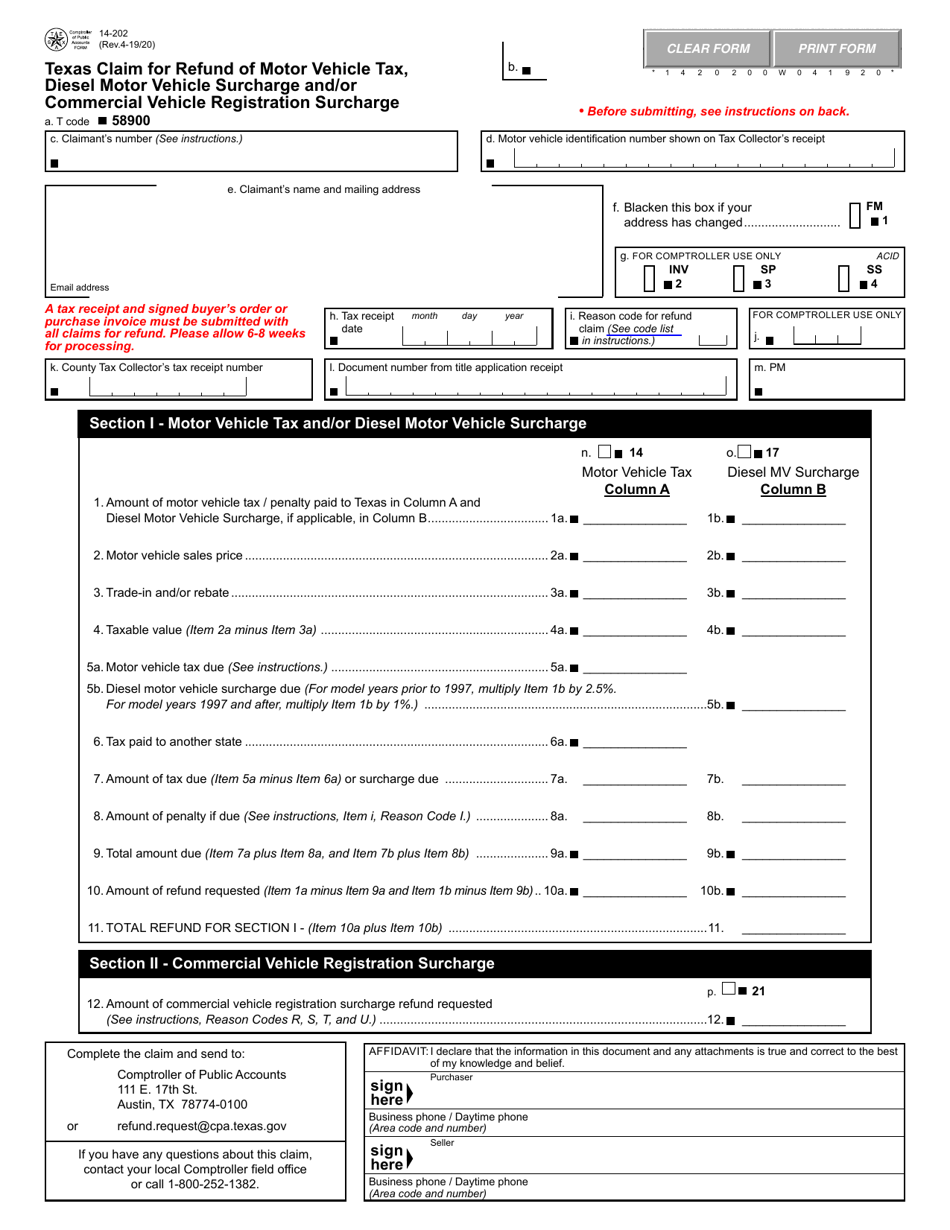

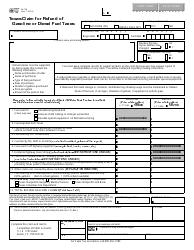

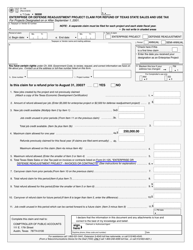

Form 14-202 Texas Claim for Refund of Motor Vehicle Tax, Diesel Motor Vehicle Surcharge and / or Commercial Vehicle Registration Surcharge - Texas

What Is Form 14-202?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 14-202?

A: Form 14-202 is a claim form used in Texas to request a refund of motor vehicle tax, diesel motor vehicle surcharge, and/or commercial vehicle registration surcharge.

Q: What can I claim a refund for using Form 14-202?

A: You can claim a refund for motor vehicle tax, diesel motor vehicle surcharge, and/or commercial vehicle registration surcharge.

Q: What is the purpose of the refund?

A: The purpose of the refund is to reimburse individuals or businesses for overpayment of motor vehicle tax, diesel motor vehicle surcharge, or commercial vehicle registration surcharge.

Q: When should I use Form 14-202?

A: You should use Form 14-202 when you believe you have overpaid motor vehicle tax, diesel motor vehicle surcharge, or commercial vehicle registration surcharge in Texas.

Q: Can I claim a refund for other taxes or fees using this form?

A: No, Form 14-202 is specifically for claiming a refund of motor vehicle tax, diesel motor vehicle surcharge, and/or commercial vehicle registration surcharge.

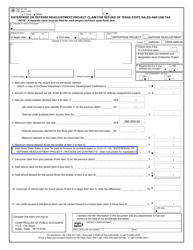

Q: How do I fill out Form 14-202?

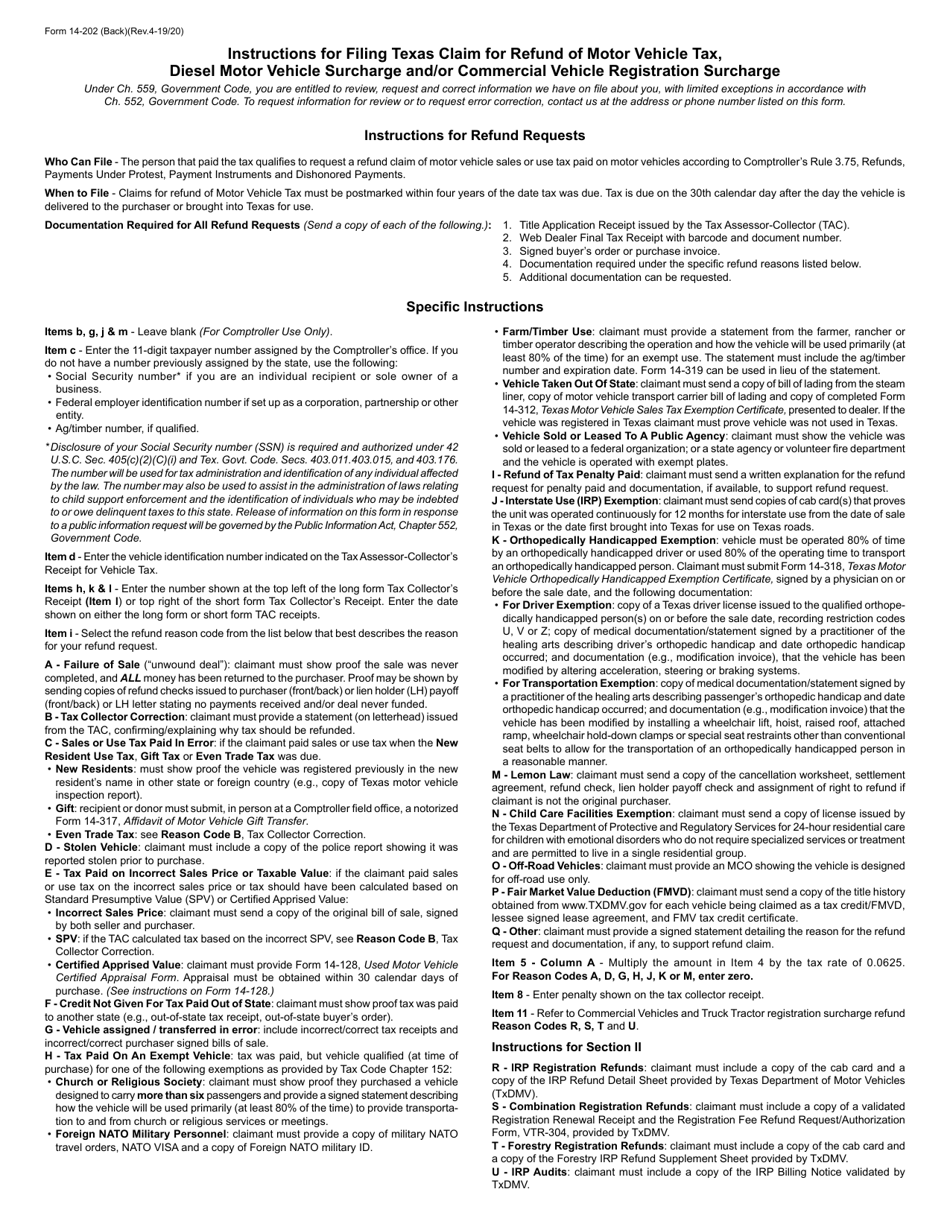

A: You need to provide your personal or business information, the type of tax or surcharge you are claiming a refund for, the reason for the refund, and any supporting documentation.

Q: How long does it take to receive a refund using Form 14-202?

A: The processing time for a refund claim submitted using Form 14-202 can vary. It is recommended to check with the Texas Comptroller of Public Accounts for the most up-to-date information.

Q: What should I do if I have additional questions about Form 14-202?

A: If you have additional questions about Form 14-202, you can contact the Texas Comptroller of Public Accounts for assistance.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 14-202 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.