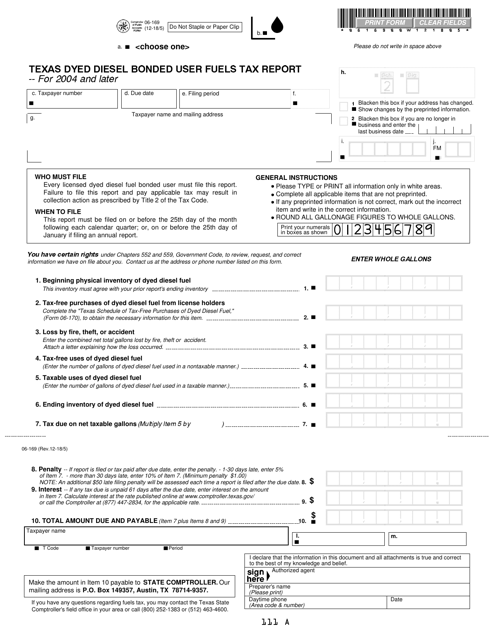

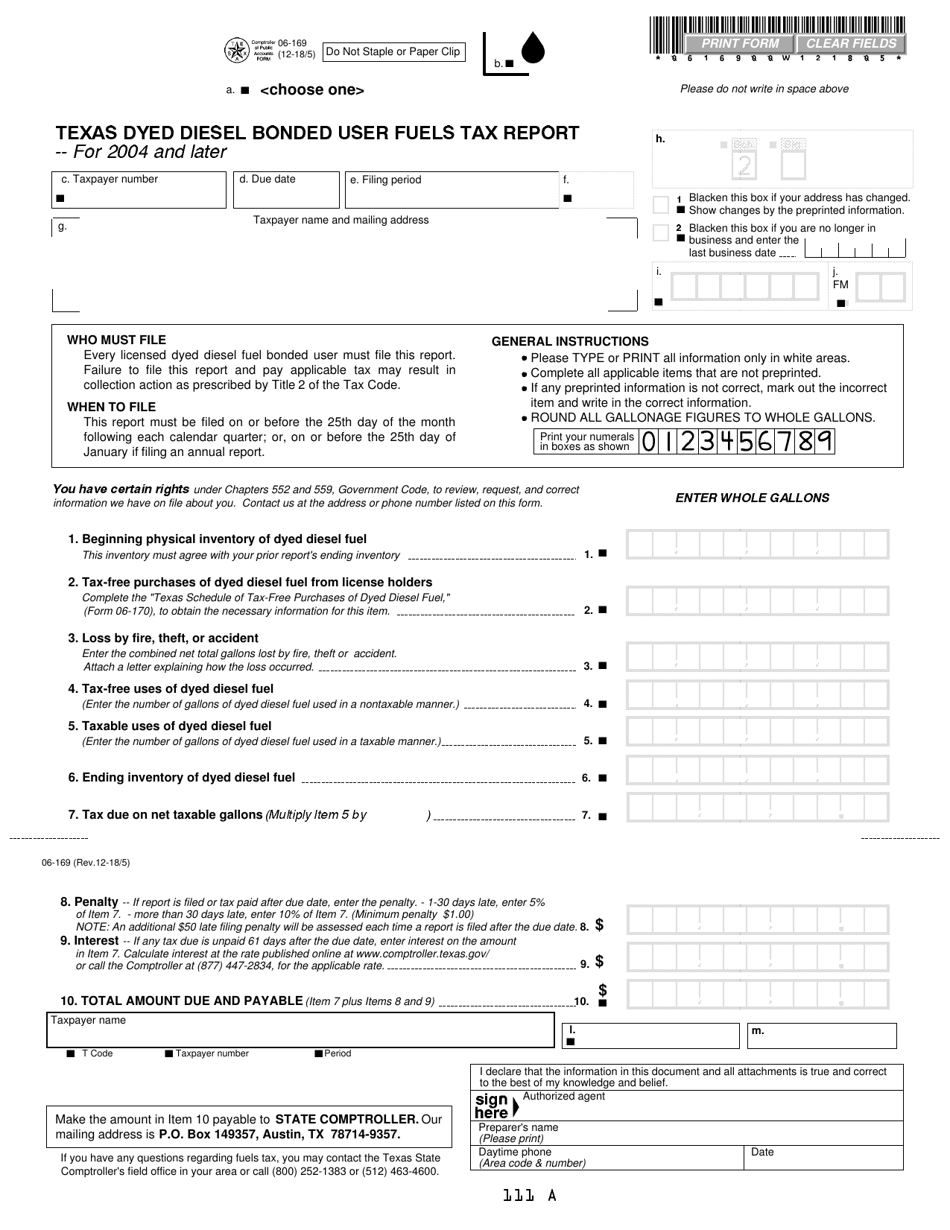

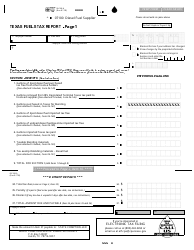

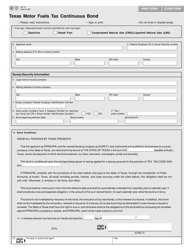

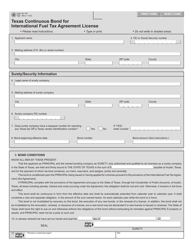

Form 06-169 Texas Dyed Diesel Bonded User Fuels Tax Report for 2004 and Later - Texas

What Is Form 06-169?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 06-169?

A: Form 06-169 is the Texas Dyed Diesel Bonded User Fuels Tax Report.

Q: What is the purpose of Form 06-169?

A: The purpose of Form 06-169 is to report the tax on bonded user fuels, specifically dyed diesel, in the state of Texas.

Q: Who is required to file Form 06-169?

A: Any person or business that uses dyed diesel fuel in Texas and is bonded is required to file Form 06-169.

Q: When should Form 06-169 be filed?

A: Form 06-169 should be filed on a monthly basis, no later than the 20th day of the following month.

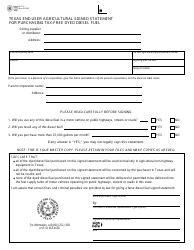

Q: What are bonded user fuels?

A: Bonded user fuels refer to dyed diesel fuel that is subject to a specific tax and must be reported on Form 06-169. These fuels are typically used in off-road equipment and vehicles.

Q: Are there any penalties for not filing Form 06-169?

A: Yes, failure to timely file Form 06-169 or pay the tax due may result in penalties and interest.

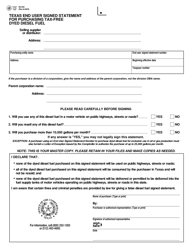

Q: Are there any exceptions or exemptions for filing Form 06-169?

A: There may be exceptions or exemptions for certain situations, such as government entities or agricultural producers. It is recommended to consult the official instructions or contact the Texas Comptroller of Public Accounts for more information.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 06-169 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.