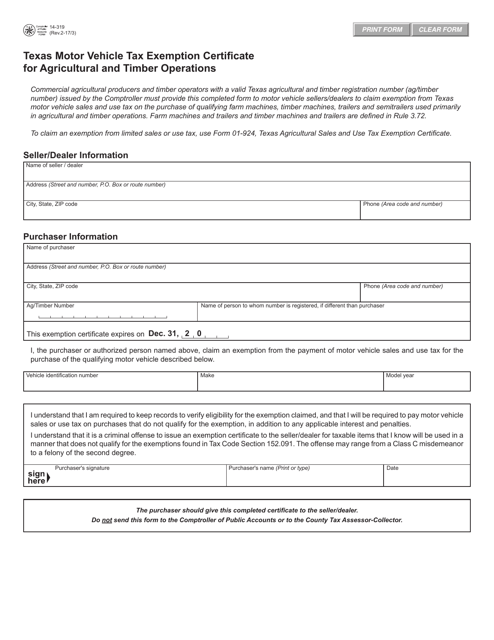

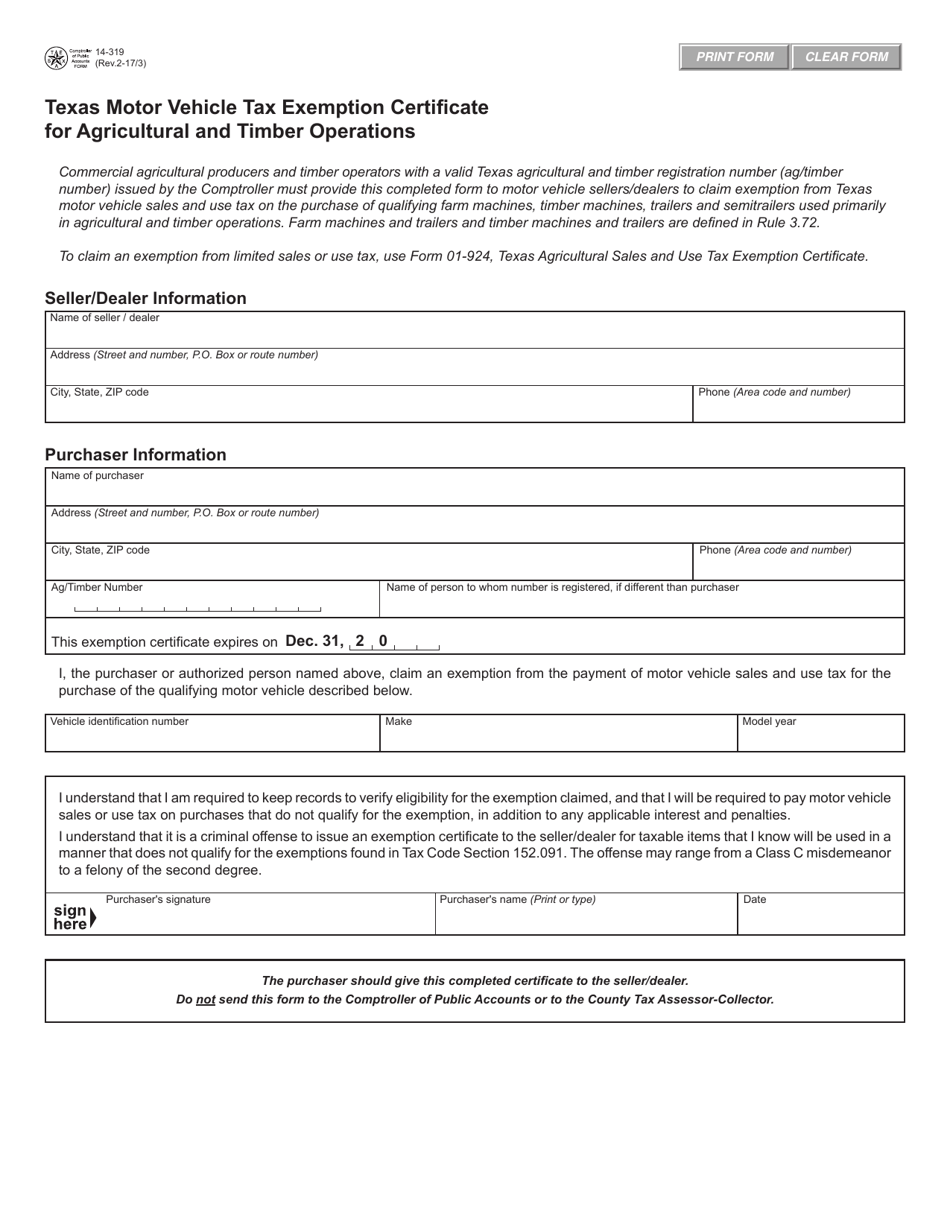

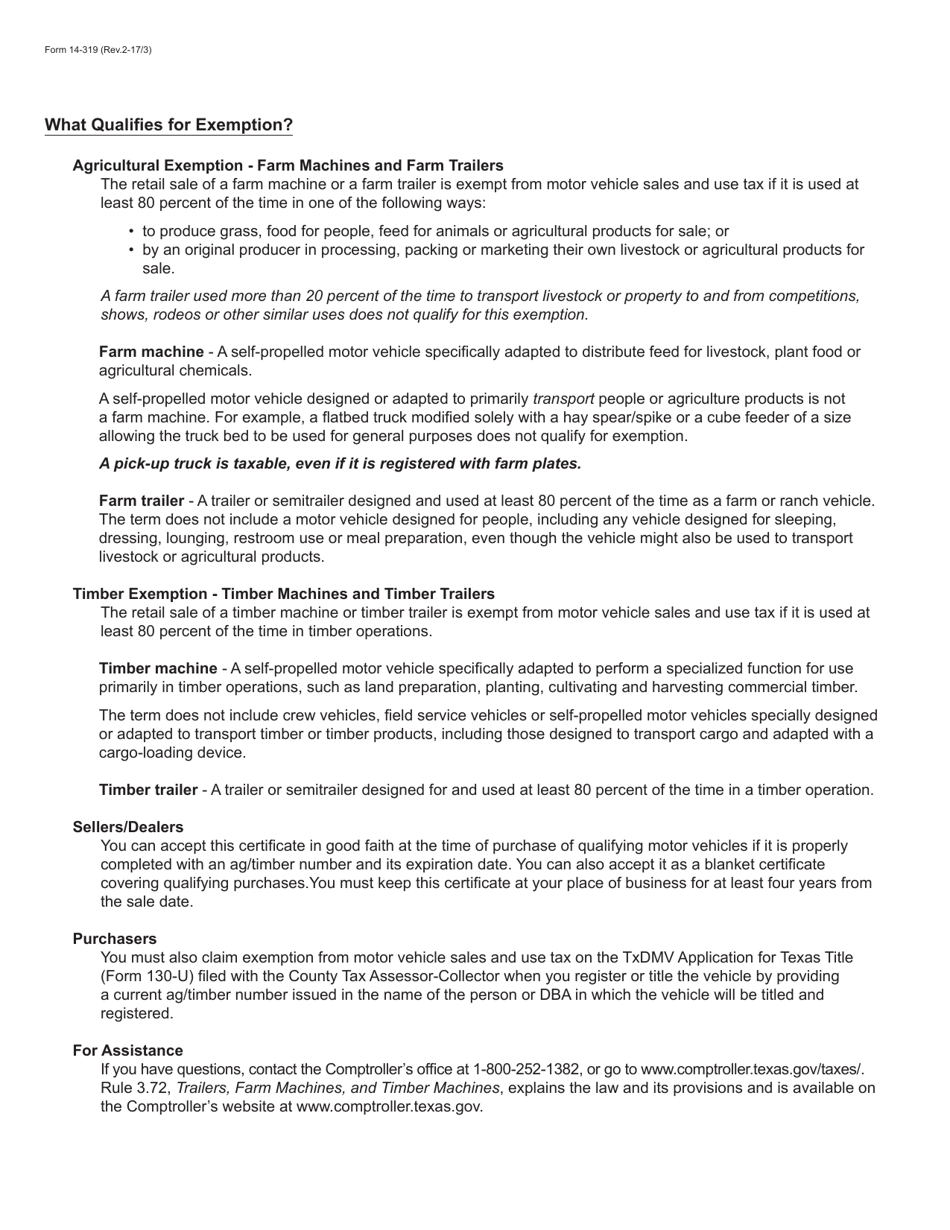

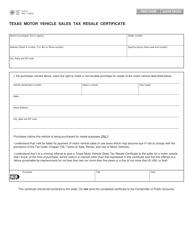

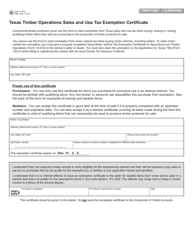

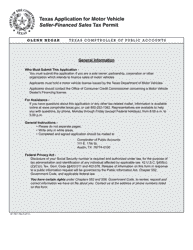

Form 14-319 Motor Vehicle Tax Exemption Certificate for Agricultural and Timber Operations - Texas

What Is Form 14-319?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

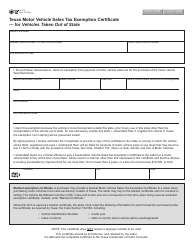

Q: What is Form 14-319?

A: Form 14-319 is the Motor Vehicle Tax Exemption Certificate for Agricultural and Timber Operations in Texas.

Q: Who is eligible to use Form 14-319?

A: Individuals or businesses engaged in agricultural or timber operations in Texas are eligible to use Form 14-319.

Q: What is the purpose of Form 14-319?

A: The purpose of Form 14-319 is to claim a tax exemption for motor vehicles used in agricultural or timber operations.

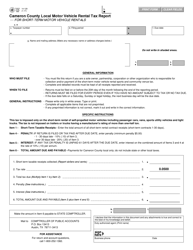

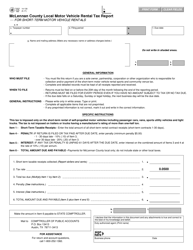

Q: What documents are required to be submitted with Form 14-319?

A: You may need to submit supporting documents such as vehicle registration, proof of agricultural or timber operation, and other relevant records.

Q: Is there a deadline for submitting Form 14-319?

A: Yes, Form 14-319 must be submitted to the local county tax assessor-collector's office within 30 days of the vehicle purchase or lease.

Q: What happens after submitting Form 14-319?

A: If approved, you will receive a tax exemption certificate, which can be used to avoid or reduce motor vehicle taxes on eligible vehicles.

Q: Can I use Form 14-319 for all types of motor vehicles?

A: Form 14-319 can be used for passenger cars, light trucks, and other motor vehicles used exclusively for agricultural or timber operations.

Q: Can I use Form 14-319 for personal use vehicles?

A: No, Form 14-319 is specifically for vehicles used in agricultural or timber operations and cannot be used for personal use vehicles.

Form Details:

- Released on February 3, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 14-319 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.