This version of the form is not currently in use and is provided for reference only. Download this version of

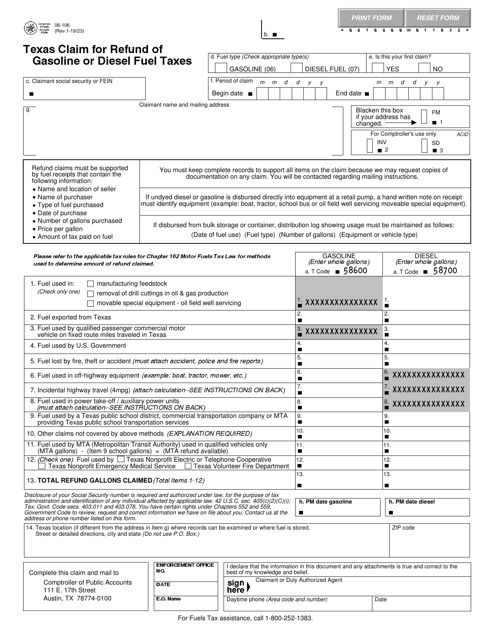

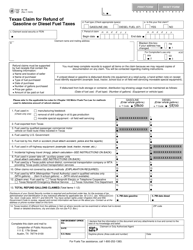

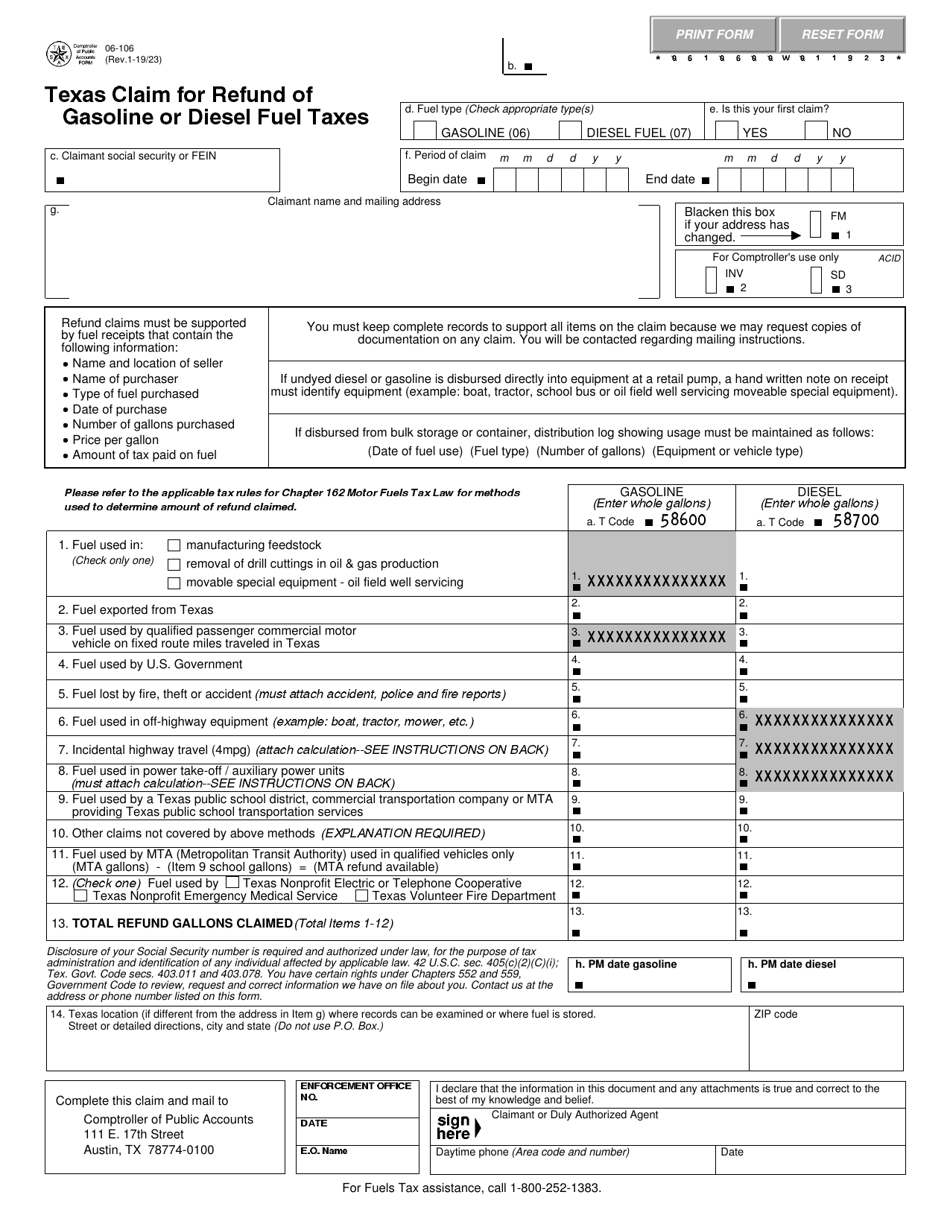

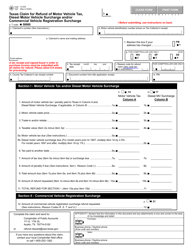

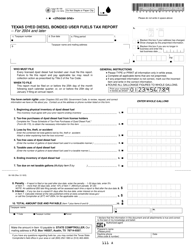

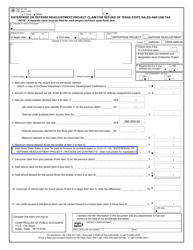

Form 06-106

for the current year.

Form 06-106 Texas Claim for Refund of Gasoline or Diesel Fuel Taxes - Texas

What Is Form 06-106?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 06-106?

A: Form 06-106 is the Texas Claim for Refund of Gasoline or Diesel Fuel Taxes.

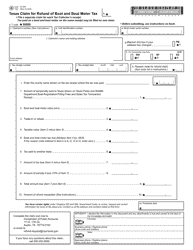

Q: Who is eligible to use Form 06-106?

A: Any person or entity who has paid gasoline or diesel fuel taxes in Texas and believes they are entitled to a refund may use Form 06-106.

Q: What information is required on Form 06-106?

A: Form 06-106 requires information such as the date of purchase, amount paid, and the reason for the claim.

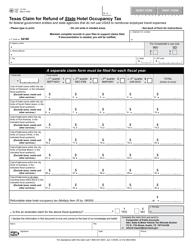

Form Details:

- Released on January 23, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 06-106 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.