This version of the form is not currently in use and is provided for reference only. Download this version of

Form 01-925

for the current year.

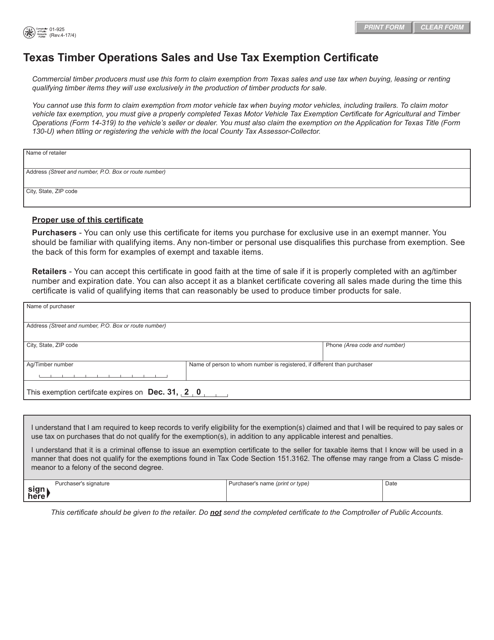

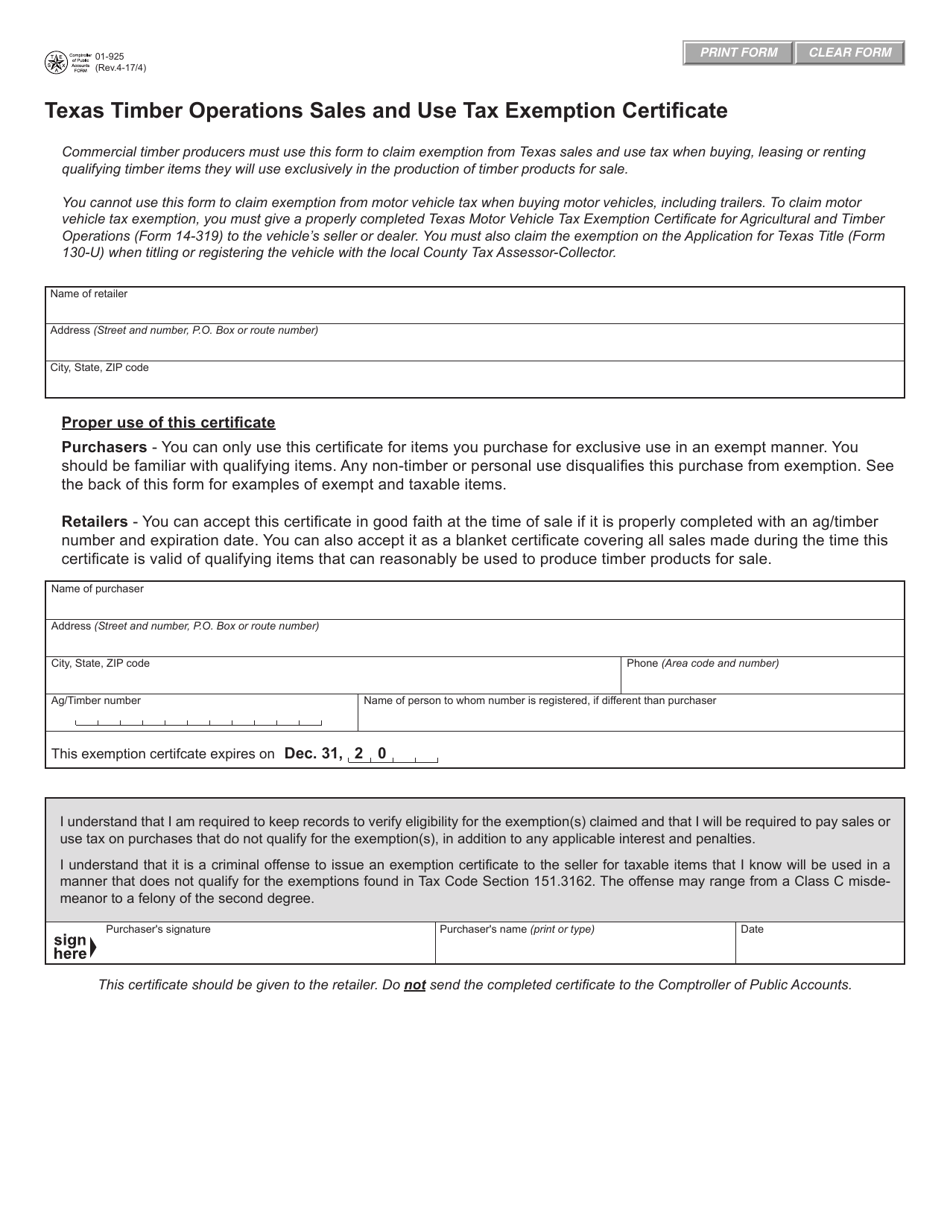

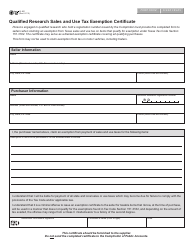

Form 01-925 Texas Timber Operations Sales and Use Tax Exemption Certificate - Texas

What Is Form 01-925?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 01-925?

A: Form 01-925 is the Texas Timber Operations Sales and Use Tax Exemption Certificate.

Q: What is the purpose of form 01-925?

A: The purpose of form 01-925 is to claim an exemption from sales and use tax for timber operations in Texas.

Q: Who is eligible to use form 01-925?

A: Timber operators in Texas who meet the requirements for exemption from sales and use tax can use form 01-925.

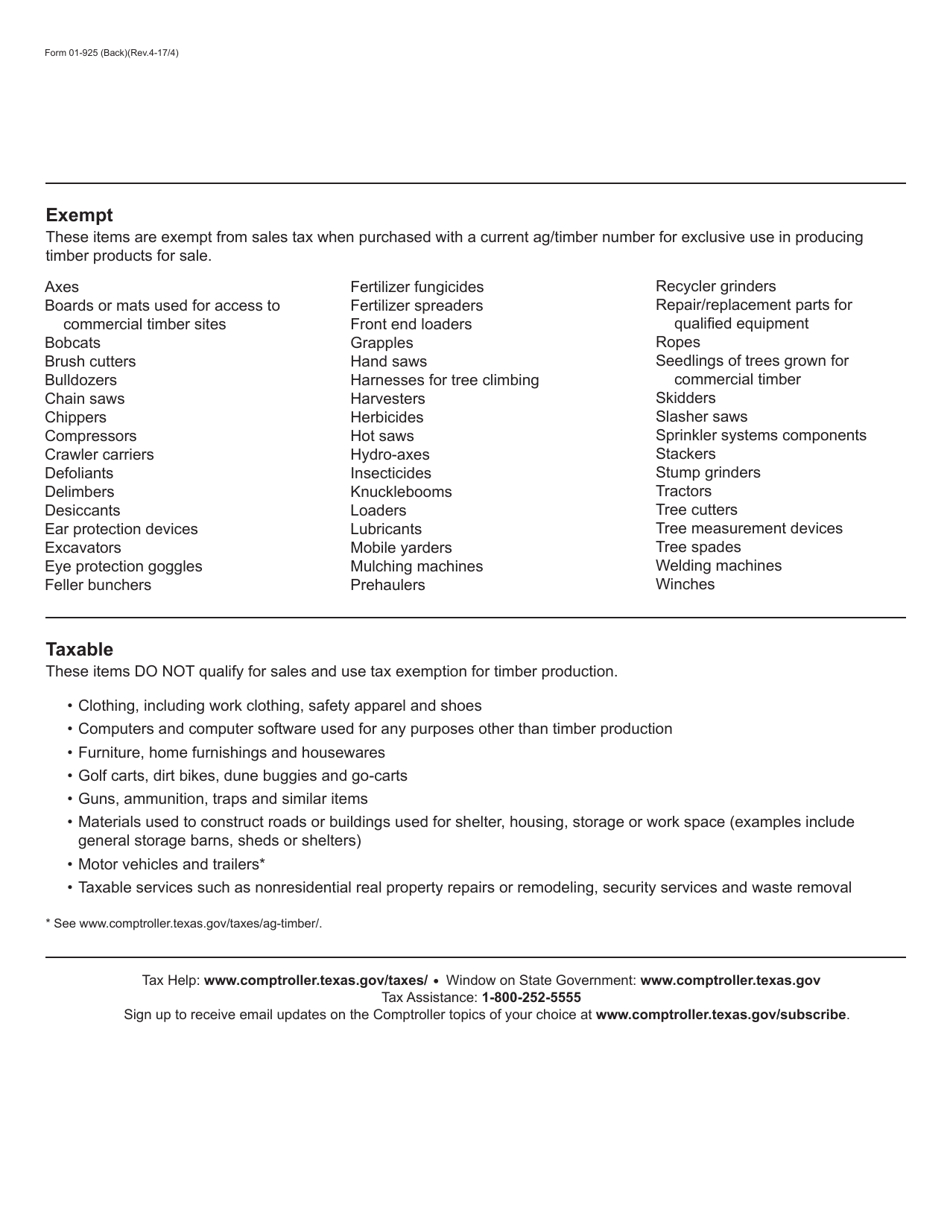

Q: What are the requirements for exemption?

A: The timber operator must be engaged in qualifying timber operations and meet certain ownership and production criteria to claim the exemption.

Q: How do I fill out form 01-925?

A: You must provide your business information, including your name, address, and taxpayer identification number, along with details of the timber operations and supporting documentation.

Q: Is there a deadline for submitting form 01-925?

A: Form 01-925 should be filed before or at the time of the qualifying timber sale or purchase.

Q: Are there any penalties for noncompliance?

A: Failure to file form 01-925 or providing false information may result in penalties, interest, or additional taxes.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 01-925 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.