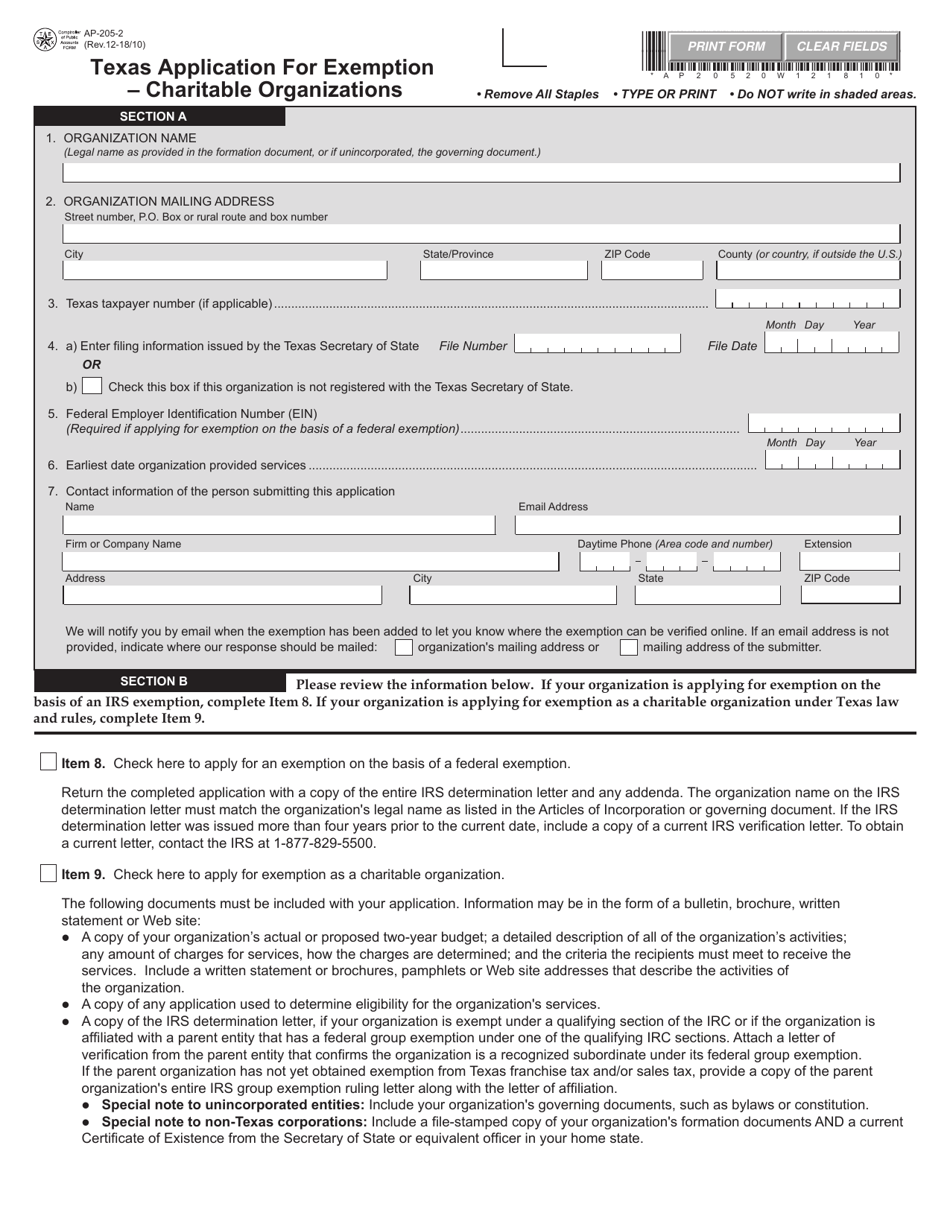

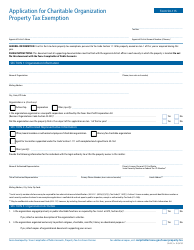

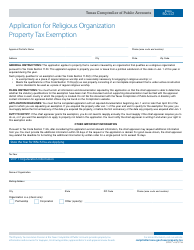

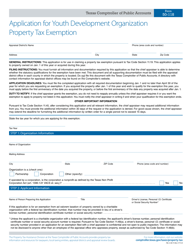

Form AP-205 Texas Application for Exemption " Charitable Organizations - Texas

What Is Form AP-205?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

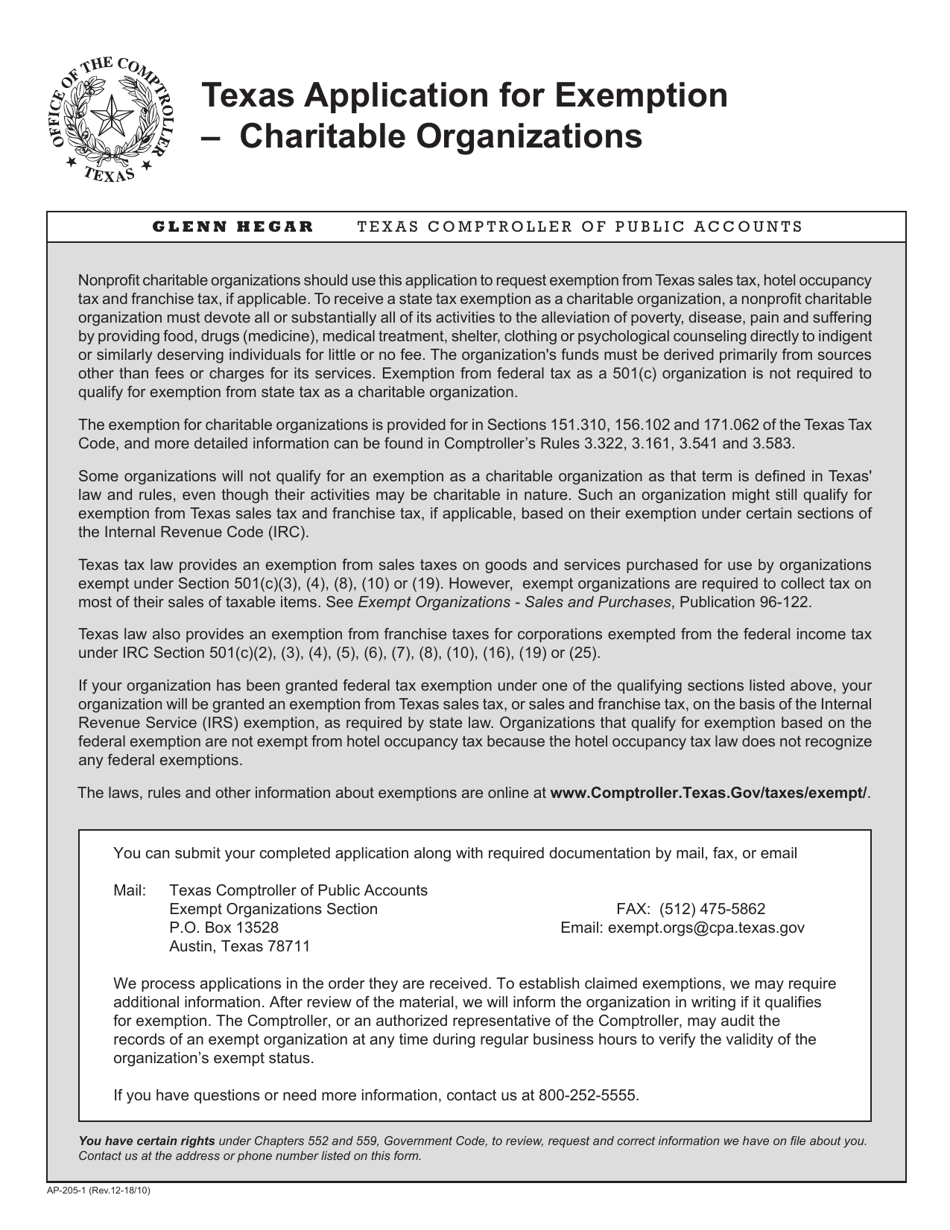

Q: What is Form AP-205?

A: Form AP-205 is the Texas Application for Exemption for Charitable Organizations.

Q: Who needs to file Form AP-205?

A: Charitable organizations in Texas need to file Form AP-205.

Q: What is the purpose of Form AP-205?

A: The purpose of Form AP-205 is to apply for exemption from certain taxes for charitable organizations in Texas.

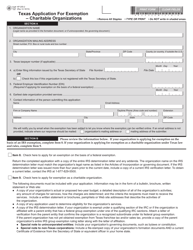

Q: What kind of exemptions can be applied for using Form AP-205?

A: Form AP-205 can be used to apply for exemptions from sales tax, franchise tax, and hotel occupancy tax.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-205 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.