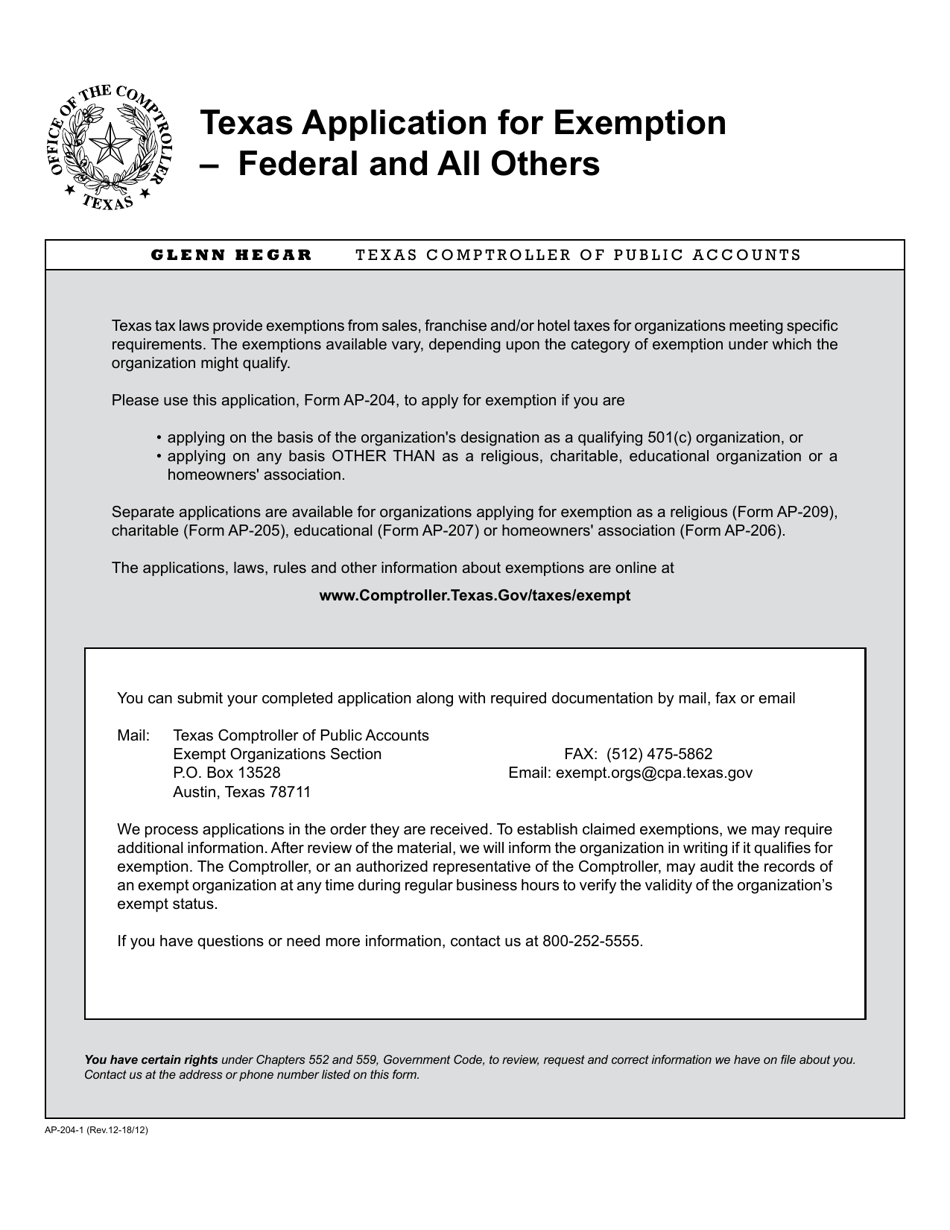

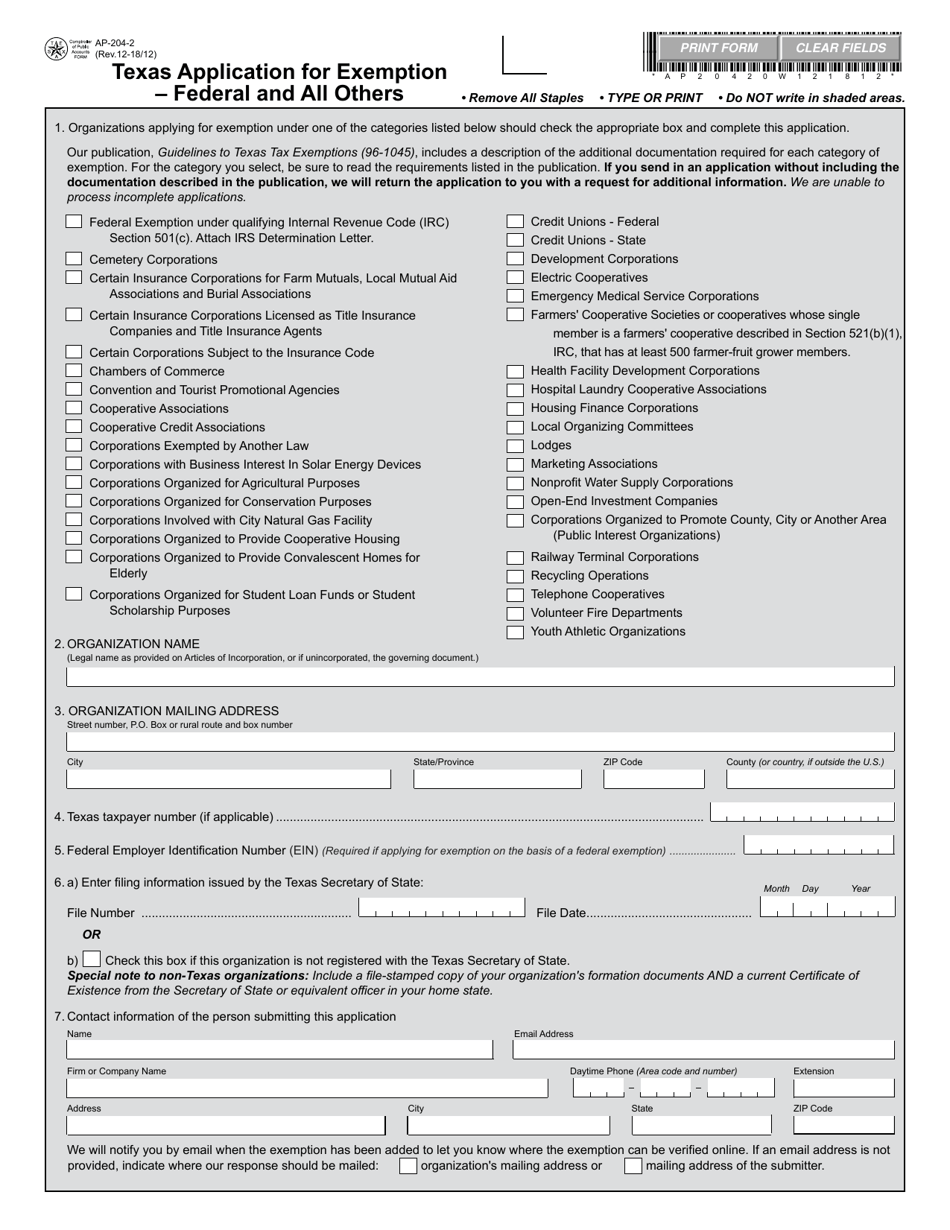

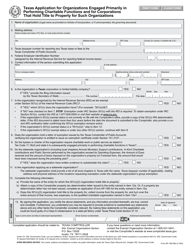

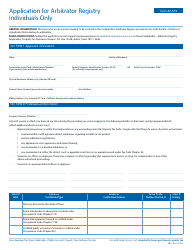

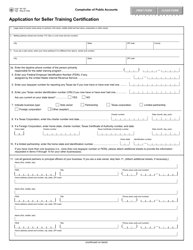

Form AP-204 Texas Application for Exemption " Federal and All Others - Texas

What Is Form AP-204?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

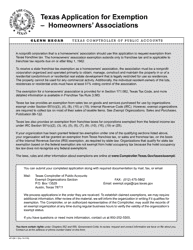

Q: What is Form AP-204?

A: Form AP-204 is the Texas Application for Exemption for Federal and All Others.

Q: What is the purpose of Form AP-204?

A: The purpose of Form AP-204 is to apply for a tax exemption in Texas for federal and all other entities.

Q: Who should use Form AP-204?

A: Form AP-204 should be used by entities that want to apply for a tax exemption in Texas.

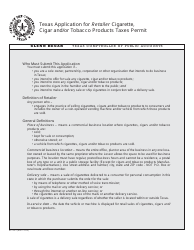

Q: What type of exemptions does Form AP-204 cover?

A: Form AP-204 covers exemptions for federal and all other entities in Texas.

Q: Are there any fees associated with filing Form AP-204?

A: No, there are no fees associated with filing Form AP-204.

Q: What supporting documents are required to be submitted with Form AP-204?

A: The specific supporting documents required may vary depending on the type of exemption being sought. It is recommended to refer to the instructions provided with Form AP-204 for a detailed list of required documents.

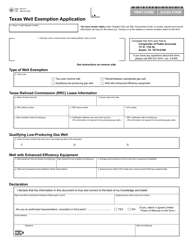

Q: How long does it take to process Form AP-204?

A: The processing time for Form AP-204 may vary. It is recommended to check with the Texas Comptroller of Public Accounts for the current processing times.

Q: What should I do if there are changes to my exemption status after filing Form AP-204?

A: If there are changes to your exemption status after filing Form AP-204, you should notify the Texas Comptroller of Public Accounts as soon as possible.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-204 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.