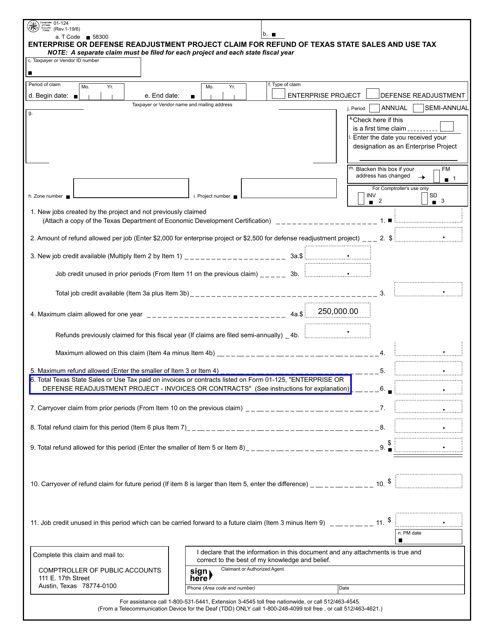

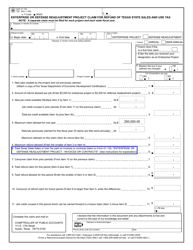

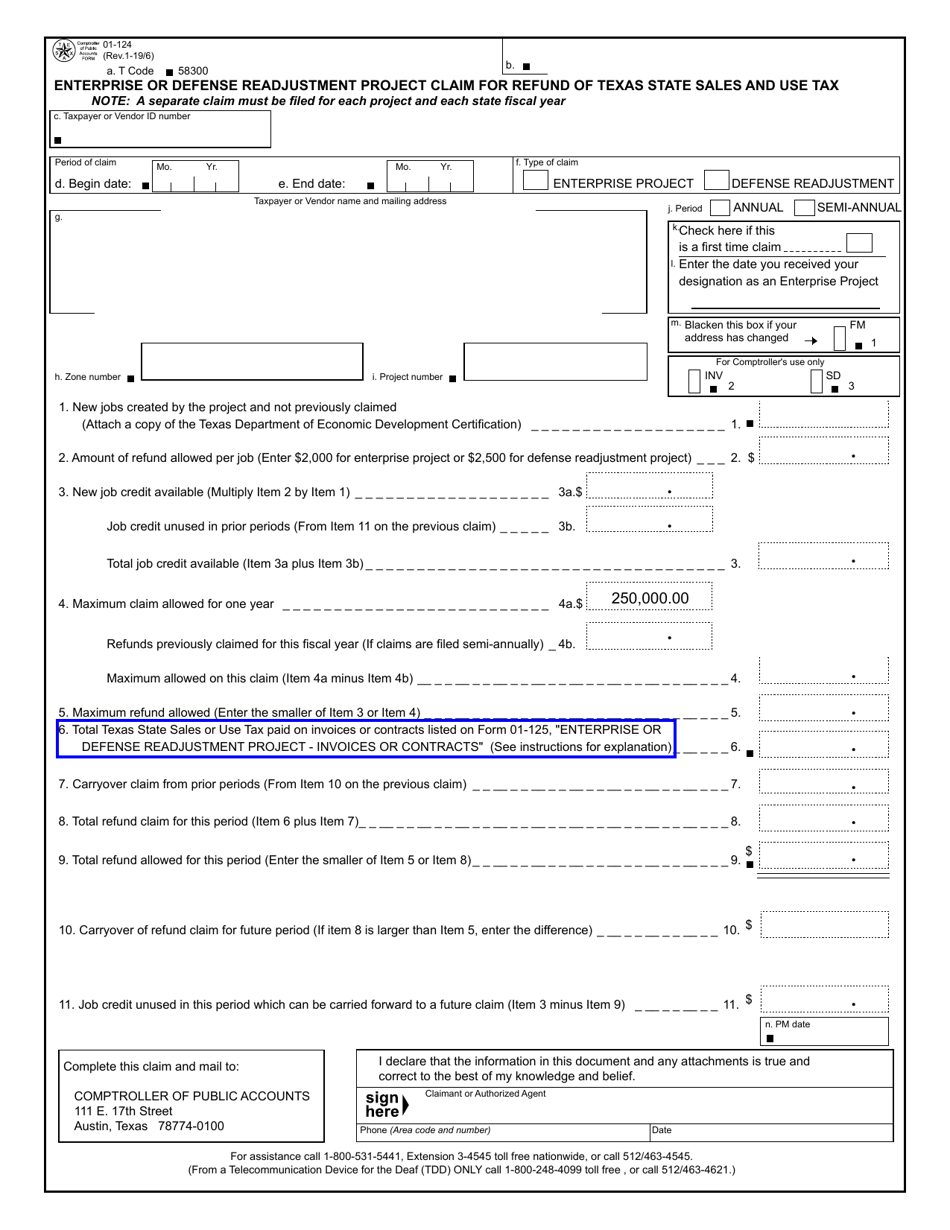

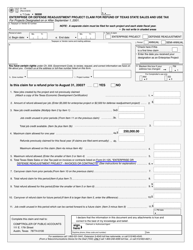

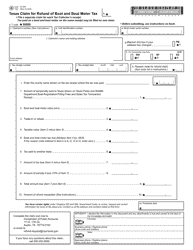

Form 01-124 Enterprise or Defense Readjustment Project Claim for Refund of Texas State Sales and Use Tax - Texas

What Is Form 01-124?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 01-124?

A: Form 01-124 is a document used for filing a claim for refund of Texas State Sales and Use Tax for Enterprise or Defense Readjustment Projects.

Q: Who can use form 01-124?

A: This form is used by individuals or businesses involved in Enterprise or Defense Readjustment Projects in Texas.

Q: What is the purpose of form 01-124?

A: The purpose of form 01-124 is to claim a refund of Texas State Sales and Use Tax paid for eligible expenses related to Enterprise or Defense Readjustment Projects.

Q: How do I fill out form 01-124?

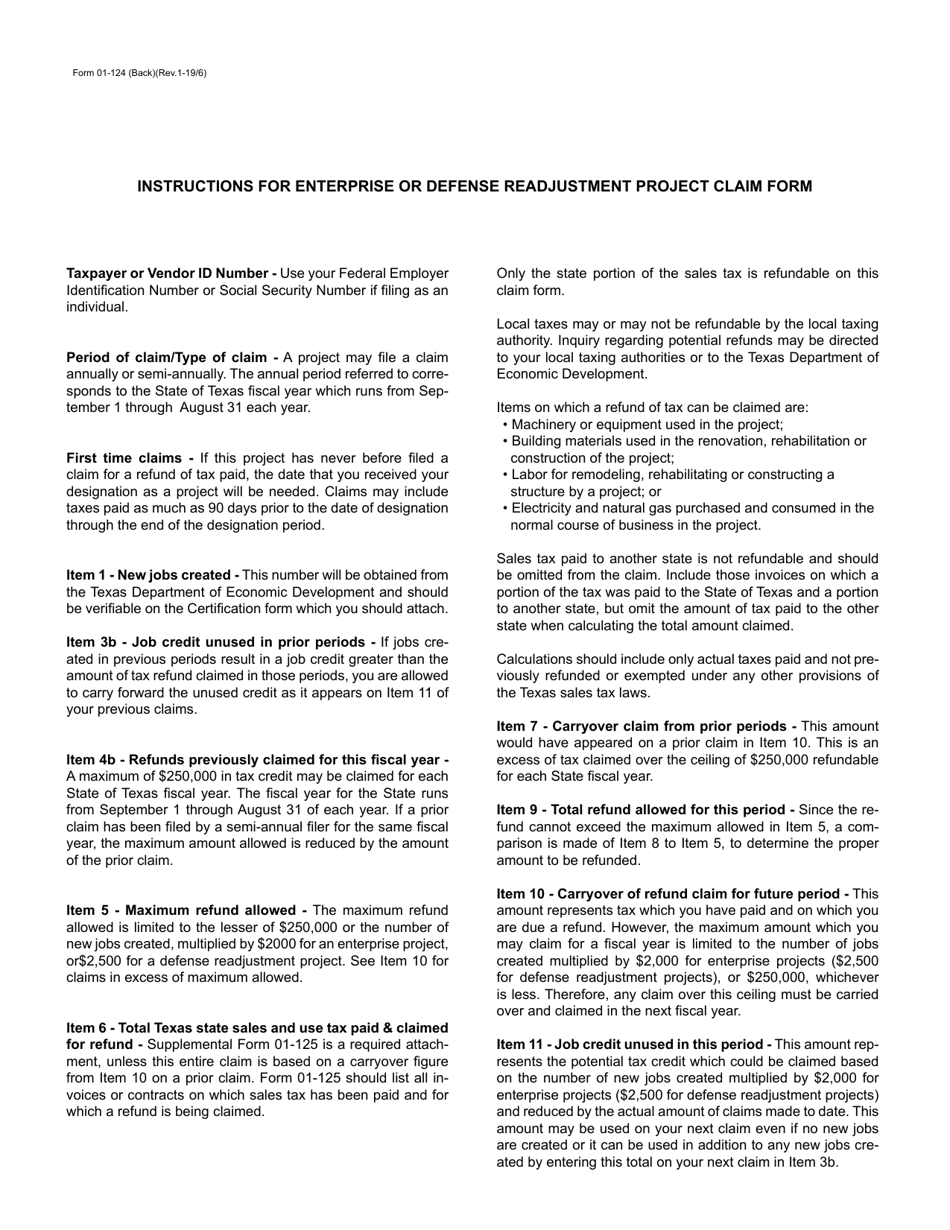

A: To fill out form 01-124, you need to provide information about the claimant, project details, and the amount of tax being claimed for refund. The form also requires supporting documentation.

Q: Is there a deadline for filing form 01-124?

A: Yes, there is a deadline for filing form 01-124. It must be filed within four years from the date the tax was due or paid, whichever is later.

Q: What should I do after filling out form 01-124?

A: After completing form 01-124, you need to submit it along with the required supporting documentation to the Texas Comptroller of Public Accounts.

Q: How long does it take to receive a refund after filing form 01-124?

A: The processing time for refund claims filed using form 01-124 varies, but it typically takes several weeks to months to receive a refund.

Q: Are there any fees associated with filing form 01-124?

A: No, there are no fees associated with filing form 01-124.

Form Details:

- Released on January 6, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 01-124 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.