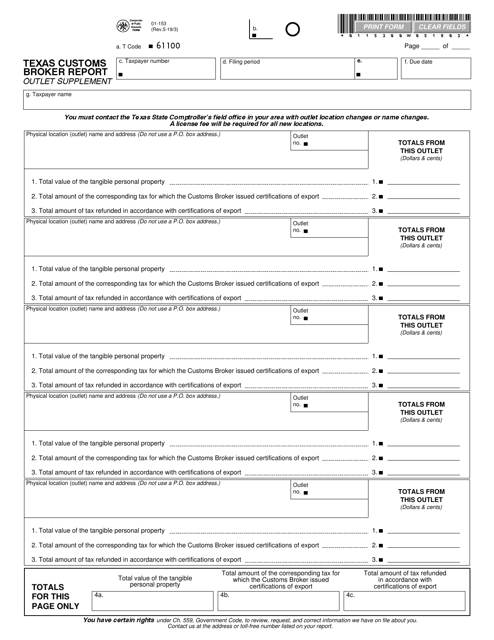

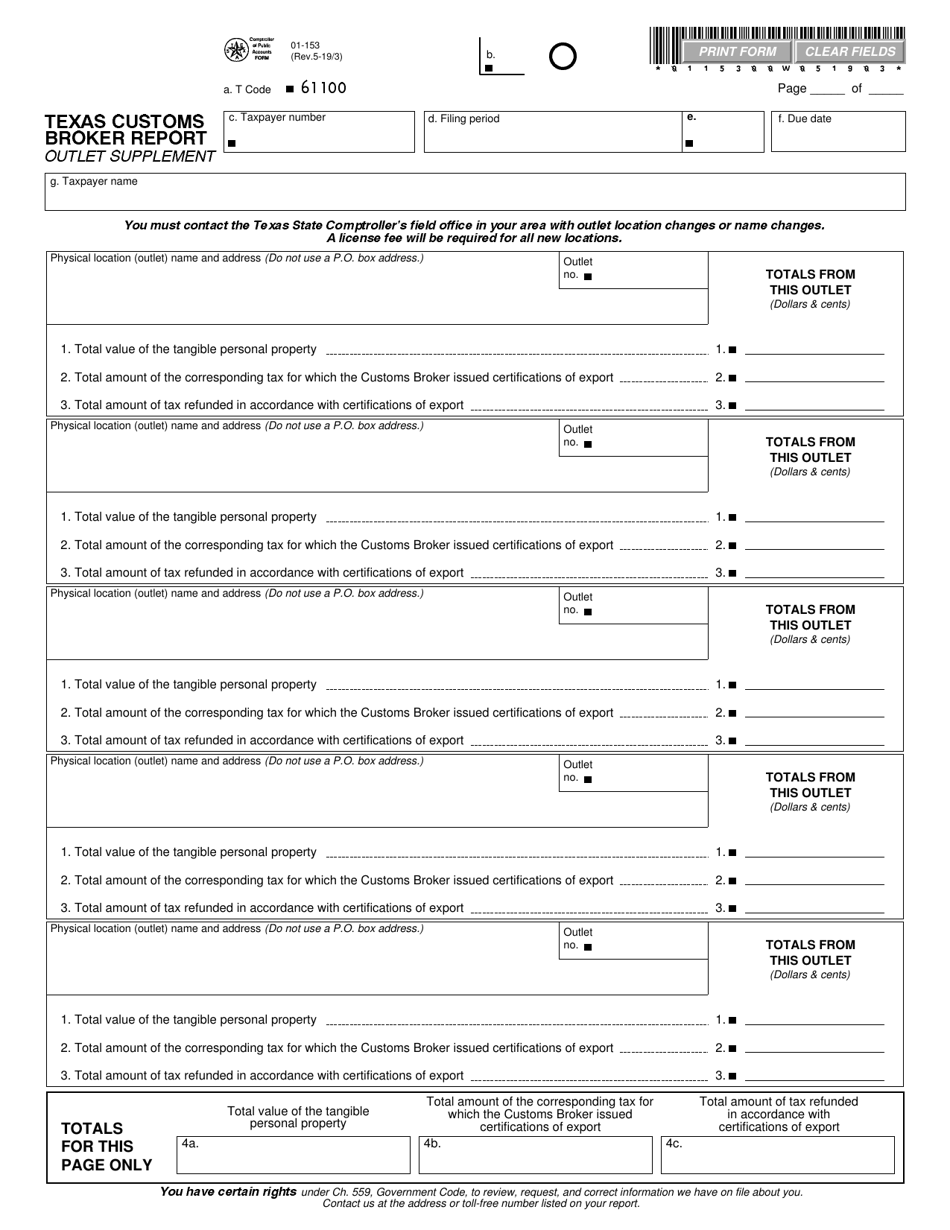

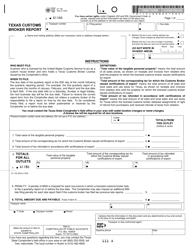

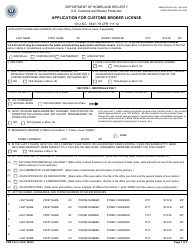

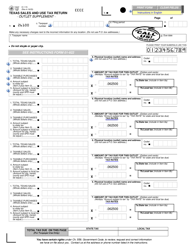

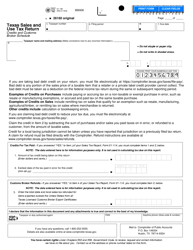

Form 01-153 Texas Customs Broker Report - Outlet Supplement - Texas

What Is Form 01-153?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 01-153?

A: Form 01-153 is the Texas Customs Broker Report - Outlet Supplement - Texas.

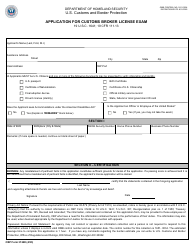

Q: Who needs to fill out Form 01-153?

A: Customs brokers in Texas need to fill out Form 01-153.

Q: What is the purpose of Form 01-153?

A: The purpose of Form 01-153 is to provide information about a customs broker's outlets in Texas.

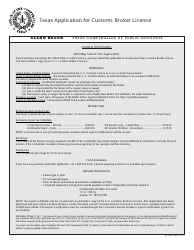

Q: Is Form 01-153 mandatory?

A: Yes, Form 01-153 is mandatory for customs brokers in Texas.

Q: When is Form 01-153 due?

A: Form 01-153 is due on or before the 10th day of the month following the end of each calendar quarter.

Q: What information is required on Form 01-153?

A: Form 01-153 requires information about the customs broker's outlets, including their location, type of operation, and identification numbers.

Q: Are there any penalties for not filing Form 01-153?

A: Yes, failure to file Form 01-153 or filing it late may result in penalties and interest.

Q: Can Form 01-153 be filed electronically?

A: Yes, Form 01-153 can be filed electronically through the Texas Comptroller's eSystems.

Form Details:

- Released on May 3, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 01-153 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.