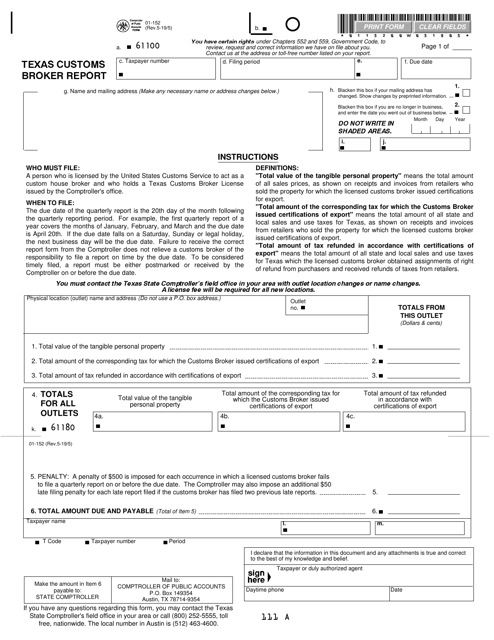

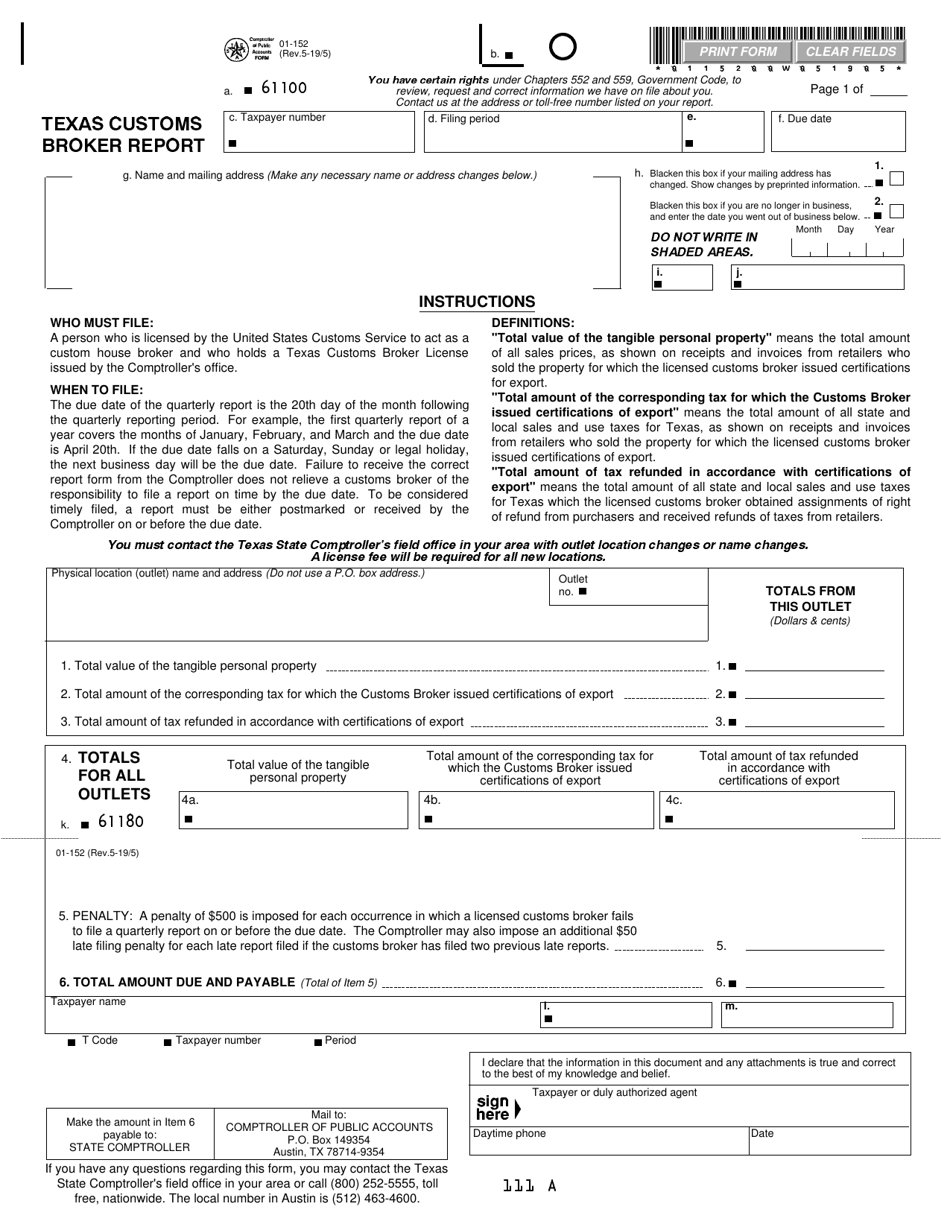

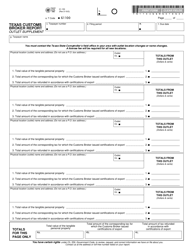

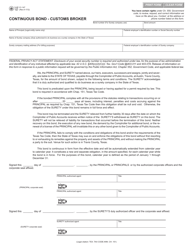

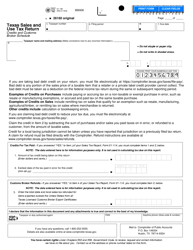

Form 01-152 Texas Customs Broker Report - Texas

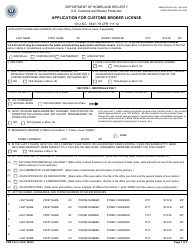

What Is Form 01-152?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 01-152?

A: Form 01-152 is the Texas Customs Broker Report.

Q: What is the purpose of Form 01-152?

A: The purpose of Form 01-152 is to report information about customs brokers operating in Texas.

Q: Who needs to file Form 01-152?

A: Customs brokers operating in Texas need to file Form 01-152.

Q: When is Form 01-152 due?

A: Form 01-152 is due on or before March 1st of each year.

Q: Are there any penalties for not filing Form 01-152?

A: Yes, there are penalties for not filing Form 01-152, including late filing penalties and penalties for understated or omitted information.

Q: What information is required on Form 01-152?

A: Form 01-152 requires information such as the broker's name, business address, contact information, and license number.

Q: Can I amend Form 01-152 if I need to make changes?

A: Yes, you can amend Form 01-152 if you need to make changes. File an amended report with the Texas Comptroller of Public Accounts.

Q: Is there a filing fee for Form 01-152?

A: No, there is no filing fee for Form 01-152.

Form Details:

- Released on May 5, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 01-152 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.