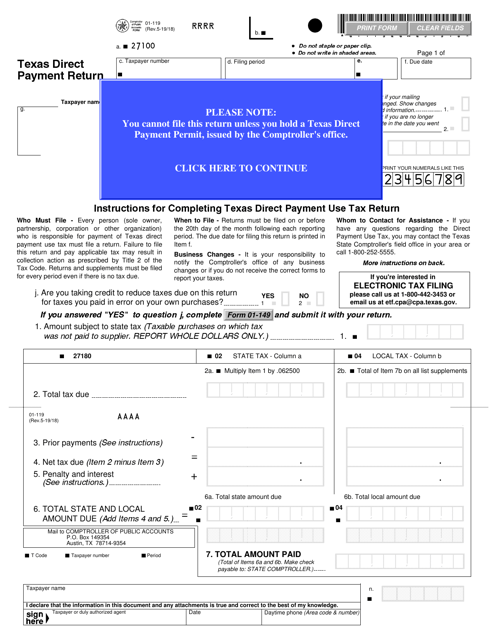

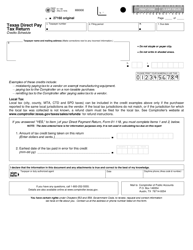

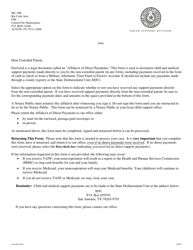

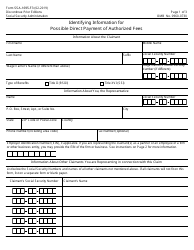

Form 01-119 Texas Direct Payment Return - Texas

What Is Form 01-119?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 01-119?

A: Form 01-119 is the Texas Direct Payment Return.

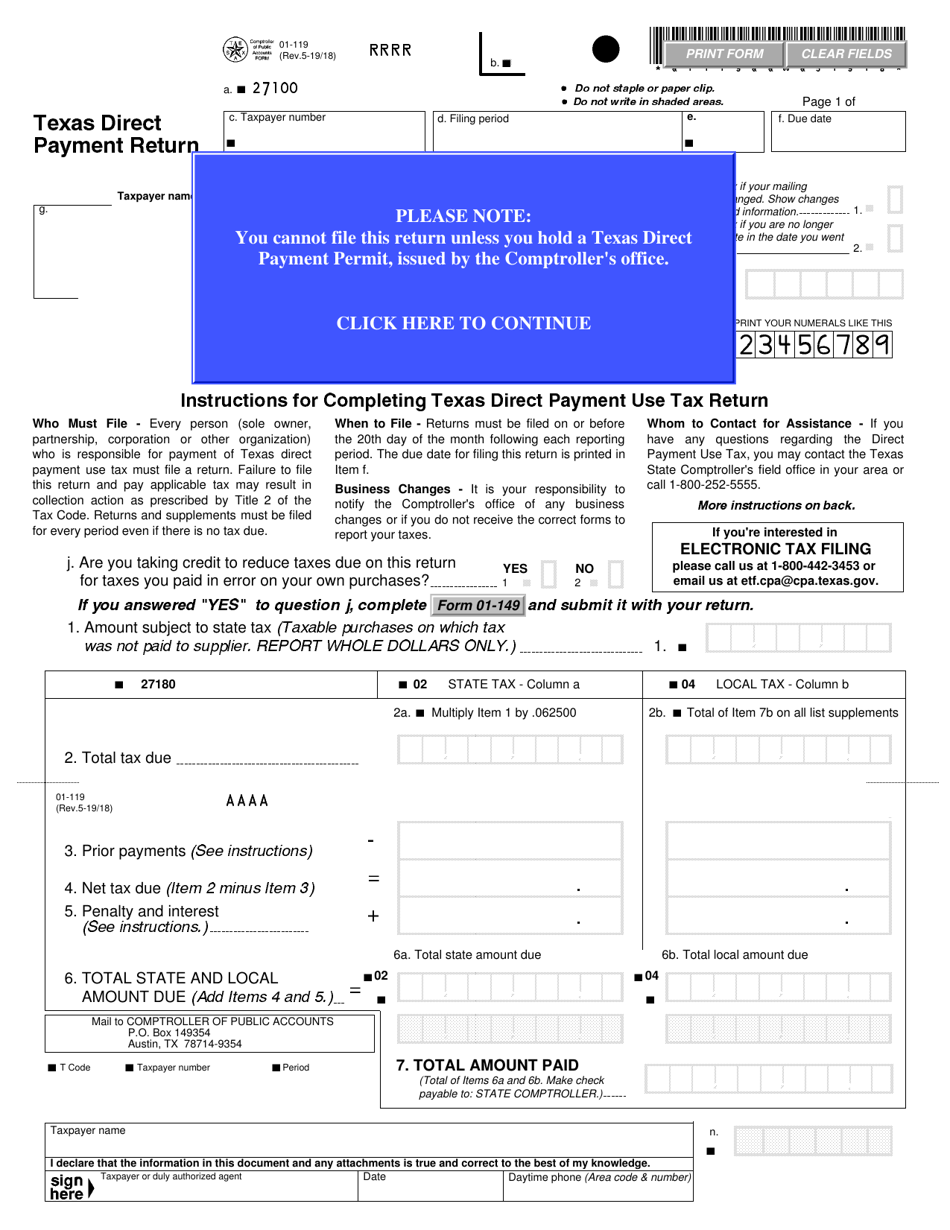

Q: What is the purpose of Form 01-119?

A: The purpose of Form 01-119 is to report and remit sales and use taxes directly to the state of Texas.

Q: Who needs to file Form 01-119?

A: Any person or business who is registered as a Texas sales and use taxdirect paymentpermit holder must file Form 01-119.

Q: How often is Form 01-119 filed?

A: Form 01-119 is filed on a monthly basis.

Q: What information is required on Form 01-119?

A: Form 01-119 requires information such as the taxpayer's name, address, permit number, and total tax liability.

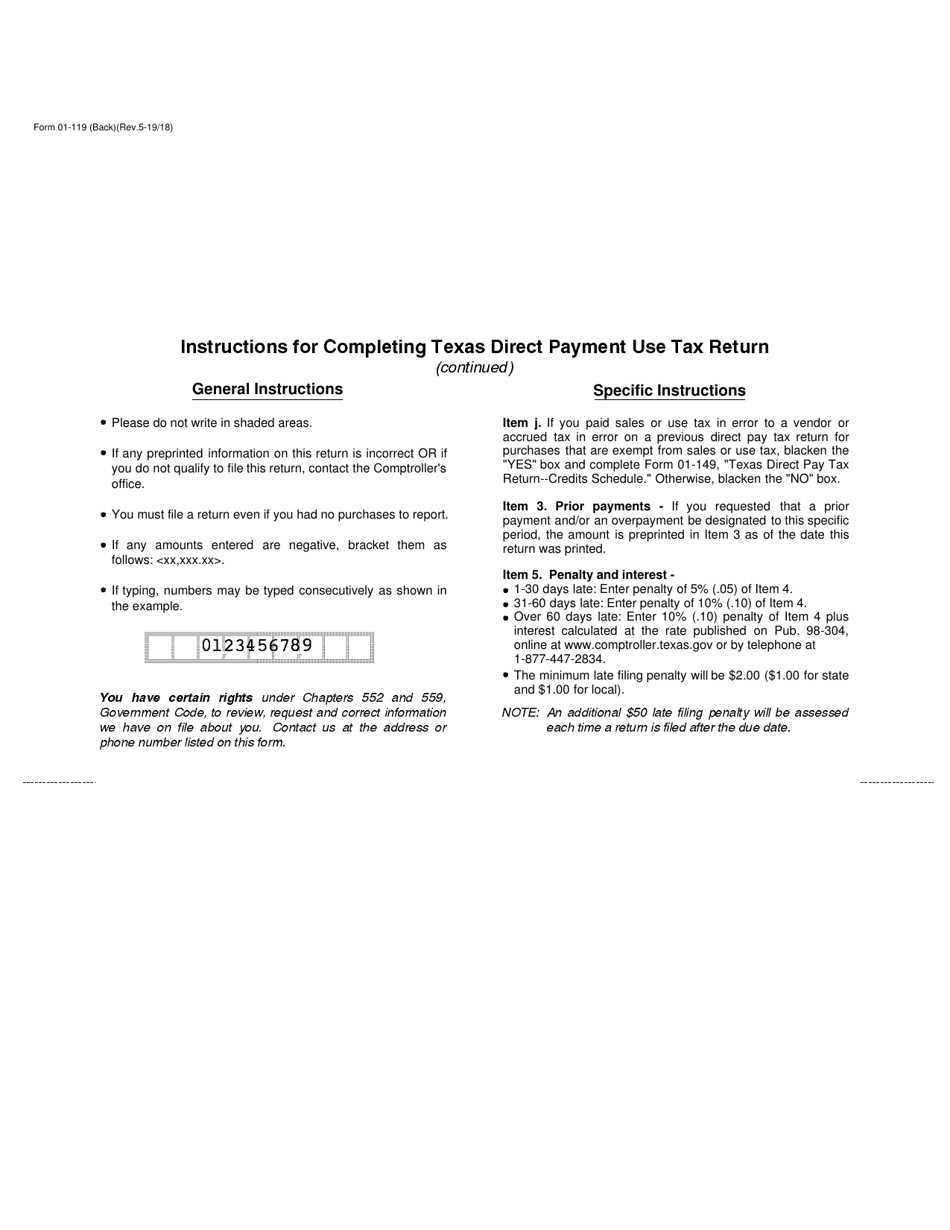

Q: Are there any penalties for not filing Form 01-119?

A: Yes, there are penalties for not filing or remitting the taxes due on Form 01-119. The penalties can vary depending on the amount of tax due and the length of time it remains unpaid.

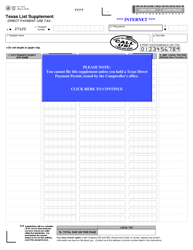

Form Details:

- Released on May 18, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 01-119 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.