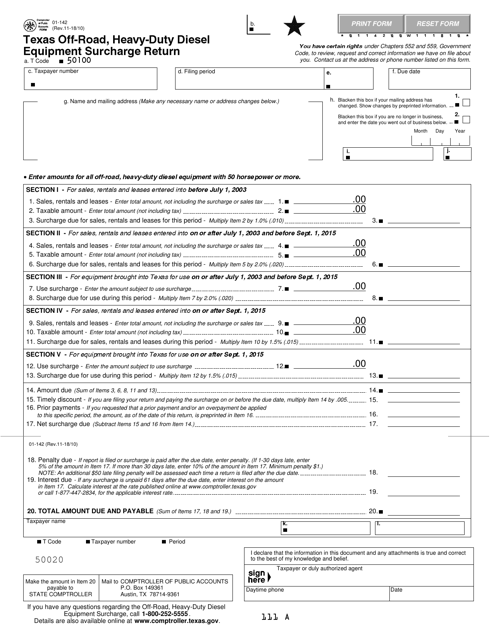

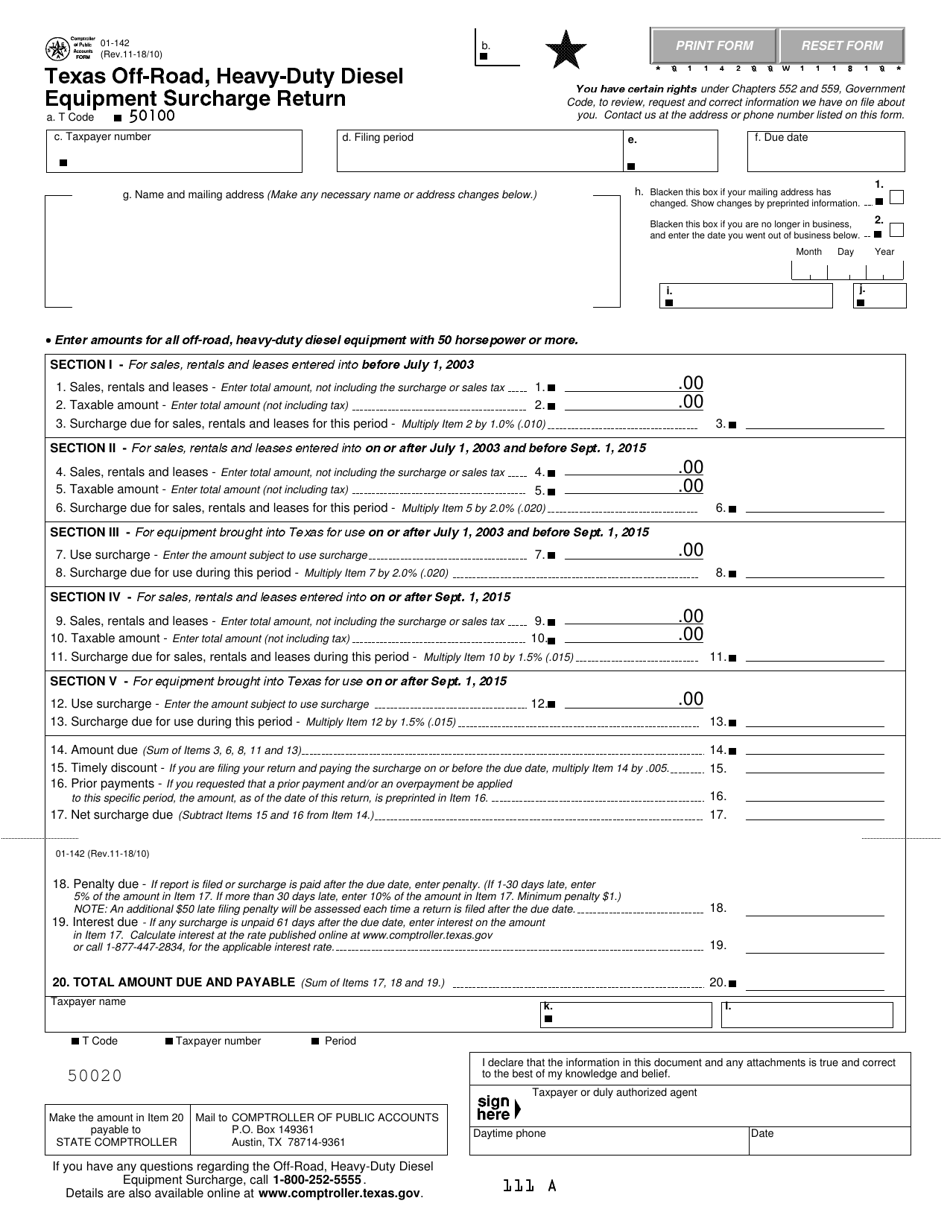

Form 01-142 Texas off-Road, Heavy-Duty Diesel Equipment Surcharge Return - Texas

What Is Form 01-142?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 01-142?

A: Form 01-142 is the Texas Off-Road, Heavy-Duty Diesel Equipment Surcharge Return.

Q: What is the purpose of Form 01-142?

A: The purpose of Form 01-142 is to report and remit the surcharge on off-road, heavy-duty diesel equipment in Texas.

Q: Who needs to file Form 01-142?

A: Individuals or businesses that own or operate off-road, heavy-duty diesel equipment in Texas need to file Form 01-142.

Q: What is the surcharge on off-road, heavy-duty diesel equipment?

A: The surcharge on off-road, heavy-duty diesel equipment is a fee imposed by the state of Texas to fund air quality improvement projects.

Q: When is Form 01-142 due?

A: Form 01-142 is due on a quarterly basis, with the due dates falling on the last day of April, July, October, and January.

Q: Are there any penalties for not filing Form 01-142?

A: Yes, failure to file Form 01-142 or pay the surcharge on time may result in penalties and interest being assessed.

Form Details:

- Released on November 10, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 01-142 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.